Anatomy of a weaker US dollar

The USD has been broadly weaker over the last month or so, but it peaked more than nine months earlier against EUR and JPY. The long base and recent strong performance in EUR and JPY despite further policy divergence suggests that the USD had been stretched and may be regarded as expensive. The mood in the market has become much less bearish towards JPY and EUR and the US economy may need to keep proving itself to avoid a deeper fall against these currencies. Policy actions of major central banks since the G20 meeting in Shanghai suggest that there has been greater corporation to avoid competitive currency devaluation by the ECB, BoJ and China, and greater concern shown by the Fed over global economic and financial market uncertainty. However, the ECB and BoJ will be eager to avoid a further rebound in their currencies and we might expect a long period of range trading in major currencies aimed in part to calm global financial market nerves. FX carry trades have been off the agenda for over a year during a period of relatively high FX market volatility. There remains significant global market risks that will continue to bubble below the surface, but it is possible to see carry trades become a factor again over coming months. If so the lowest and negative rates in EUR and JPY should return as factors dampening these currencies.

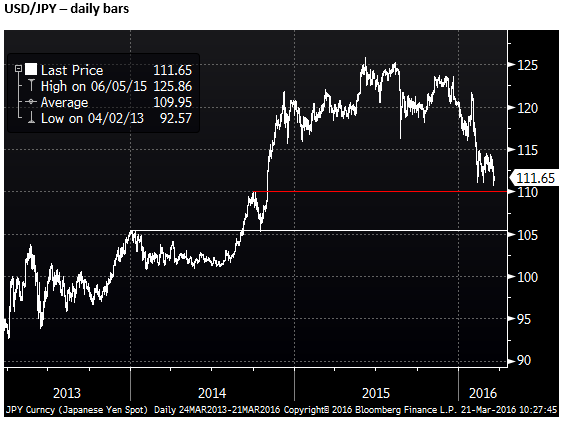

USD/JPY down-trend, but now at key support since Oct-2014 BoJ policy easing

The USD is broadly weaker this year, but it has peaked at different times against different currencies.

It peaked against the JPY some time ago, back in June last year, just shy of 126. Key risk aversion events and broadly higher global financial markets uncertainty have contributed to several periods of rebound in the JPY.

USD/JPY fell perversely soon after the BoJ attempted to reinvigorate its policy easing, arguably attempting to weaken the JPY, by adopting Negative Interest Rate Policy (NIRP) on 29-Jan-2016. Spectacularly, USD/JPY broke down below its previous lows in the 115s established over the roughly 16 months since the BoJ’s 30-Oct-2014 shock further policy easing. And since end-January this year it has not risen back above 115.

Now USD/JPY appears to have established a bearish trend that may haunt the BoJ in its attempt to boost inflation for some time.

A key level for the USD/JPY that may be important to Japanese policy makers is 110. This was around the high in the month before the October-2014 surprise BoJ policy easing. These round numbers naturally attract attention; there have been reports in the market that the BoJ has ‘checked levels’ in the JPY in the last week as the currency dipped below 111. This may be seen by the market as a sign that the BoJ/MoF is considering intervention around the 110 level.

Some market participants will find significant the exact level the USD/JPY traded at just before the 30-October-2014 policy easing (109.35), and below that is the low in the month before that policy easing (105.23), which was also roughly the high made earlier that year in Jan-2014.

It is probably the case that the perverse reaction of the JPY in response to the NIRP has contributed to some broader weakness in the USD, making it appear that this policy maneuver lacks power and may even be counterproductive; (undermining bank profits, pointing to possible limits in standard asset purchase QE policy, and creating possible inefficiencies in the functioning of some capital markets).

As we discussed in our report AmpGFX – Policy Quagmire threatens to boost JPY, 16 March, if the BoJ wanted to make this policy work, it should have ensured the JPY did not rise after its implementation by using aggressive intervention if necessary. The rise in JPY after its implementation added to the confusion and undermined the BoJ’s credibility.

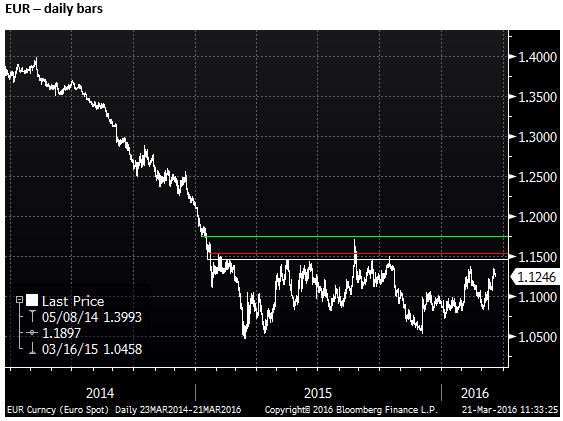

EUR/USD near the top of a broad-range since the ECB’s 22-Jan-2015 QE policy announcement

The high in the USD against the EUR was also some time ago, back in March 2015, not long after the ECB introduced its broad-scale asset purchase plan on 22-Jan-2015. Much of the fall in EUR occurred in response to negative rate policy that the ECB used before large scale QE asset purchases, implemented for the first time as far back as June-2014. (It found NIRP less institutionally difficult to introduce than QE, in contrast to other major central banks). The EUR fell sharply further from around 1.25 in Dec-2014, in anticipation of its QE in Jan-2015 to its lows just above 1.05 in March.

EUR/USD has been in a wide relatively stable range since the 22-January policy easing. It retested the lower end of its range in December 2015 in anticipation of further ECB policy easing on 3-Decmber. However, it rebounded after the ECB failed to deliver on expectations of more expansive policy and a deeper rate cut. It did cut its lower rate boundary at this time from -0.20% to -0.30%, and lengthened the duration of its QE program by six months. But this failed to meet the imagination of the market.

Like the JPY, although somewhat less so, the EUR has responded positively to bouts of risk aversion, and in general greater global market uncertainty over the last year. EUR rose towards the high side of its range in early February this year (even as much of the uncertainty at that time reflected weaker European bank equities). It drifted lower into the ECB policy meeting on 10 March, but has bounced sharply in response to this policy meeting, even though the ECB further eased policy.

The ECB again cut its policy rates, lowering the lower boundary (deposit rate) from -0.30% to -0.40%, and it expanded its asset purchases by 20bn per month to 80bn per month; including investment grade corporate bonds in the scope of asset purchases. It also introduced new Targeted Long Term Refinancing Operations (TLTROs) with incentives for banks to use the funds to increase credit growth by offering a negative rate on these loans equal to potentially the -0.40% deposit rate.

The EUR fell on the policy announcement but later rose on the ECB press conference where ECB President Draghi appeared to hint that the ECB was unlikely to cut the deposit rate again and if further policy easing were required it would use other tools; such as extending or adding to QE or TLTROs. The comments suggested that the ECB had shifted gear, no longer attempting to weaken the EUR via cutting rates, towards boosting domestic asset prices and more directly encouraging bank lending.

The EUR has since moved within sight of the upper side of its broad range since the 22-Jan-2015 policy easing. A comment by ECB Executive Board member, and Chief Economist, Peter Praet, appeared designed to help cap the EUR recovery, that “rates can still go lower” has helped prevent a bigger rebound in the EUR so far. However, this comment does not change the main thrust of the ECB policy measures implemented on 10 March, and its does appear that further rate cuts are much less likely to be implemented.

Key levels for the EUR include the lows in the days ahead of the 22-Jan-2015 policy easing, and the high in the weeks after (around 1.1540). There have been several other peaks over the last 14 months around the 1.1450, so we can assume this level up to 1.1540 is a range of resistance.

EUR did manage one spike up through the 22-Jan-2015 levels to a high of 1.1714 during the August 2015 global market swoon. This high was notably short of the level that the EUR traded just ahead of the Swiss National Bank (SNBs) shock decision to remove the floor under the EUR/CHF on 15-January-2015 and implement a much deeper negative interest rate policy. This was seen intensifying the potential for ECB to ease more aggressively and dragged down the EUR by association. This level of the EUR (around 1.1750) is another significant resistance.

Mood swing in EUR and JPY

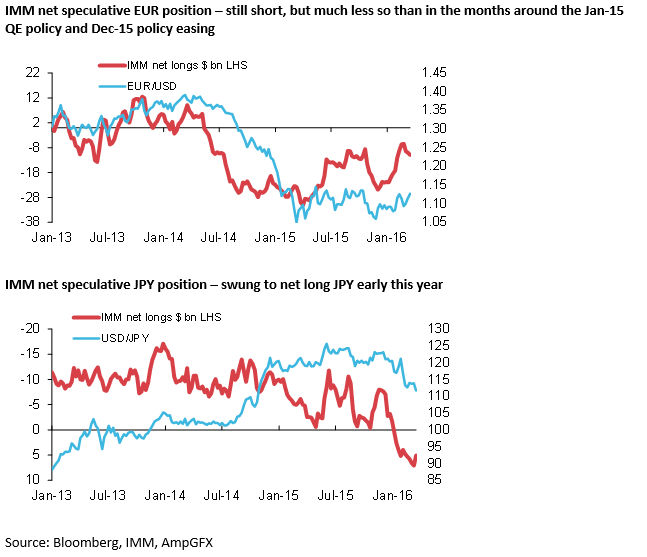

The mood towards the JPY and EUR has shifted significantly since the beginning of the year. The presumption some months ago was that these two currencies were likely to remain weak or weaken further in response to central bank policy easing that was set to remain in place for the foreseeable future, whereas the USA Federal Reserve was moving towards normalizing its policy.

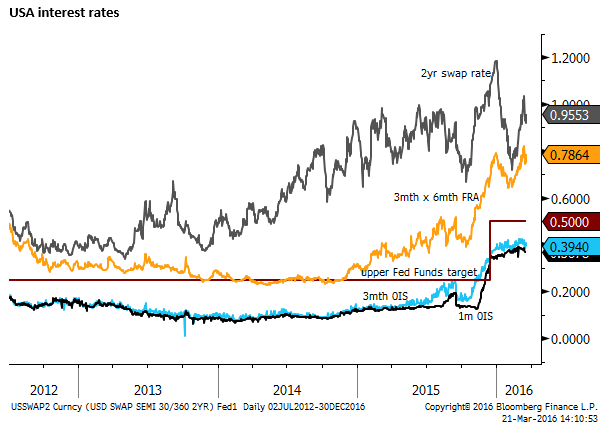

The Fed implemented its first rate hike in the post-crisis era since 2007 on 16 December 2015. The event was much discussed and delayed throughout 2015. The event had little impact on the USD, although the build up to the hike and delivery probably helped the USD finish 2015 on a broadly firmer note.

However, JPY and EUR rose in the final days of 2015 as oil prices were breaking lower from early-December and global market uncertainty was on the rise.

The rise this year in EUR and JPY despite further easing measures, after around a year of consolidating and lows set in the first half of 2015, leaves an impression that they may have already reached long term lows. Investors are no longer comfortable sitting with short positions in these currencies.

The USD needs to prove itself more than EUR or JPY

It is not clear that there has been any significant fundamental developments that would build a case for a sustained rally in either JPY or EUR, but they have proved very resilient over the last year and one must wonder what could renew their down-trend.

The stable to stronger performance in EUR and JPY over six to 12 months, creates an impression that they are relatively cheap and the USD expensive; that they have already priced in a large degree of policy divergence between the major central banks.

There is a risk that if economic conditions in the USA were to stall and cause the Fed to pause its rate hikes indefinitely and create a risk that they in fact reverse course and ease policy again, the EUR and JPY might rally more significantly.

It almost appears to be the case that the USA economy has to continue proving itself to avoid a bigger correction in EUR and JPY.

It may also be possible to imagine that the market may be able to see light at the end of the tunnel in the Eurozone economy and a time when the ECB may end its QE and NIRP.

It is a dim light to be sure, but as was the case in the final phase of the US Federal Reserve’s QE policy in late 2012 and early 2013, before it raised the possibility of tapering, the USD was relatively strong. Although at this time, the BoJ was just warming up for its own QE policy and sharp falls in the JPY were a drag on other currencies vs the USD.

FX Carry trades have not been a factor for over a year

A significant reason for the resilience and even strength of JPY and EUR is greater global market uncertainty. As such, the market is no longer fervently pursuing carry trades.

With rates so much lower and negative in both the EUR and the JPY compared to the USD, if the market was pursing carry trades, we might expect to see these currencies in a persistent down trend against higher yielding currencies, even the USD.

In fact if global market confidence was noticeably higher, the US economy might be expected to continue growing faster than trend and bring on Fed interest rate hikes sooner. In this sense the USD itself might be regarded as a risk positive currency, more so than has been the case historically when many more other currencies had significantly higher yields.

But despite the rebound in global equites in the last month or so, investor confidence remains tenuous and currency markets relatively volatile and uncertain. Implied volatilities in FX remain at a more elevated level for the last 18 months, and it does not appear that FX carry trades have played a significant part in FX direction.

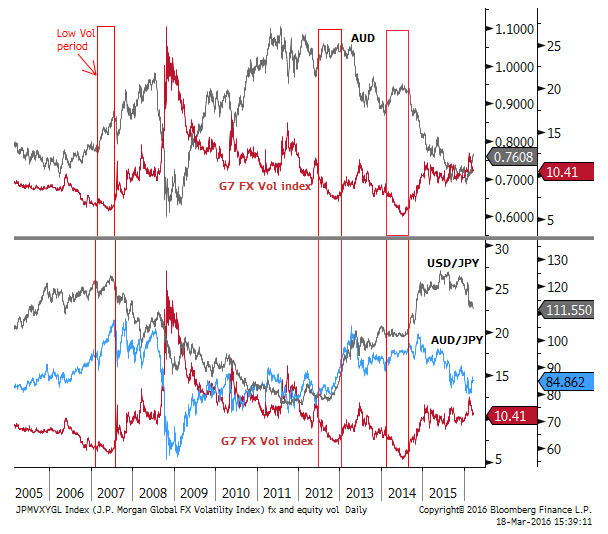

The chart below shows the JP Morgan G7 implied FX vol index against AUD, JPY and AUD/JPY. AUD has been a quintessential carry trade over the last decade. Prior to 2008, JPY was by far the lowest yielding currency, and the Japanese themselves were heavily involved in carry trades. In the low vol period prior to the ‘sub-prime’ crisis in 2007, AUD was strong and JPY weak. In low vol periods after 2008, the USD was at least as low yielding as JPY and it was typically favored as the funding currency, stable vs JPY, while AUD was strong (despite lower Australian interest rates and falling commodity prices since 2011).

In the last year, vol has been elevated, USD/JPY, AUD and AUD/JPY have been generally weak.

As such, interest rate differentials do not appear to have been all that important in currency market direction over the last year. This is in contrast to periods of low FX volatility, such as in the first half of 2014 when US rates were still among the lowest and Fed policy was still guiding rates lower for over 12-months. At this time, yield-seeking behavior dominated global markets.

Even though there has been a sharp bounce in higher risk assets over the last month, much of the gains to date appear corrective in nature. As such, we have seen little reaction in JPY or EUR.

If markets were more confident that global asset prices would remain stable to firmer for a more prolonged period and FX volatility cooled down, the market might start to sell both EUR and JPY seeking higher yielding currencies.

It is possible that this dynamic starts to take hold if asset markets remain more buoyant for a month or more. However, there are a number of underlying structural concerns in the global economy that may limit the potential for carry trades for some time. These include high levels of debt in emerging market economies, particularly China, oversupplied commodity markets, unresolved debt problems in developed markets, political uncertainty in several countries, regulatory pressure on the financial system, limited monetary or fiscal policy space to support growth, a weaker global growth outlook from the IMF and low inflation expectations.

USD did not peak against other currencies until early this year

While the USD reached its high point against the EUR and JPY more than nine months ago, the broad USD trade-weighted index did note reach its peak until 20-January 2016. This was the low point in global commodity prices, driven by weak oil, but also weak industrial metals prices. Most commodity currencies, including CAD and AUD were at their lowest points in many years at this time against the USD.

The devaluation of the CNY in August last year also set in train weaker emerging market currencies, especially in Asia. The CNY weakened sharply in early-January and the Chinese stock-market plunged rapidly, combining with the drop in oil prices to unsettle global markets and undermine commodity and emerging market currencies.

The bearish mood related to the CNY continued throughout January and was exacerbated by reports of rapidly declining Chinese FX reserves. However after the Chinese Lunar New Year break in early-February, Chinese government officials renewed efforts to stabilize confidence in their currency and stock market; including a number of official statements, monetary and fiscal policy easing announcements, and a five-year plan that appears to pay more attention to stable growth over structural reform. This contrasted with statements early in the year that appeared to suggest China would accept lower growth to accelerate structural reforms.

The oil market has also improved significantly with talk of cooperation around big global producing countries, and evidence that supply is falling and demand rising in the USA.

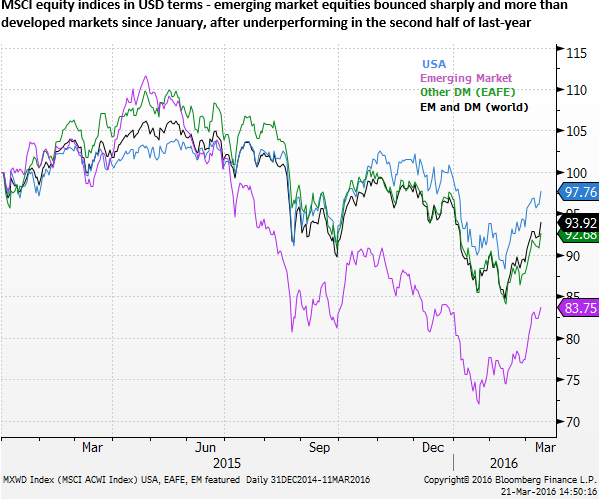

As such extreme bearishness towards emerging market assets in since August in particular, accelerating to a crescendo in January, has been sharply reversed in the last two months.

Even though there has not been much of a pull-back in JPY and EUR that have acted as safe-haven currencies over the last six to nine months, EM and commodity currencies that hit their lows early this year have bounced back. The result has been a broadly weaker USD.

Fed adopt a dovish tone

Even though risk appetite vastly improved over the last month, the Fed still took a much more guarded tone with respect to the global economic outlook and global financial market stability at its 16 March policy statement. It also downgraded its outlook for US growth and inflation over the medium and long term, appearing to remove some of the hawkishness that had been a part of its statements over the preceding 18 months as it prepared the market for its first rate hike.

The tone of the statement last week suggested that the Fed would not quickly respond to evidence of higher inflation. It appeared more worried about lower inflation expectations and still sluggish wage growth (even though unemployment has fallen close to neutral levels and actual core inflation readings have trended higher since July last year.

Shanghai Accord – sort of

Some have interpreted recent policy developments in the major central banks as a sign of greater cooperation out of the G20 summit on 25-27 February (G20 Communique). Some have dubbed it a “Shanghai Accord” in reference to the ‘Plaza’ (1985) and ‘Louvre’ (1987) accords’ that were designed to dampen perceived major currency misalignments.

The switch in ECB focus from rate cuts to domestic asset purchases and supporting corporate bonds and credit growth, the lack of FX intervention by the BoJ/MoF in the face of a break-down in USD/ JPY after its NIRP, the fiscal and monetary easing in China, and more dovish Fed appear to show a coordinated response to support global markets, avoid competitive currency devaluations, and reverse some dollar strength from a broad multi-year high set earlier this year.

Many observers doubt there was a formal agreement, but it is possible that the gathering helped move policymakers in a way to support global stability.

It may be the case that G20 officials, having seen the stronger global markets over recent months, may wish to encourage a more stable environment going forward. In this respect the comments by ECB member Praet that rate cuts were still possible, and BoJ checking FX rates below 111 may be part of the efforts to keep currencies more range bound. While the ECB and BoJ may have been discouraged from aggressively pursuing weaker currencies, neither would like to see their currencies strengthen either.

It may be the case after the global market swoon in January and a number of policy developments since, we may see a more prolonged period of capital market calmness. This may help bring FX volatility down, and it may tend to support some further gains in EM and commodity currencies, especially those with higher yields. However, after their rebound over the last two months they are now approaching resistance levels and further gains may be tentative.

Many of those structural concerns will bubble below the surface and the market in particular will worry that given enough space, Chinese policymakers may again try and squeeze the excesses out its economy and financial system. If oil prices rise too much, it might also bring back US production and the accord between global producers may falter. The US economy may start to exhibit more consistent signs of wage growth and higher inflation outcomes, bringing US rate hikes to the table. It is difficult to judge how long market calm will continue.