BoE shines, BoJ needs to regain the initiative

The Bank of England have pulled out all stops to ease policy and have achieved considerable additional monetary stimulus that will help stabilize the UK economy. This contrasts with the bumbling Bank of Japan that has enacted the most aggressive monetary easing policy in history only to see monetary conditions perversely tighten. The BoJ have failed to manage expectations and communicate a clear policy agenda. They have let critical voices grow louder without response to the point where they appear to be gaining control. This uncertainty has already resulted in a rise in JGB yields and renewed gains in the JPY. The uncertainty over policy direction may well push JPY to new highs. The signs are not good that the BoJ will turn the corner, because it appears to have forgotten how QQE/NIRP is supposed to work and may back-track rather than double-down. We look at the conundrum faced by then BoJ, what it may do if the critics win and what it should do to regain the initiative.

BoE pull-out all stops

In contrast to the limited action by the BoJ last week, the BoE has been able to engineer a surprise easing by including a sizeable QE element with its rate cut that was not widely expected and opening the door to slice rates closer to zero.

They cut the base rate by 25bp to 0.25%, a new record low, expanded purchases of government bonds by GBP60bn and corporate bonds by GBP10bn to a total GBP435bn, and introduced a new Term Funding Facility.

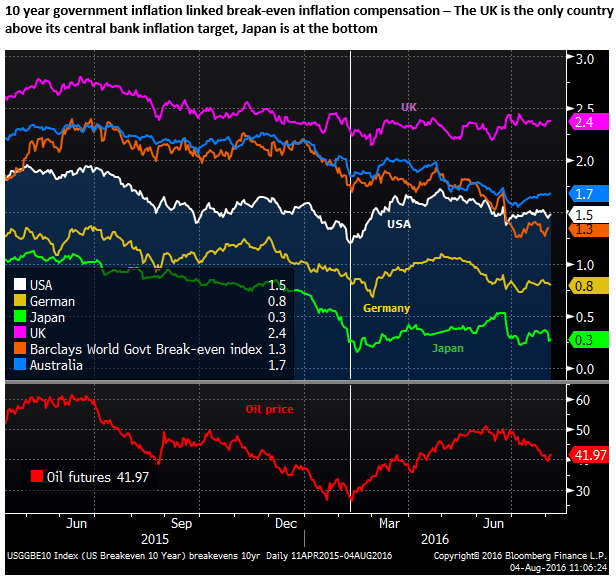

It acknowledged that the fall in GBP was forecast to push inflation above the 2% target in the near term, “probably causing it to rise above the target in the latter part of the MPC’s forecast period.” But indicated it was prepared to look through this rise as temporary. By putting growth ahead of inflationary concerns, the BoE may lower perceived real interest rates further than the nominal fall in yields.

Furthermore, the BoE statement said a majority of members expect to slice rates further, close to zero “during the course of the year”, and reinforced the easing measures by stating they can ease further across all dimensions.

However, it said, “The MPC currently judges this bound [for the policy rate] to be close to, but a little above, zero”. The committee were also not unanimous on the need for more QE, eight of nine supported the introduction of corporate bond purchases and six supported further government bond purchases.

Finally, the BoE statement reminded the market that it had already taken some measures, reducing the countercyclical capital buffer, exclusion of central bank reserves from the leverage ratio calculations, and continued to provide additional term liquidity support.

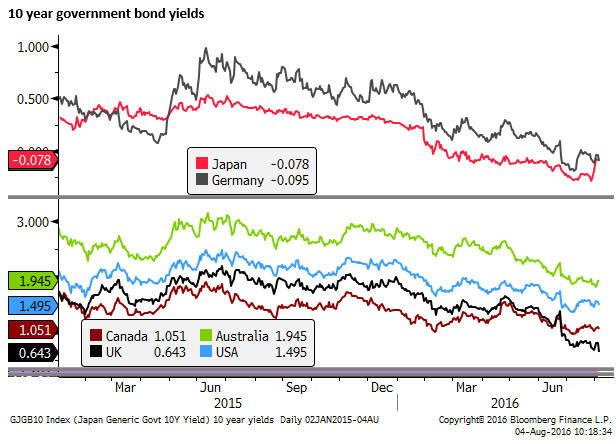

Indeed, the BoE has pulled out all stops to add additional stimulus and it has had a significant impact on financial markets. 2yr swap rates fell 8bp and 10 year gilt yields fell 16bp to a new low, noticeably diverging from the rebound in Japanese yields and drift up in global yields since the limited BoJ policy easing on 29 July.

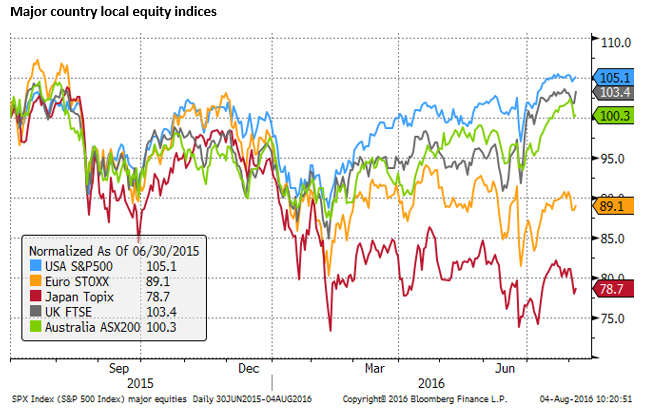

UK equities have risen 1.6% in response to the policy easing, leading gains in other markets. The FTSE index is approaching new highs for the year, well above the rout that followed the Brexit vote, leaving Japanese and Eurozone equities in their dust, at least in domestic currency terms.

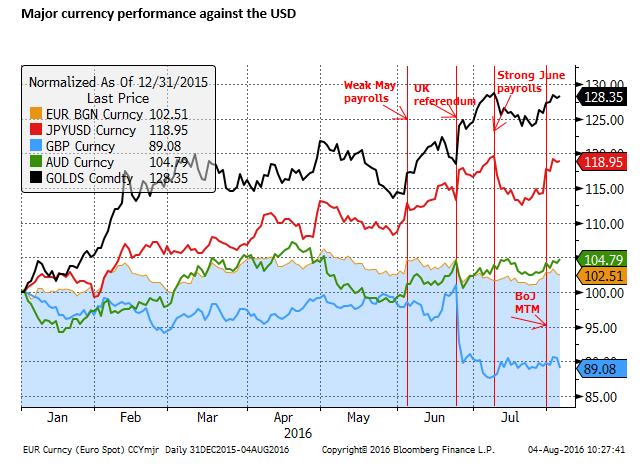

And despite the already deep slide in the GBP since the UK referendum, the BoE has succeeded in maintaining downward pressure on the GBP. The weak currency, one of the few to be weaker than the USD this year, is further enhancing the effectiveness of the BoE monetary policy easing.

BoJ credibility in on the chopping block

The actions of the BoE stand in stark contrast the fumbling policy developments in Japan this year culminating in a hopeless response to heightened expectations last week. The BoJ have failed to manage expectations and communicate a clear policy agenda. They have let the critical voices grow louder without response to the point where they appear to be gaining control of policy.

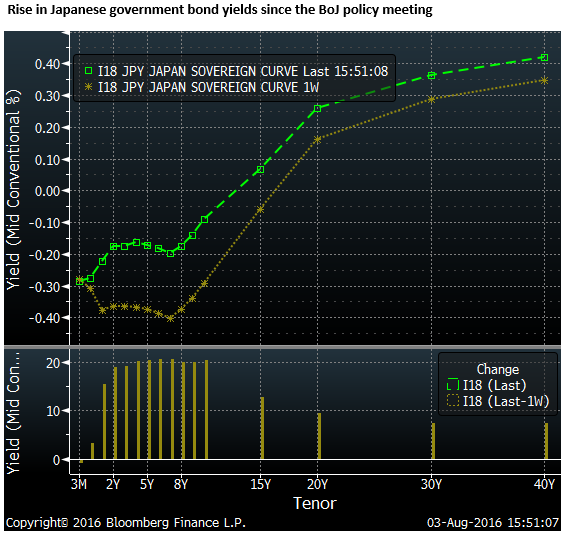

The 29 July BoJ statement said that the BoJ were re-evaluating its whole approach to monetary policy creating enormous uncertainty over policy direction. Effective policy in Japan has tightened this year by way of a 20% rally in the JPY against the USD and a 15% fall in Japanese equities. And in the last week even its long term yields have reversed half their fall since the beginning of the year with no improvement in inflation expectations.

It appears that the BoJ has lost its way and badly needs to regain the initiative, else USD/JPY will persist in its down-trend, push inflation further off course and leave the BoJ’s credibility in complete tatters.

BoJ leaves market guessing on policy direction

Many in the market including myself were blind-sided by the limited BoJ policy action on 29 July, at a time when inflation was moving in the wrong direction (lower, away from its 2% inflation target) and the government had mapped out a fiscal plan begging the BoJ to join in stimulus.

BoJ Governor Kuroda himself, in the lead up to the event, commented on the advantage of coordinated government and central bank policy easing measures. The 29 July BoJ policy statement even said, “The Bank believes that these monetary policy measures and the Government’s initiatives will produce synergy effects on the economy.”

However, rather than significantly further enhance its policy easing, the BoJ said, “The Bank will conduct a comprehensive assessment of the developments in economic activity and prices under “QQE” and “QQE with a Negative Interest Rate” as well as these policy effects at the next MPM. The Chairman instructed the staff to prepare for deliberations at the next meeting.”

This leaves the market wondering if there may be a complete re-think and overhaul of its monetary policy tactics. It suggests that there may be considerable discord within the BoJ and on the BoJ Monetary Policy Board.

The market response has included a sharp rise in JGB yields, albeit still leaving them in negative territory on 10 year maturities. This seems to suggest that the market believes that the BoJ may back-off its pace of JGB purchases and/or reverse its decision to pursue NIRP.

The critics have taken over the narrative

The BoJ has come under increased criticism externally and internally for its QQE/NIRP approach. Critics have argued that it is reducing bank profitability, undermining market functioning in the JGB market, reducing income for retirees, threatening the business of insurance companies and weakening economic confidence. And these costs may outweigh the benefit provided to the economy by lowering real borrowing costs. The strong JPY and weak Japanese stock market themselves imply monetary conditions have tightened this year. Basically it appears that BoJ policy is not working and it may need to re-think its whole approach.

Concern over impaired functioning of the JGB market

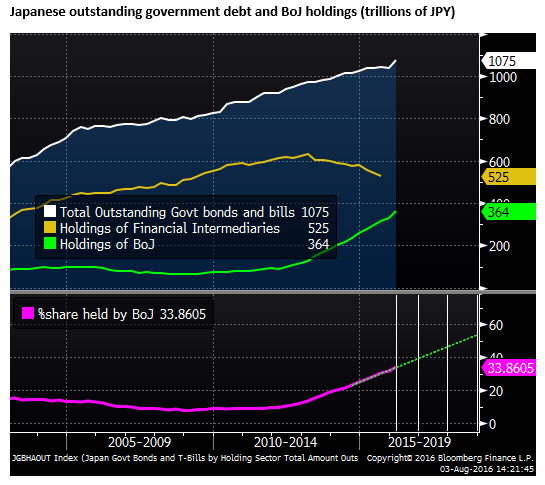

A key concern is that the functioning of the JGB market has been impaired by the dominant buyer position of the BoJ that now owns over a third of outstanding government bonds and bills.

Many commentators argue that the BoJ is reaching the limits of its capacity to buy JGBs and continuing at its current pace will achieve little other than risk destroying a market by crowding out existing private sector buyers. Critical voices worry that there may be significant volatility in the market in future, especially if the BoJ ever cuts back or even reverses its purchases, threatening stability of the economy and the JPY.

Furthermore, critics have viewed the damage to Japanese bank profits caused by negative yields and a flat yield curve, spilling over to a weaker equity market, without any increase in growth of bank lending. As such, instead of seeing lower borrowing costs as supporting growth, they see them as a detriment to the economy.

It is fascinating that conventional wisdom is that monetary policy essentially works by lowering real borrowing costs as much as possible across the curve, and yet the BoJ is under fire because its policy, until last week, was contributing to new record low yields across the curve.

The main problem is the perverse strength in JPY

The curve flattening may be a concern, because it suggests that inflation expectations remain low and may be falling, but this has more to do with the strong JPY than QQE/NIRP which is designed to lower yields across the curve, not flatten its shape. In fact the hope of the policy is that the curve steepens as inflation expectations rise.

The flat yield curve has a negative feed-back to bank profitability and the equity market, but again, if the JPY had been weaker, inflation expectations would be higher, and the curve steeper, generating positive feedback for bank share prices.

In a more conventional response to low and negative yields, the exchange rate falls and enhances the effectiveness of the policy. The rise in JPY this year has been a perverse response, severely damaging the effectiveness of the BoJ’s QQE/NIRP, and now contributing to widespread criticism of the BoJ and its policy.

QQE/NIRP is supposed disrupt and force institutional change

Worrying about market dysfunction and excessive falls in JGB yields misses the whole point of QQE/NIRP. The policy is meant to drive yields lower to the point where investors are forced out of the market so they invest in higher beta assets that better support growth and inflation.

It is not clear that the BoJ is currently holding too many JGBs, or will do so if they continue buying at their current pace for a few more years. As it stands both the BoJ and BoE hold around a third of outstanding government bonds, and relative to GDP, there are considerably more outstanding JGBs for the BoJ to buy than the same can be said for the BoE.

Japanese institutions culturally are perhaps more adverse to change than in other countries. Perhaps if they were more flexible, market dysfunction would be less of an issue. The dysfunction in the market itself appears worse because Japanese yields have been significantly below zero across the curve, and the curve so flat out to 10 year maturities, undermining bank, insurance company and overall profitability of the financial sector.

Negative yields and a flat curve are seemingly irrational. There is a better option for institutions than locking in negative yields for 10 years or more. Holding cash, gold, stocks, almost anything is better than that. Continuing to purchase JGBs is akin to staying seated and getting your finger nails pulled rather than getting up and walking out the door.

The BoJ might argue back at its naysayers that instead of complaining, get up and walk out the door just as the policy is intended to force you to do.

QQE/NIRP should bite harder even at a constant pace

The chart below shows that at the end of March this year, the BoJ held 33.8% of government securities outstanding. Based on the rate of change over the last 18 months, this will rise to 39.2% at the end of this year, 46.4% at end-2017 and 53.6% at end-2018.

The market fears that given the current lack of progress on achieving higher inflation, the BoJ could conceivably own over half of the JGB market in a few years, generating even more severe market dysfunction.

Yes it will, and again this is how the policy is intended to work. The greater the share of the market the BoJ owns, the more powerful additional purchases may be in driving yields into increasingly uncomfortably low territory unless the private sector holders, realizing they are losing more finger nails, wake up and take their savings somewhere else.

A factor that many seem to misunderstand is that the BoJ is effectively increasing its policy easing all the time even by maintaining a steady pace of purchases, because it is soaking up a greater share of outstanding government debt, forcing more assets into other markets.

Nobody can say what the future looks like, especially when the present doesn’t even seem to make a lot of sense (in that yields are ridiculously low and JPY stubbornly strong).

Another possible outcome is that Japanese institutions stop getting their fingernails pulled and more readily sell JGBs, buy more foreign assets, the JPY weakens, inflation expectations rise, yields rise and the BoJ tapers its purchases to prevent the JPY falling too far and inflation rising too far above its target. Too many, this scenario appears equally far-fetched, but of course it is the way the policy is supposed to work, and did for the Fed and BoE.

Instead of worrying about breaking the JGB market, perhaps the BoJ should indeed aim to break it so that the end game of forcing funds into inflation generating investments happens faster. A broken JGB market, whatever that means, is conceptually no worse than pursuing so-called helicopter money on a large scale.

BoJ blinked and succumbed to critics

Unfortunately, the BoJ may have blinked and succumbed to the growing chorus from its critics. The complaints over market dysfunction are stinging the BoJ, perhaps leading them to re-evaluate their QQE/NIRP policy.

Worse still, and perhaps the most worrying sign, is that the BoJ appear to have lost sight of how QQE/NIRP policy is meant to work. In its 29 July policy meeting it announced an increase in its program for lending US dollars. Japanese institutions want to borrow USD to avoid currency risks on foreign investments. By easing liquidity conditions in the USD money market, the BoJ only discouraged Japanese investors from selling JPY, arguably exacerbating the strength in the JPY and effectively tightening monetary conditions in Japan. QQE/NIRP policy should work in part by encouraging capital to flow out and weaken the exchange rate. The BoJ policy decision on 29 July blunted the effectiveness of its main policy tool.

The power of the QQE/NIRP policy has been felt globally, with downward pressure on JGB yields spilling over to lower yields everywhere else. Japanese investors leaving the JGB market have invested heavily in foreign bonds, but because they want to avoid the FX risk they have for the most part used the cross-currency interest rate swap market to hedge the FX risk. This has pushed down the JPY/USD basis in this market to record low levels, and widened the FX forward points and hedging cost in the FX forward market.

The wider the basis in the cross-currency interest rate swap market and the larger the FX forward points, the less attractive it becomes for Japanese investors to hedge FX exposure, and the greater incentive for global investors to sell JPY as a FX carry trade.

The perverse strength in the JPY this year has made Japanese investors hedge more and discouraged carry trades involving selling the JPY, thus it has pushed out the cost of hedging and x-ccy basis. The BoJ needs to embrace this spread widening not battle against it. In conjunction with a further fall in Japanese yields, the spread widening would eventually reverse the course of the JPY exchange rate, and revert it to a weaker trend, a necessary component of the monetary policy easing.

In effect, the BoJ’s USD funding policy enhancement eased monetary conditions in the US rather than Japan and weakened to effectiveness of its own QQE/NIRP policy. The move was incremental and has little direct consequence, but it demonstrates a lack of understanding and commitment to its main policy tool, further indication that the BoJ has lost its way.

Policymakers in the government, MoF and BoJ are all equally responsible for damaging the effectiveness on NIRP/BoJ by subjugating their inflation target to G20 commitments not to meddle in the FX market. It is plain as day, they Japan needed to put a floor under the USD/JPY towards 110/115.

The BoJ had already appeared to have lost its way before the 29 July policy mess by standing by and watching the JPY appreciated rapidly this year. It needed to work harder by jawboning and responding to currency strength by doubling down on its NIRP/QQE policy and forcing the government to respond with intervention by making it understand how QQE/NIRP is supposed to work.

What will the BoJ do next – target long term yields?

The market is now left in a quandary guessing what the BoJ plans next. If they have been influenced by the critics arguing that they are buying too many JGBs, pushing yields too far below zero and causing market disruption, then the BoJ may implement a variable purchase plan that depends on the levels of yields. They may scale their buying to buy less when yields are low and more when yields are higher.

This may include some of the elements discussed by Former Fed Governor Bernanke in his recent series of posts on the Brooking Institute website on unconventional tools for easing policy. In particular they may draw on Bernanke’s ideas on “Targeting long-term interest rates”.

What tools does the Fed have left? Part 2: Targeting longer-term interest rates – brookings.edu

If they use some method to target longer term yields, then it would give them an out from NIRP policy since the long term yield target would become the main policy anchor for rates across the curve. The combined effect of ditching NIRP and targeting longer term yields might help restore a more positive yield curve shape, but with yields that are overall higher.

This may help improve bank profitability and it may help reduce some of the negative impacts on confidence and the stock market. However higher yields should do little to reverse the strength this year in the JPY and may in fact strengthen it further. If the JPY were to strengthen further it would dampen inflation expectations and prevent the yield curve from rising or steepening much anyway.

Targeting long term yields now would be a policy-back down and potentially misfire

Lower yields in most respects should be viewed as adding monetary stimulus. Higher bond yields do nothing to encourage Japanese financial institutions to invest in higher beta assets that might boost growth and inflation. As such, if the BoJ aims to alter its policy mix to prevent deep falls in bond yields this may only further confuse the market as to what are its objectives and generate further doubts that it has the tools or inclination to do what it takes to achieve higher inflation.

Bernanke proposed the idea of targeting longer term yields as a method to push them lower and hold them down. If the BoJ introduce targeted yields because pre-exiting yields were too low, it entirely misses the point.

Could it Jettison or lengthen the time-horizon for reaching inflation?

Many have argued that the BoJ should also jettison its time-table for reaching inflation in 2 years because the 2-year timeframe is unrealistic and undermines the Bank’s credibility. This makes sense if you intend to back away from the current QQE/NIRP policy since indeed you are essentially admitting you are not prepared to take policy to extreme measures. However, it would then appear a complete capitulation by the BoJ and admission that it has given up. Surely then Kuroda should consider steeping down. The JPY would potentially rise significantly further with negative consequences for inflation, growth and bond yields. The critics would get what they wanted, but may inherit a bigger problem with no answers, reminiscent of the conundrum faced by policymakers before Abe and Kuroda shook the up the establishment in 2012/13.

The BoJ needs to regain the initiative in communication and act decisively

For all the market criticisms about the effectiveness of the QQE/NIRP policy, backing away from it may do little to solve the core problem. The BoJ have lost the communication battle, they have been impotent in the face of market pressure via a stronger JPY and now proven indecisive and reactive in the face of criticism of its QQE/NIRP policy.

They should try to regain the initiative. They should reassert their intention to push ahead with QQE, perhaps even increase the pace of purchases. To recognize the fear the market has that it will devour all government debt, it could set a threshold for its purchases once they reach 50% of outstanding government debt. At which point they could revert to a policy of continuing its purchase plan only if 10-year yields rise above zero, until it meets its inflation target.

It should highlight that if the government raise fiscal spending and its debt outstanding, this will allow the BoJ more scope to expand its QE purchases for longer until it reaches its 50% threshold, creating an atmosphere that the Bank is already approaching something resembling helicopter money.

In conjunction with this plan it should reiterate its intention to purchase bonds regardless of how far yields fall below zero in the meantime and argue forcefully in public and private meetings that low and negative yields should inevitably drive investors out of JGBs and weaken the JPY, both of which are the policy intention.

Ideally, FX intervention should be used to reinforce a weaker JPY trend, sufficient to reverse much of the JPY gains this year.

At this stage, we have little idea of what the BoJ intends to announce at its 21 September meeting or beyond with respect to its review of policy. This uncertainty has already resulted in a rise in JGB yields and renewed gains in the JPY. The uncertainty over policy direction may well continue to push JPY until the BoJ takes back the initiative.