BoJ twist may wind equities, bonds and JPY in a declining trio

The BoJ appears to be massaging market expectations towards expecting a policy announcement on 21 September designed to lower short-term yields and raise long-term yields in Japan (‘operation reverse twist’). This could be achieved by lowering the NIRP and adjusting the JGB purchase program to buy less long-term bonds. Recent speeches by BoJ Governor Kuroda and Deputy Nakaso provided the rationale for the twist, and press reports today channeling BoJ insiders more pointedly suggest this will be the result. We see the recent rise in global bond yields that continued Tuesday despite a much more dovish than expected speech by Fed Governor Brainard on Monday, as driven by this evidence of a BoJ twist. However, surveys and market commentary by Japanese analysts suggest that sentiment remains divided. The market overall still seems to somewhat favor a stronger JPY, retaining its year-long rising trend. USD/JPY is trading in the middle of a wide but narrowing range. We see risk to the upside in USD/JPY in response to a BoJ twist, potentially breaking the pair out of its downtrend this year. Higher long-term Japanese yields would be reinforced by a weaker JPY and potentially drive global yields much higher. Higher global bond yields are spilling over to a correction in global asset prices and weaker emerging market and commodity currencies. Traditionally, weak global asset prices tend to support JPY (seen as a safe haven). However, the USD has been the preferred funding currency for higher risk investment this year. As such, just as it is unusual to see bond and equity prices fall at the same time, we may see the JPY join the fall, and a broad rebound in the USD, regardless of if the Fed hikes rates in coming months or not.

It’s about the BoJ, not the FED

Global bond yields have continued to rise this week, notwithstanding a very dovish speech by the Fed’s Brainard on Monday seeming to put an end to thoughts that the Fed might be planning to hike next week (although the odds of a hike still stand at 22% probability).

It may be the case that rising bond yields reflect a higher risk that the BoJ implements operation reverse twist.

As we discussed in recent reports, the BoJ appears to want higher long-term yields to help revive profits for Japanese pension managers, life insurance companies, and banks all suffering from negative long-term yields, or very low ultra-long yields. As such, the BoJ may be considering buying less long-term bonds.

The BoJ Governor and Deputy Governor have both said that they do not want to reduce the level of overall policy easing and thus may counter this reduction in longer-term bond purchases by lowering its NIRP.

This year, both a stronger JPY and aggressive bond buying by the BoJ have contributed to lower long-term bond yields in Japan, and this has spilled over to lower yields globally.

We may now be in the process of reversing this influence from Japan. If the BoJ buys less long-term bonds and the JPY weakens, perhaps in response to a lower NIRP, both developments would tend to put upward pressure on Japanese and global yields.

Perversely, we may find that higher longer-term yields in Japan, spilling over to higher long-term yields abroad may encourage further gains in USD/JPY, producing a reinforcing rally in the USD/JPY and global bond yields. A higher USD/JPY will be seen to increase inflation expectations in Japan and help lift Japanese longer-term yields and steepen its yield curve.

Two reports today by Bloomberg and the Asia Nikkei press appear claim inside knowledge of BoJ deliberations ahead of the 21 September policy meeting. They tend to confirm the BoJ is heading this direction.

BOJ to explore delving deeper into negative rates – Asia.nikkei.com

BOJ Is Said to Mull Change or Abandonment of JGB Maturity Range – Bloomberg.com

Market still not convinced

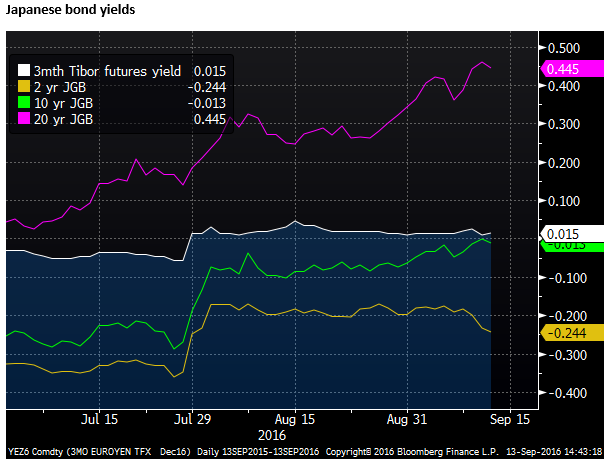

The market seems to have been slow to pick up on these messages. Market commentary from a number of Japanese analysts over recent weeks suggest that the BoJ would do little to change policy and the JPY continues to be relatively volatile. Japanese bond yields have risen and the curve has steepened, but short term yields remain significantly higher that levels preceding the 29-July BoJ policy meeting and 10-year yields are still somewhat negative.

This suggests that the market is reluctant to believe that the BoJ will lower its NIRP, and see a relatively limited adjustment to its bond-buying program.

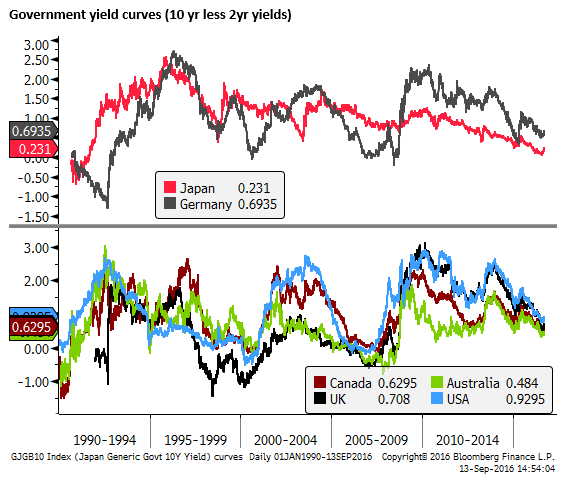

The Japanese 2yr to 10yr government yield curve recent steepening is relatively modest in a longer term context. The Japanese yield curve is flatter than all other developed markets, around its flattest since 1991. As such, there may be significant scope for the BoJ to trigger a more significant curve steepening.

A Bloomberg Survey of Japanese analysts was split on their views for the 21 September BoJ policy meeting. The survey was taken from 7-12 September, after the recent speeches by the BoJ Governor and Deputy, but ahead of the press reports out in the last day that appear to be aimed at massaging expectations towards building in operation reverse twist.

The survey found that only a 23 out of 43 anticipated any policy easing. The survey didn’t even seem to ask analysts to respond to a possible shortening in duration or lessening of longer-term bond purchases.

The survey found that only around half expected a rate cut, and some thought that a cut would be delivered at a later date, rather than next week. It does not appear that the market is well prepared for a rate cut or a lessening of long-term bond purchases.

Uncertainty remains high

The JPY and Japanese markets have been very erratic and increasingly so ahead of recent BoJ policy meetings, fueling a sense of high uncertainty. Indeed, the BoJ has tended to disappoint expectations of further policy easing since 29 January when it introduced its NIRP. The recent speeches by Kuroda and Nakaso and news media reports channeling insiders may be an attempt to reduce this uncertainty.

Global markets may be feeding on BoJ policy uncertainty

Global asset markets have been more volatile this week, with the clearest trend of higher global bond yields spilling over to a correction in global equities and EM and commodity currencies.

This makes sense because low and falling global yields had forced investors into these higher risk assets. A developing rising trend in yields is causing this yield-seeking capital to retreat from higher risk assets.

The JPY has been buffeted by two opposing forces. On one hand, the increasing prospect of operation twist in Japan is tending to weaken the JPY. On the other, weaker asset markets are reviving the traditional pattern of supporting JPY as a safe haven.

However, JPY has strengthened all year despite strong asset markets much of the year. The market has preferred to use the USD as the funding currency for riskier investments. As such, with asset markets now under pressure, because of upward pressure on global bond yields, we may find the JPY weakens against a broadly stronger USD.

JPY sentiment still bullish, but may be shifting

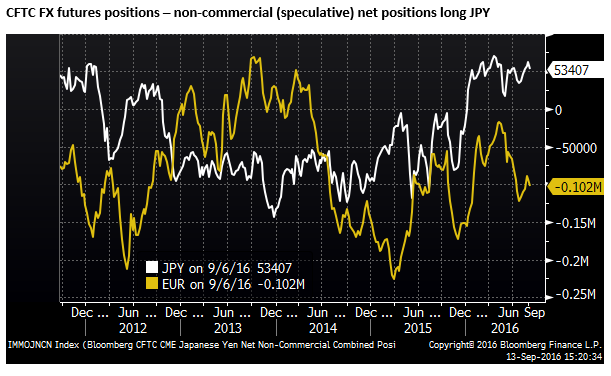

USD/JPY is currently trading in a wide but narrowing range. Market sentiment appears to be mixed judging by market commentary. There are still may that see the USD/JPY in a downtrend. Japanese exporters and fund managers have long been more inclined to believe the JPY can strengthen further and many of the negative views on USD/JPY are reported to come from Japanese banks and investment managers. Trend following traders in the Chicago FX futures market have retained a net long JPY position since January this year.

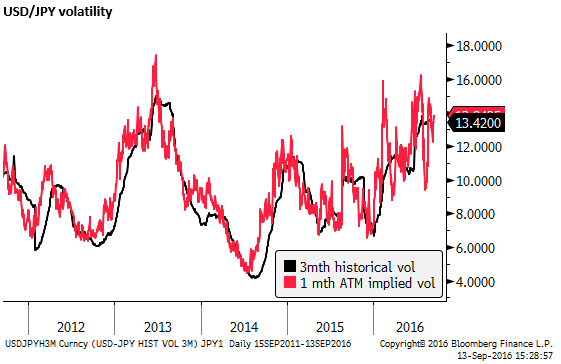

JPY volatility has increased this year, both actual and implied to around the highs since 2013. Perhaps it is surprising that 1 mth ATM vol, covering the 21 September policy meeting, hasn’t picked up even more.

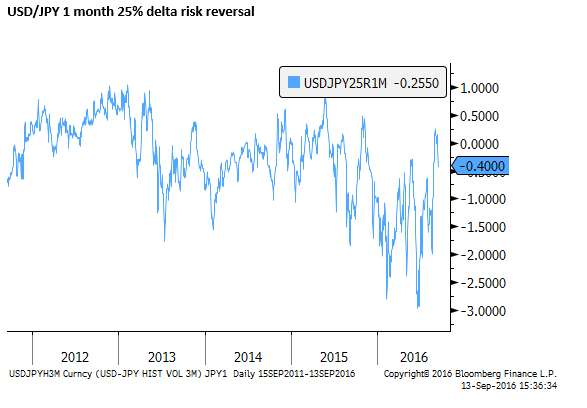

However, the options market is pointing to more balanced two-way risk than it has for some time, suggesting that the market may not be as biased towards expecting a stronger JPY as it has been much of this year. 1 mth USD/JPY 25 delta call less put option prices (risk reversals) have risen since around the 26 August Jackson Hole Symposium to a more modest net skew towards puts.

Sentiment is mixed, perhaps still biased towards expecting a stronger JPY. This suggests that there may be scope for USD/JPY to rally significantly if, as we expect, the BoJ adjusts policy to engineer a significant reverse policy twist, lowering the NIRP and reducing its purchases of long-term bonds, designed to steepen the yield curve via both lower short-term rates and higher long-term rates.