ECB taper with a twist, Italian risks hover over EUR

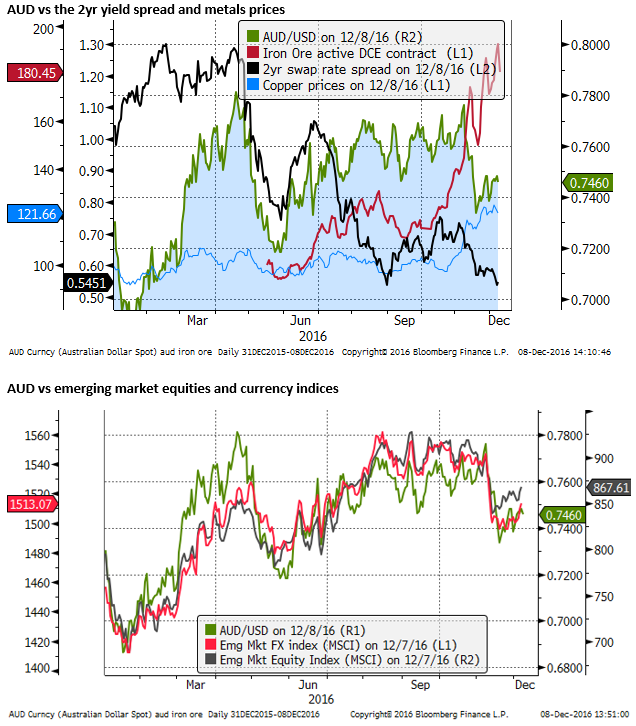

The ECB has effectively implemented a taper…although Draghi won’t call it that. It softened the blow with a kind of policy twist including a modest fall in short-term rates. The EUR resolved to the downside after the ECB meeting in what has become an increasingly volatile FX market response to these events. However, we presume this to be more related to political uncertainty in Europe since the no vote in the Italian referendum and PM Renzi resignation last weekend. The risk is building for EUR to break below its 1.05 support setting in train a deeper more persistent decline. AUD has so far held its ground since the shockingly weak GDP data this week, but it too may be building for a deeper fall as its yield advantage declines, global yields rise, and Chinese commodity prices give up some of their recent surge.

ECB taper with a twist

The ECB was expected by most people to extend the time-frame for its 80bn QE program by six months from Mar-17 to Sep-17. Instead, it announced that after Mar-17 it would lower the purchase amount to 60bn, but extend it by nine months to Dec-16. So a kind of taper.

The ECB maintained the statement that the policy will be maintained “beyond [Dec-17], if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim.”

In a dovish concession to the hawkish taper it said, “If, in the meantime, the outlook becomes less favourable, or if financial conditions become inconsistent with further progress towards a sustained adjustment of the path of inflation, the Governing Council intends to increase the program in terms of size and/or duration. The net purchases will be made alongside reinvestments of the principal payments from maturing securities purchased under the APP.”

So this adds a bias to increasing the QE if required and to reinvest maturities.

Draghi also announced that it was decreasing the minimum maturity of eligible securities in the QE program from two-year to one-year from Jan-17. Furthermore, the ECB removed the minimum yield at which QE purchases are allowed – they may now be “permitted to the extent necessary” at a yield below the ECB’s Deposit facility [-0.40%].

This is a kind of policy twist since the minimum yield removal effects mainly short term securities, and now they can buy shorter-term securities, which implies fewer purchases of longer-term securities.

This element has been a master-stroke by the ECB. It has tended to weaken the EUR, easing monetary conditions, but steepen the yield curve, taking the foot off the throat of banks, and boosting bank share prices.

Initially, the EUR rallied on the announcement of a taper in the QE amount, but then fell as the market absorbed the twist with some modest downward pressure on short-term yields.

It’s not a taper…. OK!

Draghi came to the press conference prepared to dispel the notion that the reduction in the pace of QE purchases was a taper. And he did so forcefully several times. He emphasized that the Council’s intention is to calibrate policy to continue to “exert pressure on market prices” and signal “the presence of the ECB in the markets for a very long time”…. “A sustained presence is a message of today’s decision….that’s why tapering was not discussed”.

When pressed on why he does not see a reduction in the pace of purchases as a taper, Draghi said that tapering would be a policy of gradual reduction of QE purchases to zero.

Nevertheless, Draghi did describe the decline in purchases as a response to an improved outlook, implying that he agrees it is a reduction in policy accommodation.

He said that the rationale for the QE reduction was that the outlook had improved since Mar-16 when the QE program was up-sized from 60 to 80 bn (at that time the prospects for a sustained return to our inflation objective was much darker, and deflation risks were not immaterial). Now, “the risk of deflation has largely disappeared.”

However, while the risk of deflation may have diminished, the staff forecasts have not been upgraded since those made in September. GDP was still forecast to rise by 1.7% in 2016 and 2017, and by 1.6% in 2018 and 2019. And, “The risks surrounding the euro area growth outlook remain tilted to the downside.” Inflation was forecast at 0.2% in 2016, 1.3% in 2017, 1.5% in 2018 and 1.7% in 2019.

When asked if he thought 1.7% in 2019 was consistent with the ECB mandate for targeting inflation at just below 2.0%, Draghi said, “Not really, so we have to persist.”

The forecasts were not upgraded, but the statement did signal some more confidence in the outlook. Draghi said, “Looking further ahead, we expect the economic expansion to proceed at a moderate but firming pace.”….. “At the same time, there are indications of a somewhat stronger global recovery.”

Draghi said the Council considered two options for QE, one was to extend the 80bn program six months, the other was that chosen, to lower it to 60bn and extend it nine months. He said this decision was not unanimous, but it was a “very very broad consensus.”

Since Draghi said the ECB was prepared to increase QE again if the “outlook became less favorable,” he was asked if the ECB would also reduce QE if they became more favourable. He said, “We haven’t discussed that at all today, we seem to be far away from any such high-class problem.”

Draghi was asked about the potential fallout in the Eurozone from the Trump election. He said, “The radically new administration in its way of looking at the world, or in this matter even Brexit, or even the outcome of the Italian referendum. All three events were expected to have major effects in the world. ….The markets and intermediaries proved much more resilient than expected. The effects will develop their full dimensions in the medium to long term …… So it is tough to assess the consequences now.

European market reaction

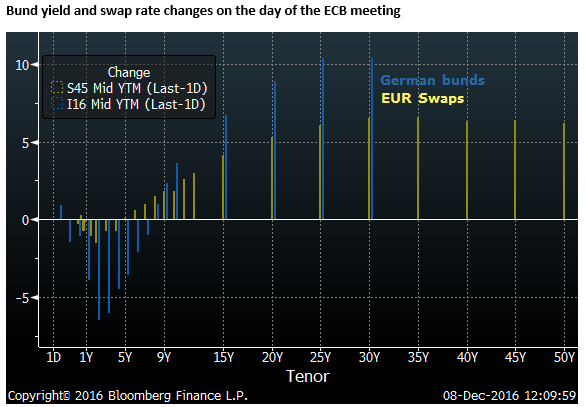

The market impact of the ECB policy measures was some twist in the EUR yield curve. The chart below shows the fall in short-term yields was significantly larger for German Government securities than for EUR swap rates, and the rise in longer-term yields was most noticeable beyond 10-year maturities, but apparent beyond 7-year maturities.

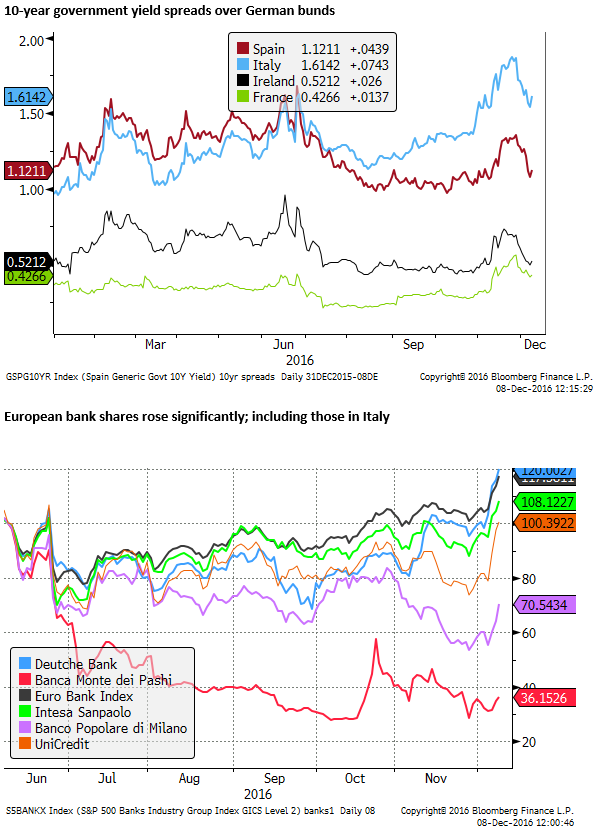

There was some reversal of the recent narrowing in the Italian 10-year bond spread over German bunds after the ECB meeting.

EUR fall may reflect the Italian political uncertainty

The EUR was quite volatile, consistent with the new paradigm of decreased liquidity in FX markets or phantom liquidity that can disappear suddenly, especially around key events. This certainly makes for more exciting markets.

EUR fell in the lead-up to the Italian referendum in anticipation of a no-vote, and then oddly bounced after the event. As we discussed in out report earlier this week, confidence in global markets, related to factors such a broadening improvement in the global economy and anticipation of more infrastructure spending, over-powered Italian political risks. (Global confidence overcomes Italian uncertainty (6 Dec) – ampGFXcapital.com)

But of course, the lack of response to a resounding no vote in Italy and resignation of PM Renzi last weekend, creating considerable political instability and risk of ant-establishment/anti-Euro government in coming months, is confusing. It suggested that market positioning was short EUR and Italian assets ahead of the event and thus lacked the power to drive these assets still weaker. It led many commentators to suppose that political uncertainty in Italy is not uncommon and may not matter so much.

It is, of course, difficult to quantify the impact of political uncertainty in Italy, and we should accept that the market could easily be distracted by other global developments. But it does appear that currencies and perhaps markets more generally have become more disconnected from fundamental developments (including political) and more influenced by market positioning. As such we are seeing delayed reactions to fundamental developments and/or divergent moves from fundamentals that can last for weeks or months at a time.

A new Paradigm in FX markets

In this vein, I would include the movements in GBP that fell sharply at end-September into early-October, even though weeks before the risks of a hard-Brexit had increased, and then recovered in a delayed fashion even though the UK economic data continued to print above expected and the UK government shifted to a more stimulative fiscal stance.

Another example would be the further decline in the USD/JPY after the BoJ implemented Yield Curve Control on 21 September. And then its surge after the Trump election reversing half of its deep fall over the first three-quarters of the year in the space of a few weeks. While this event brought with it further reasons to boost the USD, the pace, size and persistence of the USD/JPY rebound appears to reflect a correction in JPY from a level that was out of line with Japanese policy measures and Japanese economic conditions.

A related market distortion may have been the persistent fall in global bond yields this year to record low levels and decreases in inflation-breakeven compensation, and sudden reversal in the last month.

Fundamental traders have become more inert and frozen. And technical and mechanical algorithmic model trading have become more prominent.

As such, it is premature to conclude that the EUR has adjusted to the political uncertainty and risks related to Italian banks, or to readjust our thinking to presume Italian political uncertainty doesn’t matter.

Downside risks for EUR

We should still see significant downside risks associated with Italy with further potential negative fallout for the EUR and indeed wider market consequences. We need to keep an open-mind; the timing of the EUR response to these risks may just have become harder to predict.

The slump in the EUR after the ECB meeting might seem a surprising development given that the ECB caught the market unprepared by reducing its pace of purchases. There were dovish elements to the ECB meeting, such as a slight fall in short-term rates related to tweaks to maturities and removing the minimum yield on purchases, but on balance, the ECB policy change is somewhat less accommodative and in different circumstance might have boosted the EUR.

The short-lived spike in EUR on the ECB announcements and deep fall during the press conference may reflect the increased political uncertainty in Italy since last weekend. The positioning wash-out after the ECB meeting may have allowed the market to respond more to this ongoing political risk.

In a broad sense, the EUR is still trading close to the low end of its sideways range over the last two years; it may be building for a break of the 1.05 level setting in train a deeper fall towards parity. This might be consistent with the steady rise in the USD yield advantage over EUR this year and political risks in Europe that still threaten the long-term viability of the monetary union.

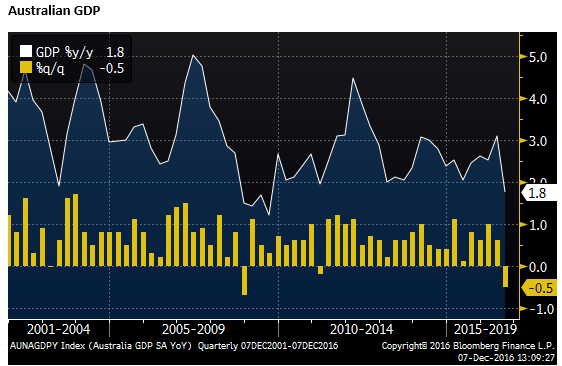

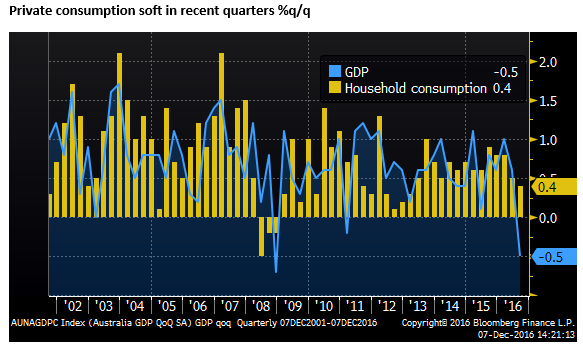

Australian GDP shock drop

The Australian GDP data on Wednesday were shockingly weak, falling 0.5%q/q and slowing from 3.1%y/y in Q2 to 1.8%y/y in Q3, compared to a perceived trend rate of growth of around 3%. On the face of it, this might be expected to have seen the AUD fall more than it has. In fact, less than 24 hours after the outcome the AUD was higher.

The muted currency response can be explained by a number of factors that suggest this outcome may underscore the state of the economy, and the RBA, looking forward, will not be rushing to cut rates.

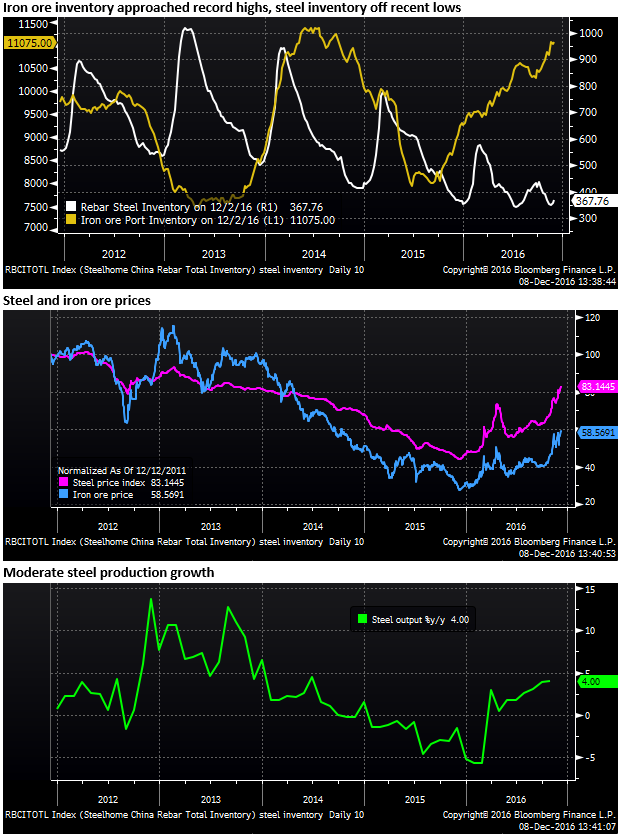

Furthermore, iron ore and steel prices in China returned to new highs, while the USD strength had lost momentum in recent weeks and emerging market assets were recovering.

However, Australian GDP data is indicative of the weaker state of the economy this year and consistent with the slower pace of employment growth. The RBA is likely to be further away from hiking rates at the same time as rate hikes are being moved up the schedule in the USA.

Even though there has been a modest uplift in Chinese economic activity, including steel production this year, helping support steel prices, there still appears to be excessive gains in steel and iron ore prices this year that might unwind at any time.

Iron ore inventories at Chinese ports are approaching record highs. Chinese economic stability continues to be threatened by persistent capital outflow, now more clearly pushing up Chinese interest rates and tightening monetary conditions.

Details in Australian GDP

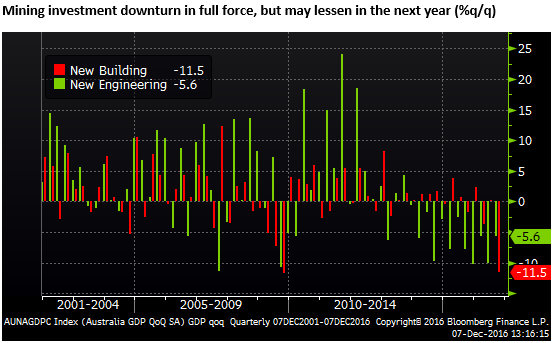

The weak result incorporates the poor state of business investment driven by the mining sector downturn. There were steep falls in the two components most affected by this sector – non-dwelling New Building (-11.5%q/q) and New Engineering (-5.6%y/y). The RBA has estimated that about 80% of the downturn in mining investment is complete, so we might expect the pace of this decline to taper and flatten over the next year.

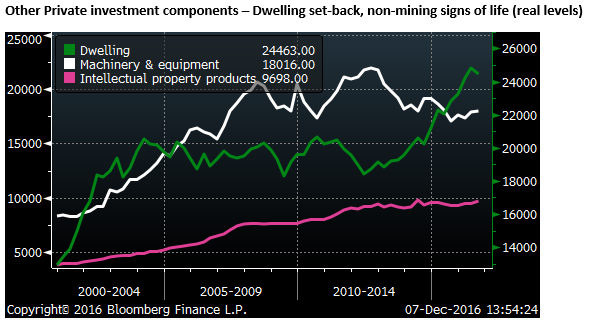

Also detracting from GDP was the other major component of private investment – housing. Dwelling investment fell for the first time in 5 quarters, down 1.4%q/q, but still up 7.2%y/y.

Dwelling investment might be expected to slow in coming quarters as building approvals fell sharply in October led by a drop in apartments. This may well start to detract from growth next year. However, the decline in Q3 was reported to be mostly driven by wet weather and activity should rebound in Q4.

More encouraging for business investment was gains in other components pointing to rising investment in non-mining sectors. Machinery and equipment increased by 0.5 %q/q and 5.7%y/y, and Intellectual property products (including computer software) rose 2.0%q/q and 3.7%y/y.

The mainstay of GDP growth, private consumption, was relatively soft up 0.4%q/q and 2.5%y/y, running somewhat below long-run or potential GDP growth. Retail sales rose 0.5%m/m in October, firmer than 0.3% expected, up 3.5%y/y, so it appears to indicate steady growth in consumption into Q4.

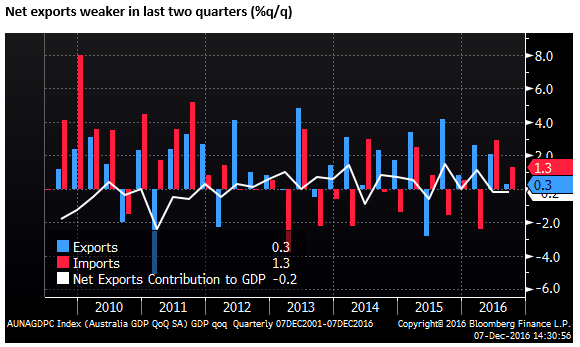

Net exports also detracted from the GDP outcome. However, this is unlikely to persist as the mining sector is expected to generate stronger export volumes as new projects, especially in LNG, come on stream.

As such there are a number of reasons to anticipate a substantial rebound in GDP in the next quarter and reasonable growth over the year ahead. However, there are still headwinds that may delay a return to above trend GDP growth. The mining investment downturn is still expected to detract from growth over the year ahead, albeit tapering off later in the period. And dwelling investment, while likely to bounce back in Q4 may start to detract from growth in the next year. The pick-up in non-mining investment is happening, but it is not particularly strong at this stage.

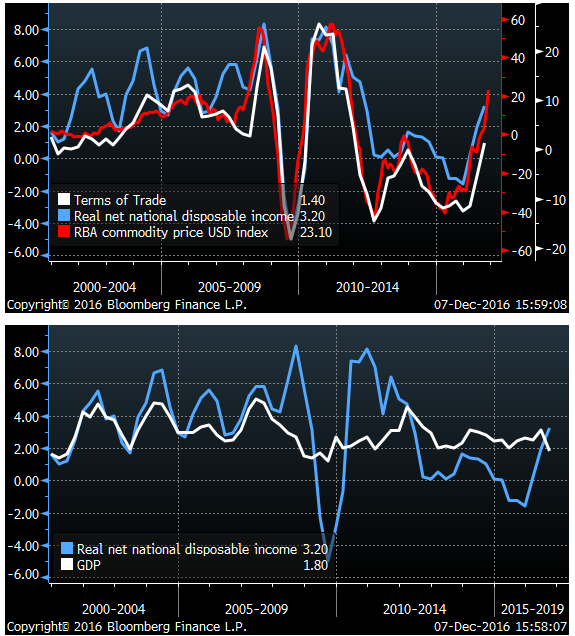

The rebound in commodity prices has started to feed through to the terms of trade and income measures in the national accounts. Terms of trade rose 4.4%q/q and 1.4%y/y.

Real Net National Disposable Income (RNNDI) is a measure national economic well-being which takes account of the change in the terms of trade, among other factors. It rose 0.8%q/q and 3.2%y/y.

The increase in commodity prices is likely to see a further significant recovery in the terms of trade in Q4 and further expansion in this measure of national real income in Q4.

The direct impact of this boost should be felt first through non-financial sector profits, helping over time lift government tax and royalty revenue. However, after a period of declining terms of trade since 2012, weakening profits and tax deductions related to massive investment completed in recent years, mining companies may have substantial tax credits and the flow through to government accounts may be delayed for more than a year.

Companies may pay higher dividends, and Australian resident owners of this sector should benefit, but a large proportion of mining companies are foreign owned. Mining companies have or soon will have excess capacity and thus are unlikely to resume mining investment. The flow through to higher dividends, employment, wages and capital expenditure from the rebound in commodity prices and national disposable income is likely to be minimal in the next year and perhaps for some time.

As such, it is difficult to read too much into the rebound in commodity prices through to national well-being. As the chart above suggests, there is a limited connection between real net national disposable income and real GDP growth. Just as the slump in RNNDI into recession in recent years did not drag the real economy into recession, the rebound underway may not suddenly boost real activity in the economy.

The boost in terms of trade may help lift medium-term confidence in the economy, pointing to improved government fiscal balance, higher dividends and a faster stabilization in mining investment over the medium term. However, there remains considerable uncertainty over the sustainable level of the commodity prices and the terms of trade. Many analysts continue to look at the recent rebound in iron ore and coal prices as a short-term development that will reverse over the year ahead as the Chinese economy slows and new mining capacity comes on stream.

What matters most for the Australian economy at this stage of the cycle is the medium term outlook for commodity prices rather than the rebound seen in the last year. That outlook may have improved, but by less than the price surge seen in recent months and uncertainty remains high, keeping in check the boost in optimism.