Fed Credibility Gap and rising USD borrowing costs

The broad fall in the USD and lack of rates market response to a somewhat less dovish FOMC statement is curious and suggests that the Fed is suffering a credibility problem. The market appears to doubt that the Fed will walk the talk. A combination of diminishing yield and caution in equities markets after the post-Brexit surge appears to be boosting gold and high yield currencies, while low conviction position squaring may be boosting JPY and EUR. There does not appear to be a consistent thematic in the market and clearer direction may not arise until after the BoJ policy meeting on Friday. In our report today we look at the upward trend in USD money market rates and cross-currency USD funding costs in recent months. This could become a factor that adds support to the USD, although clearly that received little consideration today.

Fed Credibility Gap

My initial interpretation of the FOMC statement, and that of many others judging by commentary, was that it was a more hawkish (or less dovish). In particular it included a sentence that, “Near-term risks to the economic outlook have diminished.”

How the Fed views risks tends to be an indicator of whether they are prepared to act on their forecasts to raise rates. This suggests that they have become less fearsome of risks and increases the chances of a hike in Sep or Dec.

The statement did repeat the same sentence in place since April that, “The Committee continues to closely monitor inflation indicators and global economic and financial developments.” This indicates that the Fed is still wary of the fallout from Brexit and other uncertainties. But surely that should have been anticipated.

It is surprising to see no upward response in US rates following this statement. The market reaction has been more towards reading the statement as a dovish outcome, with the USD broadly weaker and slightly lower US rates.

The market response may reflect a situation where the market was inclined towards selling USD, was waiting for the Fed in case it was hawkish, but decided that it was not hawkish enough, and sellers have stepped up.

Why would the market want to sell USD? That is a harder question answer. It may be a positioning thing – the market may have gotten long USD in recent weeks and there is a bit of a squeeze of these perhaps low conviction trades. I can certainly understand low conviction. If it’s a modest position squeeze then we might expect mainly noise and limited follow through in USD direction.

Gold has lifted relatively sharply in the wake of the FOMC statement, consistent with the broad USD down move. The up move in gold may appear to be a resumption of a rising trend this year, and appears technically more viable as a long trade against the USD.

The up move in gold may reflect extreme lows in global yields and greater uncertainty over equity valuations after their post-Brexit surge. Global bond yields have indeed fallen today and equities are mixed; as such a rise in gold makes a little more sense. If the market remains doubtful that the Fed will raise rates in coming meetings then the rise in gold may have more legs.

A higher gold price that may not be entirely related to the Fed, may nevertheless contribute to a broader sense of USD weakness and reinforce the fall in the USD against other currencies, notwithstanding what at first glance was a somewhat more hawkish FOMC statement. It may feed the notion that the Fed is suffering a credibility problem; ‘crying wolf’ on rate rises but under-delivering.

There does appear to be a sense that the Fed will not walk the talk, and combined with more policy easing expected by the BoJ and BoE, falling global yields and low credit spreads, the market may be seeking out higher yielding currencies; supporting the likes of NZD, even if the RBNZ is posed to cut rates in two weeks.

Of course that does not explain rises in JPY and EUR. Perhaps the volatility around these currencies in recent weeks places gains post-FOMC more in the camp of low conviction position squaring.

Overall there does not appear to be a clear thematic to latch onto and cautious trading is advised. Clearer direction may not arise until after the BoJ policy meeting on Friday.

Dollar funding costs on the rise

There has been an unusual creep up in USD rates/funding costs over recent weeks that may start to get more attention and add support to the USD exchange rate. Various articles attribute the rise in US money market rates (LIBOR) to new rules set to be introduced on 14 October by the US Securities and Exchange Commission (SEC) aimed at making US money market funds safer. The rules require money market funds (MMFs) to publish daily Net Asset Values (NAVs), rather than maintain a constant share price of $1.

Musings on the implications of a higher dollar LIBOR – Macro-Man.blogspot.com

The $400 Billion Money-Fund Exodus with Banks in Its Crosshairs – Bloomberg.com

This Is Why Libor’s Moving Higher – Bloomberg.com

SEC Adopts Money Market Fund Reform Rules (press release July 2014) – SEC.gov

Money market funds (MMFs) invest a large share of the funds they manage in commercial paper. These assets have higher credit risk than government paper (Treasury bills) and while they may be regarded relatively safe, in part because they are short term, investors in money market funds are seeking a very safe and liquid place to hold their assets and are sensitive to even small changes in asset value.

MMF managers and their investors are therefore very sensitive to changes in NAV and expect this to reflect at least 100% of the initial money invested. As such the new regulations encourage MMFs to invest in government paper ahead of commercial paper, or require commercial paper issuers to offer a higher yield as greater compensation for risk than MMFs have demanded in the past.

Banks, especially foreign banks in the USA, have been large issuers of commercial paper to fund their US and global operations/balance sheets. As the effective rate that they have to pay as issuers of this paper rises, in turn so does the rate at which banks are prepared to lend to each other (LIBOR).

Other new rules also tend to push MMFs out of commercial paper. Their maximum weighted average of maturities will be reduced from 90 days to 60 days. This will lessen demand for longer dated commercial paper, tending to steepen the money-market curve.

The rules set minimum holdings for ‘liquid’ assets (Treasury bills) as thresholds that allow MMF to impose fees or limits on redemptions. These rules may encourage investors to invest in MMFs that hold a greater share of Treasury bills.

MMFs will also have to disclose when holdings of liquid assets fall below 10% and will be subject to enhanced stress testing, further encouraging them to hold more Treasury bills and less commercial paper.

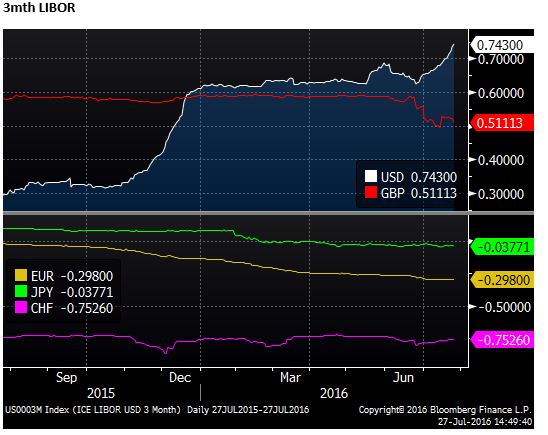

The chart below shows USD 3mth LIBOR compared to the same for the other major currencies. In most respects LIBOR is driven by central bank official rate policy settings, but USD rates have risen independently of Fed policy and other currencies’ LIBOR in recent months.

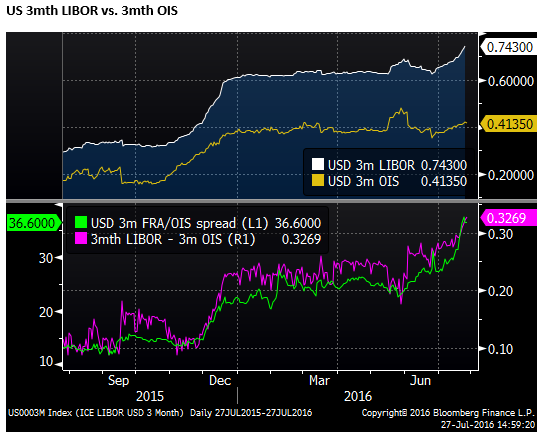

The chart below illustrates more exactly the rise in US 3mth LIBOR that is unrelated to Fed rate hike predictions. The lower panel shows two versions of the spread between the 3mth LIBOR and 3mth Overnight Interest Rate (OIS) swap rate. OIS reflects the average expected effective cash rate over the 3mth term. This spread has risen by around 10 bp in recent months.

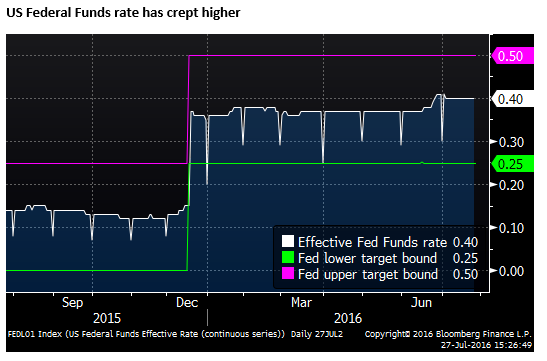

Rising Effective Fed Funds

It is also interesting to note, in what may be a related development, even the effective Fed funds rate (overnight cash rate) has risen a little for no apparent policy reason from 37bp to 40bp since June, and this may account for some of the increase in the 3mth OIS rate that is essentially the expected average of the overnight cash rate over three months.

This makes it a little harder to distinguish what part of the rise in OIS may relate to Fed rate hike expectations and what may be simply additional upward pressure on the effective overnight cash rate.

Rising USD cross-currency swap funding costs

The rise in USD LIBOR rates translates into higher carry for USD investors in the foreign exchange market and thus will tend to provide support for the USD.

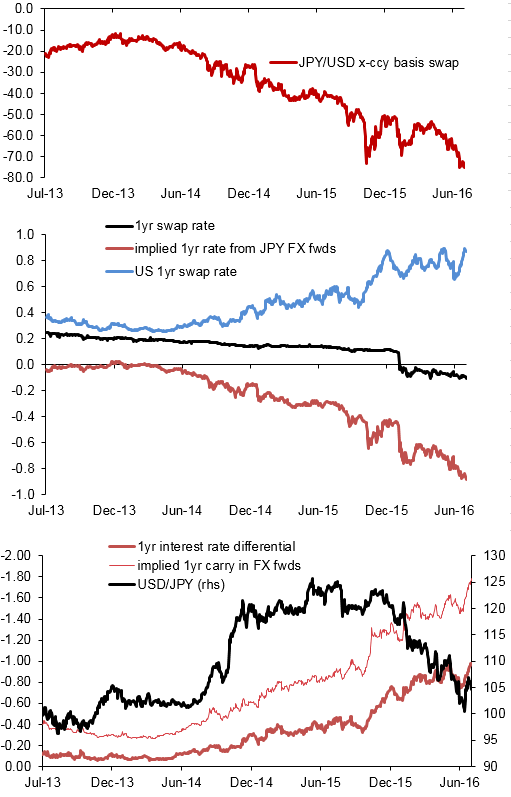

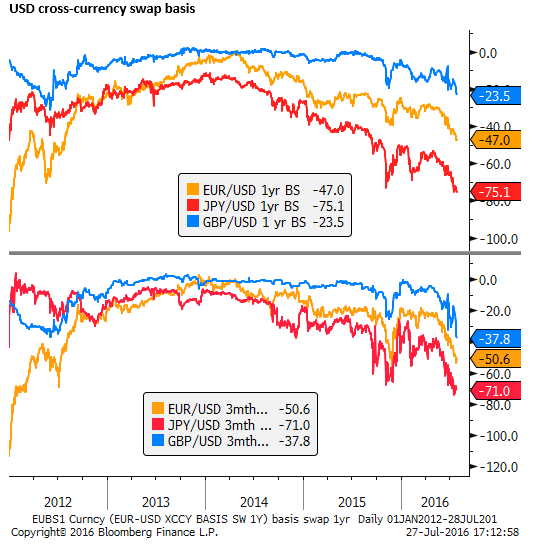

The carry in the FX market is also influenced by the cross-currency basis and this has also been widening, reflecting tightening demand for US dollar term funding relative to other major currencies. The chart below shows that the cross-currency basis for EUR, JPY and GBP vs USD. In all cases, for 3mth and 1yr terms, it has become more expensive to borrow USD in recent months.

The MMF rule changes in the US may have had some influence here. European and UK bank issuers of USA commercial paper, finding this avenue to raise USD funds more expensive, may choose alternatively to raise funds in their home country and swap the proceeds to USD funds. They use the cross-currency swap market to avoid currency risk and pay the basis points as shown in the chart above. The widening basis shown in the chart above illustrates that it is becoming more expensive for UK and European banks.

The chart above shows that JPY/USD cross-currency basis is wider than for other major currencies. This is likely to reflect the low and negative yields Japanese investors face in Japan. Japanese banks and other institutions convert their JPY funds to other currencies’ to buy overseas assets, including US bonds. To avoid the foreign currency risk (losses from a possible fall in the USD/JPY exchange rate) they swap the JPY into USD using the cross-currency swap market. This is costly and trims the effective return from these investments; paying over 70bp on 3mth to 1yr terms, it seems it trims the return on USD short term assets to virtually nothing.

USD carry rising in FX market

The wider the cross-currency swap basis, and the higher the difference between domestic and overseas interest rates, the greater the carry (forward points) in one currency over another. To illustrate this point the chart below shoes the JPY/USD 1yr cross-currency basis (top panel – widening); the 1yr domestic market money market rates in the USA and Japan, and an implied one-year JPY interest rate calculated from the FX forward market (falling further into negative territory below the domestic 1yr rate); the third panel shows the one year carry from holding USD over JPY (175bp) compared to the one-year interest rate differential (98bp).

The third panel shows that the USD/JPY has been falling despite this higher carry on long USD positions funded by selling JPY. Normally rising carry (most often associated with a widening interest rate differential) might tend to boost demand and the exchange rate for the higher carry currency. However, this has not been the case this year in Japan. In fact, it may have been the other way around; expectations that the USD/JPY would fall has increased Japanese institutional investor hedging demand, pushing out the basis and improving the USD carry (or increasing the cost of hedging).

Considering the falling USD today following the FOMC statement it may seem odd to be discussing money market developments that may support the USD. The upward pressure on USD cost of funding is not severe enough it seems to have spilled over the increased demand for USD in the FX market. Nevertheless, it is a factor to keep in mind