From 20,000 feet, NZD looks set to free-fall this year, without a parachute

The NZD/USD appears to have broken out of rising trend in place since mid-2015, and now developing a declining trend. Its fall in the last week or so has been persistent and rapid, suggesting a significant shift in sentiment is taking hold. Global equity markets appear more fully priced for a stronger global economy and are now vulnerable to rising US interest rates and global yields. Similarly, demand for higher yielding currencies like NZD may fade. Global commodity prices have turned lower in recent weeks, especially milk prices. The NZD appears very expensive compared to its narrowed yield advantage. In a rising global yield environment, the NZD may begin to under-perform and reconnect to its now small yield advantage. High levels of household debt represent a higher risk for the New Zealand and Australian economies in a rising yield environment. There would be no tears shed by the RBNZ or NZ government if the NZD fell sharply from current levels.

NZD bearish tone develops

We may be entering a persistently bearish phase for the NZD, and, more broadly, a bullish phase for the USD. Over the last 18 months or so, FX markets have been prone to snapbacks and on the whole lacking consistent direction. It has been difficult to catch and hold onto a trend. The NZD has been a prime example. But we are sensing something different developing in the last two weeks.

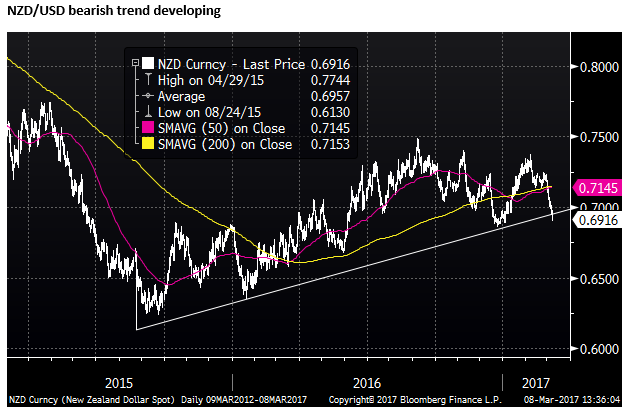

On momentum indicators, the NZD is looking oversold, and this might encourage thoughts of some profit-taking and demand from technical traders seeing support around the December lows. However, from a somewhat longer term perspective, the pace and persistence of the recent fall in the NZD may reveal a significant shift in sentiment towards the currency.

Stepping back a bit to look at the NZD chart over slightly longer time frame, the NZD appears to have broken a rising trend over the last year to 18-months. The NZD has ended a pattern of higher-highs and higher-lows from Sep-2015 to Sep-2016. A break of the December lows (set after the Fed raised rates) would make a second lower-low after a lower-high, signaling a developing downtrend.

After another period of rebound in the NZD (and broader setback for the USD) in the first month or two of this year, market positioning appears to have purged long positions in the USD, including against the NZD. As such, the market does not seem to be excessively long the USD, and may end up playing catch-up trying to re-establish long USD positions if its recent rebound builds momentum.

As at 28-Feb, just ahead of the recent surge in the USD, CFTC currency futures positioning was moderately long AUD and NZD. It was also moderately long CAD and had reduced its total net long USD position to modest levels.

Rising USD yield advantage

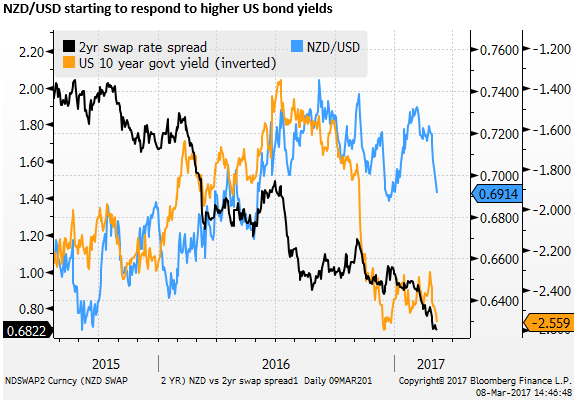

The recent fall in the NZD, from around end-Feb, has been for the most part driven by a Fed speakers raising the odds of a 15 March US rate hike.

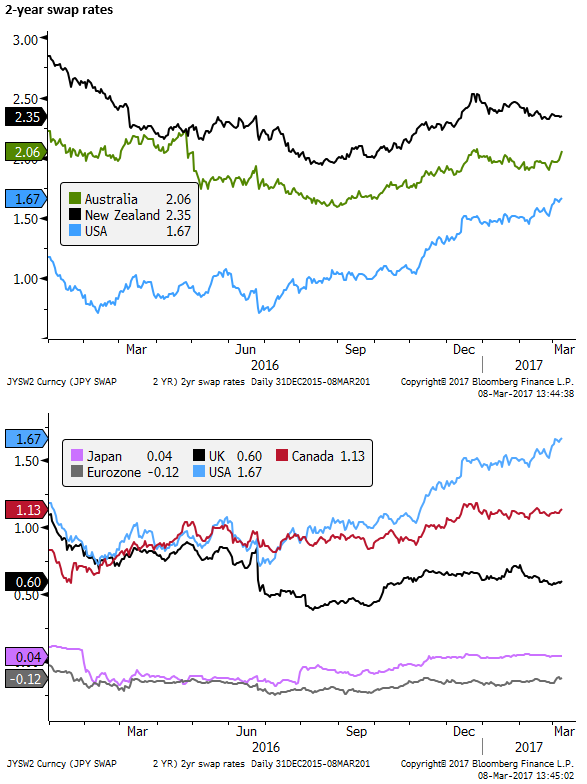

The chart below shows 2yr swap rates for major countries, Australia and New Zealand. USD rates have been rising relative to other currencies since mid-2016, lifting more noticeably after the November election of Trump and the 14 December Fed rate hike. In recent weeks, following more robust US activity and inflation data in February, and less dovish Fed-talk, US rates have firmed further relative to other currencies.

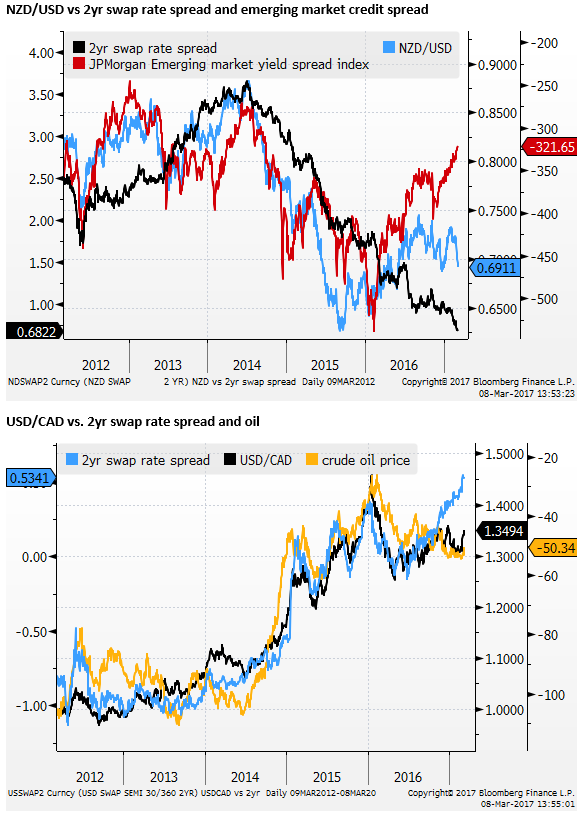

However, The USD has failed to benefit much from this rise in its yield advantage since mid-2016. As the charts below illustrate there may be other factors that account for the lack of strength in recent months; including stronger commodity prices and narrowing credit spreads, boosting demand for higher-yielding currencies like the NZD.

Global equity markets priced for growth, vulnerable to higher yields

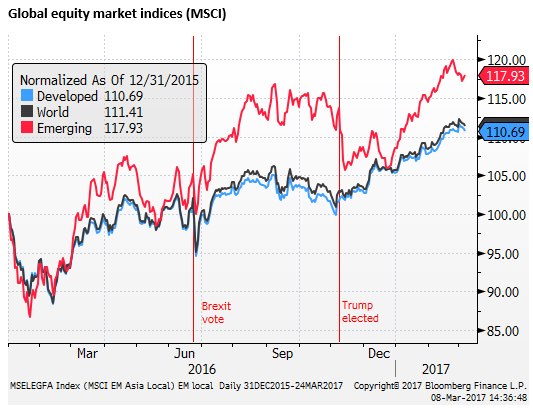

A rise in global growth confidence may have been a factor dampening the impact of a rising USD yield advantage in supporting the USD in recent months.

Global equity markets have been strong, and credit spreads have narrowed. Capital flows towards emerging markets and commodity currencies related to stronger global growth confidence may have dominated in January and early-Feb. However, Global equities have weakened somewhat in recent weeks, allowing space for the USD to strengthen.

Some peaking in commodity prices in recent weeks may be another factor helping the USD make gains against commodity currencies.

Equity markets now appear more fully priced for global economic recovery, and market attention may be switching to the potential dampening impact of higher US rates and yields on equities.

Higher bond yields may tend to reduce demand for higher-yielding products, especially now that yield spreads have narrowed. This may include less high yield demand for currencies like NZD.

Global bond yields have increased significantly led by US Treasuries since the Trump election in November. So far, this has had little dampening effect on global asset prices and demand for high yield assets. However, in recent weeks, as asset prices have begun to stall, and NZD/USD has appeared more responsive to the rise in US Treasury yields.

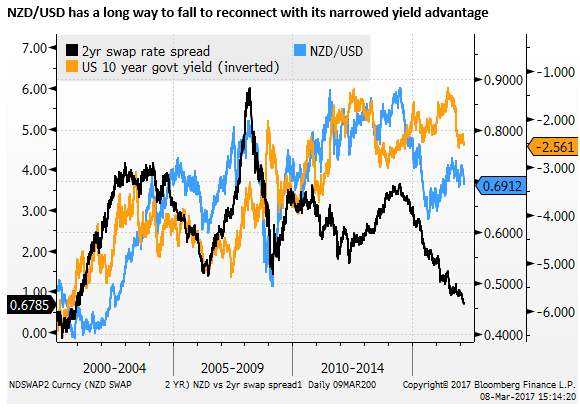

NZD appears overvalued and vulnerable in a rising yield environment

From a longer term perspective, NZD is one of the most over-valued currencies with respect to its narrowed yield advantage. The falling global yield environment of recent years may have contributed to this overvaluation.

If we are moving into a rising global yield environment, we might expect NZD to become a much weaker currency, potentially reconnecting to its narrowed yield advantage. A fall to below 0.60 would not be a stretch at all.

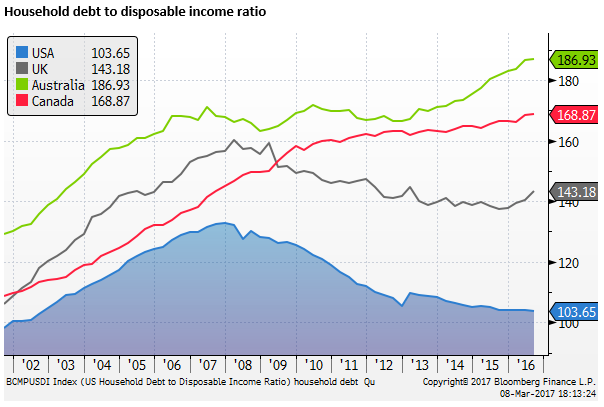

High Debt levels to work against NZD and AUD in a rising yield environment

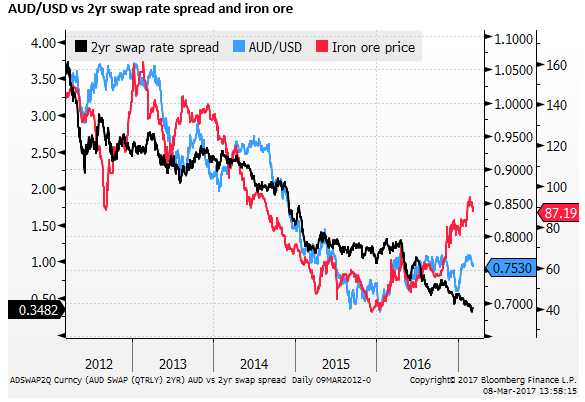

A fundamental factor that may help drive the NZD and AUD lower over the medium term is the impact of higher global yields on the Australian and New Zealand economies. Both countries have much more highly leveraged households after surges to record highs in their house prices relative to household income in recent years. As mortgage rates begin to rise, it will dampen growth in Australia and New Zealand faster than in the USA.

Their regulators have forced banks to adopt longer-term funding sources. This means that mortgage rates in both countries are now more influenced by global bond yields than in past cycles.

In the falling yield environment until Q3 last year, this tended to place downward pressure on mortgage rates in Australia and New Zealand, reinforcing housing market strength. In a rising global bond yield environment, mortgage rates in Australia and New Zealand will start to rise faster than official rates, tending to weaken their housing markets and consumer demand.

In any case, regulators in New Zealand and Australia are leaning harder against bank mortgage lending. Banks have been required to lift their credit standards and slow lending. This has to some extent allowed both countries to cut official interest rates further in the last year.

Importantly, there will be no tears shed in by governments or central banks in Australia and New Zealand if their exchange rates fall significantly from current levels.

Both would prefer a balance of policy that involves a weaker exchange rate and higher interest rates. New Zealand, in particular, has said that its exchange rate needs to fall.

US rates have further to rise

While the market has warmed to the idea of a Fed hiking rates next week, it is still reluctant to price in even two further this year (after March). However, on some measures, the Fed is already at its mandate for full employment and 2% inflation. FOMC members’ forecasts next week are likely to reveal risk of more hikes this year, as many as one per quarter.

In the tumultuous start to the Trump presidency, the USD has at times appeared to be undermined by controversy and policy uncertainty. However, the FX and rates market appears to have paid less attention to negative news related to the administration in the last week. This includes unsubstantiated allegations made by Trump against former President Obama over wire-taps, Republican infighting over the policy to replace the Affordable Healthcare Act, difficulty finding staff for high-level posts at the Treasury, and another attempt at a travel ban meeting renewed resistance from two states so far.

It appears that stronger momentum in the US economy that may, or may not, be related to hopes of fiscal stimulus and tax reform is now getting more attention.

There is enormous political uncertainty in the USA with contentious policy issues including a possible border tax, tougher bilateral trade policy, debt ceiling reinstatement next week, and North Korean tensions. This may up-end confidence in the USA and/or global economy at some point. However, the market is being forced to consider a more immediate risk that the US growth and inflation trends are stronger than previously thought.