Global confidence overcomes Italian uncertainty

Global markets are moving in a classic risk-on fashion so far this week, despite the political upheaval in Italy. Even Italian bonds and bank share prices are relatively stable. Low-yielding safe-havens, JPY, and gold, are weak. And capital appears on the move back to higher yielding and growth leveraged emerging markets and commodities, including their currencies. EUR has rejected the test of its lows in in the 1.05s and appears resolved for the near term at least to find its way further back into its stable 1.05/1.15 range over the last two years. The big sell-off over the last month in JPY and global bonds has lost momentum, and they are shifting into a slower moving consolidation. The rush of funds into the USD after the Trump election appears to have run its course for now, and may now be spilling back into emerging market and commodity currencies. The November PMI surveys for manufacturing and services sectors showed further modest improvement with uniform performance in major economies. Emerging market PMIs dipped led by deterioration in India related to its poorly implemented currency redenomination that has disrupted the overall economy. However, Russian and Chinese PMI data retained improving trends. India’s economy might be expected to rebound. The improving trend in PMIs is consistent with the stronger trend in commodity prices. Equity, bond and commodity markets are behaving in a manner compatible with more robust global growth led by infrastructure spending. There has been a rotation out of fixed income and stable income equities towards high beta equities, particularly, energy, materials, and financials. We continue to see the USD supported by rising inflation pressure in the USA. However, position squaring and improving global growth indicators may help commodity and EM currencies in the near term.

PMI surveys show broadening global recovery

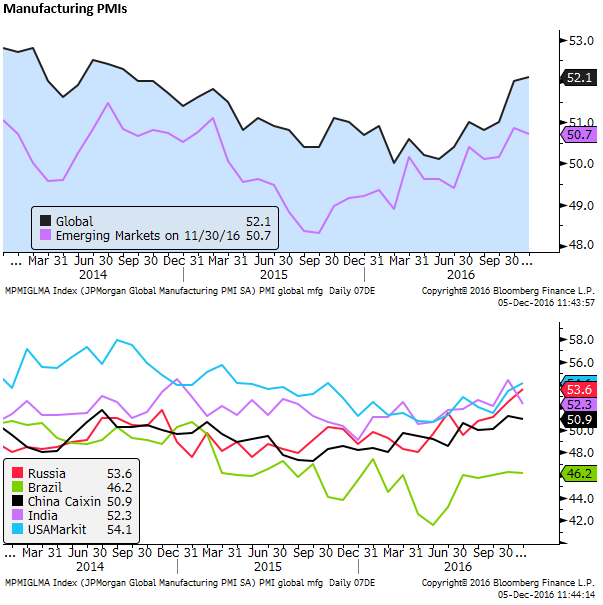

The November data showed a further step up in the global manufacturing PMI to 52.1, a high since August 2014. The emerging market manufacturing PMI stepped down somewhat to 50.7 after rising to a high October since Feb-2015.

The fall in the emerging market PMI reflected a significant pull-back in India that has been struggling with a poorly implemented redenomination of its currency designed to recoup income from the black economy, but spilled over into widespread economic disruption. The Russia PMI, in contrast, rose to a high in data available since 2013. The Chinese Caixin PMI eased a bit from its high since July-2014.

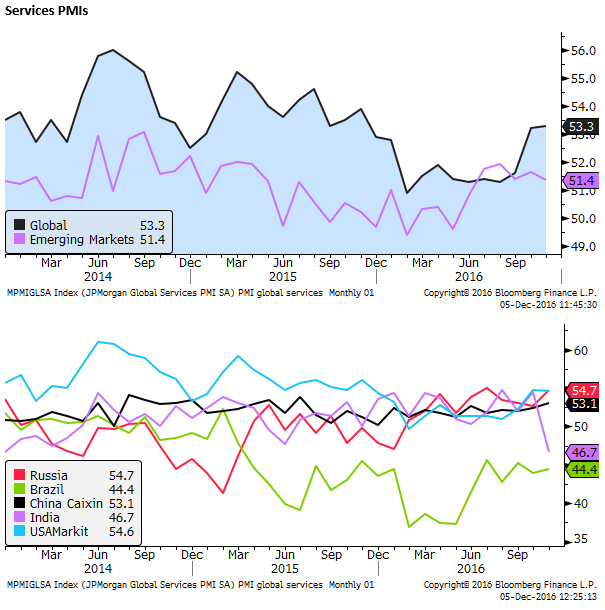

The global services PMI edged up to a high since November 2015, whereas the emerging market PMI edged down to a low since June this year.

A sharp fall in India appears to be primarily responsible for the decline in the emerging market PMI, again related to its currency redenomination. We might expect this to recover as India sorts through this issue. The Russian services PMI recovered from recent falls to approach its high in July this year, a high in data available since 2013. The China Caixin services PMI firmed to a high since December 2014.

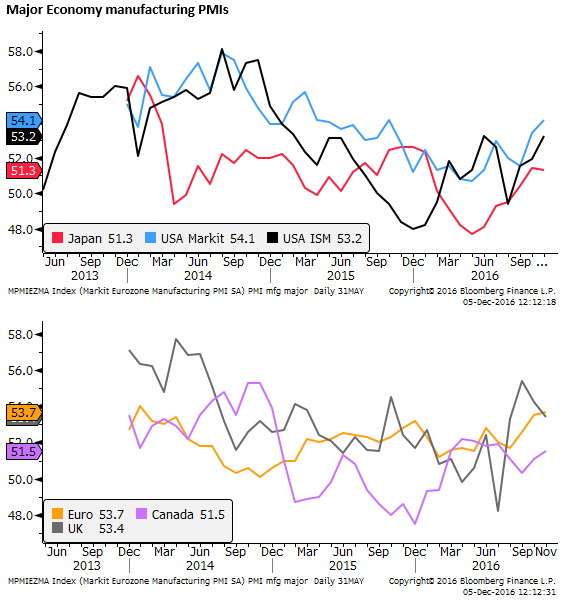

In the major economies, the USA manufacturing PMI indicators strengthened. The ISM index rose for the third month in a row to 53.2, revisiting the high this year in June, up from the low in December of 48.0. The USA Markit PMI rose to 54.1, a high since October last year, up from its low in May of 50.7. The modest recovery in the energy sector has helped USA manufacturing recover.

The Eurozone manufacturing PMI firmed to 53.7 a high since Jan-2014. The UK PMI retraced for a second month to 53.4. Japan retraced from a high in October since January to 51.3. The Canadian PMI rose for a second month to 51.5. All the major economies were above 50 and showed modest to moderate growth.

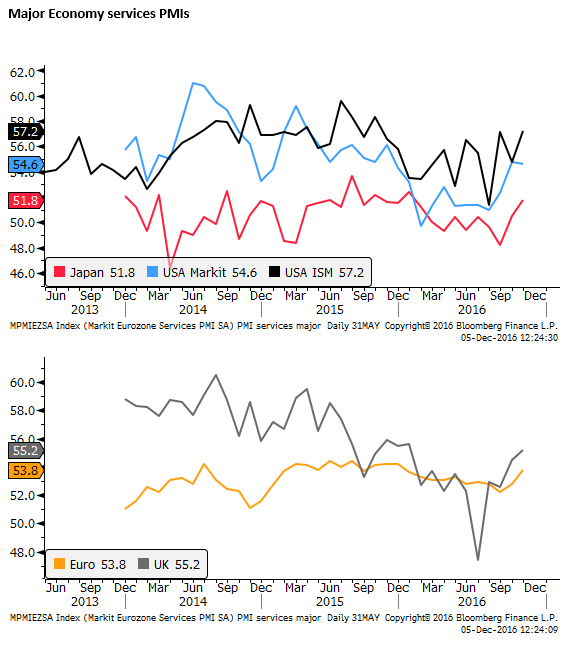

The USA service sector Markit PMI recovered from its dip in October to rise to a high since October 2015 of 57.2. The USA ISM non-manufacturing index eased a bit to 54.6 from a high in October since November 2015.

The Eurozone services PMI rose for a second month to 53.8 to a high since December 2015. The UK services PMI increased to 55.2, a high since January 2016. The Japanese PMI rose for a second month to 51.8, a high since January 2016.

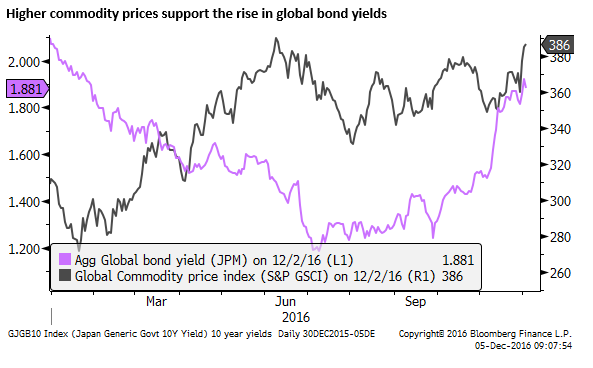

Many commodity prices rise to new highs for the year

Higher commodity prices may reflect increased optimism that the global economy, particularly in the infrastructure space, will grow faster lead by the USA and other countries plans to promote more infrastructure spending.

Coal prices in China have come off recent highs on news that its government is easing restrictions on production in response to rapid price gains and to help support growth. However, Iron ore and steel futures prices have revisited recent highs despite news that Chinese authorities have raised margins and taken other measures to cool speculation. Copper prices are also making new highs for the year.

Oil prices have rebounded to revisit their highs this year after the OPEC agreement to cut production. US natural gas prices have risen more sharply to new highs for the year, driven by US weather and demand for heating.

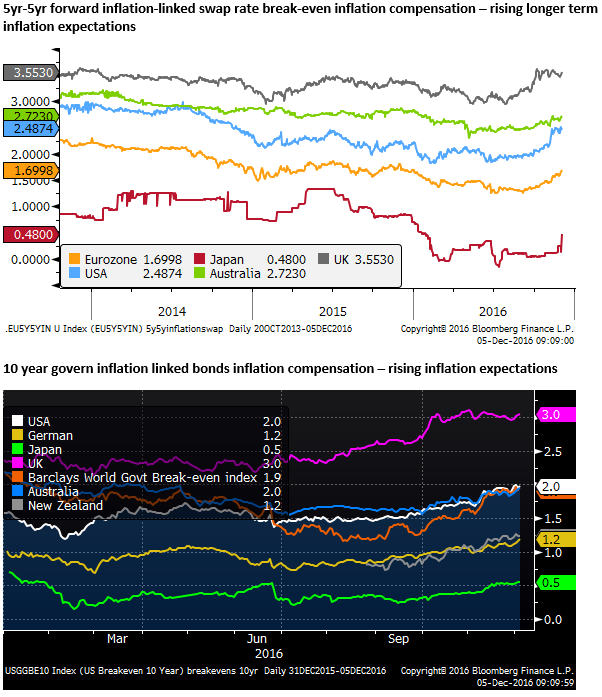

Rising commodity prices are likely to help boost inflation expectations and tend to push up global bond yields.

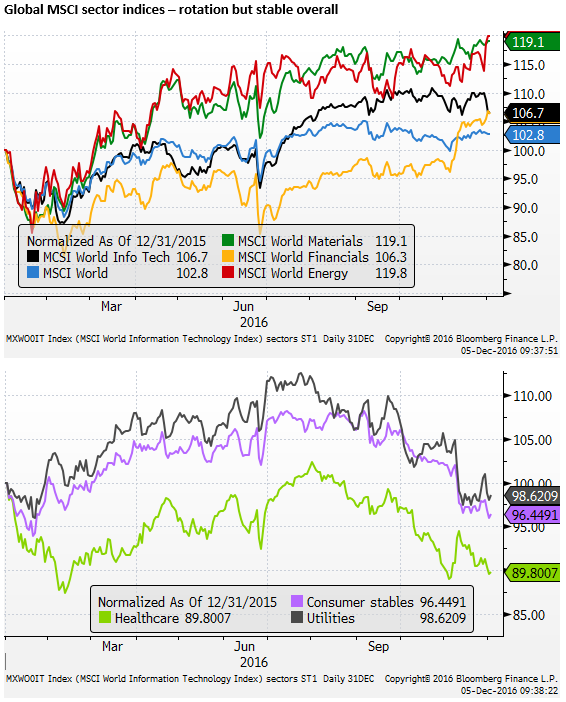

Equities robust in rotation

Equity markets remain broadly stable in the last month, despite the rise in global bond yields that might detract from shares, attracting capital towards now more attractive bond yields and raising borrowing costs for companies. Financial sector equities have rallied sharply, supported by steeper yield curves, boosting bank profits that borrow short and lend long. Energy and material sector shares have also risen to new highs for the year.

IT shares have retreated modestly. Shares of utilities and consumer staples equities, steady income earners that closely resemble bonds, have weakened.

Emerging markets stabilizing in recent weeks

Emerging market equities have been moderately weaker in the last month, although relatively stable in recent weeks

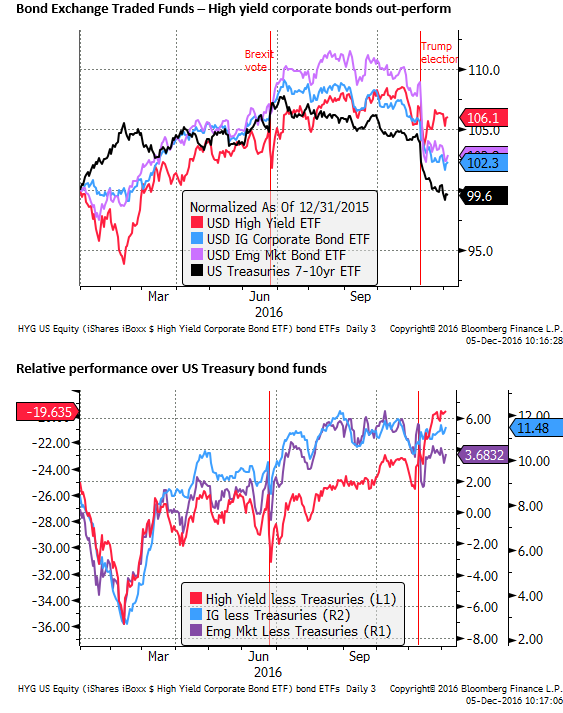

Bonds show improving risk appetite

Bond market ETFs illustrate that the rise in global bond yields has not undermined global investor confidence. The increase in yields has been larger for government bond than for corporate bonds, with high yield (lower credit quality) bonds more stable than Investment Grade corporate bonds.

Emerging market bonds have been the weakest sector, consistent with under-performance of emerging market equities. This may reflect the protectionist/ant-globalization messages from Trump and ant-establishment political trends in developed economies. However, the decline in emerging market assets, both bonds and equities have been moderate. And they have been more stable in recent weeks.

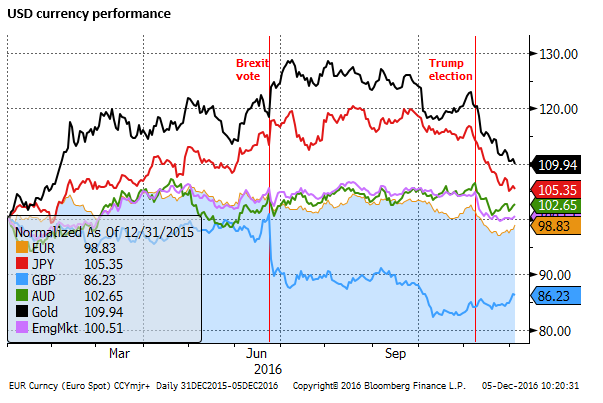

JPY and Gold weak, but USD strength fades elsewhere

In the week or so after the Trump election, during the rapid phase of the rise in global bond yields, the USD was broadly stronger against most currencies, although stable against GBP.

More recently, the foreign exchange market has shifted towards weaker JPY and gold prices, while other currencies have been stable or stronger against the USD.

EUR bottomed two weeks ago and surprised many with a rise to a three-week high after the No result in the Italian referendum and resignation of PM Renzi on the weekend. GBP has strengthened in the last week to a two-month high.

Commodity currencies also bottomed in the week after the Trump election and have firmed since last week.

Emerging market currencies have been mixed. Lagging most other currencies on average, but on balance stable in recent weeks

The weakest currencies have been the safe-havens, JPY, and gold, with strength in recent weeks returning to the higher yielding and growth-leveraged currencies. The market is taking on a more classic risk-on appearance.