Housing angst helping cap AUD

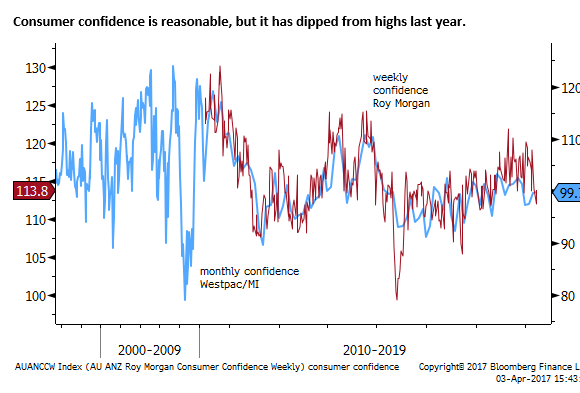

The housing market in Australia appears to be very strong and might be seen as a reason for higher AUD; generating wealth and confidence and preventing the RBA from cutting rates further. However, rapid house price growth is creating more angst over affordability concerns. Combined with high levels of household debt, it may be dampening consumer confidence and consumer spending. (Retail sales growth fell to a low since 2013). The housing market looks increasingly risky as regulatory scrutiny over lending increases, mortgage rates creep higher, tax concessions are expected to be reduced in the May budget, and growing supply of apartments comes on the market. The recent surge in investor demand may reflect a rush to get in ahead of tighter credit conditions and tax changes. If so, the housing market may slow later this year and in any case, represents a bigger risk to the Australian economy.

Renewed credit and house price growth spurs action by regulators

The Australian property market always features highly in the Australian media and dinner party conversations. And there has been a flurry of press articles in recent days in response to much anticipated renewed efforts by regulators to rein in investor credit growth and surging house prices.

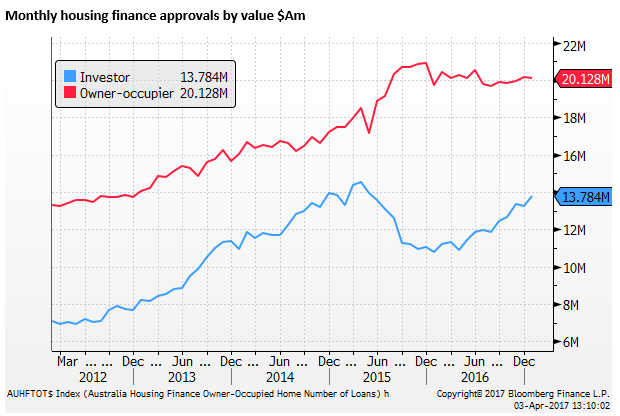

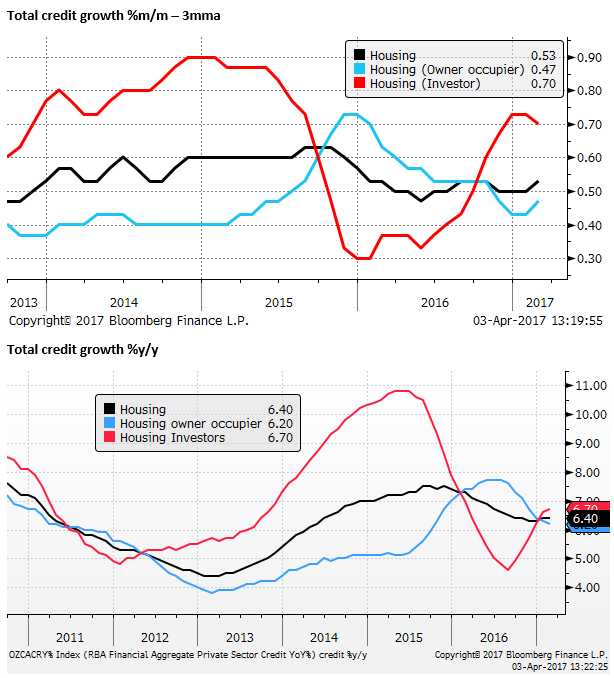

Rapid investor loan growth in 2013/2014 resulted in regulatory action to slow investor lending to no more than 10%. The charts above overstate the impact of the loan growth speed limit that started to be enforced meaningfully around mid-2015. The new rules led banks to raise mortgage rates for investors, resulting in many households changing the status of their loans from investor to owner-occupier loans.

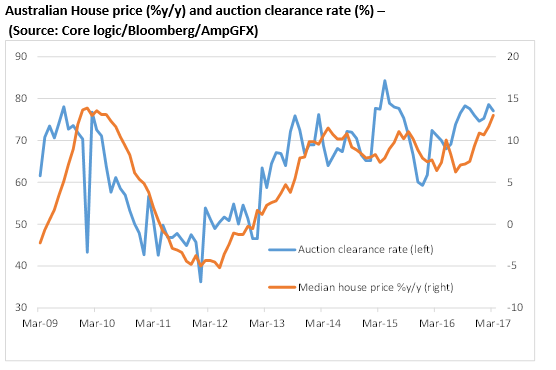

Nevertheless, there was a significant cooling in investor lending in late 2015 and early 2016, and a slowdown in house price growth. This emboldened the RBA to cut rates by 25bp in each of May and August of 2016 to try and bolster growth and CPI inflation. As the chart above suggests, the rate cuts helped renew strong growth in investor lending and house prices.

The chart below shows national median house price growth rising to 13%y/y in March, a high growth rate since 2010, up from a recent low in July-2016 of 6.2%y/y. It also shows a high rate of success of auction sales. House prices have been growing at a high rate on average since around 2013, after a short-lived lull in 2011/12.

House prices are at record highs as a percentage of household income (5 times incomes – 500%). A major political issue is low housing affordability.

The resurgence in house prices and investor activity from already high levels of household debt and house prices has alarmed policymakers. The RBA shifted its tone soon after its August rate cut, particularly when the new RBA Governor, Philip Lowe, took up his post in September 2016. It has argued that cutting rates further might cause more financial stability problems than it was worth to spur growth further.

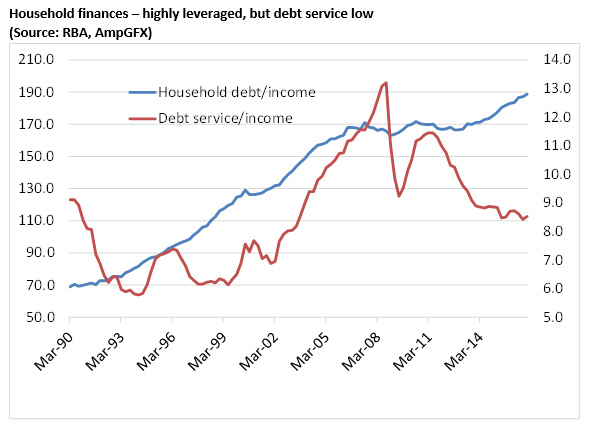

The chart below shows that household debt to income has risen sharply since 2013 to an alarming level of 189%. However, the chart also shows that the cost of servicing that debt is not high by historical standards. At 8.5% of income, it is around the lows since 2003; reflecting record low interest rates. Low interest rates and debt service is underpinning household demand for property

There were two regulatory announcements, one on Friday by the bank regulator (APRA) and one on Monday by the corporate watchdog (ASIC).

ASIC announces further measures to promote responsible lending in the home loan sector – ASIC.gov.au

APRA announced the following key points:

- limit the flow of new interest-only lending to 30 per cent of total new residential mortgage lending, and within that:

- place strict internal limits on the volume of interest-only lending at loan-to-value ratios (LVRs) above 80 per cent; and

- ensure there is strong scrutiny and justification of any instances of interest-only lending at an LVR above 90 per cent;

- manage lending to investors in such a manner so as to comfortably remain below the previously advised benchmark of 10 per cent growth;

- review and ensure that serviceability metrics, including interest rate and net income buffers, are set at appropriate levels for current conditions; and

- Continue to restrain lending growth in higher risk segments of the portfolio (e.g. high loan-to-income loans, high LVR loans, and loans for very long terms).

ASIC announced they would step up surveillance of banks and mortgage brokers to check they are not inappropriately recommending interest only loans. It said, while interest-only loans may be a reasonable option for some borrowers, for the vast majority of owner-occupiers in particular, an interest-only loan will not make sense.”

Cautious regulatory action

These new announcements have the posture of more robust action to control lending, but they are not as tough as many thought. The top speed limit for investor loan growth has not been lowered from 10%. Many had thought they might drop this to 5%. The actions to limit the share of interest-only loans to 30%, is not all that much below the current share of nearly 40% of total lending; a share that APRA admits is “is quite high by international and historical standards.”

The announcements were largely expected, and already banks have responded by raising mortgage rates on investor loans, more so for interest-only loans favoured by investors that benefit from the tax deductibility of interest payment, in recent months.

There is little evidence that firmer mortgage rates in recent months, and some bank efforts to contain lending have had any impact on actual loan growth or house price demand. Perhaps these announcements will further tighten the screws a bit.

Part of the reason why the regulators have made only modest changes to their regime may be a heightened sense of uncertainty over the sustainability of house price and a fear that tightening conditions too much may weaken the market at a time when it faces other headwinds (discussed below).

Tax concessions expected to be reduced

The next thing that housing investors will have to contend with are changes to the tax concessions on housing investment that are expected in the May budget. Most analysts and respected commentators agree that part of the reason for rapid investor demand for housing is the combination of negative gearing (tax deductibility of interest payments against total income) and a 50% discount on the capital gains tax for property investment.

The Liberal National Coalition has come under criticism for not reducing these tax concessions a year ago, choosing instead to play politics and argue against such changes that were adopted as policy by the opposition Labor party.

By arguing against these changes during the national election in July last year, the government may look hypocritical reducing these concessions in May. But calls for such changes have come from a number of business lobby groups, including some in the real estate industry, and some changes, especially to reducing the CGT concession are anticipated.

Tax settings need to be examined as part of efforts to cool housing market: Murray – SMH.com.au

Investors may be having their last hurrah

Despite these increasing headwinds to housing investment (firming rates, tightening bank lending standards, renewed regulatory scrutiny, a likely reduction in tax concessions) investor housing demand has only increased so far this year.

One might wonder what then might knock-back demand. There have been many opinions expressed on the state of the housing market, whether it in a bubble or not.

It may be the case that all the news about approaching tightening regulations and reduced tax concessions may have accentuated demand as investors sought to get in ahead of the changes; borrow at low rates while they are still available and get hold of investment properties now in the hope that any tax changes are not enacted retroactively.

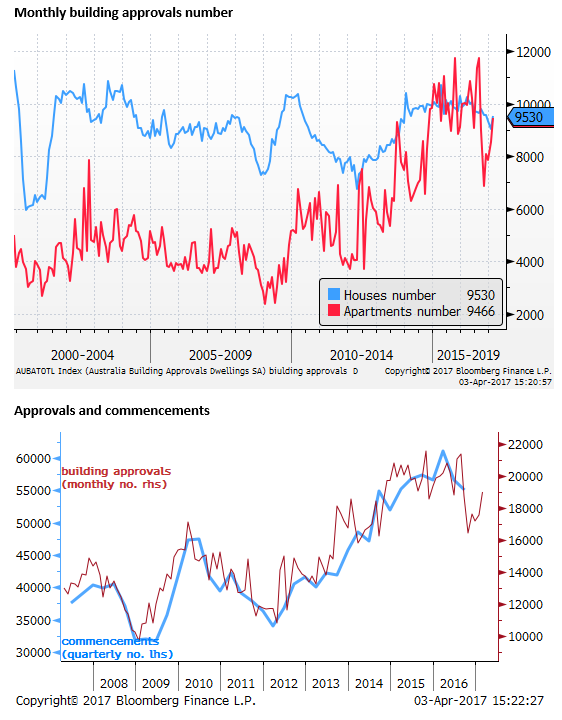

In any case, one thing is clear – the risks in the housing market and for the economy are higher now that house priced are higher, credit conditions are tighter, tax concessions are set to be reduced and the interest rate cycle has probably bottomed. Furthermore, after several years of rapid growth in apartment building approvals, there is an increasing supply of apartments coming onto the market over the coming few years.

AMP Capital Chief Economist, Shane Oliver, summed up the situation. He said, “The latest moves by APRA, coming on the back of bank mortgage rate hikes over the last two weeks, the likelihood of action to boost affordability in the May budget (including a cut to the capital gains tax discount), and the surge in unit supply at a time of silly prices, are all likely to result in a slowdown in property price gains in Sydney and Melbourne this year ahead of a 5-10 per cent price fall starting next year some time,”

Mortgage noose tipped to see property prices crash by 10 per cent – TheAustralian.com.au

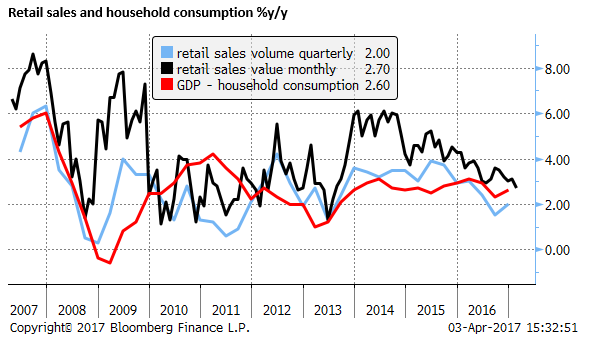

Household debt may be weighing on consumer demand

A part of the concern that the RBA already has expressed with respect to elevated household debt, is that it represents a restraint on the potential for consumer demand. Australian’s high debt levels may be dampening their willingness to spend their income on goods and services.

Retail sales reported on Monday were weaker than expected, rising in nominal terms by only 2.7%y/y in February; a low since 2013.

Higher wealth levels associated with high house prices in past cycles has tended to boost spending. However, high home prices are generating angst for many households over the affordability of homes; leaving many younger people feeling left behind and older generations worrying about the welfare of their children.