Jobs data take some wind out of the RBA’s sails

Currency markets may remain in a choppy trendless state for the time being. Low negative rate policies in the Eurozone and Japan, preclude us from buying their currencies. The USD has a weaker trend for the moment as the market considers a prolonged period of stable rates in the US. Global investor confidence also remains constrained by a range of factors and less responsive to quantitative low rate central bank policy (discussed in our report: Oil leaves a slippery slick for global markets, 15-Feb). Global growth has lost momentum and global financial conditions have tightened since the beginning of the year. Fear of lower for longer inflation is born out in market-based measures and surveys of long-run inflation expectations. The risk is swinging towards sluggish global growth, low inflation and central banks across the globe reaching more for lowering rates, with zero no longer the lower boundary. Conditions are ripe for competitive currency devaluations and this is supporting the rising trend in Gold. Below we discuss the Australian employment report and recent business surveys that suggest that the moderate recovery underway in 2015 may have lost momentum. Australia is not alone facing challenges generating a sustainable recovery, and thus it is not clear that the AUD must go down, but we expect pressure to build for a weaker AUD and/or lower interest rates.

The RBA said they were watching employment and the news was not so good

The weaker Australian employment data takes some of air out of the sails of the RBA’s more optimistic view of the economy.

In its recent statements, the RBA noted that employment growth over the last year has been well above trend even though GDP growth had been below trend. It was undecided whether this meant that the underlying trend in the economy was stronger than the GDP data might suggest, or that employment data might be over-estimating strength, and might fall-back.

However, The RBA was clearly leaning towards believing the strength in the labour market was real and would thus help propel GDP growth back towards trend over the next year or so.

The RBA found reasons for the relatively strong employment growth. It noted that labour growth had been driven by the solid recovery in the service sector that was more labour-intensive than goods producing sectors, including mining, where job growth was weak. It also argued that low wage growth was helping improve “Australia’s international competitiveness and encouraged businesses to employ more labour than otherwise”.

It said that unemployment was about ½% lower than it had earlier estimated, and it had revised down its forecast of unemployment. While not exactly sharing that figure it said in its February Statement on Monetary Policy (SoMP) that employment is “forecast to be strong enough to reduce the unemployment rate further.”

Nevertheless, the RBA was not entirely convinced and noted that it would be watching to see if the strength in employment is maintained. If not, the implication was that it would use its scope to cut interest rates again.

It said in the Feb SoMP, “The fact that the improvement in labour market conditions has occurred against the backdrop of below-average GDP growth raises some uncertainty about the economic outlook. It is possible that the strength in the labour market data contains information about the economy not apparent in the national accounts data, or that the strong growth in employment of late will be followed by a period of weaker employment growth. Alternatively, the strength in labour market conditions relative to output growth may reflect a rebalancing of the pattern of growth towards labour intensive sectors and away from capital intensive sectors.”

It concluded that, “New information should allow the Board to judge whether the recent improvement in the recent financial turbulence portends weaker global and local demand. Continued low inflation may provide scope for easier policy, should that be appropriate to lend support to demand.”

One weaker than expected jobs report is probably not enough to trigger a major re-think by the RBA, but it does suggest its optimism needs to be tempered somewhat and increases the odds of another rate cut.

Softer employment gels with ebbing business surveys

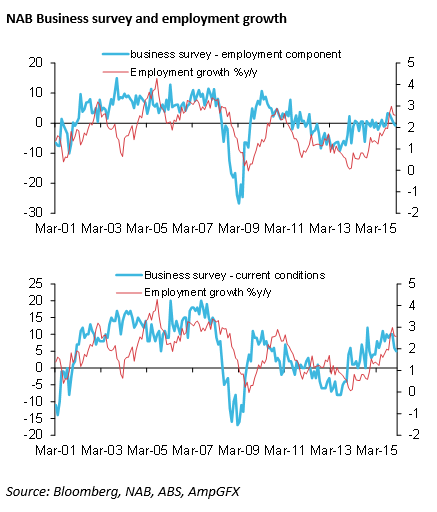

The softer employment data also gels with some ebbing in business surveys in recent months. The NAB survey of current business conditions fell from levels ranging from +8 to +11 from May to November last year to +6 in Dec-15 and +5 in Jan-16. Business confidence fell to +2 in Dec and Jan. lows since Nov-14. The employment component of the survey fell from +3 in Sep/Oct last year, a high since 2011, to -1 in Jan-16.

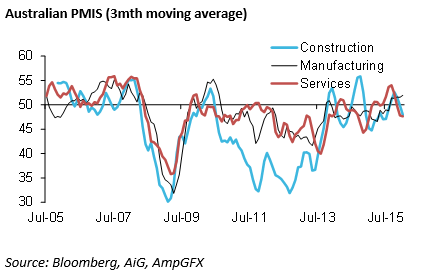

PMI data recently have also ebbed from recent highs. In particular the service sector PMI (where the RBA noted strong jobs growth) has fallen back below 50 over the last three months. Manufacturing, the smallest and supposedly the weakest sector has improved recently. The chart below shows a three-month moving average of the three different PMI measures (including construction)

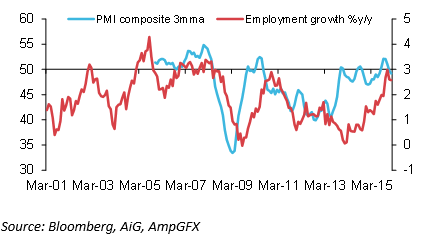

The chart below shows an average of these three measures compared to employment growth. It may also account for some set-back in the pace of employment growth

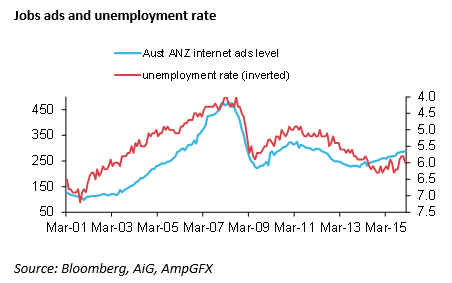

A key factor behind the RBA optimism for ongoing employment growth is steady improvement in job vacancy data in the last two years. While still well below boom time peaks prior to the 2008 Global financial crisis, vacancy measures are approaching highs in 2011. The chart below shows the ANZ internet job ads series vs the unemployment rate (inverted) that weakened from 5.8% to 6.0% in data reported yesterday for January.

A lower AUD and/or lower rates still more likely

The RBA is not likely to over-react to the softer employment report, but the economy still has considerable slack in the jobs market. With unemployment last reported at 6%, this is still well above the neutral level nearer 5%

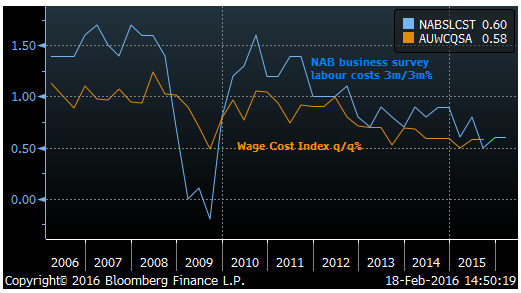

This is backed up by the low trend in wages that are running around record lows. The chart below shows the Wage cost Index (this data for Q4 is due next week) and the NAB business survey labour cost series (last reported for January).

The RBA is perhaps prepared to give the economy more time to heal, because even though underlying inflation is running near the bottom of its 2 to 3% target band, it still believes there is significant pass-through to inflation coming from the roughly 30% deprecation in the exchange rate over the last two years. As such, it does not appear to fear inflation heading dangerously below the target for a prolonged period; at least not yet.

It has also been reluctant for the last two years to over stimulate household loan growth and the housing market with further cutting rates below already record low levels.

Nevertheless, the recent pace of activity points to risks that the recovery is too sluggish and vulnerable to a slowdown in global growth that is already below trend and tightening in global financial conditions that has also occurred since the middle of last year, especially in recent months.

In light of global trends towards weaker growth this year, and the risks that the housing market loses momentum this year (see our report yesterday: Australian government tinkering with a ticking time-bomb; 18-Feb), the risk is high that the AUD weakens back below .70, either because RBA rate cuts return to the agenda, or the AUD responds to global factors.