What keeps the RBA awake at night

The RBA is not keen to cut rates, and it appears highly agitated by an over-supply of apartments and financial stability risks. The outlook for the Australian economy is highly unstable, further rates cuts are not inevitable but are probable, although may come later than most expect. The most likely scenario for cuts are either to offset an unwelcome rise in the AUD exchange rate to 80 cents or above, or to compensate for a more unwelcome turn in an irrational housing market. The later scenario is rising from the possible to the increasingly probable, but the timing will be hard to predict. It would involve much deeper rate cuts and much weaker response in the AUD.

At this time monetary policy is doing its job

The RBA no rate change yesterday was not a surprise, to cut rates again after resurgent house prices in recent months would have been down-right reckless. The evidence of strength in service exports and solid business credit growth suggest that the non-mining sectors have gathered momentum. Cutting rates would serve no purpose at this juncture and there is not clear that rates will need to be cut further this cycle. The economy is in transition from a mining investment down-turn, there is only so much monetary policy can be expected to do, and it is doing its job at this time.

There are scenarios where rates fall further. For instance no hike in the USA for some time and yield-seeking behaviour that drives up asset prices and the AUD exchange rate to the point where it starts to kill off non-mining sector activity, probably nearer 80 cents. Or a crack in the remarkably resilient Australian property market that unravels household confidence. These alternative scenarios have vastly different consequences for the AUD exchange rate.

Both are quite feasible and probably are being discussed in the trenches at the RBA, but neither support the case for a clear bias to cut rates further at this time. Uncertainty over the direction of global risk appetite and the demand for property in Australia is quite high. The risk is probably leaning towards another cut by the RBA but it may not occur, or occur much further down the track than many expect.

Another scenario that the RBA would be hoping for is that the US economy continues its moderate recovery, proceeds with hikes in coming months, the USD strengthens gradually, keeps downward pressure on the AUD and excesses in the housing market gradually unwind over a longer time frame also keeping some downward pressure on the AUD. The RBA in this scenario would aim to keep rates steady for a prolonged period before raising them again gradually. Inflation while low for a prolonged period at least stabilises and starts to rise, perhaps slower than might be preferred but in a satisfactory manner given the desire not to deepen financial stability risks associated with the housing market.

Central banks like to offer hope and confidence and while alluding to the risks, tend to focus on the positive. The central forecast the RBA is likely to be favouring in its presentation to the public is this third rosier outcome.

Inherently Honest

While the RBA statement was short and concise it was inherently honest in leaving out a clear bias to cut and focusing on the current state of policy, promising little for coming meetings. It said, “The Board judged that holding the stance of policy unchanged at this meeting would be consistent with sustainable growth in the economy and inflation returning to target over time.”

“Hold policy at this meeting” gives the RBA all the scope it needs to adjust to a wide range of possible outcomes from a variety of plausible scenarios over the short and medium term.

Many in the street thought that the RBA might have inserted a clear easing bias, such as highlighting that the low inflation outlook provided it scope to cut rates further if required. The RBA could have placed this in the statement in an attempt to limit the upside potential for the AUD exchange rate.

It’s one of those obvious statements that does need to be said, but if said serves an ulterior motive. It suggests that the RBA wants the market to believe it would be easily swayed towards a rate cut. But in light of the resurgent housing market and high and increasing financial instability risks, it is dangerous to leave the market and households firmly believing rates are likely to fall further.

Leaving out this statement risks pushing the AUD higher, and highlights that the RBA is at least as concerned by financial stability risks as it is by an unwelcome rise in the AUD.

What keeps the RBA Awake at night

The reset of the RBA statement confirms that these are indeed the risks that most concern the RBA, it said, “A number of lenders are also taking a more cautious attitude to lending in certain segments. Dwelling prices have begun to rise again recently. But considerable supply of apartments is scheduled to come on stream over the next couple of years, particularly in the eastern capital cities.”

This is the first time that the RBA has issued a warning on the over-supply of apartments in its short monthly policy statements. To include such a concern in this statement highlights its importance. It is not just a back-ground risk that might be mentioned in the semi-annual financial stability report, it is an immediate policy concern.

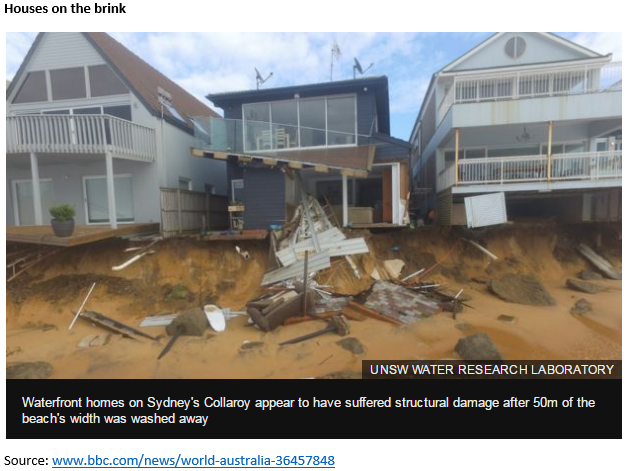

The RBA is subtly, or even not so subtly for those that read the tea-leaves closely, saying that this is a major problem that may affect the Australian economy. It is little wonder that the final policy guidance emphasised “at this meeting”, the oversupply of apartments, and tightening lending conditions specific to this segment, evidence that buyers off-the-plan will be out-of-the-money and some in negative equity if they follow through with settlement, suggests major problems.

I am personally amazed that the overall property market picked up momentum in recent months in the wake of this glaring evidence, warnings from the RBA and industry insiders, and possible tax changes by the government that may limit negative gearing and capital gains concessions on property investment.

Irrational exuberance

Some commentators have noted that investors have rushed into buy more investment property in recent months to get ahead of tax changes. Changes that would only take effect more than 12-months ahead, only if the government loses power to the opposition in the 2-July election, something that is rated at less than a 30% chance in the betting market. I would have been more worried as a property investor of prices falling after the policy implementation as investor demand dried-up, something even Prime Minister Turnbull argued in the election campaign to scare voters from the opposition. But no, investors thought they best buy ahead of the policy to lock in their tax-breaks. The property market only looks scarier in Australia. As many have noted it has all the elements of a mania. The mind-set is clear – prices only ever go up.

The RBA’s policy statement suggests that risks are now beyond just a mere possibility, they are moving into the realm of quite probable. But I am not holding my breath for the masses in Australia to come to their senses. As in all mania’s, the irrationality rises closer to the peak.

The other risk

The other risk is that the AUD now takes off again, and the RBA also warned in its statement on this front. It said, “These factors [low interest rates, lower exchange rates, and shift from household to business led business credit growth] are all assisting the economy to make the necessary economic adjustments, though an appreciating exchange rate could complicate this.”

Words that might not exactly strike fear into currency speculators’ hearts, but highlight a key plank in the RBA’s rosy hopeful scenario that the AUD remains low to help rebalance the economy.