Oil leaves a slippery slick for global markets

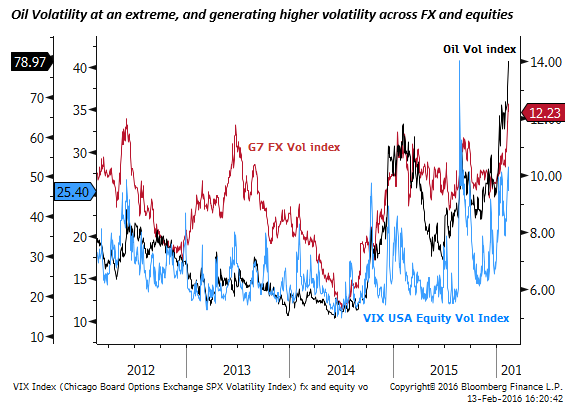

In stepping back for a moment to assess what exactly is hurting global investor confidence, it is not as easy as it seems to put a finger on the source or extent of the problem and, therefore, what might restore confidence. There is a wide degree of global market uncertainty at this time that in itself is holding markets back. It may take some time for confidence to be restored, and indeed confidence may remain relatively low for the foreseeable future. Most recently the oil market appears to be at the epicenter of the upheaval. Uncertainty and volatility in the oil market is unprecedented in recent memory and the contagion to global markets has reached globally systemic levels. Until greater clarity is restored to the oil market, the risk is high of still more severe global market upheaval and more extreme central bank policy responses.

Rounding up the suspects

A number of possible culprits may be responsible. Chief among them is the fallout from much lower oil prices; feeding through to weaker credit markets, bank loans, and oil producing countries’ economic and financial conditions. Next on the list is weaker Chinese economic growth, particularly its demand for commodities. Third is capital outflow from China and its economic and financial management. Fourth is the rise in US interest rates in December. An overarching them is high levels of debt in China, other emerging economies, and still in developed economies. Underlying concerns over profitability and balance sheets in the banking sector have re-emerged. Regulatory and capital constraints on banks have also potentially undermined the basic functioning of capital markets.

Selling Out

From a purely capital flow perspective several commentators have noted sovereign wealth funds of oil producers have probably been selling their equity assets to help fund their fiscal shortfall as oil revenues have declined.

Central banks part of the solution or part of the problem?

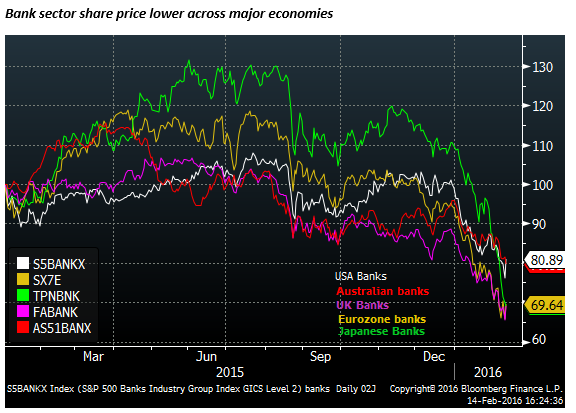

Steps by the BoJ to cut interest rates, a strong hint from the ECB that it plans to cut and/or expand asset purchases on 10-March, and more wait-and see outlooks expressed by the BoE and Fed have failed to boost confidence. There is some concern that central bank policy measures have lost their effectiveness, and may be part of the problem; contributing to excess leverage, flattening the yield curve and driving up costs to banks forced to hold negative yielding liquid assets and cash reserves.

Capital Outflow from China

The capital outflow issue from China is an interesting one. Capital outflow from China’s private citizens should create a source of demand for asset prices globally. This flow has over recent years been a significant source of support for global property markets.

The Chinese government is using its vast FX reserves to stabilize the Chinese currency and offset these flows. This might reduce demand for government bonds in major economies. However, bond prices are strong at this time. Rising yields are not an issue. As such, capital outflow from China is not itself a problem.

However, the market is fretting that this might be telling us that something is rotten with the state of the Chinese economy and financial system. It fears that the capital outflow is a symptom of problems in China that its government may not be able to manage. Those problems are high levels of national debt and over-capacity in heavy industries.

The Chinese government have indicated that they are attempting to fix these problems by shifting demand growth from fixed investment and exports to domestic consumption and service sectors, while attempting to rely less on debt fueled growth. Progress to achieving these ends will continue to be closely monitored by the market.

It’s hard to put China fears back in their box

Chinese authorities have been working much harder over the last month to improve their communication with the market, dampening excess volatility in its exchange rate and stock market, tightening up enforcement of capital controls, while at the same time staying the course towards gradually allowing freer movement of its currency and capital.

Chinese authorities have been working much harder over the last month to improve their communication with the market, dampening excess volatility in its exchange rate and stock market, tightening up enforcement of capital controls, while at the same time staying the course towards gradually allowing freer movement of its currency and capital.

At least in the last few weeks it is hard to blame Chinese market uncertainty as a driving force in the global equity market sell-off. However, many commentators have mentioned the earlier currency market volatility, Chinese capital market outflow, broader concerns around its economic management, and lack of communication with the market as factors weighing on confidence. These concerns will not be easily put back in the box.

Oil leaves a slippery slick for global markets

The oil market is arguably the most powerful driver of the slump in global investor confidence, increasingly in December and this year as oil prices fell sharply towards and through $30 per barrel.

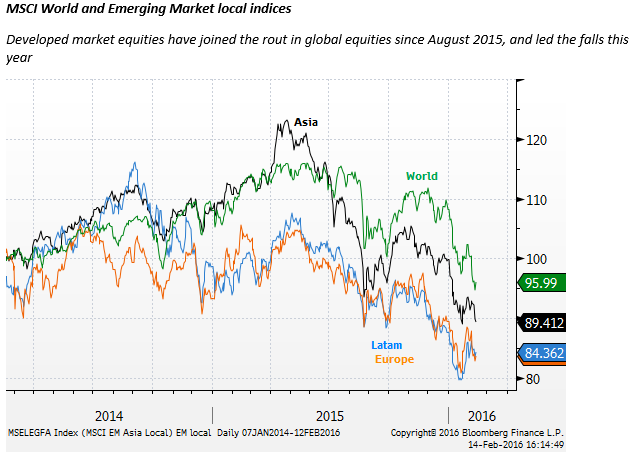

In the first instance, late last year, lower oil prices contributed to some capital flight from high yield bond markets that spread somewhat across the corporate bond market. A number of large key emerging markets have also been undermined by weaker energy and other commodity prices, combining with a slowing Chinese economy to weaken the overall emerging market and global growth outlook.

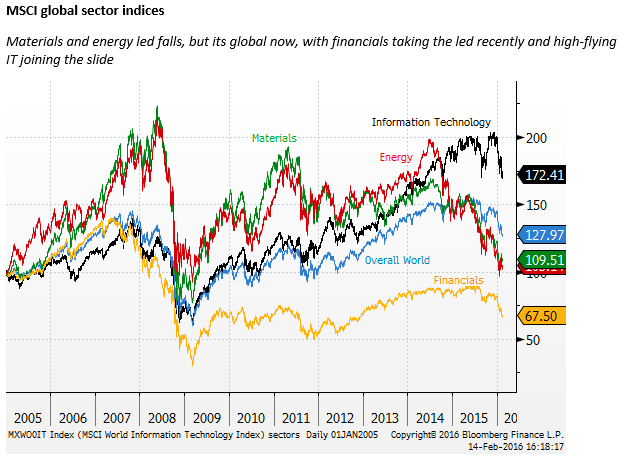

However, since the beginning of the year, fear over defaults in the energy sector have risen to much more alarming levels, spilling over to the broader equity market. The channels of contagion have been blamed on sovereign wealth funds selling equities indiscriminately and/or in particular bank stocks of which they are reported to be large holders. And a rise in the non-performing loans of banks to the energy sector and economies of troubled emerging energy exporters.

Banks have come under scrutiny

The outlook for banks themselves has been placed under much greater scrutiny. The market has gone from concerns over higher non-performing loans related to the energy sector, to worry about a lack of progress by European banks in reducing their balance sheets since the global financial crisis and Eurozone crisis, weaker profitability resulting from negative cash rates and flattening yield curves, pressures to build capital including the fallout to bail-in type bonds (Contingent Convertible, so-called ‘coco’ bonds), regulatory rules to hold more liquid negatively yielding assets, and weak profitability in general as banks are forced to take less risk and hold more capital.

Tighter lending conditions anyone?

In turn, concern over bank’s profitability and capital strength may now be generating fears of tighter lending conditions across the whole economy. While bank shares have been weak in recent weeks and a topic of conversation, few equity sectors have been spared. The whole equity market has been trading increasingly at the whim of gyrations in the price of oil.

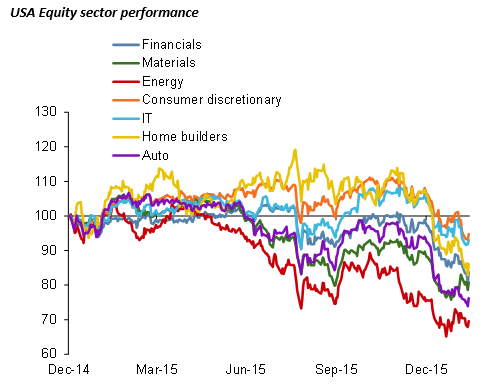

Et tu Autos and Builders?

In the US, two of the weakest sectors have been auto producers and homebuilders. Auto sales rose to a record in 2015 and should be supported by low gasoline prices. The housing market recovery is supposed to be on-track. Presumably low interest rates and low energy prices should support consumer and housing demand. Weakness in these two sectors suggests investor confidence has taken a significant hit across the board. If consumer and housing demand are not expected to keep growing at a reasonable clip in the USA then the global economy is indeed in trouble.

It is perplexing to see the breadth of weakness in developed market equities. Some commentators are wondering if the equity market is portending something more dire about the state of the global economy and financial system than is immediately apparent.

Central bankers more uncertain, but perplexed by market weakness

In the face of the considerable decline in global equity markets, rise in credit spreads and jump in implied market volatility, the Fed and several other central banks have noted that they have less certainty in the global outlook and are essentially sitting back waiting for more information before responding. But they are also arguing that there may have been an over-reaction in global markets and not all that much has changed to the underlying outlook for the global economy. They continue to argue that lower energy prices and easy global monetary conditions should support growth in developed and other energy importing nations.

It is indeed difficult to judge if the market is either telling us something, or it has over-reacted. It may be a bit of both, but overall uncertainty is higher than normal. It also appears to be the case that for the near term oil prices will remain highly influential on investor confidence. And indeed no-where is uncertainty greater than over the direction of oil prices.

Oil market uncertainty at an extreme

There are a wide variety of views being expressed by commentators in the energy market – from this is the buy of the century, to prices are collapsing to zero.

Many that take a longer view state simply that the current low levels are not sustainable and therefore they will rise before too long. Indeed the view of many central bankers, is energy prices cannot fall much further or for much longer, and when they stabilize, inflation will start to normalize from their prolonged state of extraordinary low levels.

However, a key concern of the market is that the key players inside and outside OPEC are not reducing supply and the way this ends is a collapse in oil prices until key energy producers default and are forced out of the game, inducing much hardship and broad global economic fallout.

The sharp gyrations seen in the oil price over recent weeks are bouncing back and forth between jumps on hopes of producer agreements to cutback, and drops on storage capacity getting filled up leaving no where for excess oil to go, triggering a price collapse.

The recent volatility in the oil market has not been seen in recent decades and is now rattling investor nerves across all asset classes. One might presume until this market finds a degree of normalcy, global financial markets will remain on tenterhooks.