RBA may display more optimism and revise up inflation outlook

The RBA appears set to slightly upgrade its inflation forecasts and sound reasonably optimistic in its quarterly Statement on Monetary Policy on Friday. Governor Lowe may similarly project more optimism in his speech in Sydney on Thursday night. These events may provide support for the AUD. However, there is still scope for Lowe to show caution on rising global risks associated with European elections, China’s shift to lean against its property market and tighten liquidity, and risks to global trade and geopolitical uncertainty arising from a rambunctious USA President. Lowe may also remind the market that the AUD has firmed in TWI terms to a two-year high and may undermine non-mining investment if it continues to rise. Furthermore, he may note that the AUD has risen recently despite a lower interest rate advantage, and rising interest rates in the USA and higher yields more generally abroad may tend to weaken the AUD. The AUD has been supported recently by a rebound in commodity prices contributing to a rebound in Australia’s net export income. The currency appears relatively stable, but we see limited upside and more significant downside risks over the year ahead.

RBA Upgrades global growth

The RBA appears to have upgraded its forecast for global growth in its policy statement on Tuesday. It noted a pickup in both business and consumer confidence, and forecast above-trend growth “in a number of advanced economies, although uncertainties remain”

Statement by Philip Lowe, Governor: Monetary Policy Decision; 7 February 2017 – RBA.gov.au

Higher medium risks from China

The views on Australia’s major trading partner, China, highlighted increased “medium term risks.” It noted “growth was stronger over the second half of 2016” (emphasis mine), but that the composition of growth (“higher spending on infrastructure and property construction”) and the “rapid increase in borrowing mean that medium-term risks to Chinese growth remain.”

Upgrade to terms of trade outlook

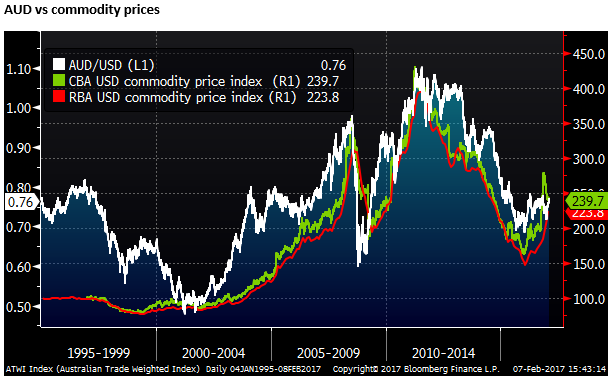

Reflecting the improvement in the global economy, the RBA also appears to have upgraded its forecast for Australia’s terms of trade (commodity prices), and therefore Australia’s domestic income. It appears to see the rebound in commodity prices in 2016 as more sustainable.

Up-turn in Global rates and yields

In discussing global financial conditions, the RBA seems to see a more sustained turn in the global interest rate cycle towards higher yields, while noting that “in an historical context” yields remain low. This may signal more preparedness for the RBA to look through recent low inflation outcomes in Australia and avoid cutting their policy rate further.

More light at the end of the tunnel

The RBA said that “the period of declining mining investment coming to an end”, suggesting the light at the end of the tunnel is getting brighter.

The RBA also sounded a bit more upbeat on the prospect for business investment. It said, “Some further pick-up in non-mining business investment is also expected”. It last said in its December policy statement that, “the outlook for business investment remains subdued.”

Some upward revision to inflation forecasts

While sounding somewhat more upbeat on global and domestic economic trends, the RBA suggested that key forecasts for growth and inflation remain largely unchanged since the November quarterly Statement on Monetary Policy. But it appears there will be some upgrade (rise) in the inflation forecasts.

It said that “The Bank’s central scenario remains for economic growth to be around 3 per cent over the next couple of years.”

And that its “inflation forecasts are largely unchanged. The continuing subdued growth in labour costs means that inflation is expected to remain low for some time. Headline inflation is expected to pick up over the course of 2017 to be above 2 per cent, with the rise in underlying inflation expected to be a bit more gradual.”

This suggests that the RBA may have lifted its headline CPI forecast a bit, and will project underlying inflation on target in the middle of its band at the end of its two to three-year forecast horizon.

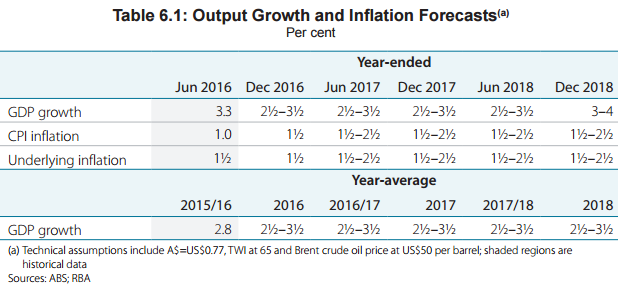

The forecasts from the November SoMP are in the table below. The GDP forecast was centered at 3.0% through to mid-2018, and then up to 3.5% and end-2018.

The headline inflation forecast in November was centered at 2.0% from mid-2017 through to end-2018. (Note above that the RBA now sees it rising above 2.0% over the course of this year).

The underlying inflation rate forecast was also centered at 2.0% from mid-2017 through to end-2018. It is possible that the RBA raises its underlying inflation forecast towards the end of the forecast period.

Note that in its February SoMP (released on Friday) the RBA will introduce forecasts through to mid-2019, allowing it to place the forecast at the center of its 2 to 3% target range at the end of its forecast horizon with-out changing its previous estimates.

If the RBA get its underlying inflation forecast back on target (centered at 2.5%) within its forecast horizon, it would suggest the RBA is stepping further away from an implied easing bias towards a neutral policy stance.

Less comfort with the AUD exchange rate

The RBA upped its concern over the strength of the AUD a touch. It said that “An appreciating exchange rate would complicate” the transition in growth from mining to no-mining sectors (emphasis mine). In previous statements, it has said that “an appreciating exchange rate could complicate this” adjustment.

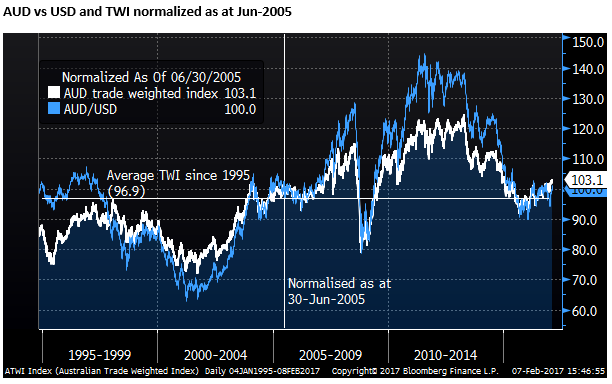

The chart below shows that the AUD trade-weighted index is modestly above its long-run average. It is at a high in two years.

RBA Governor to sound more optimistic

RBA Governor Lowe is scheduled to speak at a dinner in Sydney on Thursday, and the RBA release its quarterly Statement on Monetary Policy on Friday. From the tone of the policy statement on Tuesday, we might expect Lowe to sound reasonably optimistic about the prospects for sustained growth and revival in inflation, albeit likely to remain below desired levels for some time.

Lowe may attempt to place the market is two-minds on the exchange rate

It is possible that Lowe may give a little more attention to discouraging further gains in the AUD, but he is unlikely to over-egg this topic, considering the rebound in the AUD is not out of line with the rebound in the commodity prices, and the RBA is unlikely to be considering any policy response to address currency strength.

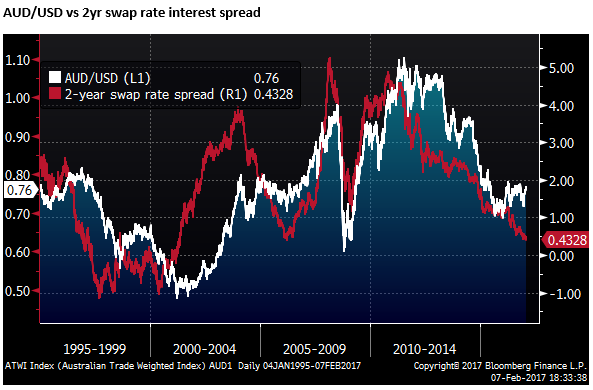

If anything, Lowe may adopt the tactic of reminding the market that higher interest rates in the USA, and rising yields abroad may weaken the AUD, and its yield advantage is largely diminished.

AUD faces more downside risk

The AUD has received support recently from a record trade surplus reported in December, mainly reflecting the resurgent commodity prices since mid-2016. Domestic economic conditions remain evenly balanced, and the rates outlook is still largely on hold this year.

There are some risks to the downside considering the increased global economic and political uncertainty projected by the rambunctious Trump administration and the approach of the French elections that pose the biggest potential threat to the stability of the Eurozone yet. Lech Walesa, the leader of the mass movement in Poland called Solidarity in the 1980s that helped bring down the Iron Curtain, said, “If Le Pen wins and Merkel loses, then the EU will fall apart,” Walesa said in an interview in Bogota, Colombia, on Feb. 3. “We have to be ready for this.” (Walesa Says People Must Prepare for Populism Breaking EU Apart – Bloomberg.com)

It is probably not in the interests of RBA Governor Lowe to speak too much about the medium-term risks that China poses to the Australian economy. But it is evidently still seen as a key risk factor. Chinese growth and demand for commodities picked up in 2016 mostly because Chinese policy became more growth orientated. At some point, timing unknown, it may again switch gear to attempt to control excessive loan growth. In fact, it has already started to move in this direction, raising rates and tightening rules on property investment. As such, we may be nearing another period of more subdued Chinese demand.

From our perspective, we see more limited upside for the AUD, and more potential downside. If global growth does continue to build momentum, we see higher US yields weighing on the AUD. We also see risks that household consumption and housing market activity in Australia will tend to be weaker in a rising interest rate environment (More Trouble for AUD and NZD (20-Dec-2016) – ampGFXcapital.com). As such, the RBA will continue to lag interest rate developments in the US.

On the other hand, risks to global investor confidence arising from Europe, Trump’s America first driven policies and wider risks he poses to the global economy (EU on the Rocks in un-nerving global seas (7-Feb-2017) – ampGFXcapital.com) may undermine the AUD.