Signs of Stress in Chinese equites and bonds

A sharp rebound in Chinese steel and iron ore prices, a sharp rebound in Chinese major cities property markets, improvement in recent activity indicators, easier monetary and fiscal policy, and calmer Chinese equites and currency in recent months have argued for a recovery in global risk appetite. However, just when confidence appears more stable is the time when Chinese policymakers are likely to step up financial and economic restructuring. The recent rise in Chinese corporate bond yields may reflect these concerns and have started to spill over to weaker Chinese equities. This could take the steam out of the rebound in global asset markets. China’s economic and financial market conditions remain perhaps the biggest risk for global markets and are being much more closely watched in the last year. RBNZ’s credibility has taken a hit in the last week and may be undermining the NZD somewhat. A lift in US yields in recent weeks may help stabilize the USD.

Chinese equities under-perform

There have been reasons to see China’s economic performance as supporting a recovery in global risk appetite in recent months. These include a sharp recovery in steel prices, rebounding property prices and improvement in activity indicators in March.

At the beginning of the year the market was unnerved by a sharp fall in Chinese equities and falling Chinese yuan exchange rate. More recently Chinese asset prices and currency have been much more stable.

Comments and actions by Chinese officials since the global market swoon in January suggested that they had swung attention back towards supporting growth via easier monetary and fiscal policy, and easing pressure on local governments and corporations to clean up excesses and structural weakness in their operations and finances.

However, when the news appears more upbeat, we need to worry that the Chinese government might swing their attention back to addressing structural problems in its economy and financial system.

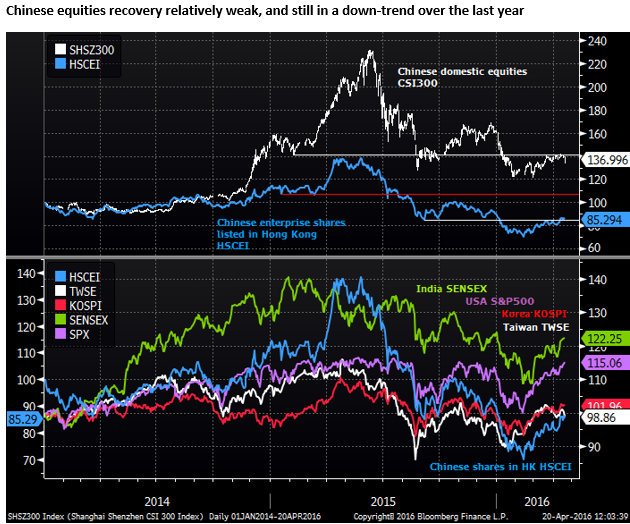

The Chinese equity market is revealing underlying weakness in Chinese economic confidence. The Shanghai stock index has stalled over the last month, and fell relatively sharply on Tuesday.

The Recovery in Chinese equities from the lows in Jan and Feb has been relatively modest; around a third of the fall from the December peak. It has stalled near the previous lows in February and August last year, suggesting that underlying demand remains weak and it is vulnerable to a further unwind in the sharp rise in late 2014 and early 2015.

A weaker Chinese stock market itself will not necessarily spill over to global equity markets and risk appetite. Frequently in the past, the Chinese equity market has been treated as a local investor market that has a life of its own.

However, on a couple of key occasions in the last year it has influenced global market trends. Its sharp sell-off and volatility in Q3 last year and in January and February this year appeared to significantly influence global markets.

There were other contributing factors during these periods of market volatility including a sudden devaluation of the Chinese Yuan in August last year, and sharp slide in oil price at the beginning of this year. The CNY appears more stable at this time and oil prices have been rising in recent months. As such, the market may pay less attention to Chinese equities. Nevertheless, underlying market concerns over the direction of Chinese economic and financial sector policy remain high, and the market is likely to remain attentive to Chinese asset markets.

Weaker Chinese corporate bonds may be spilling over to equities

Weaker Chinese equites alone might not be enough to unravel global investor confidence, but the fall follows a recent rise in corporate bond yields and may reflect increased fear that credit conditions are tightening significantly.

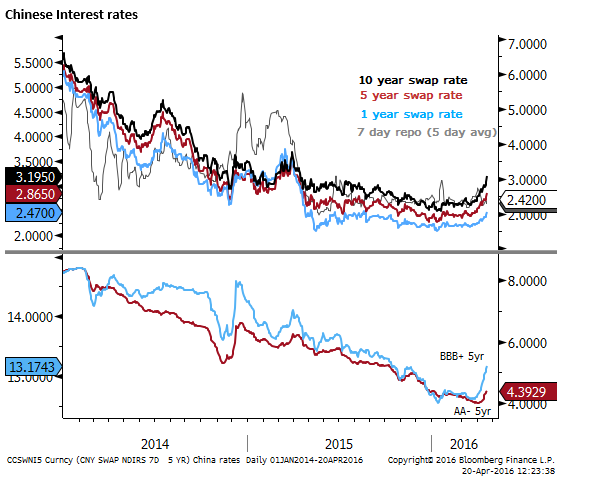

Interest rates in China had been relatively stable since Q2 last year at around their lows in several years, indicative of relatively easy monetary conditions in China, including a variety of term liquidity operations. Chinese corporate bond yields have also declined steadily over the last year.

However, market-based swap rates across the curve from one to 10 years have lifted significantly over the last month to a high in around a year, even though 7-day rates so far remain stable. Corporate bond yields have also risen significantly in the last month, more so for lower rated corporates. The moves suggest some tightening in credit conditions that might reflect underlying concerns over credit quality and government policy to allow market forces to play a bigger role is the debt market.

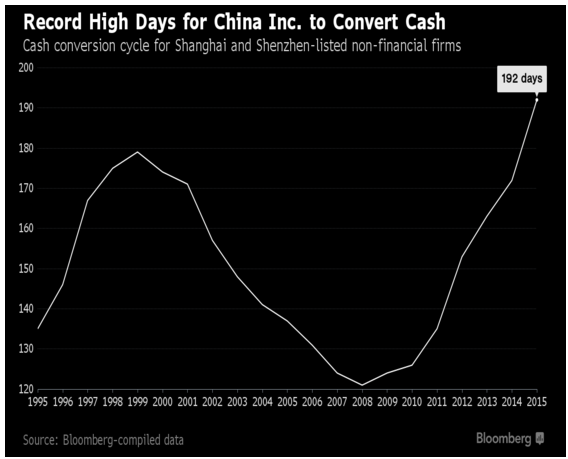

Recent news reports also highlight credit quality concerns. Bloomberg news reported that on average Chinese companies are waiting longer (192 days) to make and receive payments.

In other anecdotal evidence, the following are a number of observations by Bloomberg Journalists from the following two reports released in recent days.

China Default Chain Reaction Looms Amid 192 Day Cash Turnaround – Bloomberg.com

It’s All Suddenly Going Wrong in China’s $3 Trillion Bond Market – Bloomberg.com

The opinion of several asset managers is that the government is allowing some defaults to keep pressure on corporations to clean up excesses.

China continues to balance its policy to address financial sector excesses and structural weakness with supporting overall economic growth. This process is unlikely to be smooth and recent weakness in corporate bond and equity markets may curtail recent improvement in the outlook for Chinese markets and rekindle fears of spillover to global markets.

We expressed optimism in a recovery in global EM and commodity currencies over recent weeks, however, it is not going to be easy this year and China remains the most potent risk factor for global markets.

RBNZ’s credibility questioned

The RBNZ’s credibility has come under pressure in recent weeks. Last week it was reported that its rate cut in March was leaked via a reporter.

RBNZ Says Journalist Leaked Surprise Rate-Cut Move in March – Bloomberg.com

Yesterday Bloomberg reported on a “letter of expectations” sent to the RBNZ Board by the Government Finance Minister and Deputy Leader Bill English. The letter sent in November was obtained by Bloomberg using the Official Information Act, suggesting Bloomberg news used legal persuasion to get the report. One must wonder how they knew this letter existed, further pointing to a degree of loose lips in and around the RBNZ.

New Zealand Steps Up Scrutiny of RBNZ After Inflation Misses – Bloomberg.com

The Finance minister’s letter appears to place more scrutiny on the RBNZ Governor’s performance. It requests six-monthly meetings with the Board to discuss the RBNZ’s performance, and specifically that of the RBNZ Governor whom has the sole responsibility on interest rate decisions.

In June last year Finance Minster English commented on the persistence of inflation below target, pressuring the RBNZ to do more to achieve its 2% inflation target. Since then the RBNZ has cut rates by 1.25 percent in five 25bp rate cuts, more than reversing 1 percent of hikes in 2014, taking rates to a record low of 2.25%.

It may be coincidence, but the market would be excused for thinking that the government is effectively placing more pressure on the central bank to ease monetary policy.

Perhaps, for appearance sake, this actually makes it less likely that the RBNZ cuts rates next week, but the market might presume the RBNZ will cut rates further In June and subsequent meetings in a more concerted effort to lift inflation back to its target sooner.

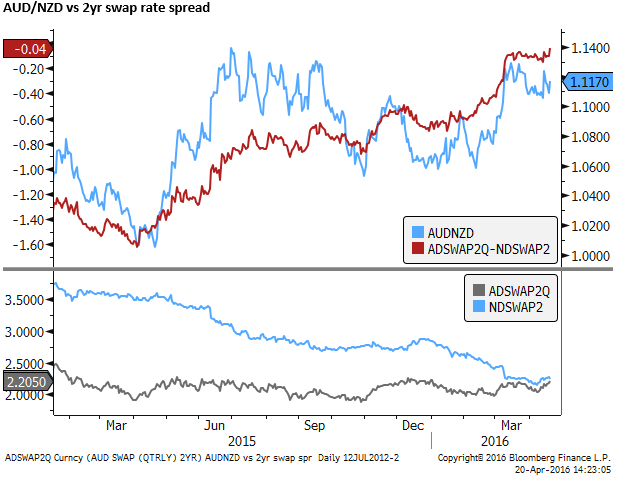

Since this report, NZD has fallen back more than the AUD and NZ rates have eased a bit more than those in Australia, suggesting that the market is buying into the idea that the RBNZ has lost in mojo and is being bullied by the government.

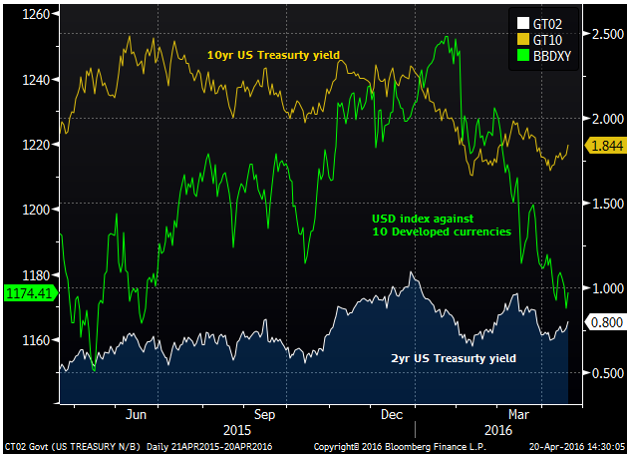

US Rates lift and support the USD on Wednesday

Broadly, we are seeing a lift in the USD on Wednesday (up from a low for the year) that is occurring at the same time as a rise in US Treasury yields and some curve steepening. The further rise in oil prices this week, ongoing evidence of resilience in the US labor market and a buoyant US equity market may be rekindling thoughts of US rate rises. Perhaps not next week, but maybe in June.

Overall there have still been mixed economic results in recent months that do not force much change in the FOMC statement next week. It could continue to say, “Business fixed investment and net exports have been soft”. It could continue to say, “Global economic and financial developments continue to pose risks.” There may have been some improvement in global market conditions, but the Fed might not want to upset the apple-cart just after it has been righted. It remains uncertain how stable are the fledgling improvement in global economic and market conditions.

As such, it is too early to look for a sustained rebound in the USD, but firmer US yields in recent weeks may help lift the USD somewhat.