Two currency themes to unwind

If the recent surge in global yields is durable, and we think it is, there are two themes in currency markets that need to be further unwound. One is the excessive strength in the JPY based largely on a lack of confidence in BoJ policy, the other is the excessive gains in currencies like the NZD based on a related ‘search for yield’.

The rise in bond yields may be more durable this time

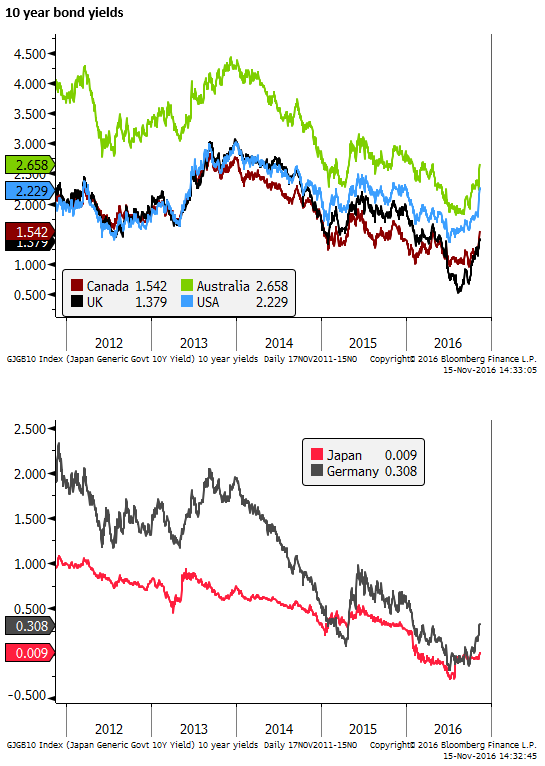

We have seen a rapid run-up in global bond yields, in a speed that resembles the 2013 so-called ‘Taper Tantrum’. The other significant bond market correction in recent years was a short-covering rally soon after the ECB began its QE program in 2015.

In these two previous occasions the bond market correction was driven largely by two specific markets; US Treasuries in 2013 and German bunds in 2015. The most recent rise in yields has had its genesis in rolling developments among all the major countries; Japan’s shift to Yield Curve Control, ECB proving reluctant to add to QE and both these countries/zones seeing problems with negative rates and flat yield curves. UK yields began to reverse post-Brexit falls as the GBP fell sharply and economic data proved resilient generating higher inflation expectations. The Trump election triggered a new wave of rises in US yields.

Since early in the year there has been increasing pressure from across G20 policymakers to pursue more infrastructure spending, and this theme has been given a big boost by Trump’s election promise.

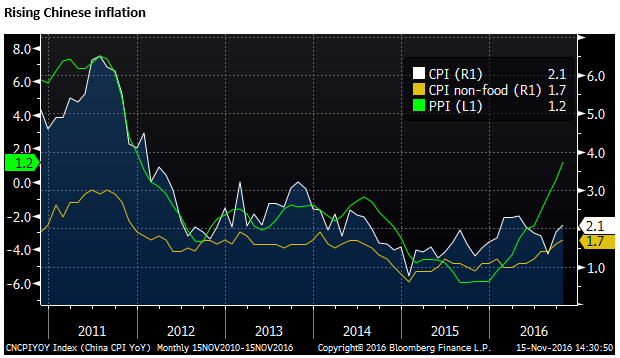

China can also be seen contributing to the rise in yields with big rises in Chinese steel prices and a turn up in its broad and underlying inflation measures, suggesting it has turned from being a long run deflationary force in the global economy to a source of inflation.

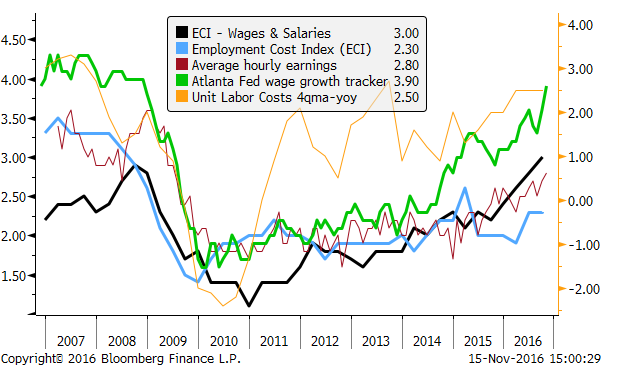

The most recent US economic data has been stronger than expected, including strong retail sales today. Importantly for the Fed’s inflation outlook, USA wage indicators are showing consistent gains over the last two years.

The broad nature of the recent set of developments driving up yields and the record low starting level of yields, suggests that the rebound underway may end up being more significant and durable than the previous periods seen in 2013 and 2015.

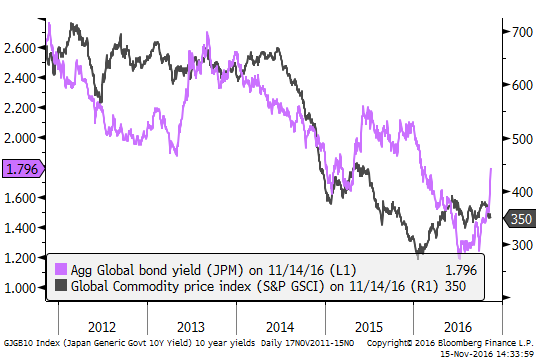

The rise in yields may also be more significant because the market has turned from a significantly overbought condition. In Q3, post-Brexit, it may have seemed that QE programs were unending and central banks had no choice but to keep pursuing these policies even as they may not be working. The US Federal Reserve was fixated by weak productivity growth and its members were revising down their long-run neutral policy rate. There was a growing perception that yields would remain low for the foreseeable future.

Catch-up plays in NZD

It is possible that after the recent surge, yields may consolidate in coming sessions. However, currency markets may still be playing catch-up to the surge in yields and inflation expectations.

Consider firstly that the plunge in global yields to record lows forced investors into a ‘search for yield’ and made a number of currencies stronger than might normally be associated with their thinner yield advantage.

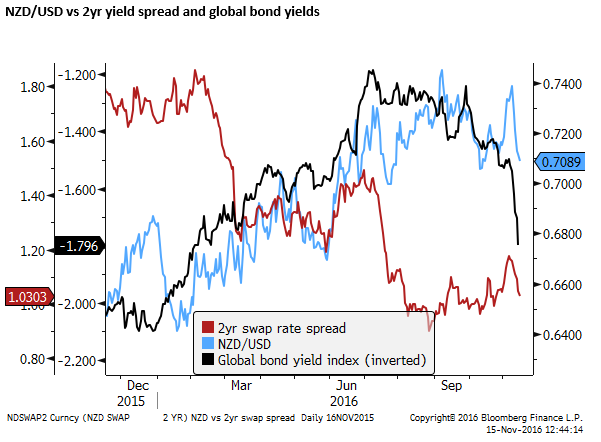

The NZD is a case in point. Its 1.75% cash rate looked attractive in a world where many competing yields were negative. We noted over recent months a higher than usual correlation in the NZD to a global bond yield index. The fall in global bond yields also helped explain the NZD out-performance against lower yielding AUD and CAD.

These commodity currencies are being supported by higher commodity prices. However, higher commodity prices themselves are contributing to higher inflation expectations and higher yields. As such, high yielding commodity currencies are getting mixed messages. While higher commodity prices may improve their terms of trade, they also threaten to see a further unwind of carry trades in these currencies.

NZD is one of the most vulnerable currencies to a deeper correction. The chart below illustrates our sense of its potential over-valuation. Global bond yields have rebounded to levels last seen in February. US bond yields have risen even more significantly, rising to a high for the year. Meanwhile, the NZD has risen much of the year despite several RBNZ rate cuts and a significant fall in its 2-year yield advantage over the USD. If the NZD/USD was able to ignore the slide in its yield advantage this year due to a fall in global bond yields and associated ‘search for yield’, the sudden reversal in the bond yields in the last week or so since the Trump election may yet cause the NZD to slide significantly to reverse its gains this year and reconnect with its 2-yr yield spread.

Reversal in this year’s gains in JPY

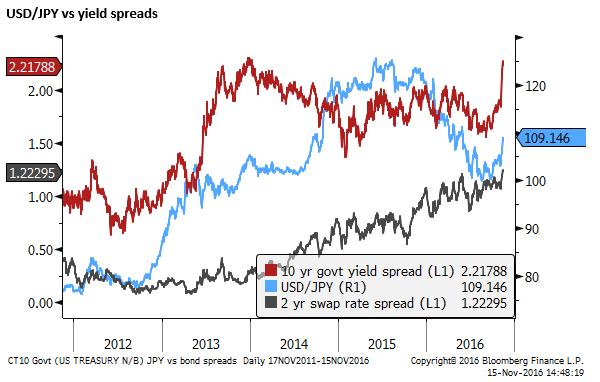

The JPY has reverted to a weakening trend since the Trump election and further rise in global bond yields, reversing some of its powerful rally from around 125 in 2015 to around 100 this year.

The strength in the JPY through the first three-quarters of the year was a contributing factor to the fall in global yields, creating a self-perpetuating cycle where a strong JPY undermined Japanese inflation expectations and made its QE monetary policy appear ineffective. This generated expectations that the BoJ would have to attempt even more adventurous policy easing. Each time it balked at further QE or rate cuts, the JPY strengthened further and Japanese investor confidence deteriorated.

The Japanese QE forced more Japanese buying of foreign bonds as Japanese yields sunk below zero, further lowering global yields, contributing to less yield disadvantage for JPY. Weaker global confidence in the effectiveness of low yields to stimulate growth generated safe-haven demand for JPY and a search for yield spilling over the strength in currencies like the NZD. Falling Japanese inflation raised real yields in Japan, tending to support the JPY.

This self-perpetuating cycle, vicious or virtuous, depending on your point of view, has now been broken.

The BoJ has moved to Yield Curve Control, and this policy now appears very effective in a rising global yield environment. As yields tend to rise, the BoJ can buy more bonds and increase the duration of purchases, or even sell short-term bonds to buy longer-term bonds. As such, the USD/JPY 10-year yield advantage has jumped sharply to revisit the high in 2013, while the 2yr yield spread is at a high since 2008.

The effective cap in Japanese yields and weaker JPY are likely to raise Japanese inflation expectations and lower real yields. As such, monetary policy now appears much more effective. There no longer appears to be a shortage of bonds for the BoJ to meet its QE purchase target.

In many respects, we view the rise in JPY this year as a perverse development and the JPY as over-bought considering the aggressiveness of the BoJ policy. Incidentally, the BoJ has now committed to continuing with its QQE/YCC policy easing measures until it overshoots its inflation target.

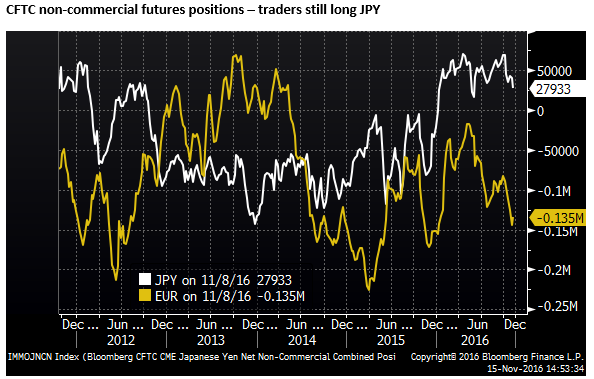

Speculative positions are still significantly long JPY and we see this potentially completely reversing back to a net short position as BoJ policy is seen for what it is, designed to weaken the exchange rate and raise inflation, something that the market has lost sight of this year. As such, in time, we may see a substantial, if not a complete reversal of the fall in USD/JPY over the last year.