USA confidence fades, EUR fortunes rise, AUD angst builds

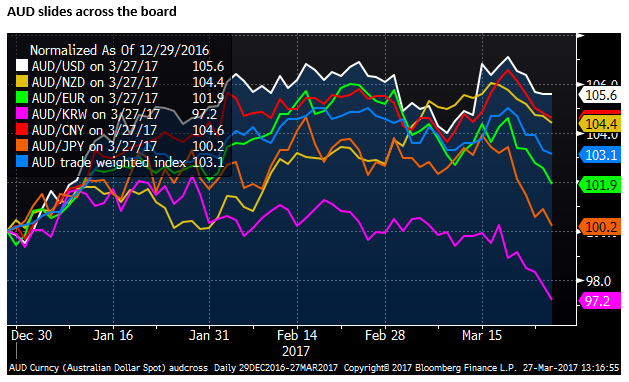

The outlook for the USD looks weaker on a number of counts – Trump optimism has faded, the Fed has emphasized a gradual approach, and recent US economic data is more mixed. In contrast, political risk is ebbing in the Eurozone and activity indicators have accelerated. US equities look relatively expensive, and the market may view EUR as basing, looking ahead to the time when ECB ends its QE/NIRP. AUD has significantly underperformed over the last two weeks. It appears to be undermined by angst over its domestic housing market, energy shortages and broader political uncertainty leading up to the May budget. Higher interest rates and corporate bond yields in China and ebbing iron ore prices may also be dampening the AUD.

US equities expensive and vulnerable to fading Trump-related optimism

The Republican-led Congress failed to deliver reform on healthcare. Tax policy reform may be just as difficult to construct with different views on a border tax and budget control. The debt ceiling problem looms again, and the Trump team faces an ongoing Senate inquiry and FBI investigation into its alleged Russia links.

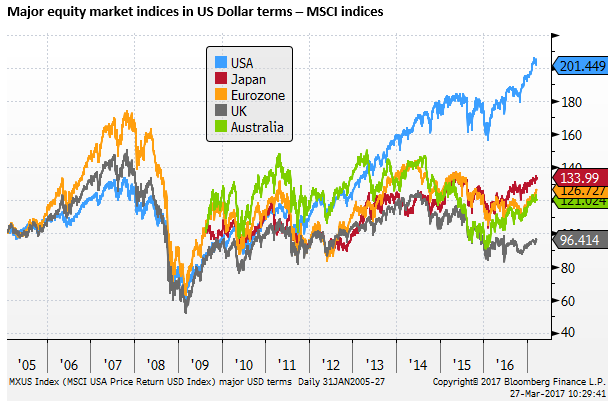

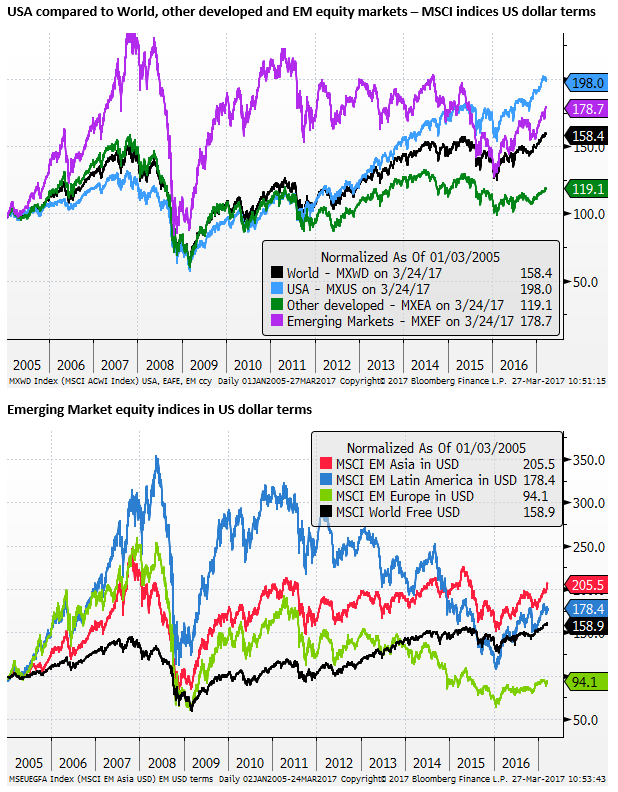

The USA stock market may appear relatively expensive to other markets. The charts below illustrate that the US equities have vastly out-performed other countries’ since around 2010/12, indicative of its progress towards returning to more normal economic conditions in the wake of the Global Financial Crisis in 2007/08 and the Great Recession of 2009/10. Its P/E ratio based on year-ahead earnings estimates of over 18 is around the high since 2002, and high relative to other major markets.

Global equities have rallied sharply since the election of Trump, so it is hard to say there is a specific Trump bump in USA equities related to optimism that Trump can deliver growth-boosting reforms, such as a tax policy overhaul and reduced business regulation. Nevertheless, it may be the case that USA stocks start to under-perform if doubts grow over the capacity of the Trump administration and Republican-led Congress to deliver reform.

Steady Fed encourages capital outflow

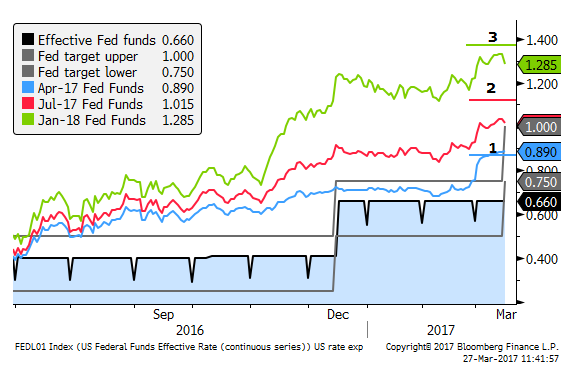

The US Fed retained a cautious and gradual rhetoric, even though hiking in March, maintaining a three-hike forecast for this year. It appears to need ongoing evidence of improvement in the economic outlook (tighter labor market and higher inflation) to force the case for a second and third hike this year.

If USA economic reports appear to show a plateauing and US equities stall, the Fed may revert to a wait and see stance through the middle of the year.

A sense of stable Fed policy may further encourage capital flows to other countries exhibiting stronger growth trends.

Some signs of US growth plateauing

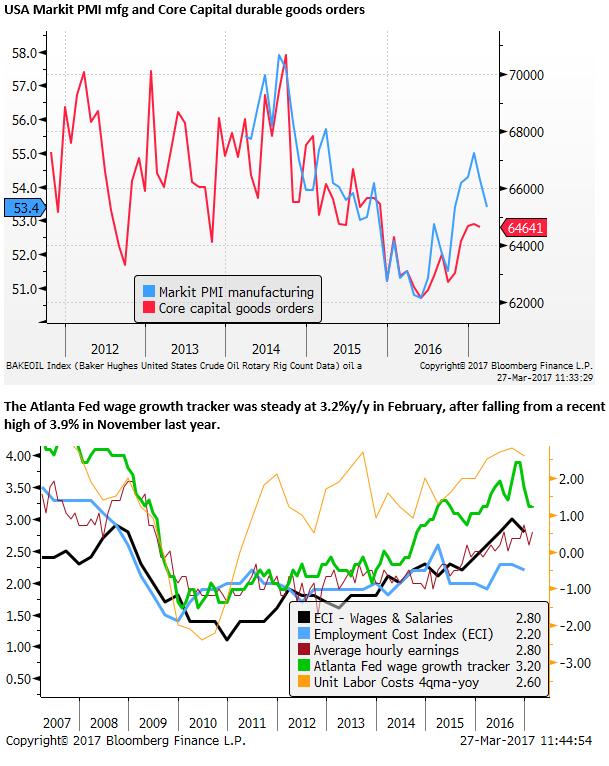

US economic momentum sill appears relatively solid. However, there have been some less impressive indicators that may portend a moderation in coming months. Core capital goods orders (nondefense, excluding aircraft) stalled in Jan/Feb after a modest recovery from a low in May last year. The preliminary Markit USA manufacturing PMI survey ebbed for a second month in March.

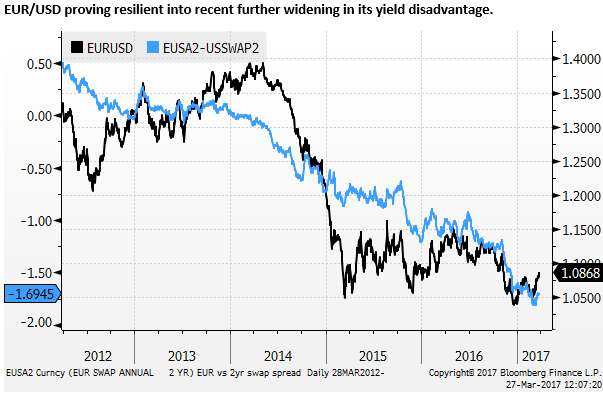

EUR may be basing

More people may be forming the view that the EUR is basing, looking ahead to a time when the ECB ends its QE program. The EUR only briefly broke below its 2015 QE induced lows in the wake of the Trump election last year. It has also been diverging from its widening short term yield disadvantage over recent months and shaking off albeit diminishing Eurozone political uncertainty.

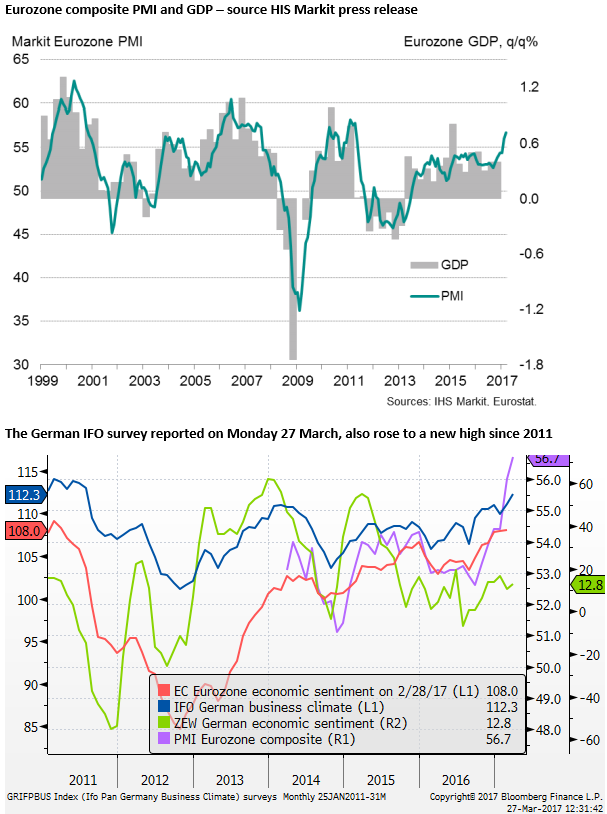

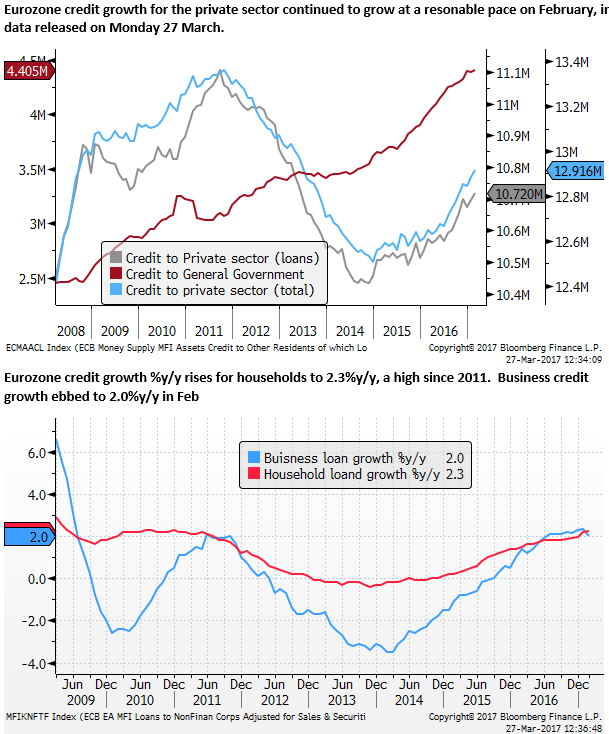

Eurozone activity accelerates

In contrast, to ebbing in the preliminary USA Markit manufacturing report, the Eurozone index rose to a new high since 2011. Furthermore its service sector PMI also rose to a high since 2011, pointing to faster GDP growth. (Reported on Friday 24-March).

Eurozone political risk ebbs

The risk of a Le Pen victory in the French election (1st round 23 April/ 2nd round (if needed) 7 May) has slipped significantly over the last month. Emmanuel Macron (En Marche) has risen to near 70% probability of winning implied by the betting market, Marine Le Pen’s chance has edged lower to 24%.

Energy, housing and political angst weighing on AUD

One currency that has failed to capitalize on a retreat in the USD and resurgence in demand for emerging markets is the AUD. It has starkly under-performed in recent weeks

The domestic media discourse is heavily focused on three interconnecting issues that appear to be dampening economic confidence and point to economic risks

One is the ever-present debate over the housing market. More commentators are expressing alarm at the run up in prices that have accelerated over recent months. Once a source of support for economic confidence, rising house prices in Sydney and Melbourne are generating alarm and demand for policy action.

The government is coming under more criticism for not doing more to wean Australians off generous tax concessions for investment in housing (reducing capital gains tax concessions and access to negative gearing). Regulators suggest that they will support tougher macro-prudential measures to slow lending for housing investment. Households are heavily leveraged and increasingly concerned that younger generations are saddled with debt or will never be able to afford home ownership. A number of commentators fear a significant correction in house prices if interest rates start to rise, especially with a growing supply of apartments in the Eastern cities after several years of record apartment approvals.

One can only wonder how Australian house prices continue to rise so rapidly, even though there is widespread discussion of a possible bubble. Some recent surveys suggest that Australian’s are turning sour on property investment. And yet auction clearance rates are around record highs, and prices are soaring. There may be a rush by investors to get in ahead of new measures anticipated in the government’s May budget to discourage investment and reportedly imminent restrictions on bank lending for investors.

There may be a risk premium being priced into the AUD related to risk of a housing bubble being pricked by policy action (tax changes or macro-prudential measures) or approaching rate rises or other external influence.

Home prices jump 3.7 per cent since start of year, 27 March – News.com.au

Why Chinese investors keep buying Australian property, 24 March: it’s cheap – ABC.com.au

73% of Aussies believe it’s time to sell, 27 March – smartproperty invesmtnet.com.au

Confidence in housing market lowest in 40 years – tenplay.com.au

Don’t bet the house on solving the affordability crisis, 26 March – SMH.com.au

Crackdown on bank lending through tougher macroprudential policies imminent, 21 March – AFR.com

RBA trapped between house price bubble and high household debt, 21 March – AFR.com

Byres won’t use the ‘B’ word but says risks elevated, 20 March – AFR.com

The other issue that may be weighing on economic confidence is an electric power shortage and high and volatile electricity prices. Industry is blaming successive governments at the state and federal level for not providing a consistent energy policy overt the last decade, resulting in a lack of investment in new generation capacity. Contributing factors have been changing government policy on a carbon tax and attempt to replace conventional greenhouse gas producing coal-fired production with renewables. There have been warnings from industry leaders that this will damage economic growth and broader investment. Further complicating the debate is the massive investment undertaken in recent years to create an export industry in natural gas. The debate is further adding pressure on the federal government.

Power wars: Politicians to blame for high prices – AFR.com

A third issue is the approaching May budget, an ongoing struggle to pass legislation and poor polling for the government. The government has struggled for some time with 20 cross-benchers in the Senate, requiring the vote of 9 of them to pass legislation. Public confidence in the Liberal National Coalition to make significant policy reform has remained low since it was narrowly returned to power in July last year. About the only thing going for PM Turnbull is that the public is equally dissatisfied with the Labor Party Opposition leader Shorten.

News Poll – TheAustralian.com.au

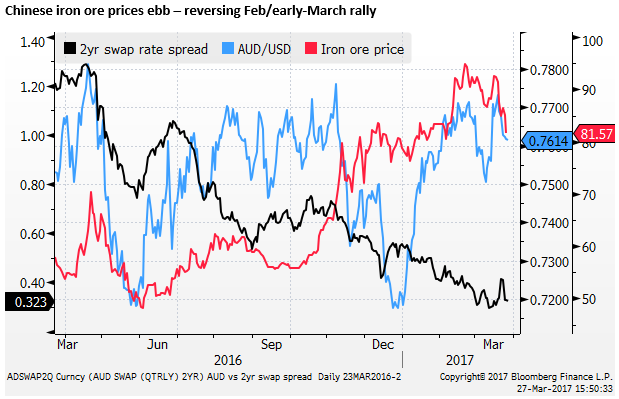

Chinese Financial and growth risk weighing on AUD

The AUD fall may also reflect a higher risk of slower Chinese economic growth and demand for steel.

Chinese policymakers set a stable growth target this year, earlier in March. Many anticipate that ahead of a 5-yearly re-shuffle in the leadership of the Chinese Communist Party in Autumn this year, economic stability will be more imperative that tackling excesses in debt, state-owned enterprises, over-capacity in heavy industries, and financial stability.

Nevertheless, Chinese policy makers have appeared to tighten policy somewhat in recent weeks and shift gear to slow rapid credit creation and property speculation in its major cities.

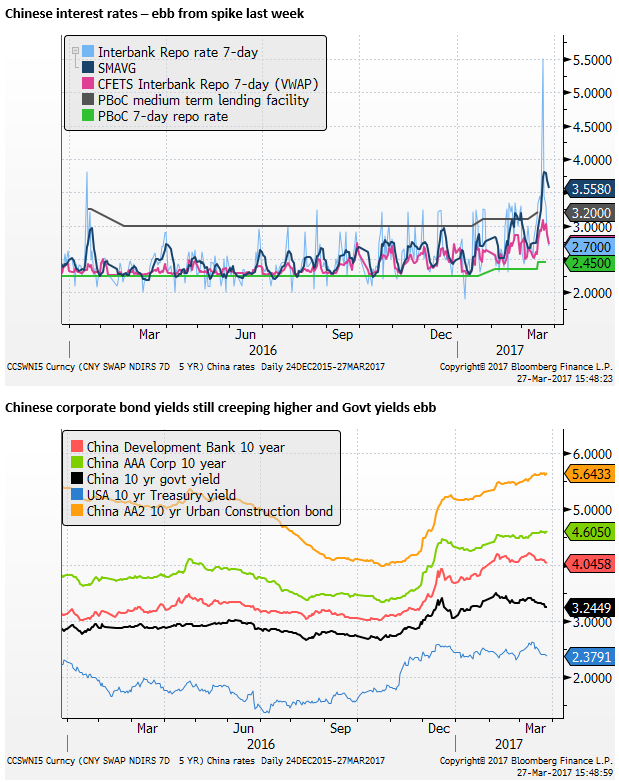

Chinese interest rates and corporate bond yields have risen, and there are reports of some more careful monitoring of shadow-banking activity.