Key developments in recent weeks include:

A rebound in interest rates and bond yields. 2yr swap rates rose above the 4.0 to 4.5% range they were trading in for two months following the banking upheaval, rising to 4.76%. 10yr yields rose from a 3.3 to 3.6% range to 3.80%.

US economic data has beat expectations. It appears that the shadow of the pandemic’s fiscal largesse that bumped the savings of households and the private sector generally has made the economy resilient to rate hikes to date. The slowdown in economic growth that many anticipate has been slow to develop.

PCE inflation appeared sticky, and consumption spending was stronger than expected. Core durable goods orders rebounded. Jobless claims were revised lower. GDP in Q1 was revised up to 1.3% from 1.1%q/q SAAR. US S&P Global composite PMI rose to 54.5, a high since April 2022. Fears of credit tightening from the banking upheaval persist but have been countered by stronger-than-expected activity and inflation.

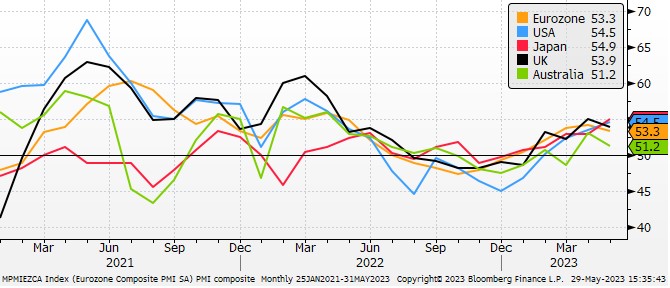

In all major economies, there is a wide and widening gap between PMIs for services and manufacturing. A slump in manufacturing has deepened, and a recovery in services has gained momentum. Services PMIs in May were above 55, around the highs since the first half of 2022, while manufacturing PMIs were generally below 50, some like the Eurozone (44.6%) and UK (46.9) significantly so.

Considering the greater significance of the service sector in more advanced economies, the strength in this sector has driven composite PMIs to solid levels above 50. “Economic growth across the four largest developed economies has accelerated to the fastest for 13 months in May” (commentary from S&P Global).

The PMI data suggests there is a large shift in demand from goods to services which may also be the shadow of the pandemic, reversing the trend during the pandemic.

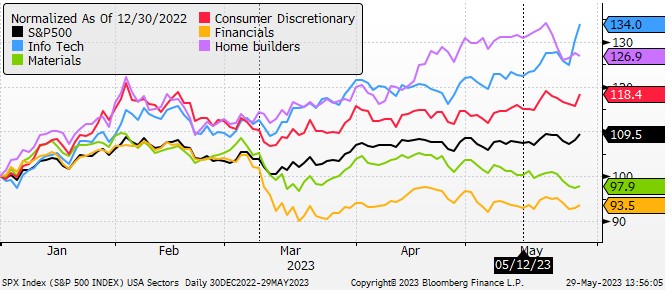

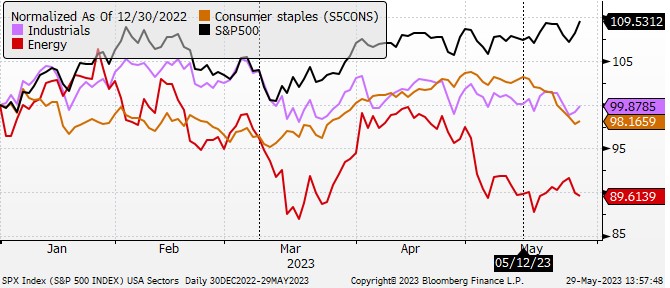

The divergence in goods vs services demand is apparent in commodity prices and sectoral performance in equity markets. Industrial metals prices have largely reversed gains from November to January. Energy prices have also fallen to lows since 2021. Agricultural prices are also around the lows set last year.

The strength in the service sector is probably helping lift the USD recently relative to most other currencies that tend to be more driven by manufacturing. This includes the EUR, JPY, and CNY. It is also supporting the dollar vs commodity exporter currencies.

The outlook for the Chinese economy has deteriorated significantly. Early in the year, optimism for a post-zero-covid rebound was high, aided by a sharp rebound in economic data. The market also perceived a shift in government policy towards promoting growth over other priorities like clamping down on private sector companies that might threaten the government’s tight grip on power and pursuing geopolitical goals.

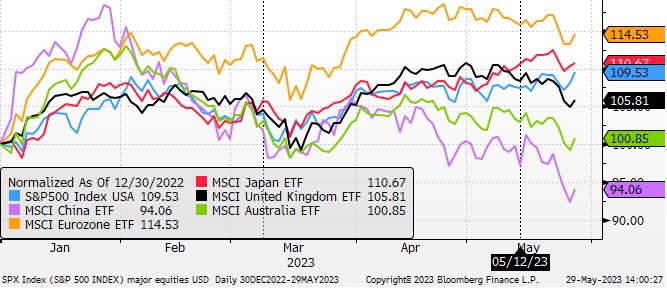

However, recent economic reports have been much weaker than expected. The rebound out of covid-zero has lost momentum. Credit problems related to property developers and the housing market, impacting local government finances, are proving to be a more persistent drag on activity and confidence. The Chinese equity market continues to flounder, suggesting local and global investors see a range of issues related to domestic financial conditions and geopolitical risks.

CNY fell to a new low for the year, establishing a downtrend after falling below previous lows in March and December. The weaker CNY is tending to support the USD against a wide range of currencies, especially those in Asia, including the JPY.

The US equity market has significantly outperformed other markets in recent weeks, led by a strong high-tech sector, especially some of its biggest and most globally successful companies. NVIDIA Corporation has been a standout, reporting strong demand for its advanced semiconductors used to power Artificial Intelligence systems. Many of the so-called FANG stocks have our-performed the broader market.

The relative strength of US equities is probably also supporting the USD, attracting capital directly to US stocks, lifting US economic confidence and raising the prospect of higher interest rates.

US equity sectors – High tech powering the rally, Financials remain in the doldrums, materials sector has turned down

US equity sectors – consumer stables and interest-sensitive sectors have turned down recently. Industrials and energy weaker

Major country equity ETFs – US stocks rise to new highs for the year, other markets lower in recent weeks led by China

USD outlook

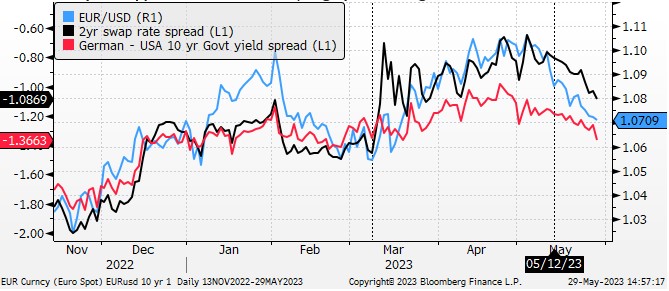

Recent events have gone some way to restoring the medium-term outlook for the USD. Yield spreads have lifted against the EUR, CNY and JPY and several other major currencies.

In recent weeks, the Bloomberg dollar index rose decisively above its range in the last two months, although it remains below levels in March prior to the banking upheaval. It is now facing significant resistance levels again and is getting close to overbought territory.

Bloomberg dollar index

Key labour data is due this week in the US and may be important to sustaining the recent strength in the dollar.

While the debt ceiling impasse continues to overhang US and global markets, it is hard to see a clear impact on trading outcomes. There may have been some support provided to the dollar as a safe haven, even though the threat to government finances and economic activity is larger for the USA.

The market has priced in +14bp for the next FOMC policy meeting on 14 June from a mid-target of 5.125% and an effective rate of 5.08%. It has priced in +24bp by 26 July and then sees rates falling (-11bp by 13-Dec and -18bp by 31-Jan-24).

- Tuesday: May CB consumer confidence

- Wednesday: Apr JOLTS job openings, Fed Beige book

- Thursday: May Challenger job cuts, May ADP employment, ULC Q1 final, May ISM manufacturing

- Friday: May labour data

- 5 June: May ISM services, X date debt ceiling

- 13 June: May CPI

EUR Outlook

EUR is at risk of further correction, considering lost yield support. Recent economic data appear to have stalled in contrast to the USA. The Eurozone manufacturing PMI slumped to a low for the G4 at 44.6 in May, dragging the composite PMI to below the USA, although still solid at 53.5.

The Euro may be seen as a bit more tied to the weaker outlook for the goods sector and deteriorating sentiment in China.

This week, direction may depend on the CPI data.

On a more positive note, European gas futures prices have fallen further to be below even pre-Ukraine war levels. The current account balance has rebounded accordingly.

- Tuesday: Apr money and credit growth, May EC sentiment surveys, Spain May CPI

- Wednesday: German May unemployment, May German, French CPI

- Thursday: May CPI, Apr unemployment

- 15 June: ECB policy

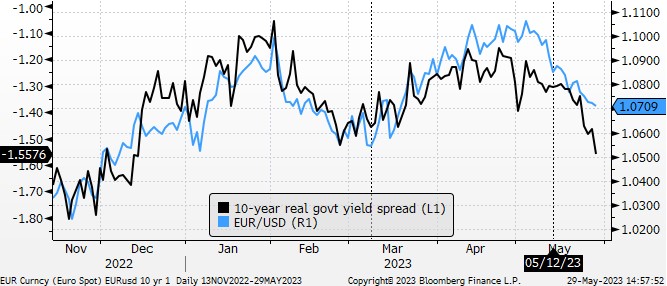

EUR has lost yield support over recent weeks, largely accounting for the moderate fall in the EUR.

EUR/USD vs the German-USA real yield spread from 10yr inflation-linked government bonds – the fall in the real yield spread points to some further downside risk for the EUR

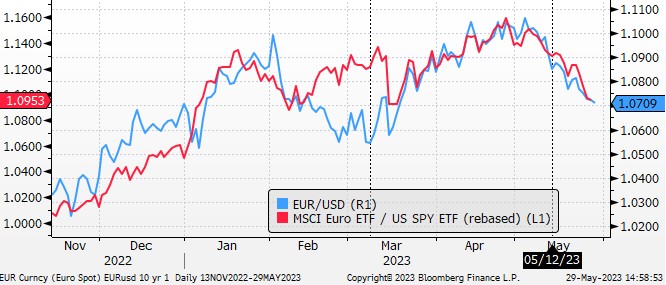

EUR/USD vs relative equity ETF performance – US equity market out-performance is consistent with a weaker EUR

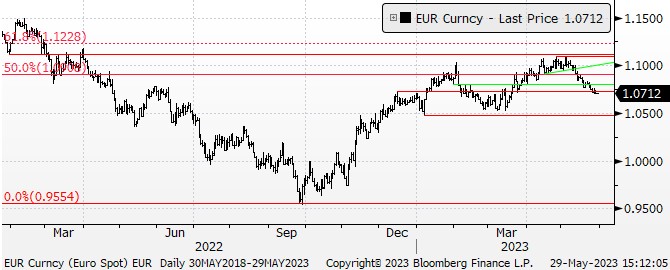

EUR may need to fall further towards 1.05 to find clearer support, although it has become somewhat oversold in the short term

JPY outlook

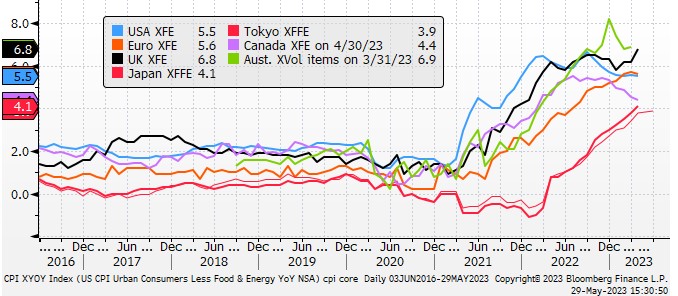

The JPY has been driven by a rebound in US yields, while the market has no clear sight of a policy shift in Japan. However, Japan core CPI XFE (4.1%y/y in May) continues to hit new peaks and may at some point reignite pressure for higher yields in Japan.

Japan’s economic performance has also tended to hold up better than peers. The composite PMI rose to 54.9 in May a high in at least three years of data available, rising above other G4 counties. Despite contracting manufacturing PMIs is most countries (below 50), Japan’s rose to 50.8, a high since September.

GDP in Q1 was 1.6% q/q SAAR, above 0.8% expected, supported by recovering tourism.

Foreign net buying of Japanese stocks has been running above the seasonal average over recent weeks

- Tuesday: Apr labour data

- Wednesday: Apr retail sales, Apr IP

- Thursday: May consumer confidence, Apr housing starts, Q1 capital spending

- 5 June: Apr labour cash earnings

- 16 June: BoJ policy

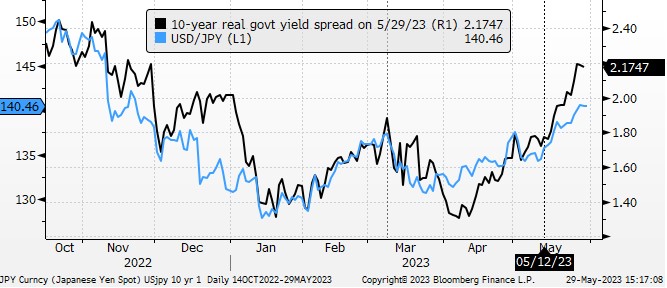

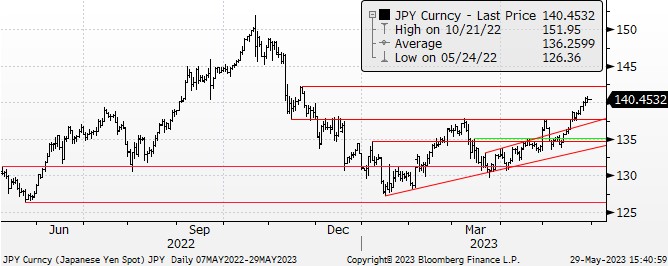

USD/JPY vs real 10yr yield spread – a sharp rebound in the real 10yr yield spread has undermined JPY. This reflects mainly higher US real yields, but Japanese real yields have fallen as well, which may reflect a more dovish BoJ policy despite rising core inflation XFE

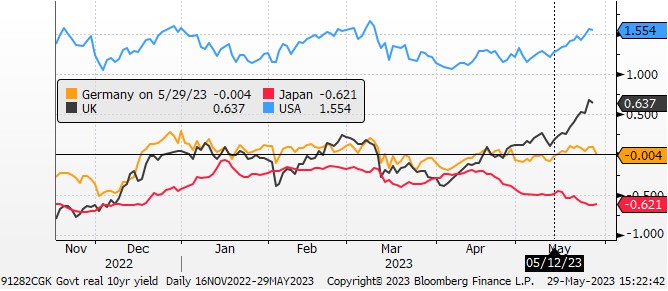

Real 10yr yields from inflation-linked government bonds – real yields in Japan have fallen to a low this year. Real yields have risen significantly in the USA to approach highs this year. UK real yields have risen to a new high

Core CPI %y/y – Japan’s core inflation still rising closing the gap with other majors

Composite PMIs – Japan’s at the top and a high in over three years

USD/JPY rose above March highs in recent weeks – It is approaching fresh resistance towards 142/143

GBP outlook

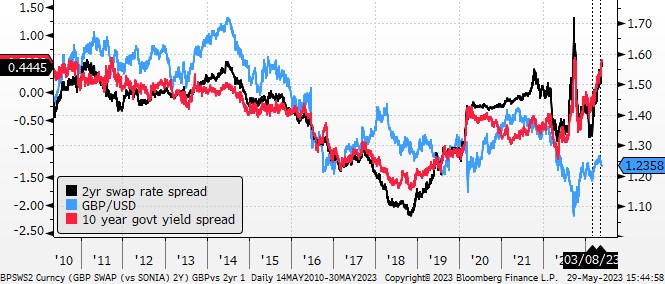

Judging by its improved yield spreads, rising to pre-2016 Brexit levels, there appears to be an upside risk for the GBP.

There may be lingering fiscal risks that account for some of the yield spread widening. Nevertheless, it is hard to ignore the sharper rebound in UK yields. Key to the recent rise has been resurgent inflation in the UK, suggesting the BoE needs to hike further and hold rates higher for longer.

- Tuesday: May Lloyds business barometer

- Thursday: May Nationwide house prices, Apr credit growth and money supply

- 13 June: May labour data

- 14 June: Apr month GDP

GBP/USD vs yield spreads – excluding the Truss fiscal crisis last year, spreads are at a high in a decade or more, noticeably above pre-Brexit levels in 2016

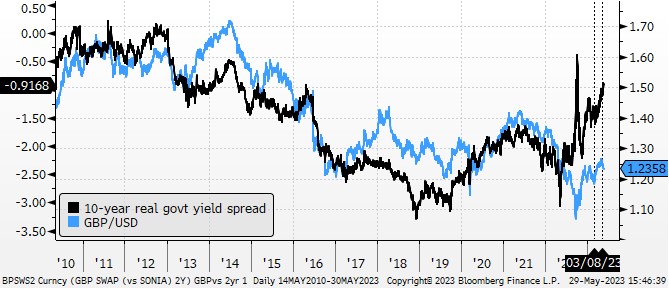

GBP/USD vs real 10-year yield spread – at highs since 2014 (excluding the Truss fiscal crisis)

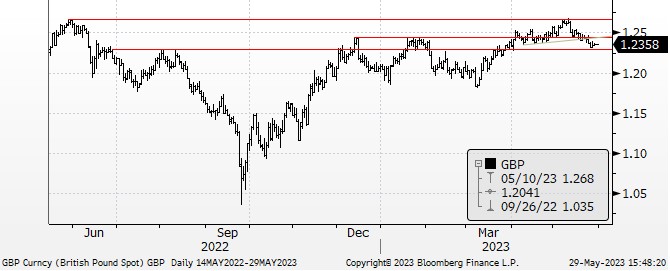

GBP/USD has found support at 1.229

AUD Outlook

The RBA Governor Lowe appears to have lost some patience with inflation over recent months and shaken off some diffidence to the politicians and press now that it is unlikely he will be retained as Governor when his term expires in September.

The recent data suggest a hold is likely next week, but the RBA has served notice that it is watching wage pressure more closely. While the labour market appeared to ease last month, another large hike in the minimum wage is expected to be announced in June. Unions supported by several government members are pushing for higher wages to compensate for higher inflation.

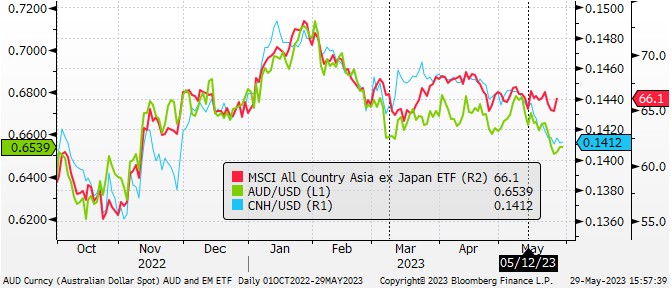

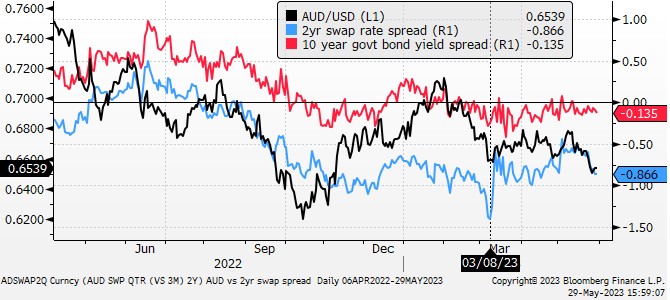

The AUD has fallen to reflect weaker commodity prices and a weaker CNY. A wider negative yield gap to the USA recently has also contributed to a lower AUD.

However, as the favourite whipping boy to reflect global risks, the AUD may have become oversold. Trading below 0.65 is relatively rare for the AUD.

The catalyst for a sustained bounce is not clear, but attention should remain on US rates, Chinese growth, and RBA policy intentions.

Attention this week turns to Australian CPI and capex data, and Chinese PMIs.

- Tuesday: Apr building approvals

- Wednesday: Q1 construction done, Apr credit growth, Apr CPI

- Thursday: May CoreLogic house prices, Q1 capex

- Friday: Apr housing lending

- 6 June: RBA policy, Q1 GDP

- 15 June: May labour data

AUD fall consistent with weaker material sector equities

AUD vs iron ore prices

AUD vs CNY and Asian equities

AUD/USD vs yield spreads

AUD vs real 10yr yield spread

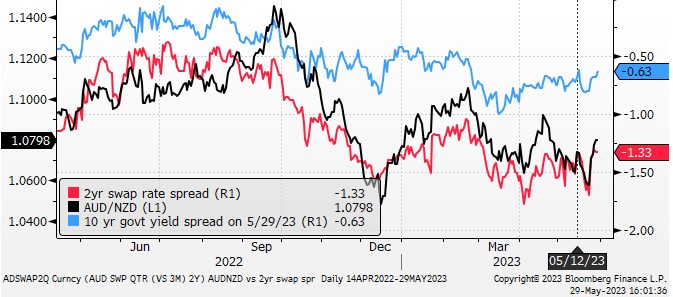

AUD/NZD has rebounded in line with an improvement in the 2yr yield spread after the RBNZ dovish hike, suggesting they may have reached peak rates

Greg Gibbs

Founder, Analyst & PM

Amplifying Global FX Capital Pty Ltd

An Australian financial services company

+1 970 409 2877

AmpGFXcapital.com

Comments