Confidence in Fed hikes waning

US interest rates have fallen significantly this year (-36bp) reducing the USD yield advantage. This has been matched by the GBP and CAD, but AUD and NZD rates have been much more stable than previous episodes of global risk aversion. The Fed is sticking to its outlook for gradual policy tightening, but weak growth is expected to be reported in Q4, activity indicators are weak heading into 2016, medium and longer term inflation expectations are down sharply, and the only plank left supporting rate hike forecasts is the solid labor market. However, recent unemployment claims have drifted up, and a considerable pause in US rates appears likely. The US economy has been dragged back to the pack to some extent by the deep fall in oil prices. While the US energy sector is not all that large, it is much more cyclical than OPEC countries, and activity in this sector has been a factor slowing the US economy. We may be moving into a phase where confidence in the US economy is waning. This may tend to weaken the USD in 2016. Global risk aversion and weaker commodity prices may also weaken commodity and emerging market currencies, but if perceptions on US monetary policy change enough, even these currencies may recover at some point.

US economy underwhelms and USD loses rate support

The market has wound back USA rate hike expectations in the wake of a sharp correction in global equity markets, significant widening in risk premia in emerging market and US corporate bond markets, sharp falls in oil prices, and recent economic indicators in the US that have been lower than expected.

As a consequence, the USD has lost yield advantage in recent weeks against several currencies. The chart below shows two year swap rates for the major currencies and the dollar bloc-commodity currencies.

US 2yr swap rate have fallen from a peak of around 1.18% at the end of last year to 0.92% (-36bp).

The USD has lost yield advantage against the EUR and JPY of late, since both the countries of the latter two currencies have rates closer to their perceived lower bound. As such, risk aversion tends to have a muted response in their rates markets.

GBP weighed down by its own fall in rates and EU-referendum uncertainty

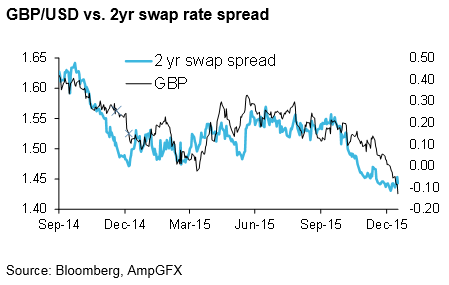

However, the charts above show that GBP rates have fallen by almost as much as USD rates since the beginning of the year, leaving the GBP/USD yield spread roughly unchanged.

As such, it may be surprising that the GBP/USD has fallen so much this year. (From near 1.48 to below 1.43). On the other hand, the GBP/USD was slow to react to the sharp rise in US rates in Nov/Dec last year; such that the fall in GBP this year may be a catch-up to last year’s rate moves. (See the GBP/USD vs the 2yr swap rate spread chart below).

It may also be the case that the GBP has lost status as a safe haven due the approaching referendum on EU membership, the uncertainty over what deal will be reached with EU negotiations before the vote, and the polling showing a significant risk that the UK shoots itself in the foot by deciding to exit EU membership. The negotiations are expected to end by March, and a referendum on the outcome is expected around mid-year.

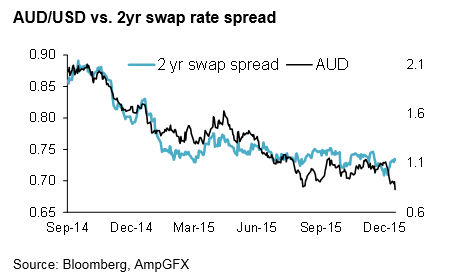

Australian and New Zealand interest rates not so reactive to global risk aversion

An interesting feature of the recent period of risk aversion is that rates in the US have fallen more than those in Australia and New Zealand. In past episodes of risk global risk aversion, rates in Australia and New Zealand have tended to fall as much and often more than the US.

Rates in Australia and New Zealand are at record lows, and the market is projecting some risk they are cut further in 2016.

Nevertheless, in a crisis, both have significant capacity to cut rates further. A key difference between now and previous crises is that both New Zealand and Australia have uncomfortably high household debt and house prices. They are faced with their own version financial stability issues, discouraging thoughts of emergency rate cuts.

In any case, economic conditions in Australia are showing significant resilience to renewed concerns over weaker commodity prices. New Zealand is more mixed, but activity indicators are still resilient.

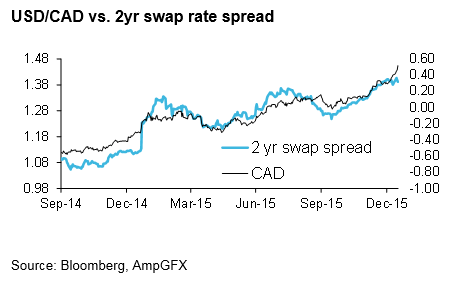

Canada rates down as market ponders rate cut on Thursday

In Contrast, Canada rates have fallen in line with US rates so far this year, after losing considerable yield advantage to the USA in Q4 last year. In early-Nov, US and Canadian 2yr swap rates were the same, now US rates are 32bp higher than in Canada, helping account for the rising USD/CAD since mid-Oct last year.

The market is pricing in around a 70% chance that the BoC cuts policy rates by 25bp this Thursday from 50bp, back their historic lows last seen in 2010; after cutting rates in Jan and July last year.

Weak growth projected for US Q4 GDP

In consideration of the economic data in recent months, it is not so surprising that US rates have led the falls over the year to-date.

The Atlanta Fed GDPNow projection of Q4 GDP is only 0.6% SAAR, taking into consideration the weak retail sales report on Friday.

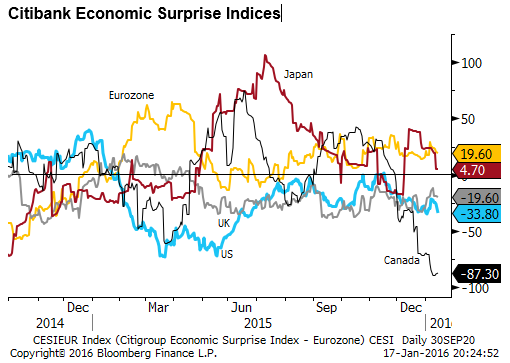

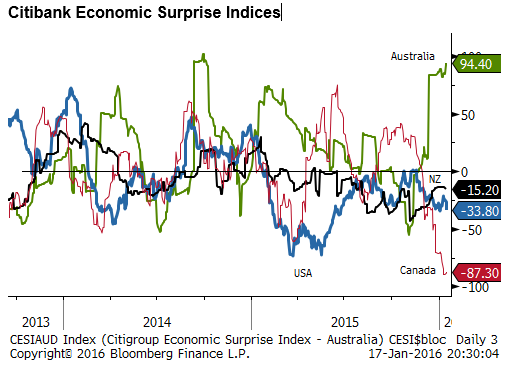

The Citibank Economic surprise index also reveals an underwhelming performance of US economic data over the last few months. The US index is at -34, compared to +20 in the Eurozone and +5 in Japan. The UK is -20; only Canada is worse that the US at -87 (close to the minimum of -100) adding to the case for the BoC to cut later this week.

Highlighting the improving state of the Australian economy of late the Citibank surprise index is +94, a polar opposite to Canada. New Zealand is -15.

Labor market the key plank left holding up the Fed projections

So far recent Fed speakers have not changed their message that further gradual rate rises are expected this year and over the next few years. However, they stress the rate-cycle will depend much on the evolution of economic data.

On Friday, New York Federal Reserve President Dudley admitted that “Some recent activity indicators have been on the softer side, pointing to a relatively weak fourth quarter for real GDP growth.” But said, “This needs to be weighed against the strength evident in the U.S. labor market. I continue to expect that the economy will expand at a pace slightly above its long-term trend in 2016.”

Dudley was upbeat on consumer spending and housing, and saw fiscal spending as “somewhat stimulative”. But he was down-beat on manufacturing (due to a weak energy sector and strong dollar), and he saw risks emanating from the global economy.

He said, “Putting these positives and negatives together, the most likely outlook seems to be more of what we have experienced in this expansion—an economy that grows at slightly above a 2 percent annual rate this year.”

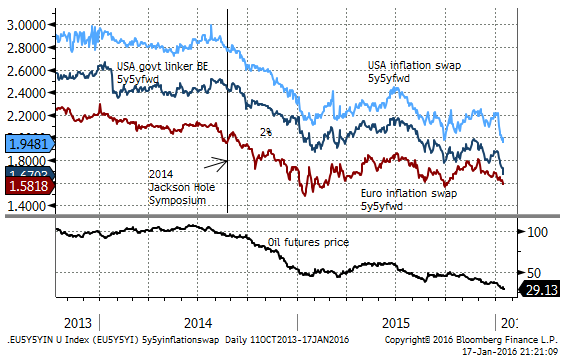

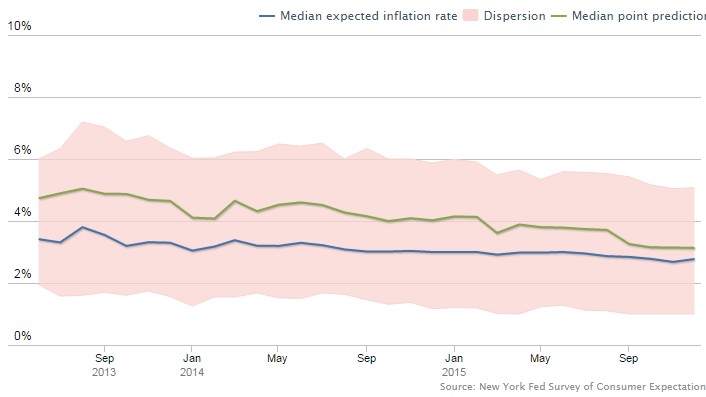

Dudley outlined the case for inflation to rise to the 2% target over the medium term. But he did highlight the fall in surveys of medium to longer term inflation expectations surveys. He said that the magnitude of the falls was still small, but it is noteworthy that surveyed expectations are at historical lows.

He said that, “should the economy unexpectedly weaken, then this fall in inflation expectations would become more concerning.”

While Dudley was referring to expectation surveys. St Louis Federal Reserve President Bullard raised similar concerns over the fall in market-based measures of inflation expectations on Thursday last week. As the chart below of 5yr-5yr forward inflation compensation show, they have fallen abruptly in the US this year to new lows (below the Fed’s 2% target).

On the other hand, Dudley raised a new reason why the Fed needs to worry about unemployment falling below its perceived neutral level. He noted that it is difficult for the central bank to calibrate policy to achieve a small rise in the unemployment rate. He said that past attempts to tighten the labour market “even a little bit” have ended in “full-blown recessions”.

Dudley is not ready to jettison the Fed projected policy tightening, but the strength in the labor market remains the key plank in that forecast. Should it lose momentum, he will be left with weaker activity indicators and lower inflation expectations; and rates will be back on hold, if not cut again, should the labor market actually reverse course.

Oil price plunge has hurt the US economy more than expected 18 months go

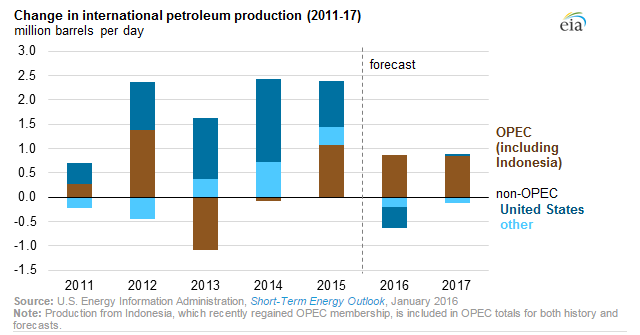

18 months ago, most thought the net impact of lower oil prices would be beneficial for the US economy, as still a large net energy importer. However. Over the last five years, the biggest marginal increase in oil production came from the USA. In 2016 it is expected to have the biggest contraction to oil production (countering the jump expected in OPEC production). Presumably this change in production is also reflected in the pattern of investment in the energy sector.

Crude oil prices to remain relatively low through 2016 and 2017 – EIA.gov

While the US energy sector might still have attractive long term potential, it is acting as the marginal supplier of oil, rising in the good times and retreating in the bad times. As such, in terms of actual activity (employment and investment) the US energy sector is the one of the most cyclical in the world. As such, even though the US energy sector is a relatively small part of the overall economy, it appears much more cyclical and can pack a significant punch on the performance of the overall economy.

Regional manufacturing surveys suggest that the down-turn in the US energy sector has been a significant drag on the overall economy. It was a factor in delaying the first Fed rate hike for longer than many anticipated (from the first half of 2015 to the very last meeting in December), and it has contributed to a lower trajectory in the outlook for US rate hikes.

The lower price of oil may not have been a net benefit to US growth, and in a relative sense to other oil importer nations, such as the Eurozone and Japan, the US economy may have been dragged back to the pack.

Many thought this may be just a timing thing. In the first phase, a cyclical slowdown in the US energy sector would be a drag, but this would be followed by a lift in consumer spending and a stabilizing US energy sector. However, the down-draft from the energy sector may be lasting longer, and the lift to consumer spending and broader economic activity not as large as anticipated.

It is unclear whether this has had much impact on the USD. It rose strongly against many emerging and commodity currencies over the last year, but it is lower against the EUR and JPY since it peaked in Q1-2015.

Looking ahead, we may be moving into a phase where confidence in the US economy is waning, and US yields are falling more significantly. This may tend to weaken the USD in 2016. Global risk aversion and weaker commodity prices may also weaken commodity and emerging market currencies, but if perceptions on US monetary policy change enough, even these currencies may recover at some point.

The Fed has not backed away from its forecasts for the economy that resulted in a rate hike in December, and project up to four more this year. Although of course they say it depends on the data.

What they said

New York Federal Reserve President Dudley

“Turning to inflation, we continue to fall short of our 2 percent objective for the personal consumption expenditure (PCE) deflator. But I take it as a positive sign that the core PCE inflation rate—that is, excluding food and energy—has been quite stable despite the downward pressure being exerted by lower energy prices on the prices of non-energy goods and services, as well as the drop in non-energy import prices from a firmer dollar.

“We are likely to see inflation rise once energy prices stop falling and the dollar stops appreciating—clearly neither trend can persist indefinitely. Of course, this assumes that the U.S. economy grows sufficiently rapidly so that pressure on available labor and capital resources continues to increase.”

“With respect to the risks to the inflation outlook, the most concerning is the possibility that inflation expectations become unanchored to the downside. This would be problematic were it to occur because inflation expectations are an important driver of actual inflation. If inflation expectations become unanchored to the downside, it would become much more difficult to push inflation back up to the central bank’s objective. Japan’s difficult experience indicates the importance of avoiding such an outcome.”

Dudley noted that the Fed is closely monitoring inflation expectations, and referred to by the University of Michigan 5 to 10 year measure and the New York Fed’s survey of 3 year expectations. He favored the second

He said that the NY Fed median of 3yr expectations, “has declined over the past year, falling by 22 basis points to 2.8 percent. While the magnitude of this decline is small, I think it is noteworthy because the current reading is below where we have been during the survey history. Up until July 2014, the median largely stayed in the range from 3.2 to 3.4 percent, and from July 2014 to July 2015 it remained near 3 percent.”

He said that, “should the economy unexpectedly weaken, then this fall in inflation expectations would become more concerning.”

On the other hand, Dudley raised a new reason why the Fed needs to worry if unemployment were to fall to low. He said, “A particular risk of late and fast [rate rises] is that the unemployment rate could significantly undershoot the level consistent with price stability. If this occurred, then inflation would likely rise above our objective. At that point, history shows it is very difficult to push the unemployment rate back up just a little bit in order to contain inflation pressures. Looking at the post-war period, whenever the unemployment rate has increased by more than 0.3 to 0.4 percentage points, the economy has always ended up in a full-blown recession with the unemployment rate rising by at least 1.9 percentage points.”

In the News

Iran sanctions lifted – FT.com

The sanctions relief, which will allow crucial sectors such as oil and finance to re-enter the global economy, is the reward for Iran after it substantially reduced the scope of its nuclear programme, including shipping abroad 98 per cent of its stockpile of enriched uranium and shutting down a heavy water reactor.

UK benefit reform demands appeal to rest of EU – FT.com

Mr Cameron is on course to secure a package of concessions on migration at a February 18 summit, including benefit restrictions and possibly an “emergency brake” to limit numbers during surges. This will allow him to call the EU membership referendum for June or July.

Austria, Denmark, France, Germany and the Netherlands see the British reforms as potentially offering new policy opportunities, in the face of pressure from populist and Eurosceptic opposition parties. “We will find it impossible to resist,” said one senior official from one of the countries, who is involved in the UK negotiations.

Cabinet minister to lead Brexit group, says Lord Lawson – FT.com

It has been speculated that two-thirds of the Conservative party’s 332 MPs could campaign to leave the bloc.

A poll by Survation for the Mail on Sunday gave the Eurosceptics a six-point lead by 53 per cent to 47 per cent. But ministers believe millions of undecided voters will ultimately swing towards an “In” vote.

Walmart to close 269 stores as it revamps online presence – FT.com

These stores represent 2.3 per cent of Walmart’s outlets, or less than 1 per cent of its total square footage. Most of that reduction is expected to be felt in the company’s fiscal fourth quarter, ending this month.

Under the plan, the retailer will close 154 stores in the US, including its 102 Walmart Express shops in more urban areas. The number is unusual: the group has only shut about 30 outlets in the past five years.

Globally, 16,000 of the Walmart’s 2.2m staff will be affected. The company said on Friday it would try to relocate staff to nearby stores, or give 60 days pay and severance packages, depending on contracts. It also plans to open more than 300 new stores in the fiscal year that starts in February.

Trudeau’s government set to speed up, double down on infrastructure – CBC.ca

The Trudeau government is “actively considering” speeding up promised investments in infrastructure in a bid to stimulate Canada’s rapidly deteriorating economy.

Asked repeatedly Wednesday if the government is considering spending more than the promised $5 billion extra on infrastructure in the coming year, Finance Minister Bill Morneau did not rule out the idea but said details will have to await his maiden budget, expected in mid to late March.

Economic News

USA

Retail sales fell 0.1%m/m in Dec, as expected, after rising 0.4%m/m in Nov, revised up from 0.2%.

However, excluding autos and gas they were flat in Dec, below 0.4% expected

NY (Empire) State manufacturing survey -19.4, weaker than -4.0 expected, after -6.2 in Dec, revised weaker from -4.6. The weakest outcome since 2009.

Industrial production -0.4%m/m in Dec, weaker that -0.2%m/m expected, after -0.9%m/m in Nov, revised weaker from -0.6%.

Manufacturing production -0.1%m/m in Dec, weaker than flat expected, after -0.1%m/m in Nov, revised weaker from flat.

University of Michigan Consumer Sentiment index 93.2 in Jan preliminary, stronger than 92.9 expected, up from 92.6 in Dec. Firming since a low for 2015 in Sep.

5-10 yr surveyed inflation expectations 2.67%, up from 2.6% in Dec, and a record low of 2.5% in Oct last year.

Eurozone

EU27 Car regos rose 16.6%y/y in Dec, the fastest rate since 2009, up from 13.7%y/y in Nov.

Eurozone trade balance 22.7bn in Nov, above 21.0b expected, up from 19.8bn in Oct, stable at around record highs. Exports rose 1.6%m/m in Dec, imports were steady.

On the Radar

USA

- NAHB Housing market index

- 20 Jan – CPI

- 20 Jan – Housing starts, permits

- 21 Jan – Philly Fed business survey

- 22 Feb Chicago Fed National Activity Index

- 22 Feb – Markit PMI manufacturing flash

- 22 Feb – Existing Homes sales, Leading index

- 25 Feb – Dallas Fed manufacturing index

- 26 Feb – House prices, Markit PMI Services flash, CB Consumer confidence, Richmond Fed manufacturing index

- 27 Jan – FOMC meeting

- 27 Jan New Home sales

- 28 Feb – Durable goods orders, pending homes sales, Kansas City Fed manufacturing

- 29 Feb – ECI

- 29 Jan- GDP Q4 advanced estimate

- 1 Feb – PCE deflator

Australia

- 20 Jan – Consumer confidence

- 21 Jan – New home sales

- 27 Jan – Q4 CPI inflation

- 27 Jan – skilled vacancies, NAB Business confidence

- 29 Jan – Credit growth

- 1 Feb – PMI manufacturing. House prices

- 2 Feb – RBA rates decision

- 3 Feb – Trade balance, PMI services, Building approvals

- 5 Feb – PMI construction, retail sales

- 5 Feb – RBA quarterly Statement on Monetary Policy.

New Zealand

- 18 Jan – REINZ house sales

- 20 Jan – CPI

- 21 Jan – Job ads, PMI manufacturing, consumer confidence

- 26 Jan – PMI services

- 27 Jan – PM Key speech

- 28 Jan – RBNZ rates decision

- 28 Jan – Trade balance

- 29 Jan – Building permits, credit growth

- 1 Feb – Net Migration, Treasury monthly economic indicators

- 3 Feb- RBNZ Governor Wheeler speech.

Eurozone

- 19 Jan – current account balance, construction output

- 19 Jan – CPI final

- 19 Jan – ZEW survey

- 21 Jan – ECB meeting

- 21 Feb – Consumer confidence

- 22 Jan PMI manufacturing and services flash

- 25 Jan – German IFO

- 27 Jan – German retail sales

- 28 Jan – EC economic surveys

- 28 Jan – German CPI

- 29 Jan – CPI advance estimate.

- 2 Feb – unemployment

- 3 Feb Retail sales

- 5 Feb – German factory orders

UK

- 19 Jan – CPI

- 19 Feb – BoE Governor Carney speech

- 20 Jan – employment/unemployment

- 21 Jan – RICS house price balance

- 22 Jan – Retail sales

- 25 Jan – CBI Industrial Trends Survey

- 27 Jan – BBA loans for house purchase

- 28 Jan – GDP Q4

- 2 Feb – Mortgage approvals, credit growth, BRC Shop price index

- 2 Feb – PMI manufacturing

- 3 Feb – PMI construction

- 4 Feb – PMI Services

- 5 Feb – car regos

- 5 Feb – BoE policy

Canada

- 19 Jan – Cross-border securities flows

- 20 Jan – BoC rate decision

- 20 Jan – Manufacturing sales, wholesale sales

- 22 Jan – CPI

- 22 Jan – Retail sales

- 28 Jan – CFIB Business barometer

- 29 Jan – Monthly GDP

- 1 Feb – PMI manufacturing

- 5 Feb – trade balance

- 5 Feb – employment/ unemployment

Japan

- 22 Jan – PMI manufacturing

- 25 Jan – Trade balance

- 27 Jan – Small business confidence

- 28 Jan – Retail sales

- 29 Jan – unemployment, CPI, IP, Household spending

- 29 Jan – Vehicle production, Housing starts, Construction orders

- 29 Jan – BoJ policy

- 1 Feb – Vehicle sales

- 3 Feb – PMI services, consumer confidence

- 8 Feb – Current account balance, Labor cash earnings

China

- 19 Jan – IP, Retail sales, Fixed asset inv., GDP Q4

- 27 Jan – Industrial profits

- 1 Feb – Govt PMI manufacturing and non-manufacturing

- 1 Feb – Caixin PMI manufacturing

- 3 Feb – Caixin PMI services