AUD in no man’s land, political and economic risks remain elevated

Domestic Australian factors are being overshadowed by global developments. These global drivers account for both its rapid rebound over the last month and its significant correction in recent days. Throughout this move we have been skeptical that the AUD can sustain its rally with significant local political and economic uncertainty. These risks remain and continue to make it difficult to hold long AUD positions. On the other hand, political and economic uncertainty in many alternative currencies are equally troubling. In Australia, economic momentum picked up in 2015, but has been more mixed in 2016. The housing market is starting to ebb from strong levels, political risks remain elevated, bank equity performance has been weak, potentially a drag on confidence. However, Global drivers remain in control, and while uncertainty is elevated in Australia, it is not clear that it will be sufficient to throw the Australian economy off course. The RBA Statement continued to express a steady policy outlook albeit with an easing bias.

Domestic factors overshadowed by Global developments

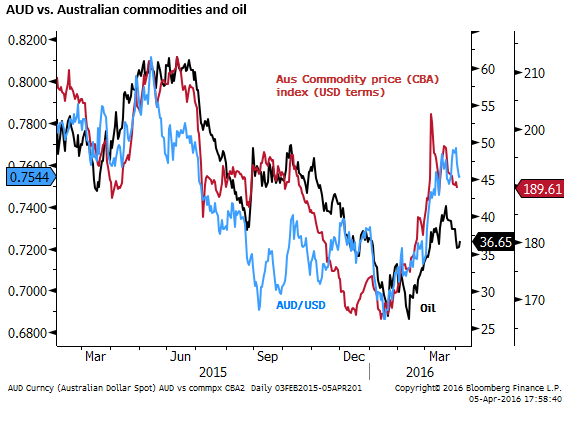

The AUD has been relatively volatile of late with most of the drivers coming from offshore. The rebound in iron ore along with other commodity prices helped the AUD rebound, as did the rebound in emerging market equities and currencies and a broadly weaker USD. It reached a recent high above 0.77, rising above a series of lows from the first half of 2015 between .75/.76, enticing several bank analysts to revise up their near term targets to 0.80.

However, it the last few sessions it has dropped back to the low .75s, this time with a fall-back in oil prices, spilling over to weaker iron ore prices, and a pull-back in EM currencies. It is now testing the same key technical levels from early 2015.

Domestic and Global uncertainty

Amidst the volatility, there does not appear to be much consideration for events in Australia. The economic and political environment in Australia has become more uncertain and under other circumstances might have undermined the AUD.

However, political and economic uncertainty are hardly unique to Australia with a number of countries facing more intense or at least similar pressures; a lament of the IMF Managing Director (Lagarde Sees Political Dangers Galore With Global Economy Tepid – Bloomberg.com). (US Elections, Brexit referendum, Greek finances, terrorism, refugees, South Africa and Brazilian political troubles.)

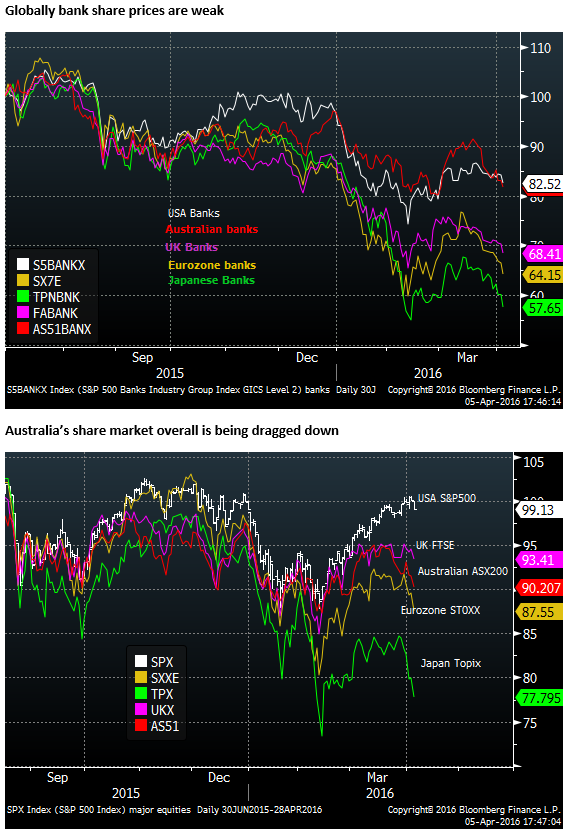

And then there is the uncertainty generated by the negative rate policies in Japan and Europe that have not had the anticipated effect of weakening their currencies, while contributing to much weaker bank share prices in these countries.

The volatility in global markets since the beginning of the year related to oil markets and China also continues to create uncertainty.

While risk aversion remains elevated, low yields abroad may yet still support the AUD.

It remains difficult to trade the AUD with conviction at this time. Global drivers remain in control, and while uncertainty is elevated in Australia, it is not clear that it will be sufficient to throw the Australian economy off course.

The RBA thinks the recent rebound in the AUD complicates the economic adjustment

The RBA statement yesterday said of the exchange rate, “The Australian dollar has appreciated somewhat recently. In part, this reflects some increase in commodity prices, but monetary developments elsewhere in the world have also played a role. Under present circumstances, an appreciating exchange rate could complicate the adjustment under way in the economy.”

This was an adjustment from its previous remarks, “The exchange rate has been adjusting to the evolving economic outlook.” The RBA had more-or-less maintained this sanguine assessment since August last year, comfortable that the AUD had fallen significantly to help the economy transition through its mining sector down-turn. However, with the AUD back to levels prevailing in the first half of 2015, it was no longer so comfortable with the AUD.

Nevertheless, the RBA was cautious not to talk the currency down too aggressively. They were aware that its strength was driven by global factors. It was not clearly out of line with the recent rebound in commodities and could be explained by easier monetary policy abroad. The RBA was also recently criticized by the US Treasury for its jawboning of the exchange rate, and it may have felt pressured by the spirit of détente in currency wars that evolved from the Shanghai G20 meeting.

The RBA, nevertheless, delivered a message that the currency is no longer helping, saying its recovery “could complicate the adjustment in the economy”.

Political uncertainty

There are a number of vulnerabilities that need to be kept in mind. The first is a Federal election. The date remains uncertain but 2 July is shaping up as a high probability. In effect the major parties are in election-mode. The government, led by PM Malcolm Turnbull, has made several fumbles in recent months and has seen its lead in the polls dissipate, turning what should have been a sure victory into tight race.

The opposition Labor party has proposed a significant cut in tax incentives for investment in the housing market, narrowing tax breaks to investment in newly built properties. Their policy appeals to a large segment of a polarized electorate on this issue, concerned over housing affordability and fairness. On the other hand, there is a scare campaign lead by the government that Labor’s tax policy could significantly weaken house prices and damage the Australian economy.

The Labor policy, whether it is a good idea or not, has put pressure on the government to come up with its own tax reform agenda. The government has floated a few tax policy balloons only to see them shot down, contributing to the impression of lacking a clear policy agenda.

Flailing confidence in the government and an impending election in a tightening race is generating uncertainty that may drag on investor and consumer confidence.

Housing market uncertainty

The fact that Labor’s tax policy is a key contributor to the political uncertainty may drag on the housing market itself. House prices have shown some stabilization this year after dipping in Q4, but price growth appears mature. Bank lending for housing and building approvals are now slowing from peaks last year. At the very least, this significant driver of the Australian economy in 2014 and 2015 appears likely to become a modest drag this year. How big a drag may depend on which side of politics gets up.

Bank share price uncertainty

Australian Banks have been coming clean on weaker corporate loans related to the resources sector and exposure in Asia. There has been some spill-over to consumer lending in states most exposed to the resources sector.

Banks in Australia have been experiencing some of the same pressures inflicting those abroad; including being forced to raise more capital since mid-2015, and raise lending standards in the housing market. They have also come under more regulatory pressure to clean up their trading behavior; in an echo of the fixing scandals that afflicted large banks abroad, the Australian Securities and Investment Commission (ASIC) is pursing legal action against at least two of the four major banks.

Australian banks, like those abroad are also facing threats to their effective oligopoly from potential new fin-tech start-ups.

While Australian banks are still considered to be relatively safe investments and well capitalized, their share prices have been trending down and they account for a bigger share of the domestic equity market than other developed economies. The big four banks account for around 25% of the capitalization of the Australian share market.

Bank share prices are also tied to the state of the housing market. With household mortgage debt to income ratio over 180%, Australian banks mortgage loans 60% of all loan assets, Deposits less than 60% of total bank funding requirements, and banks accounting for 25% of the domestic share market, the stability of Australia’s financial markets and economy are closely intertwined with the performance of housing and banks.

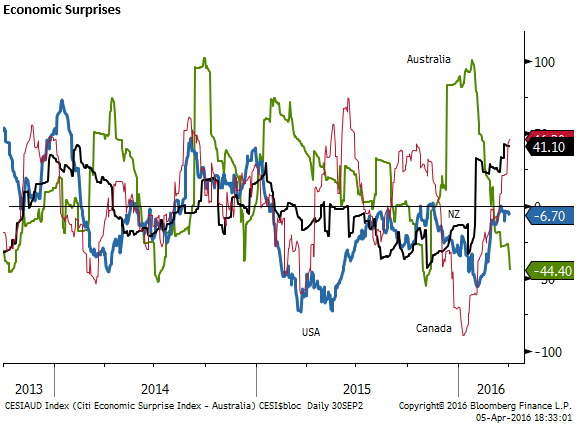

The Australian economic performance mixed so far this year

The chart below shows the Citibank Economic Surprise indices for the dollar bloc economies. At the beginning of the year, Australia was registering an almost perfect score for beating market expectations, helping diminish the chances that the RBA would need to cut rates again. However, this trend has turned around and negative surprises have dominated in recent months.

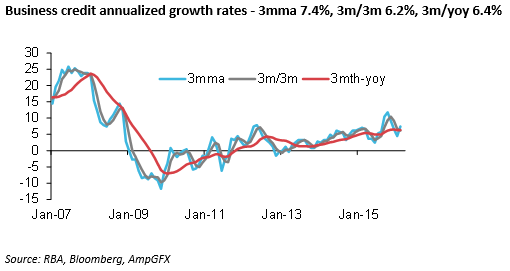

Business Credit Growth is encouraging

Business credit growth has been robust, running around 6 to 7% annually. It turned positive around Q2-2013, trending gradually higher. The RBA sees this as a sign of recovery; it said in its statement on 5 April, “Consistent with developments in the labour market, overall GDP growth picked up over 2015, despite the contraction in mining investment. The pace of lending to businesses has also picked up.” (Emphasis mine), repeating this message on business lending over the three meetings this year.

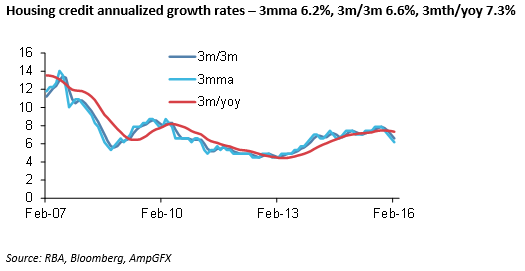

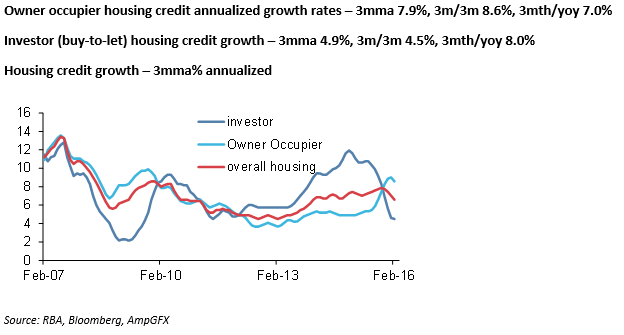

Housing Credit growth may now be ebbing

However, credit growth for housing has ebbed recently. Perhaps a good thing from a financial stability point of view given the high leverage of Australian households, but a sign of moderation in the housing market.

In April, the RBA said, “Credit growth to households continues at a moderate pace, albeit with a changed composition between investors and owner-occupiers.” (Repeating this message in all three meetings this year).

Monthly housing finance approvals also suggest finance for housing, particularly for investors is declining from a peak in April last year. Owner occupier finance approvals were still rising until December, and have only dipped for one month so far in data available up to January.

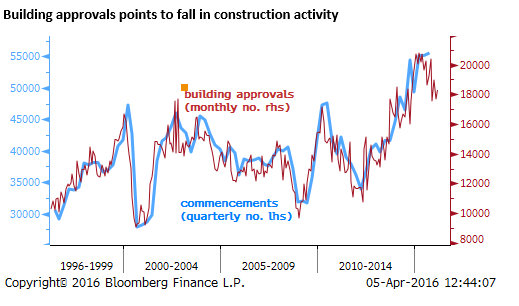

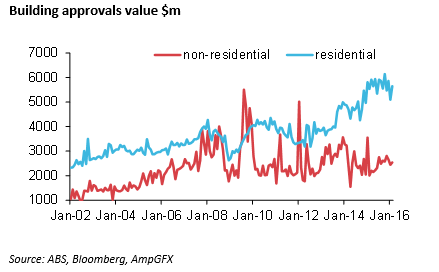

Residential building peaking

Building approvals have lost momentum from a relatively high level since around Q2-2015. As such we should see commencements now begin to peak, and residential building activity should start to become a modest drag on activity after being a significant contributor over recent years

The chart below shows non-residential and residential approvals by value. Non-residential approvals are very volatile, but there is little discernible trend. They have remained relatively stable at a modest level since the 2008 global financial crisis.

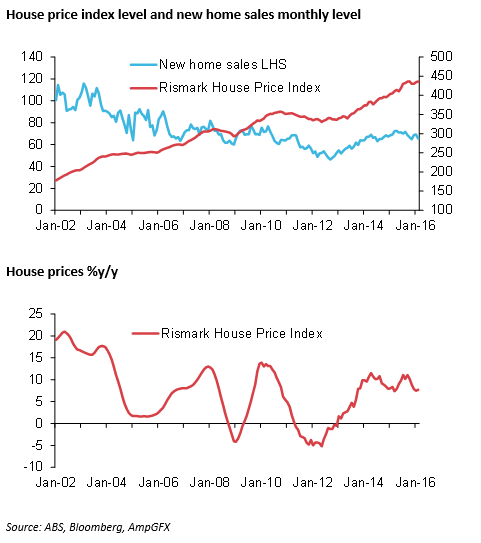

House price growth mature

House price data fell somewhat in Q4 last year, but have risen solidly in Q1 this year, so have been more mixed lately. The pace of growth from a year earlier has eased to 6.4%y/y in March from a recent peak of 11.1% in September last year.

In Its April policy statement the RBA said, “Low interest rates are supporting demand, while supervisory measures are working to emphasize prudent lending standards and so to contain risks in the housing market. …… “The pace of growth in dwelling prices has moderated in Melbourne and Sydney and has remained mostly subdued in other cities.”

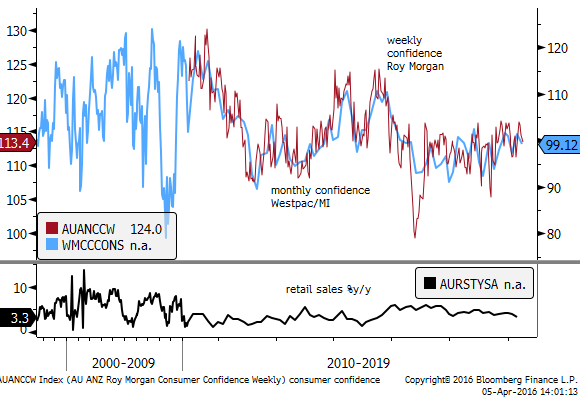

Retail sales have lost momentum

Retail sales have lost momentum in recent months (0.0% in Dec, +0.3% in Jan, 0.0% in Mar). It may simply be a lull from the moderate pace recorded in 2015. From a year earlier, sales rose 3.3%y/y in Feb, down from 4.1%y/y in December and a recent peak of 4.9%y/y in June-2015.

Consumer confidence has remained relatively stable, somewhat firmer since around October last year compared to the preceding year, but it remains relatively modest.

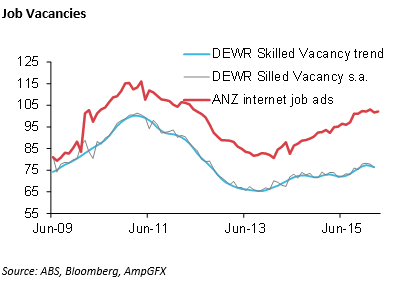

Job Vacancies growth stalled

Job vacancy data had been growing solidly last year; internet ads rose to a peak annual growth of 11.3%y/y in January, but they are a little lower in the last two months. A government measure of skilled vacancies have also ebbed in Jan and Feb from a peak in December.

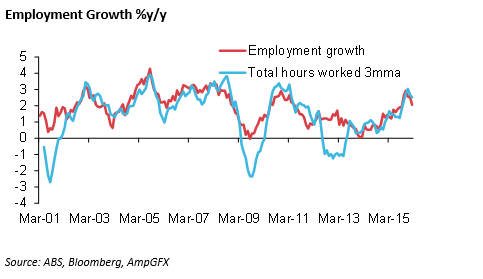

Job growth rose to a peak annual growth rate of 2.9%y/y in November last year has eased recently to a still strong 2.0%y/y. Total hours worked concurs up 2.5% 3mth/yoy in Feb, down from a recent peak of 3.0% in December.

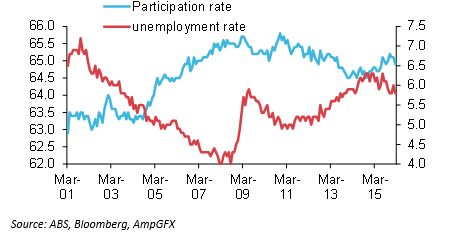

Unemployment was 5.8% in Feb, returning to the recent lows in Nov/Dec last year, more frequently now below 6.0% after chopping around 5.9% to 6.3% from May-2014 to Oct-2015. Participation has also increased recently, although it dipped in February.

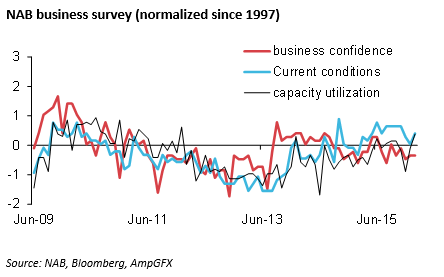

Business Surveys moderate

The NAB business survey has remained stable at moderate levels. Conditions have been a little above long run average levels since 2015, while confidence has been modestly below. Capacity utilization appears to be around average.

The PMI Manufacturing index rose strongly to a high since 2004, and the three month average rose to a high since June 2010. This indicator was generally below 50 during the mining boom and thus is not necessarily an indicator of broad strength in the economy. The manufacturing sector has diminished over many years to be a small part of the overall economy (The auto industry has virtually closed shop). This indicator may be a sign that the last few companies standing, naturally the most resilient, are now bouncing back strongly with the aid of a weaker Australian dollar.

The PMI indicators are volatile and it is hard to discern a trend; the services PMI reached a recent high since 2008 in August last year, but has retreated recently to around a flat growth level near 50. The construction PMI has dropped below 50 since December, dragged down by the mining sector, but underpinned by residential construction.

Mixed outlook keeps RBA policy steady

Overall there is little clear evidence that activity is weakening, although the improving trend over the last year may have stalled. The data is not demanding that the RBA do anything, although it admits that inflation is likely to remain subdued.

The RBA said in its April statement that, “Inflation is quite low. Recent information has confirmed that growth in labour costs remains quite subdued. Given this, and with inflation also restrained elsewhere in the world, inflation in Australia is likely to remain low over the next year or two.”

The assessment of the RBA at each of its three meetings this year has been that there are “reasonable prospects for continued growth in the economy, with inflation close to target. The Board therefore decided that the current setting of monetary policy remained appropriate.”

However, it retains a bias to ease further, it repeated that, “Over the period ahead, new information should allow the Board to assess the outlook for inflation and whether the improvement in labour market conditions evident last year is continuing. Continued low inflation would provide scope for easier policy, should that be appropriate to lend support to demand.”

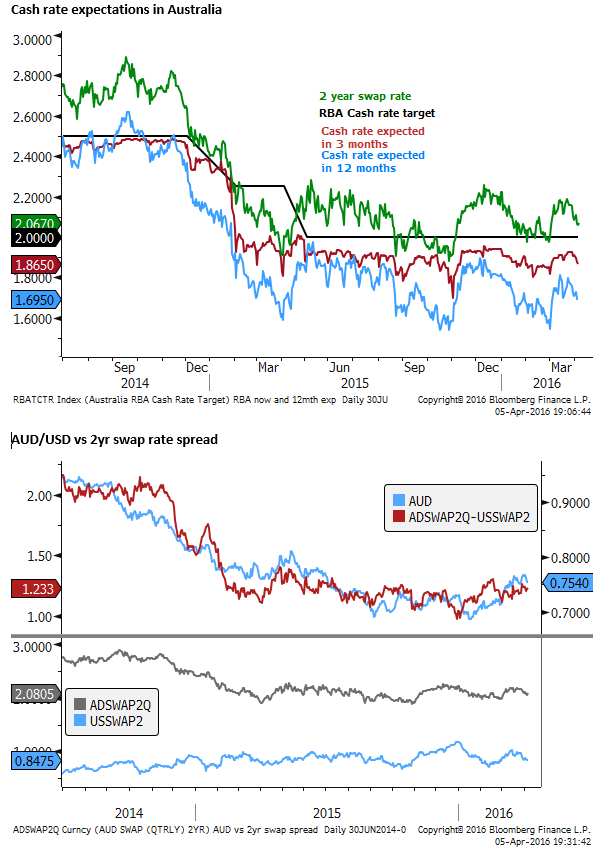

Given this policy guidance and the mixed but relatively stable economic performance, the outlook for Australian rates has been relatively stable compared to the USA and other developed economies.

The market has constantly priced in risk of rate cuts in Australia over the last year, although none have been delivered since May last year. The strength in the AUD in the last month has edged up the odds of a cut somewhat. The falling trend in global yields has also contributed to easing expectations. Over 12 months, around 30bp of cuts are priced in from the current rate setting of 2.00%.