BoJ policy reboot or tweak?

The BoJ policy adjustments, while relatively subtle at this time, have afforded it more flexibility and sustainability that should help boost confidence and address key concerns that it had run out of scope to adjust policy and may be forced to reduce policy accommodation. It helps restore confidence that the BoJ can sustain and enhance policy easing to achieve its inflation goal. It further provides guidance that it will persist with policy accommodation until it overshoots its target. It has set in place a slightly positive yield curve that helps underpin financial sector profitability. The combination of these factors might be expected to lift economic confidence and inflation expectations in Japan, in turn stabilizing the JPY and potentially in time reversing some of the strength in the JPY this year. The lack of bounce so far in USD/JPY may reflect the proximity of financial half year end in Japan, generating near term demand for the currency. It also reflects disappointment that the BoJ didn’t immediately cut its cash rate target, and set only a very gradual slope for the yield curve of around 1bp per year. It also retained its quantity targets for JGB purchases and money base, dampening the sense that it believes in yield control, and perpetuating a sense of inertia in policy. The FOMC contributed to a weaker USD by lowering its long run GDP potential growth rate and long term neutral interest rate forecasts, maintaining a weak outlook for growth over the next three years and a slow return to 2% inflation. Even though it appears eager to hike once this year, the long delays in delivering hikes and lower path of hike projections continued.

Japan bank share prices rise, yield curve stable

It is hard to be sure yet how the market has interpreted the BoJ Monetary Policy Meeting (MPM) on Wednesday with the Japanese markets closed on Thursday. Furthermore, there may be an element of book squaring and corporate hedging activities in the run up to the end of Japan’s financial half year on 30 September that may have lessened the capacity of the market to fully respond to the more medium term aspects of the policy.

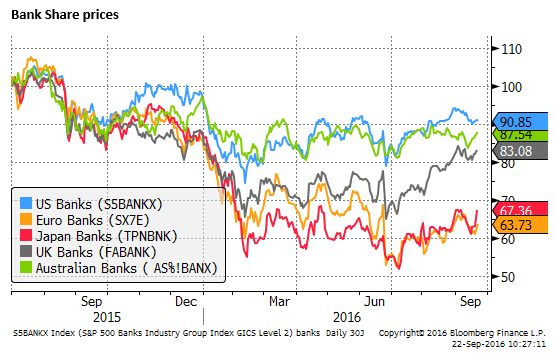

In what limited trading there has been, Japanese bank shares rallied sharply, out-pacing gains in other major markets, helping them recover some of their significant under-performance this year

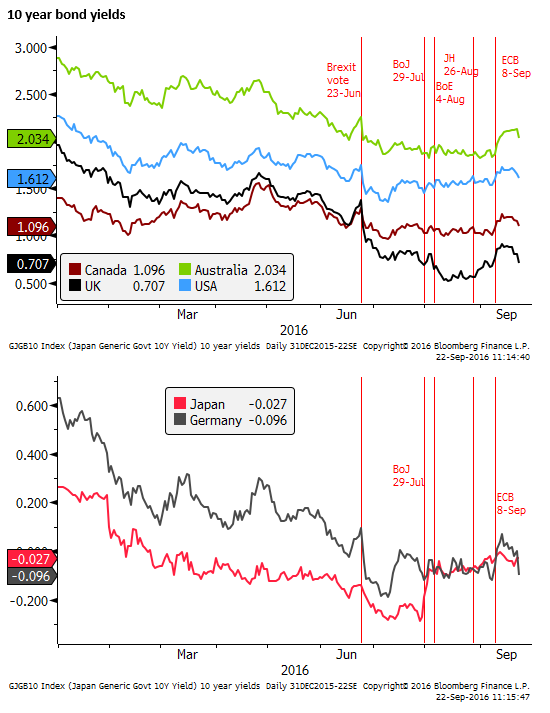

Japanese bond yields were little changed. 10 year yields closed at -0.03%, up 3bp from -0.06% on Tuesday, but little changed from a week earlier, and close to its recent average. This was consistent with the new BoJ 10-year target yield of “more or less at the current level (around zero percent)”.

Longer-term yields were also steady and short-term yields rose a bit, so overall, the curve was a touch flatter than before the MPM. The Japanese yield curve steepened in the lead-up to this announcement, but peaked a week before the meeting, and has flattened recently.

Fed projects a weak USA recovery

Global bond yields have also fallen, in part following the FOMC meeting where the Fed again downgraded its long-term neutral interest rate forecast from 3.0% to 2.9%, reflecting a lower long-run potential GDP growth rate forecast (reduced from a median of 2.0% to 1.8%).

It also continued to forecast a modest growth path of 2.0% in the next two years, slowing to 1.8% in 2019, and inflation only reaching its target of 2% sometime in 2018.

Corresponding with this modest growth and subdued inflation outlook, it lowered its outlook for rate hikes next year from a median of three to two, after also failing to deliver a hike and therefore lowering its median forecast for hikes this year from two to one. As such, it essentially removed two hikes from the forecast horizon, indicating a slower path back to neutrality (2.9%) that is projected to take more than three years.

This modest pace of hikes is still above the market pricing in the curve, but it tends to confirm the trend towards delaying hikes and lowering the forward projections, supporting the tone in the market towards lower bond yields.

The Fed statement and press conference suggests that the Fed is quite keen to deliver one hike before year-end, suggesting that only a relatively stable trend in payrolls growth and a steady set of broader labor market indicators might be sufficient to support a hike; most likely after the 8 November election. But a hike in these circumstances will appear to have been delivered reluctantly because the Fed has paused for a full year, and may be followed by another prolonged wait for a third hike in the cycle, unless the economy were to surprise to the upside.

BoJ disappoint on degree of yield curve steepening

We had thought that the BoJ MPM this week would do more to steepen the Japanese yield curve and spread to higher bond yields globally. However, the BoJ announcement of a new policy “QQE with Yield Curve Control” at best only reinforced the steepening in the curve that occurred following the 26-August Jackson Hole Symposium and in the week after the 8-September ECB meeting. During this period, speeches and media outlets appeared to raise the odds of a kind of operation twist where the BoJ might encourage a steeper curve, albeit in the context of at least maintaining the overall level of policy accommodation.

BoJ reboot or tweak?

The new BoJ policy approach appears to be a significant shift in policy to try something new that might be more effective (targeting yields along the curve), but appears half-hearted by continuing to stick with most of its previous approach (targeting quantity of asset purchases and money-base expansion). Its target yield levels (short-term cash rate unchanged at -0.10% and 10-year yield “more or less at the current level (around zero percent)”) generate a still very flat yield curve (rising 1bp per year).

By still forecasting an unchanged pace of asset purchase and money base expansion around 80tn JPY per year (even though providing themselves flexibility on this amount and removing its 7 to 12 year duration target), the BoJ is still likely to place some broad flattening pressure on the yield curve. As such, it is not surprising that 10-year yields in Japan closed below zero %, and longer term yields also were little changed. The 10-year yield target itself appears biased to below zero, since it is “more or less at the current level”; in the lead up to the BoJ MPM, the 10-year yield was always below zero, stable at around -0.03% in recent weeks.

The BoJ is targeting both the yield curve and quantity of purchases. It would be better to do one or the other not both. We think that moving to yield targeting is a positive development that could significantly reboot BoJ policy. But the yields chosen are too low for long-term bonds and too high for short-term rates, and the targeted curve too flat, in our view.

The BoJ has also confused the message by retaining a quantitative target, creating doubt that it has confidence in either approach (yield control or money base control). It is evident that the BoJ itself is divided on the best way forward and Governor Kuroda and the board has compromised on a middle path. The market was already skeptical that the BoJ had run out of ideas and scope to ease policy; its policy decision this week has not been decisive enough to shake the skeptical mood dominating sentiment.

The response in the JPY after the policy event reflects this sentiment. It sold off initially as the market saw promise in the shift to yield control, but swung back to the previous strong JPY trend when the changes lacked punch.

The BoJ MTM attempted to add punch by introducing a new “inflation-overshooting commitment”. This commitment is intended to boost long-term inflation expectations. The promise is to continue expanding the money base until CPI excluding fresh food rises year-on-year above the “price stability target of 2% and stays above the target in a stable manner.”

The new approach of the BoJ is designed to make it more sustainable and provide a sense of guidance that it will be in place until inflation overshoots its target. By shifting to yield control, the policy may be more sustainable by allowing the BoJ to buy less bonds and use other methods to control yields, including long term loans, if it runs into constraints over the supply of bonds.

Many in the market had become worried that the BoJ was causing dysfunction in the bond market and pushing yields so low out the curve that it was crunching profitability in the financial sector. The BoJ is continuing with its quantity targets, and thus it has not totally alleviated concern that this policy will run into limits on the supply of outstanding bonds. And its 10-year yield target is still very low (essentially sub-zero), suggesting there is little scope for yields to rise above zero for long-term bonds. As such, the profitability in the financial sector will remain relatively constrained.

However, the BoJ is at least supporting a very modest positive slope in the curve. To the extent that financial institutions can borrow or short-sell short-term securities at negative rates, and invest-long term, the shape of the curve provides some scope to earn a positive margin. Banks’ profits will still be constrained by their large base of deposit liabilities (paying zero rates of interest). The BoJ’s tiered approach to rates policy, setting negative rates on only the marginal tier of bank’s current account balances at the BoJ, does still help significantly lessen the cost to banks from its deposit liabilities.

The positive response in bank share prices (albeit less than a day’s worth of trade to judge by) suggests that the BoJ’s positive curve shape target has helped in improving the outlook for bank profitability.

Policy flexibility, but reluctance to use it

The persistence with the quantitative JGB asset purchase target and lack of action on the interest rate settings suggests a degree of inertia in BoJ policy, fueling doubts that it is willing to significantly enhance policy easing. However, the BoJ did say that, “The Bank will cut the interest rates further if judged necessary” (referring to both the cash rate target and the new 10 year yield target).

Now that the BoJ has added yield control, it does appear that it has greater flexibility to cut the short-term rate and adjust its asset purchases to pursue curve steepening with control over long-term yield levels. But there are lingering doubts over whether the BoJ board will use this flexibility. It still appears tied to quantity control and reluctant to lower interest rates, limiting the perception that it is will respond decisively by easing policy further if required.

The strength in the JPY appears to reflect these doubts over BoJ willingness to go further and utilize the greater flexibility in its new policy regime.

The BoJ also appears to have given itself more time to achieve its higher inflation target and be less reactive to recent evidence that inflation pressure has stalled and weakened. It has recently spent much time discussing the progress on raising inflation since 2012/13, concluding that in a broad sense its policy easing program has worked. This contrasts with the more reactive and urgent policy action up to 2014.

The BoJ is likely to sit on its latest policy measures and assess the market and economic response over a number of months. This may tend to perpetuate the rising trend in JPY this year.

However, part of the reason for the gains in JPY this year relate to excessive curve flattening in Japan, undermining financial sector profits, and a sense that the BoJ had run out of scope and flexibility to further ease policy. There was also concern that the BoJ might give up on its inflation target. The combination of these factors was undermining economic confidence in Japan, lowering inflation expectations, weakening domestic demand, and tending to widen the current account surplus and increase real interest rates. The rapid and persistent appreciation in the JPY itself worsened each of these factors, generating a vicious cycle of JPY gains.

The BoJ policy shifts, while relatively subtle at this time, have increased the flexibility and sustainability of its policy. It has improved the profitability of the financial sector, and it has appeared to reinforce the inflation objective. Even though the horizon for achieving 2% inflation is now not specified, the BoJ has committed to overshoot. This may tend to boost confidence and lower real yields in Japan and help stabilize the JPY. If the JPY were to return to a weaker trend, it would also turn a vicious cycle to a virtuous one that tends to raise confidence and inflation expectations, enhancing the effectiveness of the BoJ’s yield curve control policy.

As such, while having been frustrated several times this year by the lack of BoJ policy action and persistent gains in JPY, our sense is that the JPY is now in a position to turn around its rising trend.

The weaker pace of recovery in the USA, stalled tightening in its labor market, and downgraded view at the Fed of the long term growth and neutral policy rate have also undermined the USD and contributed to the strength if the JPY this year.

The fall in USD/JPY since the central bank policy meetings this week has tended to reinforce the down-trend in USD/JPY. However it has so far stalled for a third time since mid-year at near 100. As such the USD/JPY continues to trade in a narrowing wedge. At this stage we are somewhat more optimistic that USD/JPY is coming close to the end of its falling trend this year.