Which Wheeler will show up this week at the RBNZ

RBNZ Governor Wheeler sent mixed messages in his 28 January policy statement and 3 Feb speech on the Policy Targets Agreement. The statement concluded with an easing bias, although Wheeler claimed that core inflation and inflation expectations were consistent with his PTA, implying he was in no rush to cut further. Few in the market anticipate a cut at the policy meeting this week, but the developments since 28 Jan suggest that the inflation impulse is weaker than expected, inflation expectations are still falling and are now below the 2% medium term target, the outlook for dairy prices and the global economy have weakened further, and domestic activity indicators have also been more mixed. It may seem abrupt for Wheeler to simply cut at this meeting. But it is a quarterly forecasting round, and if the mood at the RBNZ has shifted, it is time to strike while the iron is hot. Cutting now or at least stating that a cut is likely to occur in coming meetings might be useful in keeping a lid on the exchange rate.

Mixed messages in the previous policy statement

The market is pricing in a 28% chance of a 25bp cut this week on 10 March, but it is pricing in almost two further cuts over the course of the year.

In a confusing policy statement on 28 January, the RBNZ sent mixed messages on its policy outlook. To be fair, late-January was in the middle of a particularly volatile and uncertain time, and most central banks were ambivalent.

It said, “Headline CPI inflation remains low, mainly due to falling fuel prices. However, annual core inflation, which excludes temporary price movements, is consistent with the target range at 1.6 percent. Inflation expectations remain stable.”

It further said, “Headline inflation is expected to increase over 2016, but take longer to reach the target range than previously expected.”

Together these statements appear to suggest that RBNZ could sit tight on policy for a while, especially if it is more worried about house price inflation.

However, the RBNZ still concluded in this statement that, “Some further policy easing may be required over the coming year to ensure that future average inflation settles near the middle of the target range.”

This dovish bias on rates suggested the outlook for inflation was too low for comfort. But the statement also made a virtue of core inflation within the 1 to 3% target band (even if below the mid-point target), and stable inflation expectations, leaving the market mixed on whether to expect a cut in March or not.

It was only a soft easing bias, since it said “may be required” rather the more certain expression that the RBNZ has utilized on the past, typically just before changing rates, “likely to be required”.

Wheeler steered market away from expecting rate cuts

A week later on 3-Feb, RBNZ Governor Wheeler tipped the scales in favour of no action in March.

He said, “Our goal is to anchor inflation expectations close to the mid-point of the price stability target range, while retaining discretion to respond to inflation and output shocks in a flexible manner. In this regard, some recent inflation indicators are encouraging. Annual core CPI inflation, at 1.6 percent is well within the target range, and the Bank’s combined measures of annual inflation expectations are averaging 2 percent.”

And further, “With the ongoing weakness in commodity prices, and particularly oil, it will take longer for headline inflation to reach the target range. On the other hand, the data on core inflation and inflation expectations are more encouraging in terms of consistency with the PTA.”

In this speech, core inflation wasn’t just “consistent” with the target range, it was “well within”, and he implied core inflation and expectations were “consistent with the PTA”

The RBNZ’s Policy Targets Agreement (PTA) with the government, apart from its primary CPI target, also charges the RBNZ specifically with monitoring asset prices.

The implication is that the RBNZ is willing to run below the 2% mid-point of its 1 to 3% CPI inflation target range for longer in order to dampen excessive gains in house prices that it fears may reverse at some point and wreak economic damage.

It is not clear how much and for how long the RBNZ might accept lower than target inflation. Wheeler said in his 3 Feb speech that the RBNZ views the PTA “flexibly, rather than taking a mechanistic approach.” He gave no time frame.

The 28 Jan policy statement backed up by the Wheeler 3 Feb PTA speech suggested that the RBNZ was prepared to wait and wear sub-target inflation for much longer. It could be argued that there was little willingness to act on the easing bias unless forced to be weaker than expected outcomes for growth and inflation.

Furthermore, the PTA speech suggested it may be futile cutting rates further anyway. Wheeler said that below target inflation was a global phenomenon, and the Phillips curve appears to be very flat.

He said, “There are major structural forces acting to reduce inflation that domestic monetary policy cannot influence. These forces, arising typically from trends in globalization, information technology and demography, have exerted substantial downward pressure on global inflation in recent years.”

The RBNZ has changed its tune

The RBNZ has changed its tune since it started cutting rates a year ago. In April 2015, prior to the most recent rate cutting cycle that began in May-2015, the RBNZ expressed concern over falling inflation expectations and the prolonged period of sub-target inflation outcomes; contributing to a lower inflation mindset. It subsequently cut four times (100bp in total) between May and December, fully reversing the 100bp of hikes in 2014, returning rates to a record low.

Since then, there has been no headway in raising inflation, and the most recent evidence is that the inflation impulse may have weakened again and underlying inflation has been below target since 2009. It is fair to say that consistency of message has not been the RBNZ’s strong point.

Inflation expectations are trending down

Both the Jan and Feb statements claimed that inflation expectations were stable at 2%. In itself this assessment is a stretch, because even though recent surveys of long term inflation expectations are now close to 2%, they have been trending down.

Many have argued that there is a bias in surveys to say inflation is higher than official data, and the trend is more important that the level. This is the position taken, for instance, by NY Fed President Dudley, in discussing the University of Michigan 5 to 10 year inflation expectations survey and the NY Fed’s own survey of three year ahead expectations. Both are still well above 2%, but they are at record lows, a concern for the Fed.

Wheeler chose to comment on the current level of expectations, not the falling trend. In contrast, a speech by RBNZ Assistant Governor Mc Dermott a year earlier, used to make the case for cutting rates, said that while surveys are “currently consistent with the mid-point of our target.” He also said, “But all highlight the downward direction over the past year.” (The dragon slain? Near-zero inflation in New Zealand, John McDermott – RBNZ.govt.nz)

An update on long term expectations is not available since the Wheeler speech, but surely his staff would be worried to see the survey of 2-yr ahead inflation expectations (released on 16 Feb) plunge to a new record low since the last meeting (from 1.85% to 1.63%).

Weaker inflation impulse

Furthermore, only hours before the Wheeler 3 Feb speech, wages data were reported weaker than expected, growth remaining intractably stagnant. Annual growth in the labour cost index slowed from 1.6%y/y to 1.5%y/y in Q4.

More recent price indicators point to weaker underlying inflation in Q1. The NZ Treasury Monthly Economic Indicators noted signs of easing price pressures in the construction industry (evidenced from the Q4 PPI data).

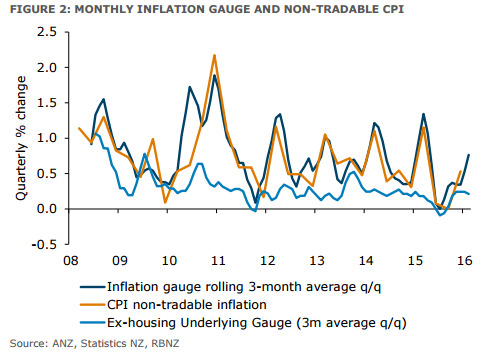

The ANZ bank in New Zealand’s monthly inflation gauge that tries to predict non-tradeable (domestically driven) inflation in New Zealand rose 0.3%m/m in Feb and only 0.1% excluding the housing component.

The data are non-seasonally adjusted and the ANZ economists estimated that assuming the result for March was at its average of the last few years, the rise in non-tradeable inflation in the quarter would be 1%, a tad below normal for Q1 (implying annual non-tradeable inflation would fall from 1.8%y/y in Q4 to 1.6%y/y in Q1), but excluding housing it would be up only 0.2% q/q in Q1.

It said, “The longer this goes on the more the evidence mounts that the economy has transitioned to a period of structurally low inflation.”

Which Wheeler will come out to play this week?

We cannot be sure which RBNZ will come out to play this week, will it be the one a year ago worried about falling inflation expectations and a protracted period of below target inflation, or will it be the Wheeler that sees inflation expectations anchored at 2% and core inflation consistent with his PTA.

As discussed above the needle should have moved towards seeing increased downside risk for inflation, testing the grounds on which Wheeler may see the outlook consistent with the primary goal in his PTA of 2% inflation over the medium term.

Dairy Industry weakness deepens

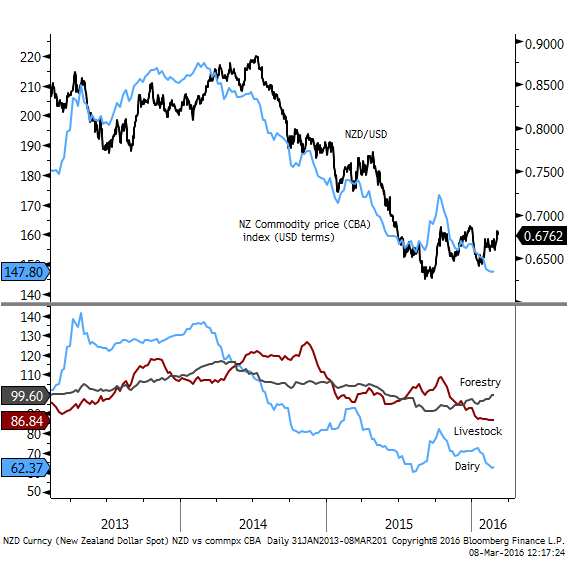

The recent strength in the NZD is another reason to get on with cutting, unlike AUD and CAD, commodity prices relevant to New Zealand have not increased

On Monday, the NZ Dairy cooperative, listed company Fonterra, cut its projected payout to New Zealand dairy farmers for the current season ending May (2015-16) to a nine-year low. The price projected per kgms was lowered to NZ$3.90 from $4.15, at the lower end of banks’ forecasts.

This would be down from $4.40 in the previous year, and far below $8.40 in 2013/14, $5.80 in 2012/13 and $6.05 in 2011/12.

A concern for the RBNZ is that this would mark the second year where a majority of farmers are operating at a loss, and the prospects remain bleak for a quick recovery next year. The more prolonged the period of losses the more dairy farmers that may default on loans.

At the time of the 28 January RBNZ policy statement, the NZD was at its low point for the year, after falling sharply on global risk aversion. The RBNZ still said, “Further depreciation in the exchange rate is appropriate given the ongoing weakness in export prices.”

If the RBNZ wanted a lower exchange rate in January, the case is only stronger now. This increases the case for the RBNZ to move forward with cutting rates this week, to help emphasize its wish to keep the currency lower.

Macroprudential policy aims to contain housing market risks

The main reason for the RBNZ to not cut rates this week is a strong housing market. This remains a difficult conundrum for New Zealand supported by rapid immigration and already record low interest rates.

This is why the RBNZ has already employed macroprudential measures to contain the housing market, allowing them to cut rates further than they might have otherwise, recently returning them to record lows last year.

In October 2013, the RBNZ first set a limit on the proportion of all banks’ mortgages with loan-to-valuation ratios (LVRs) of over 80% to less than 10% on new lending, nationally.

In November last year, it modified these rules to tighten conditions for lending specifically for investment property (buy-to-let) in the hot-property market of its largest city, Auckland. And eased its LVR restrictions in the rest of the nation.

Investor loans with LVRs over 70% must now be less than 5% of new lending in Auckland. Non-investor (owner occupier) loans with LVRs over 80% in Auckland remained at no more than 10% of new lending. Where as in the rest of the nation all loans with LVRs over 80% must not be more than 15% of new lending (raised from 10%).

The RBNZ has acknowledged that these new rules have appeared to cool activity in Auckland, a result that may allow it some additional room to lower rates. However, a good deal of this demand for housing in Auckland has simply shifted to its near surrounding areas (Waikato and Bay of Plenty) that have seen a significant increase in demand recently pushing up their house prices at a faster rate. As such, the RBNZ needs to be wary that while whacking the mole in Auckland its head has popped up in nearby cities and also its second largest city in Wellington, according to news reports.

Nationally house prices were reported by Quotable Value to have risen by 11.6%y/y in Feb, down from a peak of 15.0%y/y in November last year. This is still a very rapid pace of price growth from already elevated levels

Nevertheless, the RBNZ has recently reset macroprudential policy to address the asset price problem.

By introducing a differentiated set of LVR rules in Auckland between investors and owner-occupiers, the RBNZ has laid the ground work for adopting similar policies in other hotspots if it so chooses, or rolling them out nationally. It has the mandate to move relatively quickly and unilaterally.

As such, with more flexible macroprudential tools available, it appears that the rates policy should be freer to target CPI inflation.