Long AUD/USD (From 31-Dec to 4-Jan)

We were stopped out of our long AUD/USD position below, thankfully before the flash crash kicked off on Thursday morning in Asia. So there was no extraordinary slippage.

Real-Time AmpGFX – Bought AUD/USD (Sun 12/30/2018 4:30 PM MT)

Bought one unit AUD/USD at .7058

Comment

Trump’s tweet over the weekend should raise hopes that a trade deal will be reached with China in coming months.

Trump has said that a deal “if made, would be comprehensive”

Xi also expressed optimism over progress in negotiations.

After a period of sharp decline in US equities and broader financial market upheaval, and facing a range of domestic political controversies, Trump may be more eager for a win on foreign trade policy.

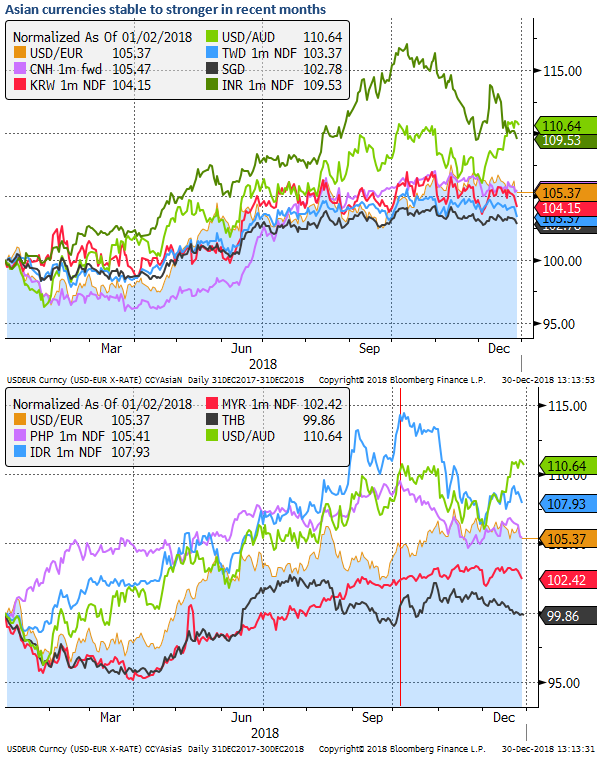

The AUD has significantly underperformed other Asian currencies and other major commodity currencies over the last month, so may seem relatively cheap.

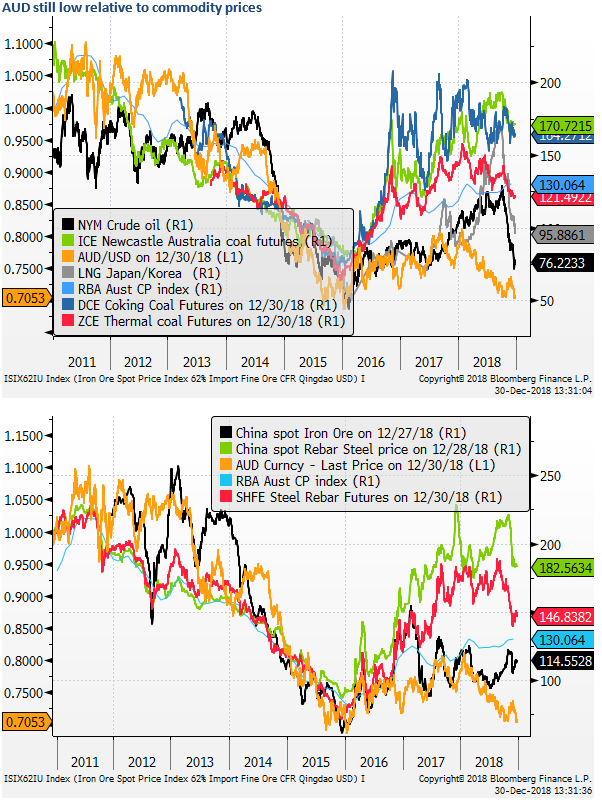

The fall in AUD in part relates to the fall in the oil price, with a significant portion of Australian exports, in particular, natural gas, and to a lesser extent thermal coal, linked to oil prices. However, steel and coal prices are still well above their lows in 2015, the last time the AUD was around its current levels. And notwithstanding the slump in oil prices, they have largely only reversed the rise over the previous 12-months. Overall, the AUD still appears to be somewhat below longer-run relationships with commodity prices.

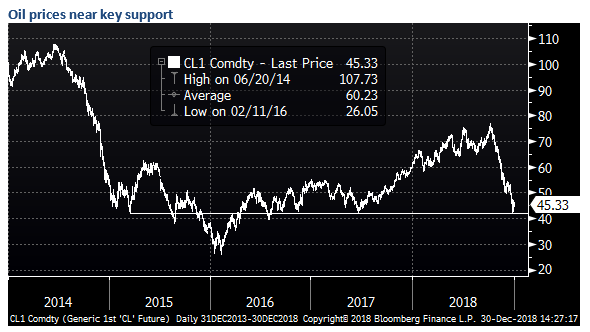

The outlook for the AUD may depend on the capacity of oil prices and global asset markets to recover from their sharp correction over recent months.

The prospect for oil prices may improve since OPEC+ did agree to reduce supply on 7-Dec by 1.2 m bpd. Oil is now around the base of its range in 2015 through 2017, outside of its period of severe weakness in early 2016.

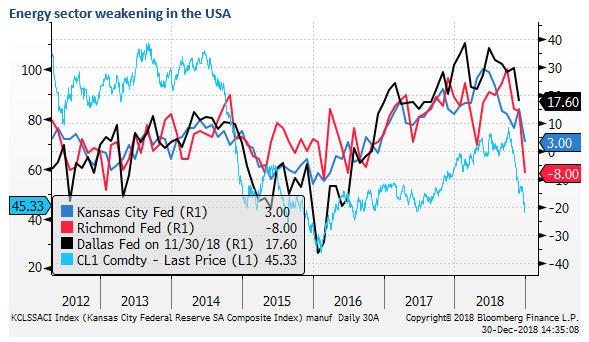

Furthermore, the fall in oil price may start to have a dampening impact on US manufacturing outlook given the now more significant oil and gas sector in the USA, lessening the chances of a resumption of US rate hikes.

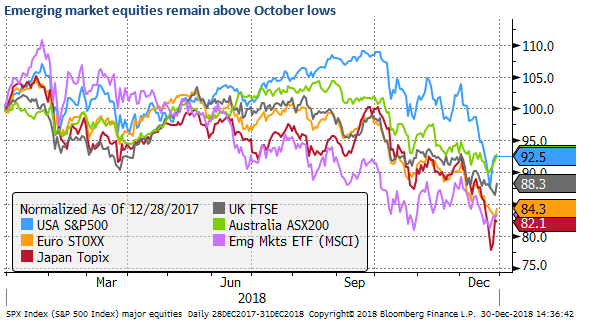

After a year of weaker emerging market assets, they have started to out-perform even weaker developed markets, in particular, the US equity market, since October. This suggests that investors may be under-weight emerging market assets, and concerns over the risks ahead for the global economy may have a bigger impact on US assets, including the USD in the coming months.

The focus in US politics is on border wall funding and the ongoing government shut-down. This may point to dysfunction in US government and undermine confidence in the US economy and the USD as it faces more challenges over the year ahead; including the return of the debt ceiling, Mueller investigation, a divided Congress, a slowing economy and widening fiscal deficit.

Meanwhile, the prospect of more stable US interest rates in coming months may help support emerging markets and global risk appetite.

On 23 Dec, Trump tweeted that he had a productive call with Turkish President Erdogan, including “discussed heavily expanded Trade.” TRL was at the centre of financial market turmoil in August, and confidence has returned.

China has announced fiscal stimulus, implied they may ease monetary policy, and introduced support mechanisms for its financial markets over recent months. Market sentiment towards China has deteriorated significantly, and the risk is now that it may improve in the coming months.

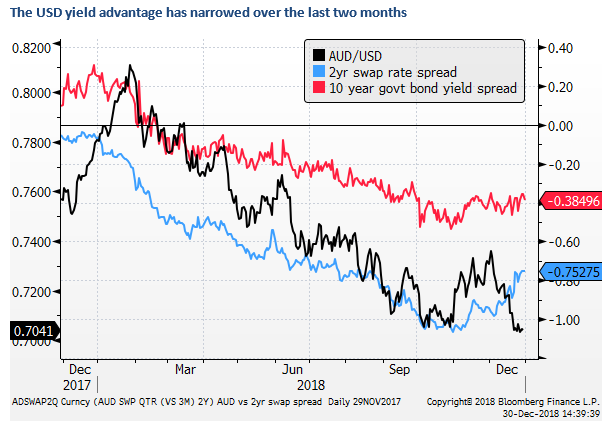

The outlook for Australian interest rates remains largely stable for the year ahead. Yields have fallen in line with the global trend.

AUD is trading around its lows for the year, at the lows in October, just above .70. We would be looking for a double bottom to form.

Long one unit of AUD/USD at 0.7058; s/l 0.6973; t/p 0.7373 (Capital at Risk 0.85%)