Assessing upside for AUD, and a range of global risks

We are toying with the idea of buying AUD either against the USD or the NZD. But broader uncertainty is keeping us on the sidelines for now.

Potential for strong wages and labour data Wed/Thur

Labour market data in Australia, New Zealand and a number of major economies have tended to be stronger than expected over recent months and indeed for some time. (including the UK earlier today).

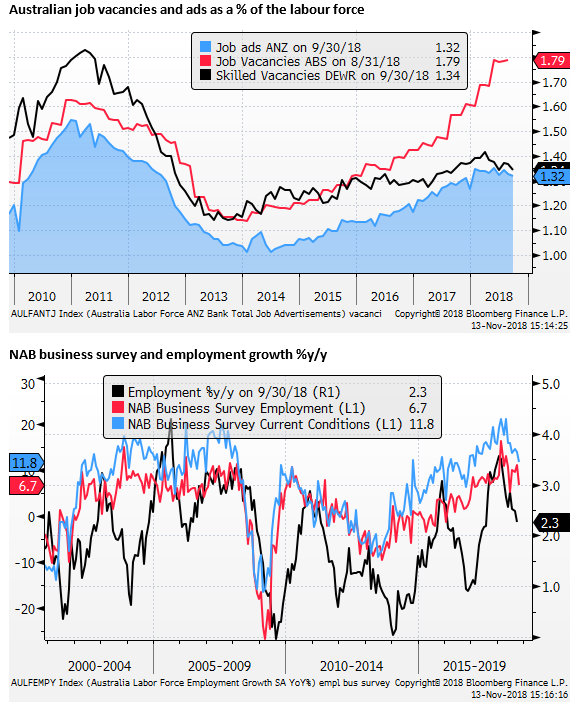

The leading indicators of employment in Australia have levelled off, or softened a bit, but remain at a relatively high level.

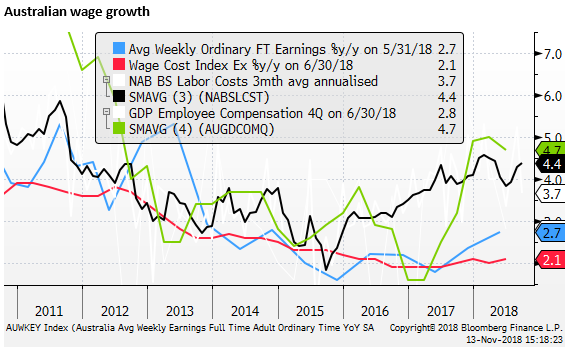

The wage data (today) is expected to show a further advance. A minimum wage increase should help lift the quarterly wage outcome. Wages last quarter were also higher than expected, suggesting there is an improving trend.

In his speech on 17 October, RBA Deputy Governor Debelle also noted some recent new enterprise agreements that might lift wages in Q3.

Debelle said, “Around one-quarter of all employees will have received a 3.5 per cent pay rise following the increase in national minimum and award wages on July 1. For some retail and public sector employees, we are also seeing some new enterprise bargaining agreements signed following a lengthy period where wages had been frozen.”

The market is looking for a lift in wage of 0.6%q/q, matching the gain in Q1 that was the highest since Q1-2014. And a rise of 2.3% over the year (up from 2.1% in Q1), which would be the high since 2015.

These sound like reasonable expectations, but we can see some risk that they rise a bit more than expected, and might help lift the AUD.

Trade tensions ease

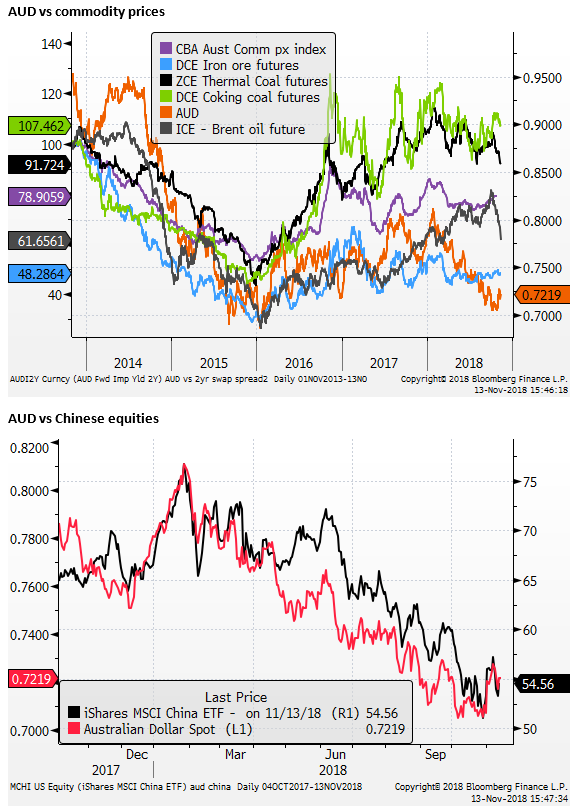

The AUD has lifted in the last day, along with other Asian currencies, on reports that the US administration and Chinese government are talking on trade again, to help lay the groundwork for the Xi-Trump meeting at the G20.

This suggests that we should expect some progress on improving trade relations. It would not surprise if this leads to a delay in the broadening and increase in tariffs planned for the beginning of next year.

However, US administration officials are at odds over what they aim to achieve from these talks. And we think it is unlikely that there will be a winding back of tariffs. And broader agreement on industry polices will be harder to achieve.

A cooling in trade tensions may boost confidence in China and Asia, and see capital flow into the region and boost the AUD.

Weaker Chinese Credit Growth

But we are still worried by the slowing in Chinese shadow-banking credit and the dampening impact this may be having on private companies in China. The Chinese authorities are also showing concern, introducing a number of measures designed to shore up financing for private companies.

The Chinese aggregate financing data released on Tuesday were significantly weaker than expected.

Chinese economic monthly data is released 1.5 hours after the Australian wages data today. Weaker Chinese data may dampen confidence in Chinese assets and the AUD as a proxy.

Chinese policy stimulus

Weaker credit conditions and weaker growth data in China have resulted in a variety of recent announcements by the Chinese government to support financing and growth. The market will be weighing the odds of further stimulus, and assessing how effective this will be in restoring growth and confidence in China.

Again there is room for some optimism to return, but doubts will also remain. It is hard to see a strong rebound in Asian asset markets on the prospect of Chinese policy stimulus and renewed trade talks, but it is possible to see a modest recovery in confidence.

Slowing Tech Sector

An additional factor that may prevent a strong rebound in Asian markets is the recent deterioration in tech sector equities reflecting concern over slowing demand in the sector.

US Inflation data

Tomorrow in the US the CPI inflation data is released. We are wary of a higher than expected outcome that then boosts the USD; potentially undermining global asset markets.

Eurozone risks

Italy, as expected, threw the gauntlet down to the EU over its budget. The market impact has been negligible. EUR/USD is recovering along with the GBP, and may also be drawing strength from news on trade talks between the US and China.

EUR may have become more aligned to global growth as its recent economic slowdown has been led by weaker external demand.

While the US may be prepared to ease trade tensions with China, Trump may be moving to raise trade tensions with Europe.

Auto tariffs

The administration is reported to be coming to a decision on what to do with its review that began in May on whether to impose tariffs of autos. It is possible Trump uses these as a negotiating tactic with the Eurozone and Japan to get a better trade deal.

Trump called out France on unfair tariffs on US wine. This is reminiscent of his calling out Canadian dairy trade in the lead up to NAFTA negotiations.

We need to be wary of heightened trade tensions between the US and Eurozone replacing or adding to tensions with China.

Brexit

GBP/USD rebounded as it appears a deal on Brexit divorce is imminent, and will be presented to the UK cabinet in the next day or so. However, the upside will be limited by the risk that this deal, even if agreed to by cabinet, will not pass the UK parliament.

From what I am reading, it appears more likely to fail a full vote of parliament, so we should expect turmoil in GBP to return, perhaps within hours of a deal being approved by the cabinet, as critics in parliament may step up their attacks on the deal.

As such we would not be surprised to see GBP pop and drop. This may drag the EUR down, and contribute to broader FX volatility.

Australian housing market

Finally, a reason to temper enthusiasm for the AUD is the signs that the housing market may be further deteriorating. Auction clearance rates nationally hit a fresh low since 2012. The bottom line is that the RBA remains a long distance from raising rates.

We can see a scenario where the AUD rises this week on labour data and an easing in trade tensions, but the gains may be limited, and then subject to a number of risks that could see the gains reverse.

Oil price drop

Oil prices have fallen abruptly and influence Australian commodity prices, especially for thermal coal and natural gas. As such this could be weighing on the AUD somewhat.

However, the AUD has been trading well below what might normally be consistent with commodity prices. So it has not had an obvious impact. Perhaps it has contributed to some further fall in AUD/NZD

Lower oil prices would tend to support Asian currencies and global growth expectations. However, this may not be a big consideration for the market at this time.

Download Full Report