Comment on the BoC policy statement – more dovish than expected

The Bank of Canada policy statement walked further down the path started by Governor Poloz in his 27 September speech, where he emphasized data dependence. While the BoC retained its tightening bias, saying, “less monetary policy stimulus will likely be required over time,” it emphasized reasons to wait. It said, the “Governing Council will be cautious in making future adjustments to the policy rate. In particular, the Bank will be guided by incoming data to assess the sensitivity of the economy to interest rates, the evolution of economic capacity, and the dynamics of both wage growth and inflation.”

The Bank’s standard model suggests rate hikes are needed, but all the matters of judgment suggest that hikes are not needed, or at least may not be needed for quite some time.

These include:

- Structural factors at play globally that suggest inflation may remain lower than previous cycles. The MPR has a box on this factor (“The Role of Globalization and Digitization”). It actually tends to downplay them, but still notes them as something that might require a more cautious policy approach.

- Evolution of Capacity. The Bank forecasts that the economy is now operating around its capacity, and that it will move into a positive output gap in the coming year. However, it sees a risk that it is under-estimating growth in capacity. Poloz notes that capacity does tend to grow more than expected in this part of the cycle, and that more rapid business investment will add to capacity.

- Evidence of slack remaining in the labour market. As in other countries, the Bank can see evidence on broader measures of unemployment and slow wage growth that there may still be slack in the labour market.

- Sensitivity to interest rates. With higher household debt, consumers may be more sensitive to interest rate rises.

Furthermore, the Bank pushed back its timetable for inflation reaching its 2% target from mid-2018 to the second half of 2018, “because of the recent strength in the Canadian dollar.”

The statement also elevated NAFTA as an issue of concern saying it its statement that, “However, this outlook [strong global growth] remains subject to substantial uncertainty about geopolitical developments and fiscal and trade policies, notably the renegotiation of the North American Free Trade Agreement.”

The basic message is that the Bank is now in watch-and-wait mode to assess how all of these matters of judgment play out. It will need the data outcomes to drive the next rate hike. This suggests that the timing of the next hike is much more uncertain, and unlikely before next year.

In response to the statement, Canadian 2yr swap rates are 4.5bp lower (down 2.5bp from the previous day’s close). Rates were higher ahead of the statement by around 2bp.

The odds of a 6-Dec rate hike have fallen from around 50% to 34%. The market retains two further hikes in the curve out to end-2018. Dec-18 3month bill futures implied yield is down 2bp.

There still appears to be scope for Canadian yields to slip further on this statement, especially if you tend to believe the judgment factors will turn out to be more true than not.

USD/CAD has risen above a previous high at 1.2770; it may be en route to test resistance between 1.2860 to 1.3030, around where it was trading just ahead of the first rate hike in this cycle on 12-July.

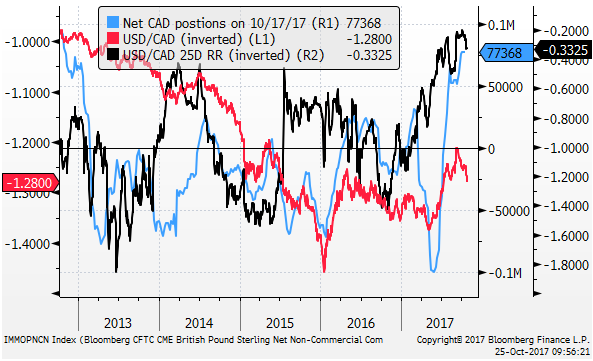

Upside risk may also be apparent since CFTC positioning and option skew suggests that the market is well long CAD.