Comment on trades – US bonds, EUR & Bitcoin

Heading into payrolls, I decided to take profit on half of my short US 10 yr US Treasury bond futures position.

I have made a significant amount in the trade and want to lock in some gains ahead of data that could generate significant volatility.

The recent volatility in equities makes it harder to predict the near-term direction in bonds.

The more important aspect of this data remains wages. Inflation remains the missing link in the USA and global economic recovery. A rise in wage growth is likely to cause ripples in the market. The recent rise in bond yields may have already factored in some rise in wage growth. And if it occurs, the equity market may take more punishment as talk of a Fed behind the curve may increase.

I wrote this week that rising yields might trigger some equity correction that spills over to a stronger USD. I thought this would extend to the EUR. Initially, it has not, but I have reset that trade.

Eurozone equities are down more significantly today, suggesting that the strong EUR is feeding back more significantly to the STOXX

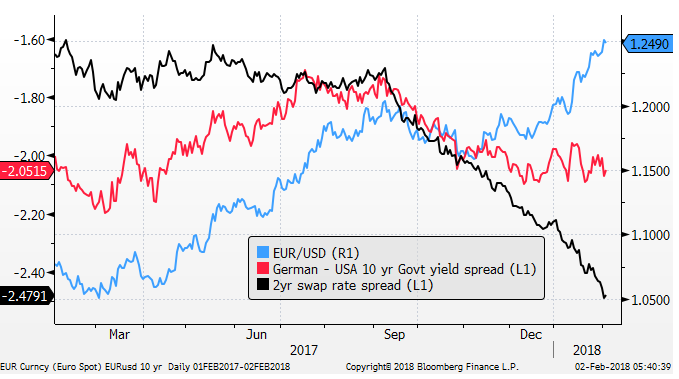

The recent resurgence in EUR has continued to defy the widening yield disadvantage. If capital has been moving to EUR to seek performance in its equity market, then it is hard to see what continues to drive it up.

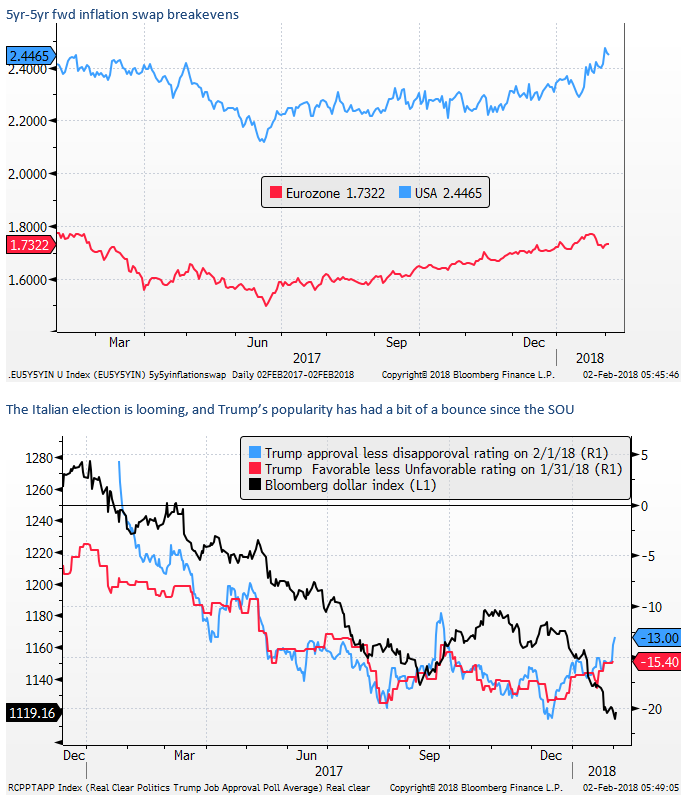

The most recent surge in the EUR appears to have hit Eurozone inflation expectations. (5yr-5yr fwd inflation swap breakeven). This should have policy implications and may coincide with some ebbing in Eurozone confidence surveys.

On the other hand, the weaker USD has contributed to some increase in US inflation expectations and may have policy implications, and stronger US confidence surveys.

If the US payrolls fail to be stronger than expected and wages are subdued, EUR will probably rise, but it may still be facing headwinds near tech resistance 1.25/26. There are some similarities with short US bonds and short EUR, both may underperform in a weaker US data outcome, but the combination may be less volatile with EUR short potentially doing better if strong data triggers equity and bond market volatility.

Bitcoin was going to be my long-term trade, but I decided that I shouldn’t be dogmatic and retain some discipline on acceptable losses. There has obviously been a lot of speculative money drawn in, and the price action has probably knocked a lot of confidence out of the market that may take some time to restore. I will consider buying again when I can see more positive technical patterns emerge. However, there is a risk that it blows off all the gains in the last year before it cleans out the recent enthusiasts.

The premise that bitcoin and ethereum can take on safe haven status remains valid. Their construct remains attractive in that sense.