Long EUR/USD ( From 18-Dec to 19-Dec) Expecting no Fed rate hike

Real-Time – Sold EUR/USD to close long position after FOMC (Wed 12/19/2018 12:27 PM MT)

Sold one unit EUR/USD at 1.1383

Comment

The Fed raised rates as widely expected, and lowered its median expectations for hikes in 2019 from three to two hikes. And then one further hike in 2020.

As I discussed in my thoughts below, these actions display a lack of flexibility at the Fed that suggests a risk that they make policy mistake by hiking in the face of significant global and domestic market turmoil.

The Fed Chair press conference might be able to display more flexibility, but this close to year end, the market is not in a mind to position for the medium term and we see a risk of significant volatility in the FX and wider market.

As such we have closed our position

Real-Time – bought EUR/USD expecting no Fed hike (Tue 12/18/2018 3:08 PM MT)

I think the odds of a Fed hike tomorrow are low, less than 50%.

Basically, when the FOMC sit down to discuss developments (It’s a two-day meeting that started yesterday), it makes no sense to proceed with a hike at this juncture.

Commentators are still calling for a hike and their argument now boils down to – the Fed should hike because not to do so might cause more uncertainty; they think that it would seem panicky to not proceed after giving no signs ahead of this meeting that they may not hike.

I disagree, the Fed has said in recent weeks it is time to proceed more cautiously.

The market has taken this as a sign that the Fed might project fewer hikes next year. No key member of the Fed has suggested that this interpretation (hike in December and then project fewer hikes in 2019) was incorrect, so it has become the consensus.

But in itself, it misses the point that the Fed has been saying it needs to be more reactive to current conditions now that it is in the vicinity of neutral.

The whole point is that the projected rate path should have less meaning. The Fed now needs to demonstrate that it is not on auto-pilot, but watching current conditions. Conditions in global financial markets suggest that a hike could be a mistake. With a live meeting every six weeks, should global market conditions improve, the Fed could easily resume hikes early next year. This would be a far better strategy than proceeding with a hike now in the face of deteriorating global financial markets and more intense fear over the state of the global economy.

Unless the Fed is going to forecast that the US recovery is going to stall next year, they cannot project rates are kept on hold next year, and indeed into 2020. So hiking tomorrow, and then projecting a further three hikes over the 2019/20 would appear too hawkish considering the risks embodied in current market conditions.

The Fed would feel uncomfortable sounding hawkish at this juncture for fear of making a policy mistake. This realization may see the Fed opt for a better strategy; to hold rates steady and project several hikes ahead. And couching their hold in terms of being cautious but optimistic. This should support the stock market by illustrating that the Fed is cognizant of risks and willing to listen to market conditions, while retaining a bias for higher rates ahead.

Druckenmiller is spot on. He notes that there is no cost to the Fed not hiking tomorrow, but it is taking a big risk if it does. As CBs are constantly reminding us that setting policy is about mitigating risks.

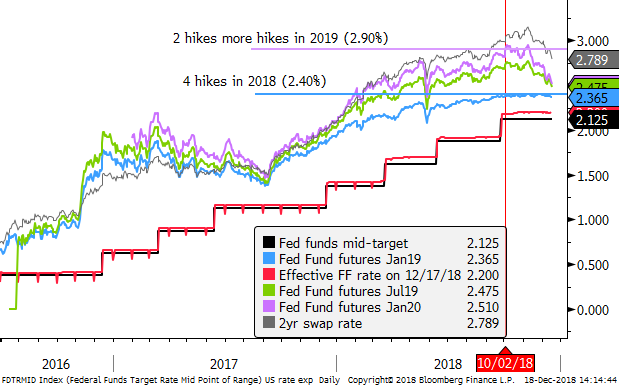

The effective FF rate is currently at 2.20, above the mid-FF target 2.125. Basically, the FF is now trading right on the IOER, which was raised by only 20bp at the September meeting and now sits below the top of the FF target (2.25). To help keep the FF rate towards the mid-target, if the Fed does hike, they may again raise the IOER by only 20bp; ie to 2.40% (10bp below the top of the new target range (2.25 to 2.50). Presuming the FF rate continues to squeeze towards the IOER, the market might expect it to trade around 2.40% should the Fed hike rates; above the mid target (2.375%)

Jan FF futures are trading at 2.365 (with Jan 30 meeting next year). So the market is not fully pricing in a hike tomorrow, but its pretty close. Bloomberg calculates the probability at 65%, but it looks more like 85% is where the market is.

Beyond that, the market is seeing a high risk that the Fed does not hike again in 2019 with Jan-20 FF futures at 2.51% (only 11bp up on where FF should be trading after one more hike).

Interestingly, the market is now pricing in rate cuts in 2020, so it views the economy moving into a weaker below trend growth phase in 2020. The rates curve is now inverted at the short end from 1yr to 3yrs. This is not a good look for the USD.

So even if the Fed does do as widely expected and hikes tomorrow, we see limited upside for the USD. The market may then take its cues from the statement and press conference. There is more reason to expect a cautious tone in both.

If the Fed does hold fire, this should help support global risk appetite and weaken the USD.

With oil prices hit hard to new lows the market may be reluctant to buy commodity currencies, although rebounding equities could support EM and commodity currencies.

We have decided to buy the EUR/USD ahead of the FOMC as a way to position for a no hike outcome. This may be less sensitive to a risk-on move, but it may also be less undermined by more equity market volatility should the Fed hike and fail to calm market fears that it is going too far.

Position

Long one unit EUR/USD at 1.1359; s/l 1.1263; t/p 1.1613

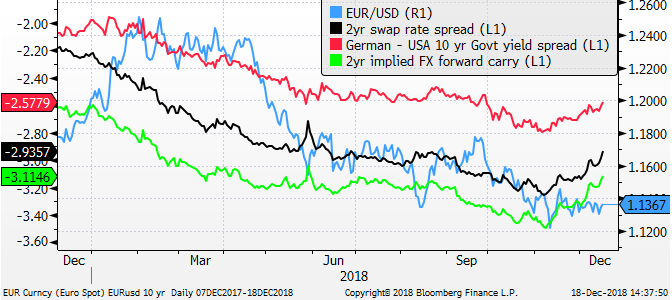

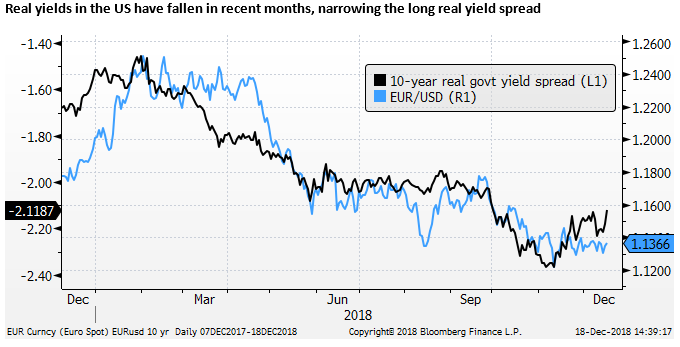

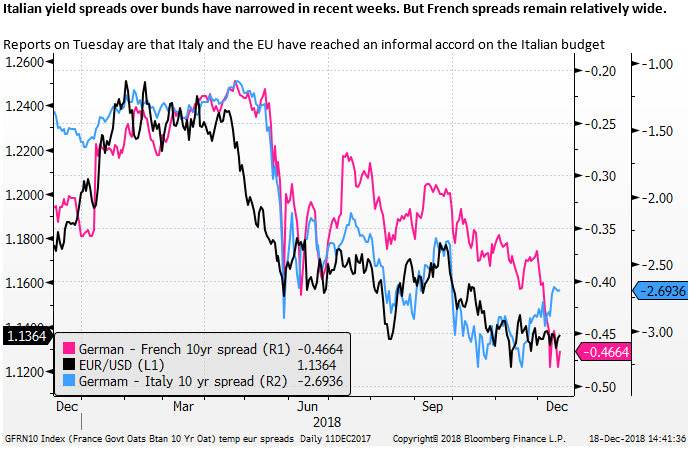

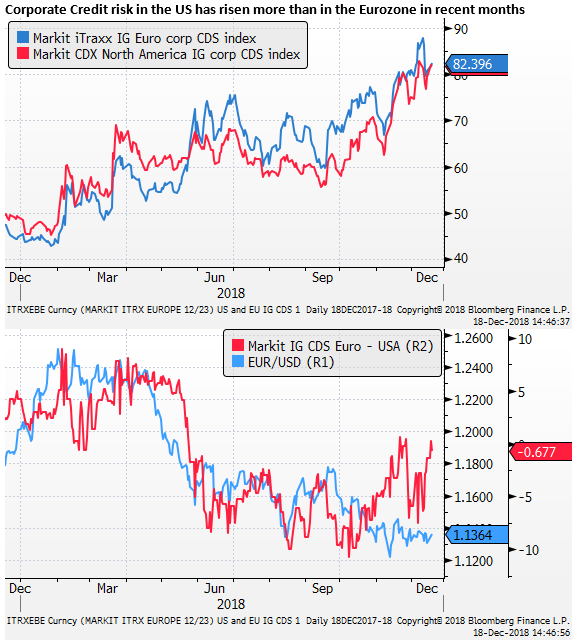

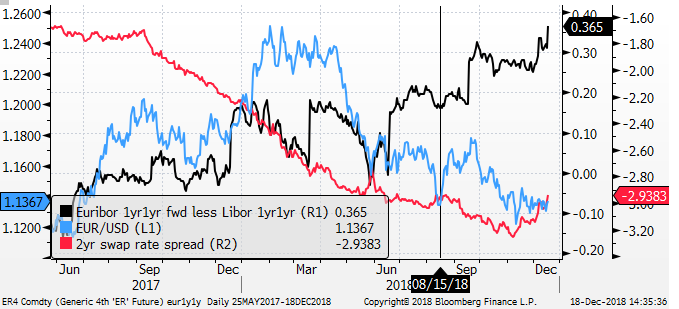

One-year-ahead relative rates appeared to support the EUR/USD last year and early this year, although they seem less relevant more recently. Nevertheless, both forward rate expectations and 2yr swap rate spreads have narrowed in the last month or two.

Long end rate spreads and direct carry in the FX market has narrowed in the last month or two. There is no evidence of a squeeze in year-end dollar funding costs