RBA hints at an easing bias

The final ‘policy guidance’ paragraph added that the RBA is now “monitoring developments” suggesting that it is less sure that its current policy setting will remain appropriate.

It said, “Taking account of the available information, the Board judged that it was appropriate to hold the stance of policy unchanged at this meeting. The Board will continue to monitor developments and set monetary policy to support sustainable growth in the economy and achieve the inflation target over time.”

Previously, it concluded with, “Taking account of the available information, the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.”

The RBA is typically relatively cautious in tipping its hand in the policy statement, and while subtle compared to the RBNZ statement last week, you might conclude that the change in this final RBA paragraph amounts to a shift from a neutral policy stance to an easing bias.

The rest of the statement has not changed much, suggesting that the RBA is broadly sticking to its forecast of a gradual return to its inflation target that will take several years. As such, we might conclude that the RBA is not rushing to ease policy and is watching to see how the global and domestic economy unfolds.

Nevertheless, the final paragraph suggests that the RBA is now prepared to ease policy should various threats to their outlook build further.

The RBA repeated its upbeat view on the labour market; it said, “The vacancy rate remains high and there are reports of skills shortages in some areas.” Interestingly, quarterly vacancy data did rise between Nov and Feb, in data reported last week, to a new high. However, arguably more timely skilled vacancy and job ads reports were weak in February, and are exhibiting a downtrend over the last year; so some ebbing from solid levels may be evident in some leading indicators.

The key risk for the RBA remains sluggish household consumption. The statement said, “Growth in household consumption is being affected by the protracted period of weakness in real household disposable income and the adjustment in housing markets.”

The RBA is continuing to forecast a tightening labour market, flowing through to faster wage growth, supporting household income growth and household consumption.

It noted the ‘tension’ between the labour market and GDP reports; it said, “The GDP data paint a softer picture of the economy than do the labour market data.” Key to their projection for steady rates is that this tension is resolved by GDP, and other activity indicators, rising to meet the strength in the labour market. Should it turn out that labour market strength wanes, the RBA is likely to move to cut rates.

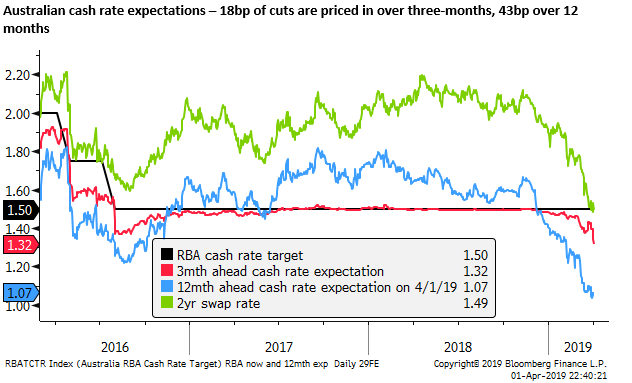

In response to the RBA statement, after some gyrations as the market absorbed the subtle shift in guidance, 2yr swap rates have fallen 3.5bp. And the AUD is down around 20 FX pts. The market is judging there is a somewhat higher probability that the RBA will cut rates in coming meetings.

Since last week, some better global news may have buoyed the AUD and the rates outlook. Chinese PMI and some other Asia regional PMIs strengthened in March. Global equity markets rose and global bond yields reversed some of their recent sharp falls. And Oil and and iron ore prices are stronger. Such considerations may limit the downside response in the AUD to the RBA policy statement.

However, the USD is performing relatively strongly across a range of currencies, including Asian currencies on Tuesday, and this is helping the AUD fall in response to day’s RBA policy statement.