Short AUD/USD (10-Oct )

This trade was stopped out at the adjusted stop loss order at a small profit

Real-Time AmpGFX – AUD orders adjustment (Wed 10/10/2018 3:23 PM MT)

We mentioned that we were going to treat this trade as a short-term “day trade” based largely on what we expected to be some further follow-through selling in the AUD in line with the ongoing slide in Chinese assets.

The problem with shorting AUD at these levels is that it is close to the bottom of the range and there is a risk of rebound on position-squaring.

Accordingly, we have tightened our orders around this trade.

Position

Short one unit AUD at 0.7083; s/l 0.7078; t/p 0.7013.

Real-Time AmpGFX – sold AUD/USD (Wed 10/10/2018 1:15 PM MT)

Sold one unit AUD/USD at 0.7083

Comment

I am going to treat this largely as a day trade and watch with a close stop.

Viewing the fall in global equities, including a further deep fall in Chinese ETFs (-2.8%), we see at least some further follow through in the AUD into the early Asian trading day.

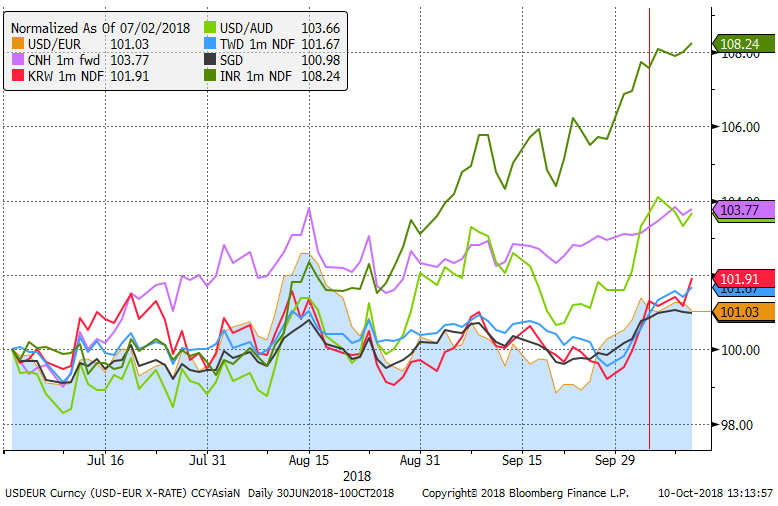

The CNH continues to weaken and approaching the psychological 7.0 level. 12mth forwards are through this level since Monday at new lows for the CNH.

TWD and KRW are also near there weakest levels for the year.

We have noted the increasing risk for China in recent reports and we were stopped out of a short AUD position yesterday.

Position

Short one unit AUD at 0.7083; s/l 0.7138; t/p 0.6883 (Capital at risk 0.55%)