Short AUD/USD (From 29-Aug to 5-Sep)

Real-Time AmpGFX – Bought AUD to close remaining short, lowered NZD/USD stop loss close to mkt (Wed 9/5/2018 3:06 PM MT)

Bought half unit of AUD/USD at 0.7195 to close remaining short position

Lowered NZD/USD stop loss close to market

Comment

The Australian GDP report was much stronger than expected on Wednesday. It appears that the economy has strong momentum (4.1% annualised growth in H1), and while risks may be building we would not be surprised to see a robust trade report later today and business confidence and employment next week.

The AUD has built in a significant degree of the risks arising in the economy from a weak housing market, weaker EM assets and China-US trade relations.

However, Australian export commodity prices have remained solid. The RBA has maintained its upbeat view for the medium term outlook and the GDP report should reinforce their optimism.

There is a risk of a rebound in risk appetite after a period of significant weakness in EM assets. Italian bond yields have fallen in recent sessions. Turkey is expected to hike rates next week.

We see downside risk returning if Trump announces tariffs on an additional $200bn of Chinese goods, as may arise by end week. EM markets and global growth confidence may continue to be challenged going forward as the US raises rates. The US labour market data may be a catalyst for further broad USD strength.

However, we prefer to reduce risk at this juncture. We fear a short-term rebound in AUD and other currencies against the USD, and wish to lock more of our recent profits in what remains a volatile and uncertain environment.

Positions

Short half unit GBP/USD at 1.2918; s/l 1.3058; t/p 1.2388 (Capital at Risk 0.58%)

Short half unit NZD/USD at 0.6679; s/l 0.6633; t/p 0.6388 (s/l lowered from 0.6678)

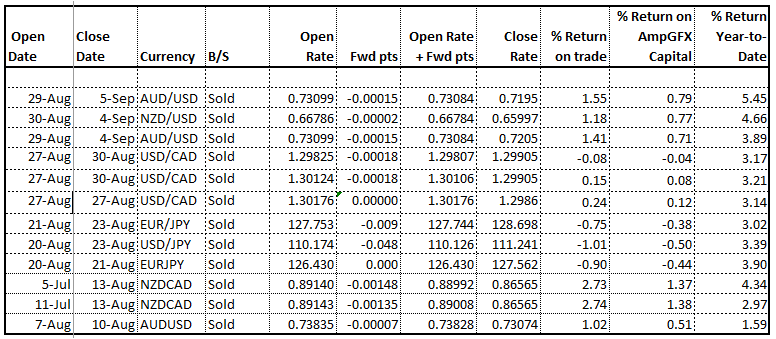

Recent Trades

Real-Time AmpGFX – lowering s/l in AUD after GDP report (Tue 9/4/2018 8:51 PM MT)

Comment

We had noted several risks to the growth outlook in Australia, but the GDP report suggests that the economy has strong momentum. The RBA Governor yesterday reiterated an upbeat view for the economy and maintained a view that the next move it rates was more likely to be higher, albeit some time from now.

The report reflects strong employment growth lifting income and consumption, strong company profit growth with stable to higher commodity export prices, even as the AUD has softened, and stronger export volumes, and strong private sector investment. This report should sustain confidence that rates will remain at least steady for some time.

The AUD may squeeze higher still, and we wish to lock in some of our gains, so we are lowering our stop loss to above its high yesterday.

Positions

Short half unit GBP/USD at 1.2918; s/l 1.3058; t/p 1.2388 (Capital at Risk 0.58%)

Short half unit NZD/USD at 0.6679; s/l 0.6678; t/p 0.6388

Short half unit of AUD/USD at 0.7310; s/l 0.7243; t/p 0.6888 (s/l lowered from 0.7323)

Real-Time AmpGFX – bought AUD and NZD to close half short position in both after RBA statement

Bought half unit AUD/USD at 0.7205 to close half short position

Bought half unit NZD/USD at 0.6600 to close half short position

Comment

We had thought that there was a risk that the RBA would acknowledge that the balance of risks have moved away from a ‘the next move in rates was more likely to be an increase’ to a balanced assessment.

However, they have left their policy statement unchanged.

Considering the significant fall in the last week, and proximity to key support around 0.7150, we have decided to take some profit and reduce our risk in both the AUD and NZD.

Positions

Short half unit GBP/USD at 1.2918; s/l 1.3058; t/p 1.2388 (Capital at Risk 0.58%)

Short half unit NZD/USD at 0.6679; s/l 0.6678; t/p 0.6388

Short half unit of AUD/USD at 0.7310; s/l 0.7323; t/p 0.6888

Real-Time AmpGFX – sold AUD/USD (Wed 8/29/2018 1:58 AM MT)

Sold one unit of AUD/USD at 0.7310

Comment

The out of cycle mortgage rate hike by Westpac, one of the four major Australian banks, is likely to be followed by the others, and should be viewed as like about half an out of cycle rate hike by the RBA. This is likely to place further downward pressure on the housing market that is already sliding and arguably at an accelerating rate in the last month or so.

This raises the risk that the RBA considers cutting rates again this cycle. The initial response of commentators is at least that it will further delay a rate hike by the RBA. But there was not much of a hike priced-in by the RBA in any reasonable time frame. And the RBA is already not seeing inflation return to its target within their two to three-year forecasting horizon in the quarterly policy statement. So inevitably questions will be asked what that inflation target means if they do not cut rates to try and achieve it.

Some may claim that the Australian economy has reasonable momentum and can withstand a small rate hike, but the risk is that even this small hike spills over to weaker consumer sentiment and significantly undermines growth.

The weak housing market, and still elevated political risk, US tariff policy on China, and rising US rates all pose downside risks for the AUD.

In the last two weeks, the USD has been declining, and the AUD has lifted, but we are not convinced the USD will remain in broad retreat for much longer.

Positions

Short one unit of AUD/USD at 0.7310; s/l 0.7413; t/p 0.6888 (Capital at risk 1.03%

Short one unit of USD/CAD at 1.3013; s/l 1.2988; t/p 1.2788