Short EUR/USD (from 30-Jan to 12-Feb)

Real-time AmpGFX – sold to square USD longs and AUD/NZD (Mon 2/12/2018 9:03 AM MT)

Bought half unit NZD at 0.7239

Sold half unit USD/CAD at 1.2606

Bought half unit EUR/USD at 1.2262

Sold one unit AUD/NZD at 1.0810

Comment

I have closed my long USD positions and my long AUD/NZD position. I am square apart from the bitcoin ETN (COINXBE).

I wanted to return to square; after an erratic day of trading on Friday, I think it is time to retest my views.

An initial concern that comes to mind is that equity markets may start to find their feet, and this has not been good for the USD.

Partisan politics in the US has led to a big blowup in the budget, and will limit its capacity to attempt to narrow it.

The chances of any bipartisan efforts to reduce government spending succeeding in the US under a Trump presidency are very slim.

There is an argument that the weaker dollar theme could be propelled by budget risks.

Trump is supposed to be announcing budget cuts. If these fall flat and acrimony and blame games start in Congress, it will not be a good look.

A strengthening US economy and rising inflation expectations, raising US yields should tend to support the USD, but it is not clear that this will be a deciding force.

We will be looking at selling US bonds again as one of the best ways of trading this theme

AUD/NZD appears in a range and is not compelling at the moment. RBA was more successful in dampening rate hike expectations, NZ retail sales data were strong, there is a lot of political machinations in both countries, housing markets are weaker, China developments are murky. AUD is curiously trading as the more risk-sensitive currency.

XBT is working against resistance at the top of the gap after Thanksgiving last year (9022); since its low in Feb it has been making higher highs and higher lows. I think it looks constructive.

Positions

Long half unit COINXBE at 345.00

Real-time AmpGFX – Trading View, order update (Friday, February 09, 2018 4:24 PM MT)

Friday would have been a good day to do nothing and go skiing.

Through the morning USA session, you could see broadening contagion in the equity market selloff to emerging market and high yield bond markets. And increasing dollar funding pressure. On many risk measures, it appeared that broader risk contagion would unfold.

To date, the fallout in equity market correction this week has been relatively modest to currencies or bond markets (where I have positions). I have been positioned for some fallout to the USD, while attempting to hold a short US Treasury bond position, but wary that bond yields could fall if the equity market rout extended much further.

The fall in equities had accelerated into the close in recent sessions, so I thought we were shaping up for the same result on Friday. With the increasing influence of algo trading and index investing in ETFs, my concern was that we could see a surprisingly weak close to the week that left the market very nervous and spreading more than it has to date to FX and bond markets.

In the event, equities bounced sharply in afternoon trading and closed with a rising spurt.

It is far from clear that the market is out of the woods. Indeed there are reasons to expect a more prolonged period of market volatility. Even if this does not drive equities net lower, we still see risk biased towards a recovery in the USD, more than we have seen to date.

Investors are likely to remain more wary of late-cycle economic risks of inflation, less QE, and faster central bank policy tightening. It may also be the case that the market is becoming more nervous about the expected higher net supply of US Treasury bonds from ongoing fiscal expansion, just as central banks are slowing purchases.

There may still be some systemic contagion risk that flows from the failure of inverse volatility investment strategies. And other investments set up to enhance yield via leveraged investment. The sudden rise in VIX serves as a warning to these higher risk strategies that had become more popular in the preceding low vol market.

If the USD fall had been related to low vol higher risk investment in global assets chasing capital gain and yield enhancement, then a period of prolonged circumspection could see a further unwind in the USD decline.

As such, I did not rush to close long USD positions in the second half of the day, and will see how they trade early next week.

My first move on Friday morning was to close long USD positions. This in part reflects a shift in my attitude towards protecting profits. Retracements can be large into end week, and US equity futures were trading firmer into the market open.

I then resold EUR and NZD, and then added a short CAD position as the morning equity session turned sour. I kept these positions because my bias is to see dollar strength even if equities start recover, but remain more volatile. This reflects a view that more volatile markets may make the market look more at the rise in US yields that have occurred in recent months, and be more cautious selling or borrowing in USD to invest in higher-risk global investments.

However, price action towards a stronger USD is still muted, and this worries me that holding long USD positions in a rebounding equity market may not work.

In the end, I have been caught up in an end of week retracement in equities and the USD, albeit because I resold USD near the lows on the day.

My AUD/NZD long has been frustrating. It is interesting that the AUD has been much more reactive to equity market correction than the NZD. As such, AUD/NZD has traded lower in bouts of equity market weakness. I can’t really explain why AUD has been more risk-sensitive than NZD.

My confidence in the AUD/NZD position is fading. I have considered exiting it, but it has so far held near recent lows, and I am watching it more closely. It may just be in a choppy range, so I will hold to see if there is an opportunity to exit on a possible recovery to the top of its range.

I am now square US bonds. This has been a very effective trade to start the year. I was holding the short position seeing a possibility of a further outsized rise in yields. However, I am not convinced these are great levels to be short bonds, and the risk is more evenly balanced. I closed this position in the midst of the morning equity market slide, fearing broader equity market contagion. The equity rally into the close is obviously a stabilizing influence for yields. However, the outlook for yields in the near term is now more mixed.

Positions

Long one unit AUD/NZD at 1.0797; s/l 1.0733; t/p 1.0988

Long half unit COINXBE at 345.00

Short half unit EUR at 1.2235; s/l 1.2367; t/p 1.2128

Short half unit NZD at 0.7249; s/l 0.7367; t/p 0.7078

Long half unit USD/CAD at 1.2625; s/l 1.2523; t/p 1.2848

Real-time AmpGFX – Sold EUR and NZD to re-open short positions (Fri 2/9/2018 10:16 AM MT)

Sold half unit EUR at 1.2235 and a half unit on NZD at 0.7249 to re-establish shorts covered this morning

This morning I thought we might see stable equity markets and some retracement of recent USD strength.

The performance of the equity market so far today has not been impressive, now I am seeing risk of an accelerating fall into the close for the week that would significantly undermine investor risk appetite further.

As such, I have re-established the earlier long USD positions. I intend to firm up my views and provide a more extensive comment later today.

Positions

Long one unit AUD/NZD at 1.0797; s/l 1.0733; t/p 1.0988

Short half unit TYH8 at 121-29+; s/l 121-22+

Long half unit COINXBE at 345.00

Short half unit EUR at 1.2335

Short half unit NZD at 0.7249

Real-time AmpGFX – Bought EUR and NZD to close short positions (Fri 2/9/2018 7:04 AM MT)

Bought half unit EUR at 1.2275 and half unit NZD at 0.7253

Comment

risk of some end week square up of recent short USD positions; locking in some profit and will reassess during the day.

Real-Time AmpGFX – bought US Tr bonds (to square half short), sold EUR/USD (Fri 2/2/2018 5:26 AM MT)

I bought half unit of US TYH8 (to share half short) at 121-05, I remain half unit short

I sold half unit EUR/USD at 1.2490, to re-establish short after being stopped out yesterday.

Comment to follow (see separate post on 2-Feb)

Positions

Short half unit TYH8 at 122.203125; s/l 122-06+ (yield at around 2.65%)

Short half EUR/USD at 1.2490; s/l 1.2623

Stopped out on 1-Feb

Real-Time AmpGFX – Sold EUR/USD (Tue 1/30/2018 1:46 PM MT)

Sold half unit EUR/USD at 1.2405 and s/l orders moved closer to market in short USTreasury bonds and long AUD/NZD.

Comment

Bond yields may have taken over the driver’s seat for global equities, rising more on their own accord and placing some selling pressure on global equities.

The USD has been more correlated with equities recently, and corrective price action in equities may also help the USD also recover somewhat.

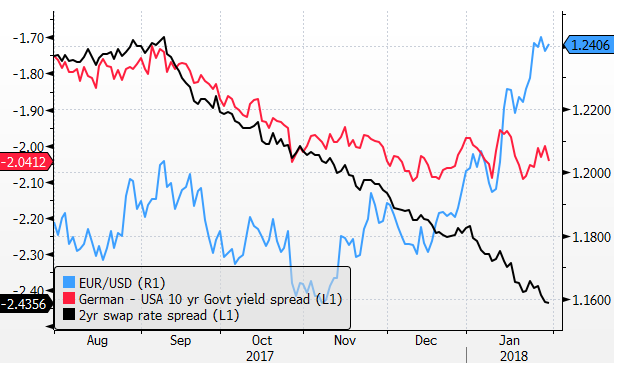

Even though currencies have not been responding to yield spreads; if markets turn corrective, they may refocus somewhat on yield spreads.

The short end spread has moved to a new wide, and the long end German/US yield spread has remained relatively stable in recent months as the EUR has risen to new highs.

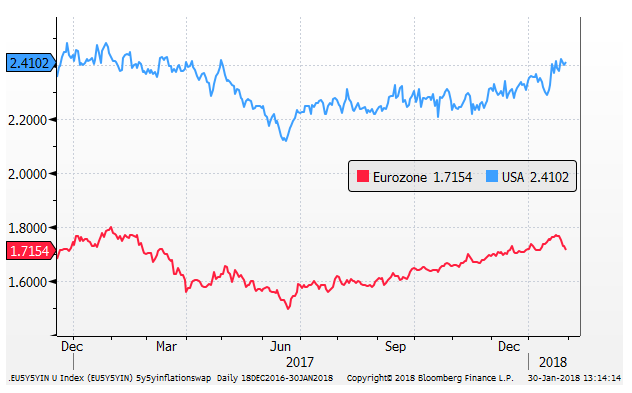

Inflation expectations 5yr5yr fwd swaps show some relative improvement in US inflation expectations in the last two weeks. This may reflect concern that the high EUR is dampening inflation in the Eurozone, and thus may prompt lower for longer policy comments by the ECB.

The German inflation data was weaker than expected, pointing to a lower than forecast EU CPI report on Wednesday

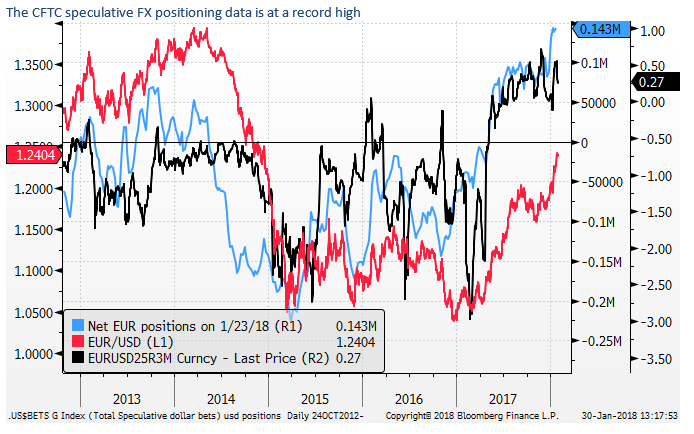

The EUR is into a significant long-term resistance zone, retracing about two-thirds of its QE/NIRP fall from 2014 to 2016, near the base levels from 2005 to 2014.

The market may be reluctant to buy the USD ahead of the Trump State of the Union Address, worried he may sound divisive. But the chances are that this speech does little to change market opinion.

The market may be reluctant to buy the USD ahead of another US Congress government funding bill needed by 8 Feb, and debt ceiling issues towards late Feb.

However, it may be the case that political risk in the USD is already high, and these issues may not be the deciding factor for the USD.

Positions

Long a half unit of an XBT derivative at $10,600 (Bitcoin tracker ETN) – no orders

Long half unit AUD/NZD at 1.0959; s/l 1.0943; t/p 1.1123 (s/l raised from 1.0843)

Short half unit TYH8 at 122.671875; s/l 122-22+ (yield at around 2.58%) (lowered from 123-19.5)

Short half unit TYH8 at 122.203125; s/l 122-06+ (yield at around 2.65%) (lowered from 122-22.5)

Short half EUR/USD at 1.2405; s/l 1.2513; t/p 1.2128