Short EUR/USD (From 5-Oct to 10-Oct)

Real-Time AmpGFX – Bought EUR/USD to close short position (Wed 10/10/2018 8:56 AM MT)

Bought EUR/USD at 1.1533 to close short position

Comment

Optimism is building for a deal on Brexit being produced by Monday

We see the updraft in the GBP as potentially quite large and this could drag up the EUR and weaken the USD for a time.

This closes all our positions as we were stopped out of a short AUD/USD position earlier on Wednesday in Asian trading.

Real-Time AmpGFX – Sold EUR/USD (Fri 10/5/2018 1:06 PM MT)

Sold one unit EUR/USD at 1.1521

Comment

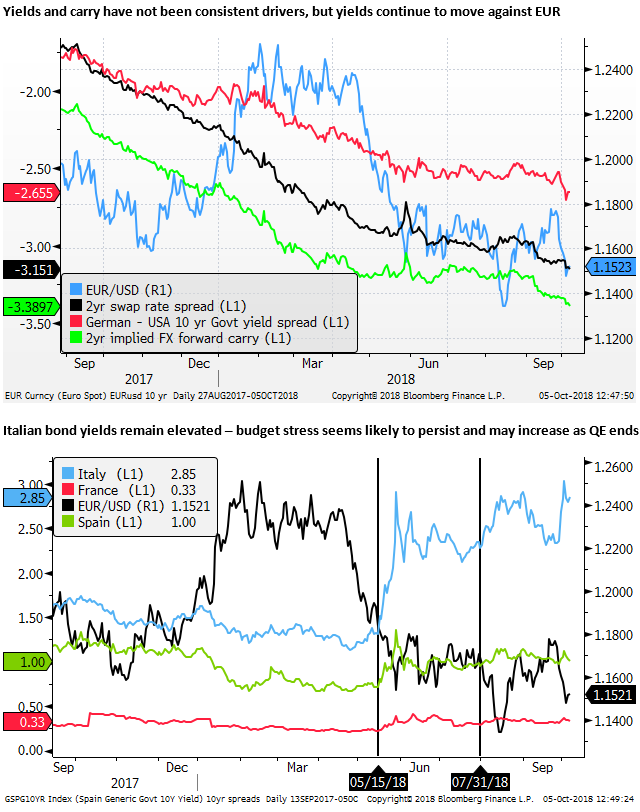

European economic reports continue to struggle through the middle of the year, and CPI core inflation was lower than expected in September.

Italy’s budget projections are likely to generate tensions with the EU. Italian bond yields remain elevated. Eurozone equities are struggling.

With the ECB tapering its purchases further since October and ending purchases from January, official support for Italian and other bonds in Europe will decline, generating more risk of weaker outcomes.

US yields have jumped this week, and are holding recent gains which is consistent with a stronger longer-term outlook for the US economy. It may generate broader strength in the USD in coming weeks, extending gains this week

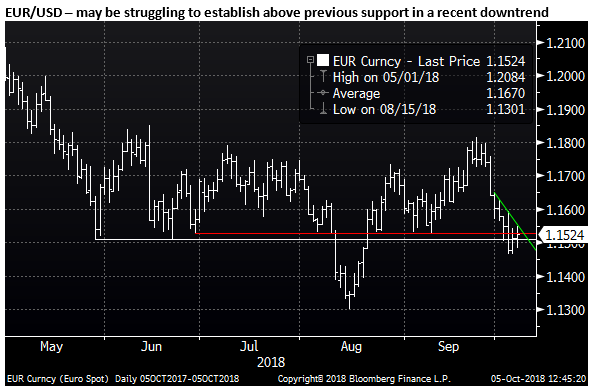

Technically EUR may be settling below its range established from Jun/Sep (excluding a period of weakness in mid-August), at least it is struggling to regain and hold previous lows in the low 1.15s.

Positions

Short one unit AUD/USD at 0.7075; s/l 0.7123; t/p 0.6823 (Capital at risk 0.49%)

Short one unit EUR/USD at 1.1521, s/l 1.1613; t/p1.1358 (Capital at risk 0.83)

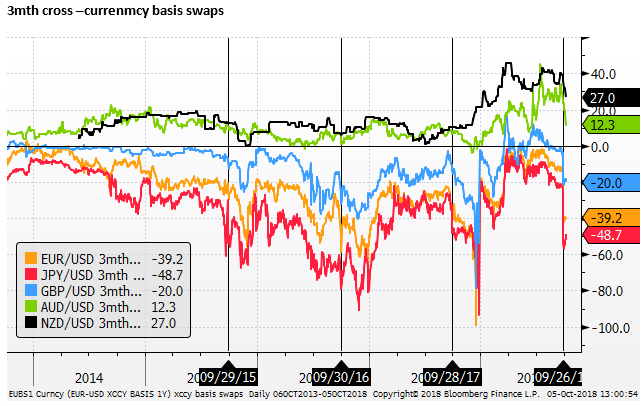

As often happens, dollar funding costs for three-months (now through the end of the year) have increased since end-Sep. This increase through the x-ccy swap market is relatively large for this time of year, and can tend to spike more later in the year. This increases carry return for the USD may help support the USD.