Short NZD/CAD ( From 14-Sep to 20-Sep)

Real-Time AmpGFX – Assessment after NZD surge (Thu 9/20/2018 2:24 PM MT)

We were stopped out of our short CAD/NZD position today on the rise in the pair through 0.8623.

The principal cause is the rebound in the NZD following a stronger than expected GDP report yesterday.

In the global risk-on rebound this week, the NZD may have been playing catch-up. The NZ data trend has been weaker than expected and the market may have been clinging to a negative outlook for the NZD, but gave up after the GDP report.

The GDP outcome for Q2 was strong after three-quarters of lacklustre growth. The data alone might suggest the RBNZ will stay with a steady rates policy for some time, anticipating that the next move in rates will be higher.

However, as we have discussed, the business and consumer survey data has been consistently softer this year and point to a weaker second half economy, and below trend growth through the year, raising the risks that the RBNZ will cut rates at some stage, potentially before year end.

Milk futures prices are also weaker, so we continue to expect under-performance in the NZD, and its rebound may be an opportunity to sell.

The issue is finding the right candidate to sell NZD against.

We are not inclined to jump back into the CAD at this time; while we see a NAFTA trade deal as likely, this outcome may now be factored into CAD to a significant extent, and a no deal could have a large negative impact on the CAD.

Furthermore, CPI and retail sales data out in Canada tomorrow may cause significant moves in CAD that are hard to predict.

The USD is under pressure broadly this week. We are not confident that it will reverse direction quickly. Sentiment may have swung back to EM markets in the near term based largely on the idea that they are good value after their wide under-performance of USD assets in recent months.

The market may see mid-term election risk as negative for the USD, or worry about a negative backlash from tariff wars on US business and consumer confidence. There is a tendency for the market to look for a peak in US rates and worry about twin deficits over recent years.

As we have discussed in the past, the choppy performance in the USD in recent years may reflect a battle between short-term positive cyclical strength vs long-term structural weakness.

Perhaps we could buy EUR that appears to have made a significant break higher out of its recent range. This might be a viable trade. The Italian government appears set to stay within EU budget guidelines. European equities and credit risk metrics have improved significantly.

However, Eurozone economic and inflation data have disappointed expectations of a rebound, so it hard to see a strong fundamental case for its continued advance.

Perhaps buying a Scandi currency is a thought. SEK and NOK are showing strength as the market gears up for rate hikes expected relatively soon. However, trading NZD vs Scandis seems kind of funky, spreads and slippage may be hard to manage. My level of expertise with Scandi’s is low.

Selling NZD vs JPY is not unthinkable. Japanese economic reports are showing strength. Japanese equities are performing well recently with a number of commentators noting strong profit growth in Japan. Abe has won a vote for LDP party leader removing political uncertainty.

NZD/JPY has risen significantly and may be approaching technical resistance; it would be a somewhat contrary trade

The risk is that JPY remains soft as US yields rise and risk-on trading attracts sales of JPY. On the other hand, JPY has had a limited correlation with any one factor in the last year, so we do not sense that it will fall much even if yields and global equities rise.

AUD/NZD is a go-to pair to reflect fundamental domestic conditions between the two. Buying AUD/NZD may work, the rates and commodity spreads suggest it can trade higher. Technically these are also good levels to buy, near the bottom of its range, and possibly an uptrend.

The issue I have with AUD is the weak housing market, legal issues facing banks that may make them tighten credit conditions further, and the increasing political uncertainty. The risk posed by tariffs appears to have decreased for now, but may come back at some stage.

After a few trades in a row that have gone bad, I feel that I need to be patient and wait for a better opportunities.

The RBNZ statement is next Thursday. It is between MPS, so the safe bet for the RBNZ is to leave its messages unchanged, so it should not affect the NZD. The ANZ business confidence data on Wednesday may be important. If it continues to languish at recent lows, then concerns for weaker growth should build. On the other hand, a rebound could contribute to a further squeeze higher in the NZD.

Real-Time AmpGFX – Sold NZD/CAD to re-establish short position (Tue 9/18/2018 6:49 AM)

Sold one unit of NZD/CAD at 0.8573

Comment

We were stopped out of our short position in NZD/CAD during our evening on a rise through our stop loss at 0.8608, executed at 0.86114, this appears to be essentially at the high in the pair.

We will be looking into what seems to be a surprising rise in AUD and NZD after the tariff announcements in early- Asia trading yesterday.

It generally reflects the strength in most Asian currencies and most Asian equities, including the Chinese markets, which may reflect a degree of buy the rumour sell the fact reaction in a market that has already existed a lot of their exposure to the region.

However, the tariff announcement was at the harsh end of the spectrum, rising to 25% at year-end and the threat of expansion to a further $267bn in goods.

This should be viewed as a significant risk to the Asia region, and a threat to global growth confidence.

As mentioned earlier, the NZ economy appears to have stalled, and milk futures prices are falling. So we also want to be short NZD in any case.

The NZ GDP data coming this week is an immediate risk to the trade. The market is still looking for a reasonable increase in Q2, although the predicted annual growth figure is expected to be below trend growth (somewhat above 3%).

Positions

Short one unit NZD/CAD at 0.8573; s/l 0.8623; t/p 0.8023 (Capital at risk 0.67%)

Short one unit AUD/USD at 0.7162; s/l 0.7228 (Capital at Risk 0.65%)

Real-Time AmpGFX – Sold NZD/CAD (Fri 9/14/2018 11:04 AM MT)

Sold one unit of NZD/CAD at 0.8547

Comment

We were stopped out of a short EUR/CAD position on a move through our stop loss at 1.5223, executed at 1.52252 earlier on Friday, which unfortunately was very close to the high.

Bloomberg reports that “four people familiar with the matter” said that Trump instructed aides on Thursday to proceed with tariffs “on about $200bn” more Chinese goods, despite the invitation by Treasury Secretary Mnuchin to restart talks with China.

The report suggests that an announcement has been delayed as the administration considers revisions based on concerns raised in the public comment period. This suggests there may be some adjustment in the tariff rates or modification of which goods tariffs should apply to.

There has been no official announcement, and it remains to be seen if the US administration will move ahead, but our view is that the trade hawks in the administration have had the upper hand with Trump and we should expect further action.

Milk futures prices continue to slide.

The NZ PMI manufacturing survey three-month moving average fell to 52.0 in August, a low since Dec-2012, concurring with the weaker ANZ business survey.

Market expectations are for NZ GDP growth to remain below potential in Q2, released next week.

A NAFTA trade deal remains in negotiation, but we see less blocking the path to an agreement. Issues remaining seem relatively minor, and Canada appears willing to provide some ground on issues over dairy; enough to provide a face-saving way for Trump to accept a deal that most in Congress appear to want, allowing him to keep his focus on being tough with China.

Canada faces some significant data points next week including CPI and retail sales on Friday next week; we have no particular bias as to whether these reports will be strong or weak.

NZD/CAD still appears in a downtrend after breaking its lows in August. The retracement in recent days has stalled near these previous lows.

Positions

Short one unit NZD/CAD at 0.8547; s/l 0.8608; t/p 0.8023 (Capital at risk 0.79%)

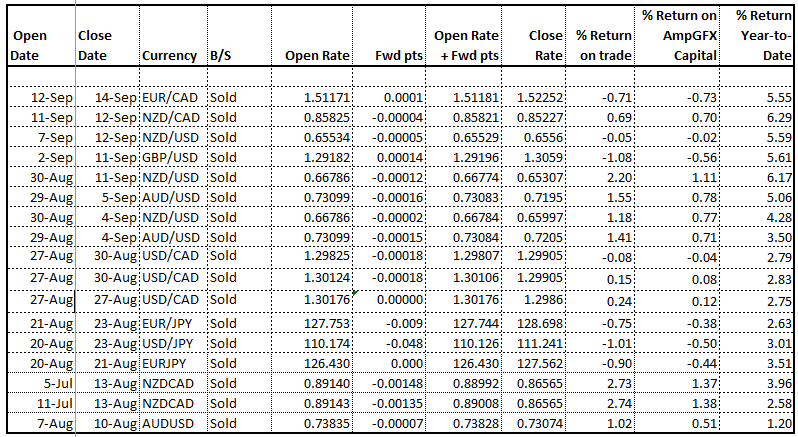

Recent Trades