Sold 10-year US Treasury Bond Futures (from 12-Jan to 5-Feb)

Remaining half unit TYH8 closed on stop on 5-Feb (in profit)

Real-Time AmpGFX – bought US Tr bonds (to square half short), sold EUR/USD (Fri 2/2/2018 5:26 AM MT)

I bought half unit of US TYH8 (to share half short) at 121-05, I remain half unit short

I sold half unit EUR/USD at 1.2490, to re-establish short after being stopped out yesterday.

Comment to follow (see separate post on 2-Feb)

Positions

Short half unit TYH8 at 122.203125; s/l 122-06+ (yield at around 2.65%)

Short half EUR/USD at 1.2490

Real-Time AmpGFX – Sold US Treasury 10-year bonds, adding to short (Wed 1/24/2018 1:37 PM MT)

I have sold a half unit of TYH8 at 122-0.6+, adding to short US 10 year Treasury bond futures short.

Comment

Global growth indicators have continued to improve.

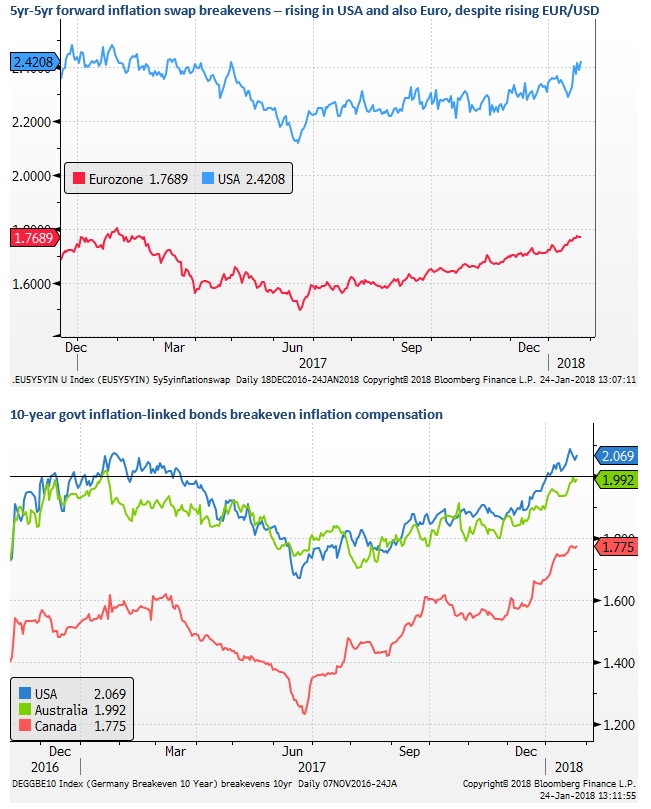

Inflation breakevens have shown higher inflation expectations, in line with firming commodity prices.

US GDP report due for release on Friday, Atlanta Fed Nowcast is at 3.4%, NYFed Nowcast at 3.94%, median market estimate at 3.0% (bluechip forecast is 2.7%). The risk is biased toward a higher than expected outcome, and third in a row above 3.0%.

The USD has weakened further and this is further easing monetary conditions in the USA, and raises inflation expectations.

Trade measures by the US may raise inflation expectations.

Positions

Long a half unit of an XBT derivative at $10,600 (Bitcoin tracker ETN) – no orders

Long half unit AUD/NZD at 1.0959; s/ 1.0843; t/p 1.1123

Short half unit TYH8 at 122.671875; s/l 123-19+ (yield at around 2.47%)

Short half unit TYH* at 122.203125; s/l 122-22+ (yield at around 2.58%)

Real-Time AmpGFX – Sold US Treasury 10-year bonds (Fri 1/12/2018 7:20 AM MT)

Sold half unit of US Treasury 10 year bond futures (TYH8) at 122-21+/32 (benchmark yield at around 2.582)

Comment

I have been on vacation with poor access to the internet, but have been watching developments and thinking about selling US bonds for the last week or so. But I decided to wait until I returned to the office.

I will flesh out thoughts on this further, but some are: the weak USD trend is adding to US inflation pressure. Globally major economies are moving towards full employment. The market still has a very sanguine view on global inflation pressure. Perhaps the secular forces that have pushed inflation lower are now largely in the data (have run their course). Commodity price indices are higher. The global economy appears to be in a sustainable growth path that could withstand policy tightening. The market is very sensitive to any news that the ECB or BoJ may be lessening QE. The equity market rally has come a long way but still appears very resilient. Central banks should increasingly consider policy tightening to address financial stability risks from rising asset prices, at least to lift real yields that appear very depressed.

US CPI was released this morning; this trade was conducted after its release. Yields rose after the core CPI data was a tick higher than expected.

Positions

Long a half unit of an XBT derivative at $10,600 (Bitcoin tracker ETN) – no orders

Long half unit AUD/NZD at 1.0959; s/ 1.0843; t/p 1.1123

Short half unit TYH8 at 122.671875; s/l 123-19+ (yield at around 2.47%)