Trading View Update – Bitcoin, US Bonds, AUD/NZD

Trading View Update – Bitcoin, US Bonds, AUD/NZD

Much of the focus in the market at the moment is on the further rapid slide in the USD to new lows since 2014 . I haven’t participated in this fall, preferring instead to place my eggs in the basket of Bitcoin and more recently shorting US Treasuries.

Bitcoin

The performance of Bitcoin since I got involved has been pretty nerve-racking, and even a modest position has generated some interesting mark-to-market days. I anticipated a volatile ride and have been telling myself that this is a long-term play. Still, I am spending too much time watching its daily gyrations. Nevertheless, I am resigning myself to take whatever comes with Bitcoin. It is my one long-term play. I anticipate it steadily gaining credibility as a store of value.

As Cryptocurrencies and the blockchain technology gain acceptance, perhaps begrudgingly, and battle through an inevitable regulatory push-back, Bitcoins status should grow. In fact, more regulation should eventually improve the acceptability and status of Bitcoin, and it may grow to rival gold as a safe-haven from government and financial markets misadventure.

I agree with many of the naysayers that say it is a mania and is being driven to a large extent by highly speculative players seeking quick gains, attracted largely by its rapid price gain. But I still see that gain as sound in the long run. It is difficult to say what value Bitcoin should have in the long run, just like it is difficult to say what value gold should have, the price of which is to a large extent driven by investor demand for an ultimate safe-haven.

As Bitcoin goes through a period of consolidation and back-filling, it could halve in value from here, but if and when it starts to rise consistently again that speculative mania could again drive it much higher and quickly. My rough view on ‘fair-value’ is around 50,000, but I can see the potential for a mania fueled push to 100,000 to 500,000. I don’t have a strong view on the timing of the next period of upswing. It has probably been pushed back as it comes to terms with increasing regulation over the course of this year.

US Bonds

My short US Treasury bond position is in part inspired by the weak USD. The weak USD reflects strong global equity markets, fueled by stronger and more synchronised global growth. The US is participating in this growth that appears more sustainable than at any time since the 2008 Global Financial Crisis.

Global inflation pressure has been subdued, driving global yields to record lows in recent years, along with the dampening impact of global QE policies on yields.

Nascent inflation pressure is building, and may well come through in the USA faster than other countries. The weaker USD is increasing that inflation pressure in the USA, directly via higher commodity prices and higher import prices, and indirectly via boosting net export demand in the USA.

Despite the rate hikes to date in the USA, financial conditions have eased, and continue to ease, due to a weaker USD and rising equity prices. And this should increase upward pressure on US yields.

Even if there are still secular trends holding down consumer price inflation related to technological disruption and demographic changes, yields should continue to creep up as more rapid economic growth begins to bump up against capacity constraints. A point that Ray Dalio made at Davos on Wednesday.

Furthermore, there is a risk that these secular forces driving down inflation are peaking, just as nascent wage and commodity price pressures are building. As such, there could be upside surprises to still very subdued global inflation expectations.

In addition, the tide has turned on the pace of global QE policy. QE may still be dampening yields, but it may no longer be enough to prevent them from responding the building fundamental pressure to rise.

Reluctant to sell the USD

After a year-long fall in the USD, we are wary of selling the USD because we see a risk of rising US yields returning to support the USD. In recent months the fall in the USD appears more related to a global chase for equities bringing with it related currency flows.

Yields have risen only mildly to date and have not been seen to threaten the global equity market. The improvement in the USD yield advantage against many other currencies has failed to support the USD much; if at all.

Yield enhancement via currency carry trades is out of favour as investors focus more on equity returns and perceive the USD at risk of continuing to fall for a variety of reasons. These may include: long-term valuations, current account and fiscal balances, the political uncertainty in the USA, and the recent pattern of a weaker USD that appears more correlated to global equity performance.

However, if US rates and yields rise more sharply than currently expected, due to higher inflation expectations, in part driven by the weaker USD over the last year, it could trigger a correction in global equities and re-direct market attention to the recent improvement in the US yield advantage. The resulting rebound in the USD could be significant and might arise after a significant further rise in US yields. As such, tactically we prefer to sell US bonds rather than sell USD at this time.

AUD/NZD

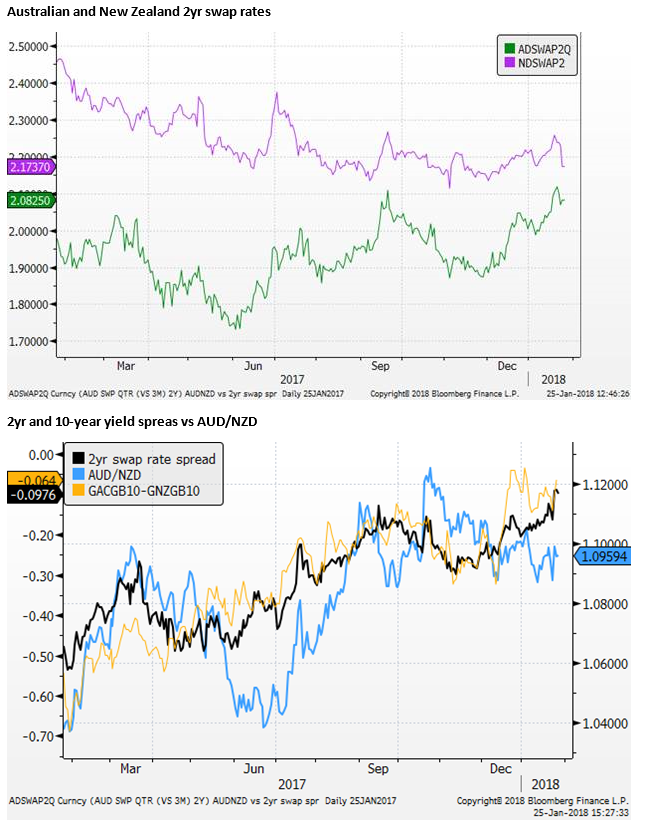

Another position that we have held since mid-December is a long AUD/NZD position. This has traded in a fairly narrow and directionless range since we entered the trade. When we entered this trade noting that interest rate spreads and relative commodity price developments pointed to upside risk for the cross.

However, there has been little investor interest in this cross in the past month, with much of the focus, in the FX market, on the broad direction of the USD.

The cross rebounded from the bottom of its range to near the top, after the much weaker than expected Q4 New Zealand inflation outcome. This accentuated the improvement in the AUD/NZD yield spread since last year, pushing the 2yr spread to a new high (-9bp) in about 18 months

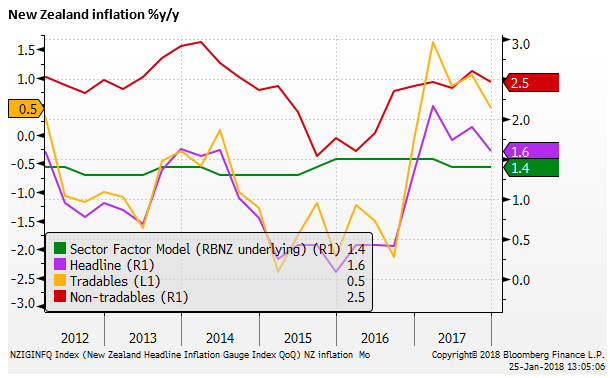

Weak NZ inflation

The weak NZ inflation data reflects those secular forces still weighing on inflation. Weak retail goods inflation, much of it imported, such as IT goods, clothing, footwear, furniture and appliances; all down significantly from a year earlier. Overall inflation slowed from 1.9%y/y in Q3 to 1.6%y/y in Q4, below the 2% target. However, domestically generated and underlying inflation measures were more stable.

The RBNZ preferred underlying measure, the Sector Factor Model, was steady at 1.4%y/y in Q4, continuing its largely unchanged position over the last five years, down from its highs a year earlier at 1.5%, up from 1.3% two years ago.

Non-tradables inflation slipped from a recent high of 2.6%y/y in Q3-17 to 2.5%y/y in Q4.

The trimmed mean slowed from 2.0%y/y to 1.7%y/y (using 2014 weights), but fell further on new weights to 1.5%y/y.

The weighted median was steady at 2.0%y/y.

Wary of weak Australian inflation

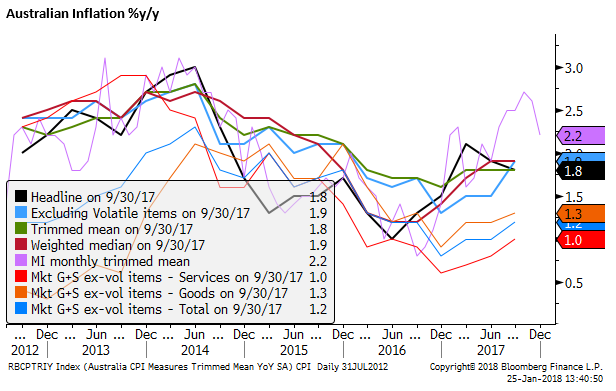

One of the reasons why the AUD/NZD has not risen more on this weak NZ inflation data is that the market may be wary that the same low inflation outcome will result in Australia when it releass its Q4 inflation data on Wednesday next week.

One reason to be wary of a low Australian inflation number is that the ABS reweighting of the CPI basket, the first in six years. This picks up a shift in consumer patterns towards cheaper goods and services. The RBA said in its November Statement on Monetary Policy that it lowered its inflation forecasts to “allow for the upcoming reweighting.”

Another reason is that Amazon launched its Australian operations in early-December, after much delay. In preparation for the increased competition from the online store, Australian retailers may have been more wary of price increases in the second half of last year. Considering New Zealand’s Q4 inflation miss came mostly from retail goods, the Amazon-effect might accentuate a similar trend in Australia.

The RBA forecast CPI headline at 2.0%y/y in Q4 and underlying inflation at 1.75%y/y in Q4, remaining steady at this level for the coming year before rising back to 2.0% in 2019; notably still below 2.5%; the mid-point of its 2 to 3% target range.

The market expectations on Bloomberg look a bit more optimistic. The median forecast for the trimmed mean and weighted-median underlying measures is 1.9%y/y, and 2.0%y/y for the headline measure.

The chart below of various CPI headline and underlying measures shows that inflation has been trending up from a low around a year ago, although remains broadly below the RBA target.

It is interesting that the monthly inflation measure from the Melbourne Institute has significantly over-estimated inflation compared to the government ABS measures since mid-2017.

Australian data out-performing NZ since mid-2017

Regarding recent economic data trends, Australia has tended to out-perform expectations, while New Zealand has tended to underperform. The Citibank index of economic surprises is up from -25 in December to +48 in Australia. In New Zealand, it is down from around +35 in December to -14.

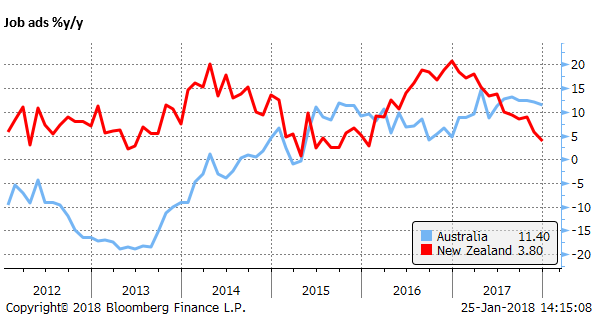

By comparison, it appears that the momentum in the Australian economy has moved ahead of that in New Zealand since around mid-2017. For example, job ads growth in Australia has held up at a strong 11.4%y/y in December, while it has slowed in New Zealand to 3.8%y/y.

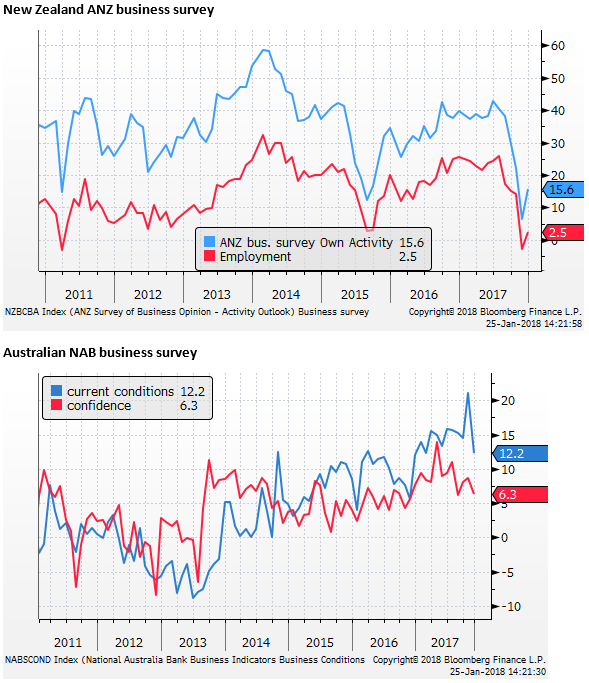

Similarly, business surveys have ebbed in New Zealand and have remained elevated in Australia

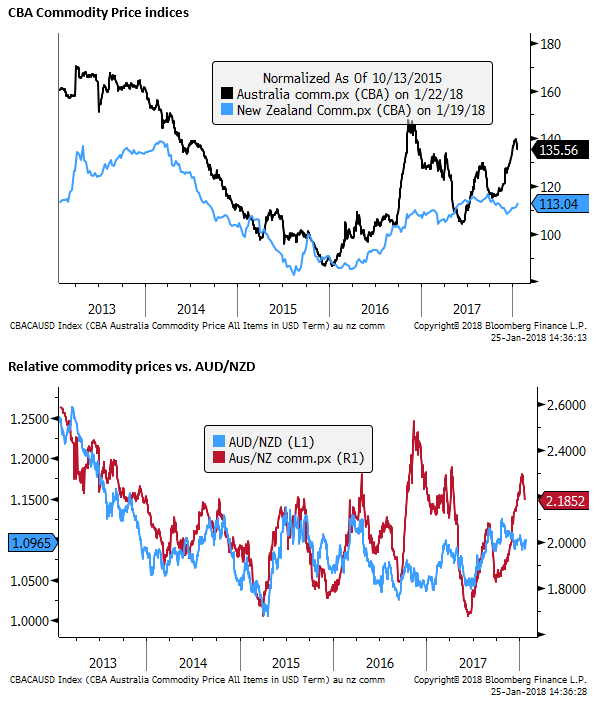

Commodity prices

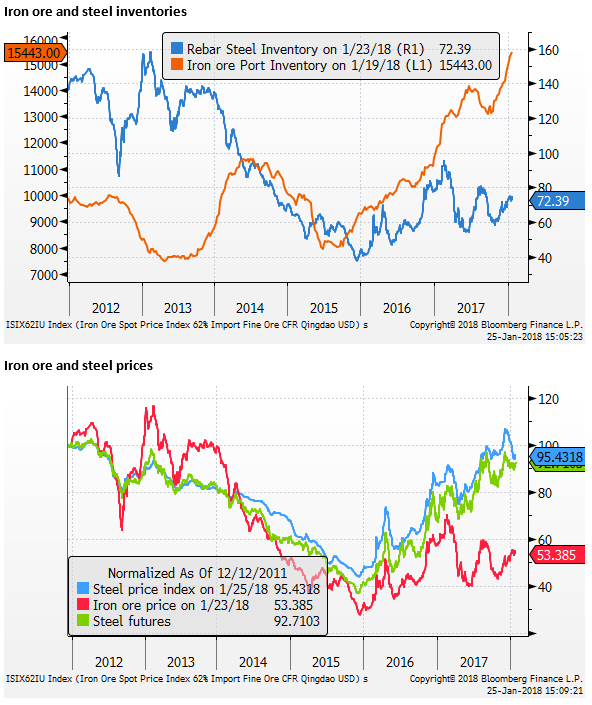

Commodity prices started to move in Australia’s favour from November, with a solid recovery in Australia’s steel-making and energy commodities from lows in October. More recently, New Zealand commodity prices have recovered modestly, while Australian prices have ebbed.

The China factor

A factor that may be influencing the AUD more negatively than NZD is that AUD is seen as the main proxy for Chinese economic and financial risks.

There may also be more concern over slowing in Australia’s housing market, generating fears of fallout to consumer activity. The election cycle may also turn more negative for Australia as the year progresses

New Zealand’s housing market has also slowed in the last year, and it too may be influenced by developments in China. However, when investors are expressing concern over these risk factors, the AUD has tended to be more negatively affected than the NZD.

Views around China are generally stable, and the market remains upbeat on the global outlook. However, China is seen to be placing more emphasis on addressing excesses in shadow banking this year, and this appears to have generated higher corporate bond yields in China, and may tighten monetary conditions for Chinese companies and local governments.

There are also widespread calls for weaker iron ore prices in the coming year on high stockpiles in China, increasing supply from Australian producers, and a seasonal pattern that is starting to develop in China.