A bout of optimism amidst intensifying risks

The turn lower in the USD in recent sessions feels like a technical retreat from resistance. It comes despite intensifying risk from a trade war, ongoing political risk in Italy and a tightening US labour market. However, we are wary that the USD may continue to weaken in the near term. Political risk in the USA is rising. A trade war could be seen as a threat to US hegemony and support for tariffs from the US public may waver. Global growth indicators have weakened, but there is scope for confidence to improve, even if risks remain elevated. The Fed has sent mixed messages. Longer term concerns over the US twin deficits could return. The AUD outlook remains mixed. Partial indicators point to more rapid economic recovery, but the housing market may be deteriorating. Higher coal prices have boosted the terms of trade, but risks from a trade war and China’s regulatory crackdown on shadow-banking remain elevated.

A bout of investor optimism amidst a range of ongoing and even intensified risks

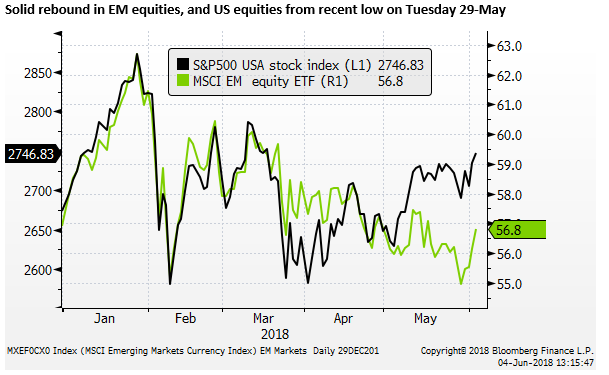

Trade war news has if anything intensified in the last week, and over the weekend. But you would not know it with the rebound in emerging market and global equities, and a fall in the USD.

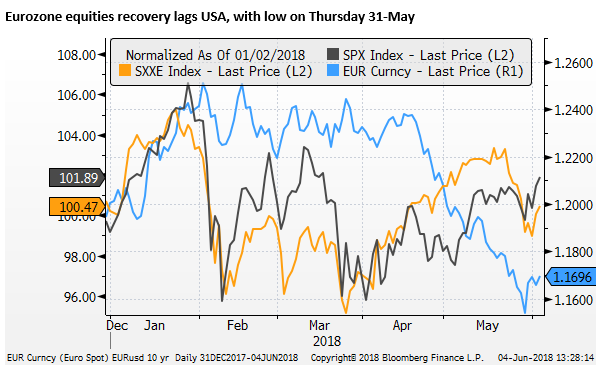

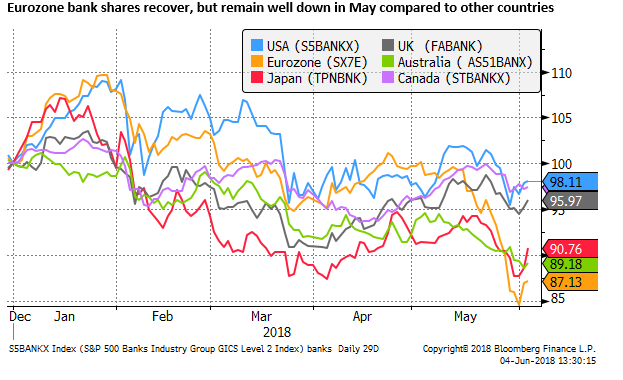

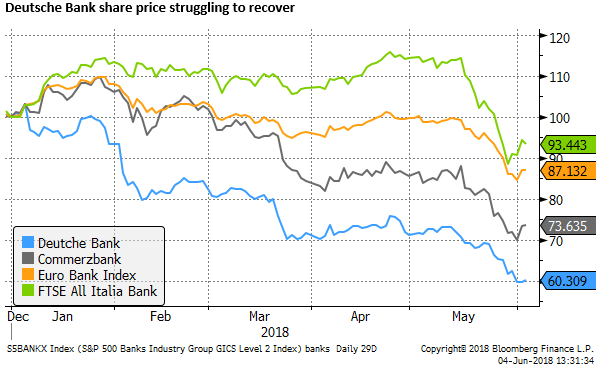

Political risk in Italy has hardly been removed with the governing coalition of left and right populist parties that wish to defy EU fiscal rules. A big question for Italian and Eurozone financial stability is what happens if the ECB ends or further reduces its asset purchases after September; will Italian yields blow out further without ECB demand?

US labour data increase the risk that the US economy moves into a higher inflation environment, forcing the Fed to raise rates faster. At the very least the Fed appears set to continue to raise interest rates on a quarterly pace for a while yet.

US Political Risk

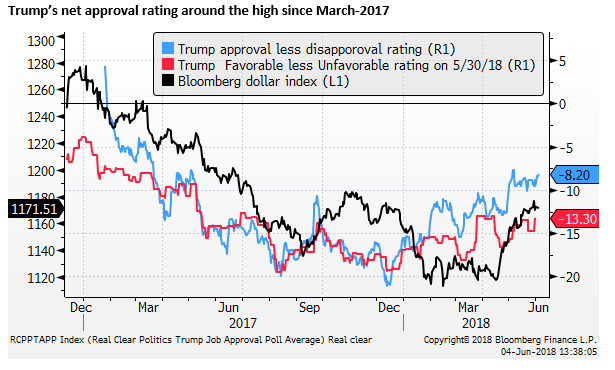

Perhaps the USD is weaker on Monday because of political risk in the USA, with Trump threatening to defy the Mueller investigation. The mid-term elections in November are approaching, and Trump faces a potential domestic backlash from a trade war with its G7 partners and China.

In recent months, Trump’s approval rating has improved as he has taken a tough line in trade negotiations. But domestic opinions may become more mixed as commentators highlight the potential economic fallout to USA manufacturers, facing higher costs for steel and aluminium, and a tougher environment in its export markets.

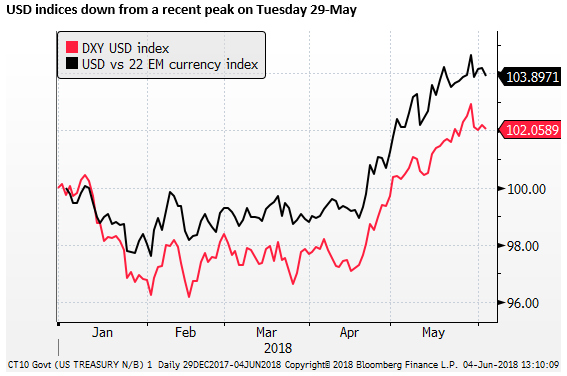

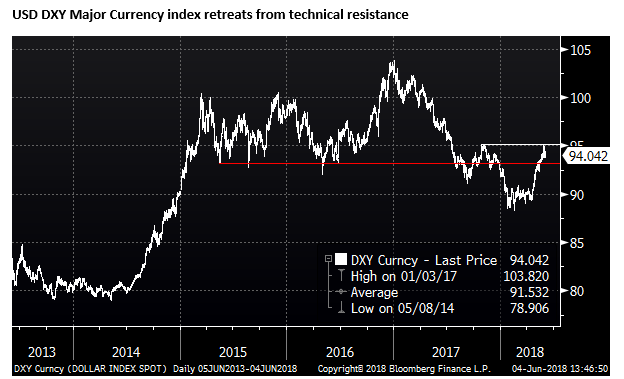

Technical pull-back in the USD

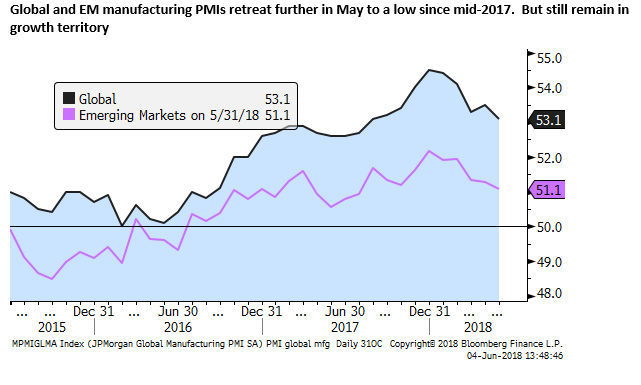

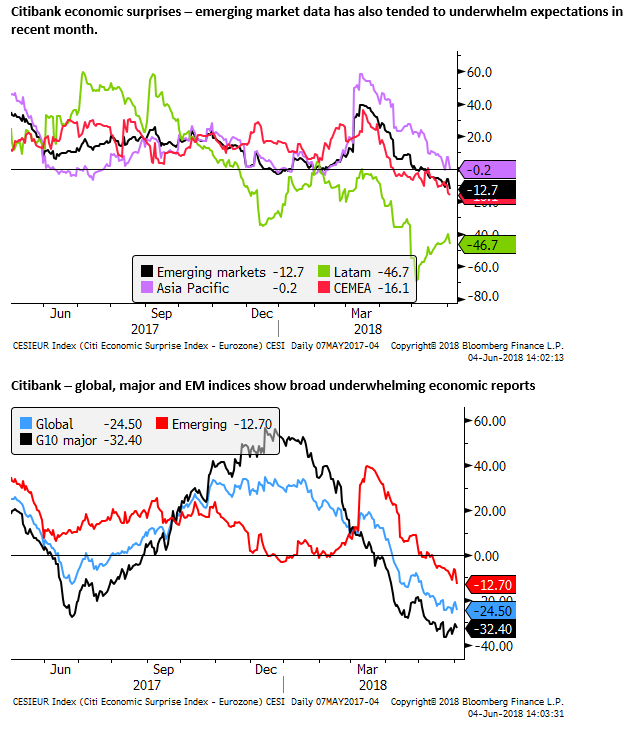

The USD may simply be retracing after a period of strong recovery. Investors had retreated from EM and higher risk markets this year. Short term traders have gotten long USD. Even if a trade war eventuates, or Italy’s new leaders threaten to blow-up the EUR, it may take months, and in the meantime, global economic growth indicators remain solid, even if they have retreated from earlier in the year.

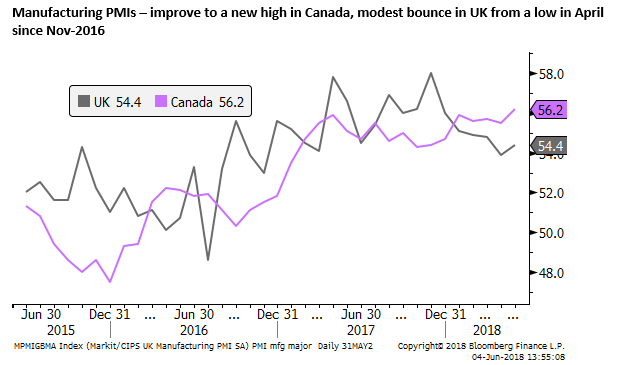

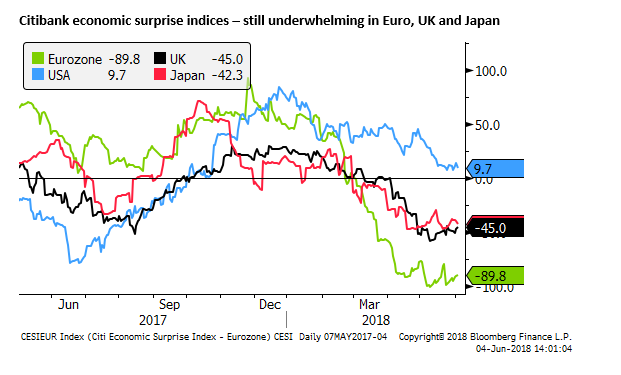

The Eurozone and UK economies are thought to have been depressed by a range of temporary factors in the first four months of the year (weather, strikes, and timing of Easter). If so, we should expect a period of better economic news in coming months.

We might again see a degree of synchronized global economic recovery that buoyed investor confidence last year and early this year. So far the evidence is mixed, but there is room for investors to respond if global economic reports, especially outside the USA show improvement

Wary of further weakness in USD

The interaction of short-term momentum, economic data and risks from a developing trade war and political uncertainty make for difficult trading conditions ahead in the FX market. If we had to have a view, we would be wary of further weakness in the USD in the near term.

The market could easily again latch onto a view that the USD faces long-term challenges from twin deficits.

While Trump may be right that with its large trade deficit the USA is well-placed to win a trade war, the market could see the consensus building outside the USA (in defiance of US trade policy) as a sign of longer-term isolation in the US economy. Investors could see diminishing USA hegemony and less reason for central banks to hold USD in FX reserves.

The tightening US labor market could be seen as a weakness rather than a strength, limiting the growth potential in the USA. While labor market bottlenecks could generate inflation, inflation has been slow to develop and investors continue to doubt it will rise much.

The Fed has said it will tolerate a period of above-target inflation, and it is unlikely to quickly react to fresh signs that inflation is rising, especially if it does so only gradually. While wage growth ticked up in the payrolls report, the uptrend is still gentle and not clearly established.

The message from the FOMC April policy meeting was mixed and suggests that there is still considerable debate over the need to raise rates much further. Some members are unconvinced by the tightening labour market data and want to see clearer evidence of higher wages. Some are concerned that the flattening of the yield curve is signalling tightening financial conditions. Some participants think that the forward guidance in the policy statement should be changed to acknowledge that policy is now closer to neutral, rather than “likely to remain, for some time, below levels that expected to prevail in the longer run”.

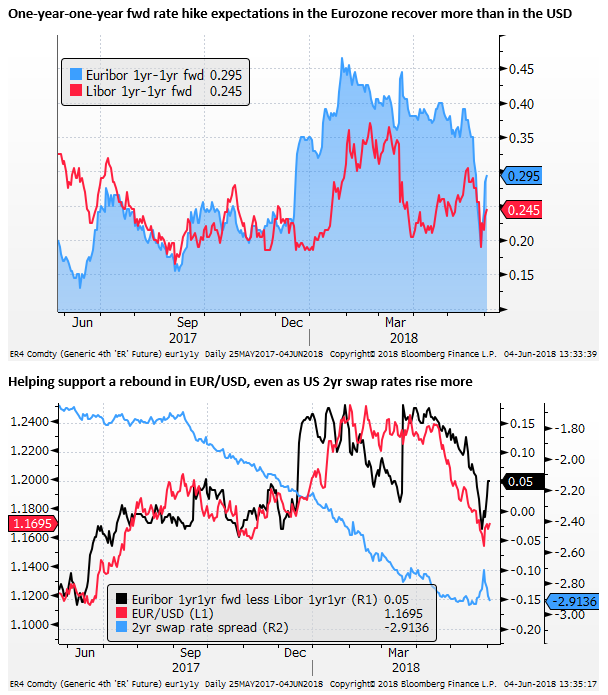

As such, the market may again be trying to look over the peak in US rates towards the next US economic downturn and convergence in economic conditions and monetary policies globally.

Political uncertainty in the US may increase again, undermining confidence in the USD. A weaker USD will be seen as providing support to emerging market economies.

Lower oil prices may tend to further boost confidence in EM markets, and combined with a weaker USD, tend to encourage self-reinforcing flow to EM markets.

EUR and commodity currencies, acting more like high-beta assets, positively correlated with global investor confidence, may also strengthen. If so, the USD will again appear weak and able to defy stronger US economic reports, just as it did late last year into January, and following the strong US labor data on Friday.

Australian recovery looking more robust

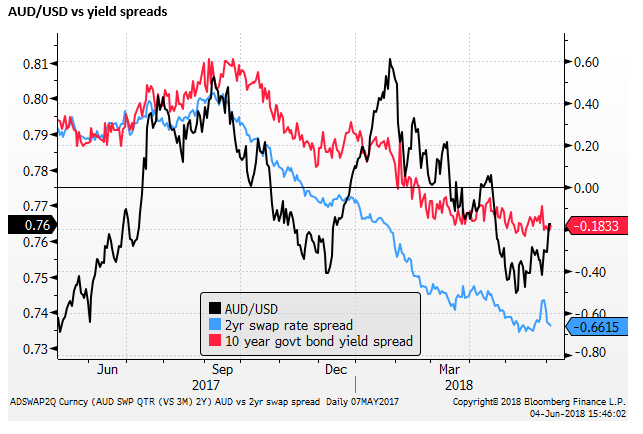

One of the most upwardly mobile currencies on Monday was the AUD, busting up through 0.76 that had capped the currency over the last month.

Economic reports released on Monday point to solid underlying economic momentum.

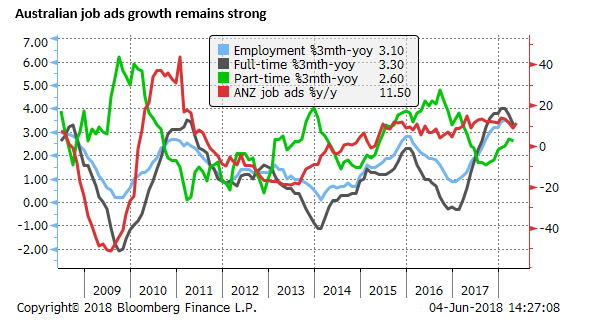

Job ads rebounded 1.5%m/m in May, after drifting lower by a total of 0.7% over the previous three months, to be up a sold 11.5%y/y.

From the business indicators report that provides components for the GDP Report (Due on Wednesday), company profits rose 5.9%q/q in Q1, more than 3.0% expected, up 5.8%y/y, supported by stronger mining income, indicative of higher commodity prices.

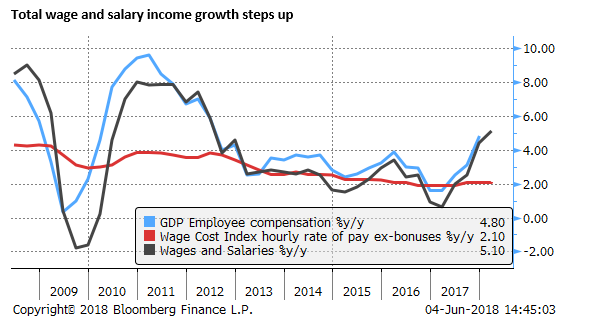

Wages and salaries rose 0.8%q/q and 5.1%y/y, the fastest rate since 2012, indicative of strong employment growth, and stabilizing wage growth, which should be a support for household consumption.

Inventories rose 0.7% q/q, more than an expected outcome of no change. Combined with the higher measures of national income, higher inventories should boost market expectations for the GDP report.

Typically economists await the current account data due later today before updating their GDP forecasts. The median expectation reported on Bloomberg ahead of these data was 2.7%y/y. There is every reason to see a higher outcome.

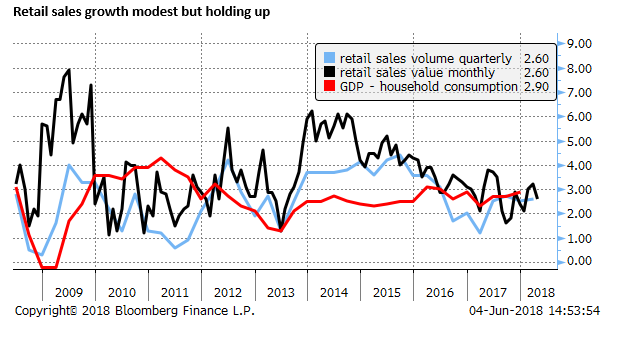

April retail sales also managed to beat expectations; up 0.4%m/m (somewhat above 0.3% expected). Sales value is up a modest 2.6%y/y, but up a more solid 4.3% annualized rate over the last three months.

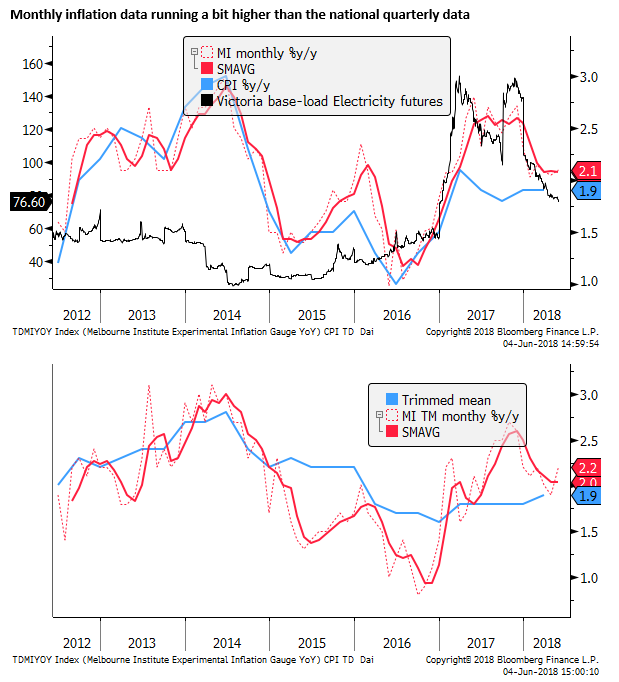

Inflation indicator firmer

The Melbourne Institute monthly inflation indicators also suggest that inflation may be a bit higher than the national quarterly data. The headline rose 2.1% 3mth/yoy in May (above the CPI up 1.9%y/y in Q1). The MI trimmed mean rose 2.0% 3mth/yoy in May (above the CPI trimmed mean up 1.9%y/y in Q1)

Not yet moving the needle on RBA policy

The question does this data move the needle on the RBA rates outlook. It didn’t on Monday, Australian 2yr swap rates rose about 2bp, no more than would have been expected with improved global investor appetite, and higher US rates.

The fact is that it kind of matches what the RBA has been predicting – a pick-up in GDP growth “to a little above 3% from late-2018” (May policy meeting minutes).

However, the data might suggest growth gets there a little earlier, so there is room for the market to bring forward their rate hike expectations somewhat.

Higher wages growth

Confidence in the growth and inflation outlook might have also been given a lift from an announcement on Friday that the Fair Work Commission approved a rise in the minimum wage of 3.5% from 1 July. This follows the 3.3% rise last year. Two years in a row where minimum wages have risen at more than the national pace of 2.1%y/y growth in the wage cost index. The decision might tend to help lift overall wage growth in the year ahead.

Housing market deteriorates

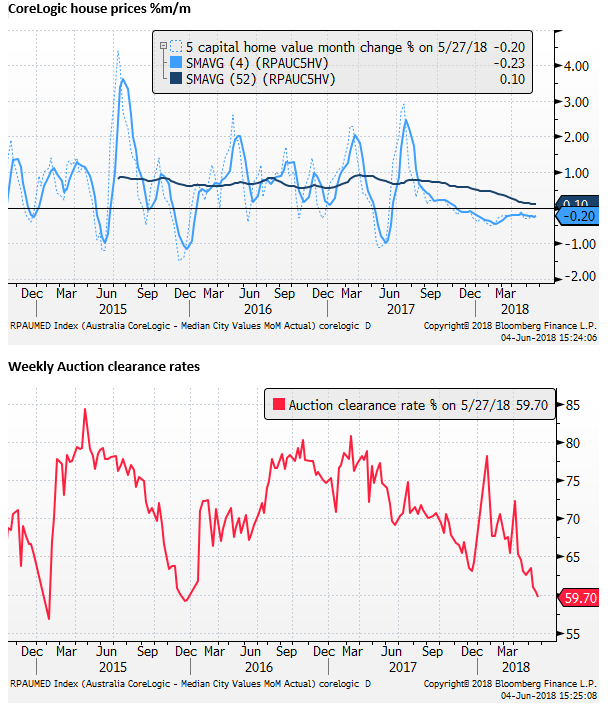

A factor that continues to dampen the outlook for rates is a slowing housing market. The CoreLogic house price index for Australian capital cities, reported last week, fell 0.2% m/m in May, the seventh month of declines. More alarmingly the auction clearance rate fell to 59.7 in the week to 27-May, well below the long run average above 70%, pointing to deteriorating demand.

As yet there is little evidence that weaker house prices have dampened household spending. Stronger employment growth is helping underpin household consumption, but there is a risk that a weak housing market undermines consumer confidence and increases savings as households see their wealth ebbing against high household debt.

The outlook for consumption is also clouded by the tightening in bank lending conditions that include higher rates on interest-only loans, forcing more households to switch to principle and interest payments that require higher monthly loan repayments. The RBA has downplayed the impact on consumption patterns, but it does generate greater uncertainty. Furthermore, banks are expected to tighten lending conditions further in the wake of the Royal Commission into banking and broader financial sector conduct.

An additional risk element for housing is the possibility of tax policy changes after the next election, expected within the next year. The headwinds to the housing market appear to be weighing on buyer sentiment and contributing to a weaker house market.

As such, notwithstanding solid economic growth indicators, the market is reluctant to bring forward RBA rate hike expectations. This may limit potential upside for the AUD.

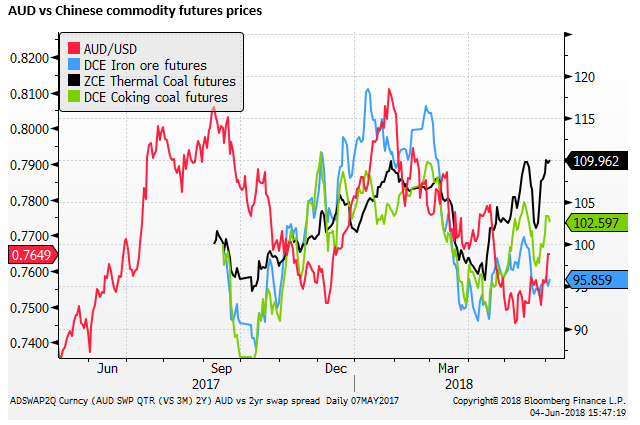

Higher coal prices support the AUD

Commodity prices are providing some support for the AUD. Iron ore prices have remained relatively stable since March, resilient to any fears that steel tariffs might disrupt demand and production of steel. Chinese demand appears stable. In the meantime, coal prices have risen, particularly thermal coal. We should expect to see this boost Australia’s net export performance in coming months.

Technical resistance at old uptrend line

Technically, the AUD is at an interesting juncture. It has broken above its recent highs in the last month around 0.7580/.7600, and these levels might now provide support. However, it has been in a downtrend since January and it is also facing resistance around previous lows in March, and an uptrend line over the last two years that it broke below in April. That line is now a resistance level.