A grimmer view on global risks boosting the dollar

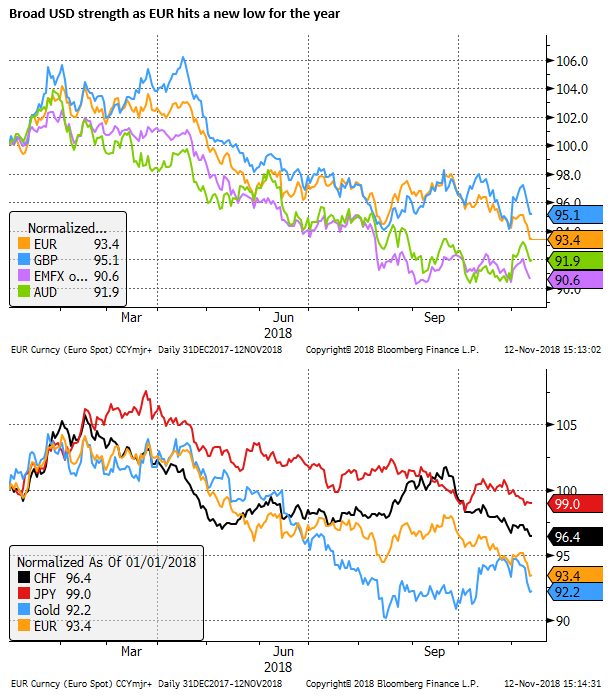

The market appears to be taking a grimmer view of big global risk factors (Brexit, Italy, Chinese economy, and US trade policy). The relative certainty that the Fed will persist with rate hikes despite souring global growth confidence may by driving up the USD. Asian markets may be undermined by signs of weaker demand for tech goods, and a lack of bounce in Chinese assets pointing to deeper more persistent troubles in China over an above fears over US trade policy. The EUR may be responding belatedly to persistently softer growth in the Eurozone and fading confidence in its export markets. Brexit uncertainty has increased, dragging down GBP, but it could rebound quickly if the market contemplates fresh elections and a second referendum. Two-way risks remain into year end. China is rolling out policies to support its economy, the Xi-Trump meeting may ease trade tensions, US political risks may become more elevated, oil price falls may support the global economy, and US rate hike expectations may fade if US equities slide accelerates. However, a relatively robust US economy, high USA yields, and fading global confidence may drive further gains in the USD in coming weeks.

Relative Certainty

Dollar gains accelerated and broadened on Monday. The GBP is slumping on renewed Brexit fears, and EUR appears to be developing a more persistent downtrend. Investors are taking a grimmer view of the big risk events that are in play (Brexit, Italy, China-US trade relations).

Despite high uncertainty in global markets, the US Fed is expressing a firm view that it will proceed with gradual rate hikes through to mid-next year. This relative certainty may be helping boost the USD.

EUR fall not so much about Italy

Italy faces a deadline to respond to EU complaints about its budget on Tuesday, perhaps undermining support for the EUR. However, Italian yields and were only a few basis points higher on Monday, relatively unfazed by what most expect will be a reaffirmation of the standoff between the EU and Italy.

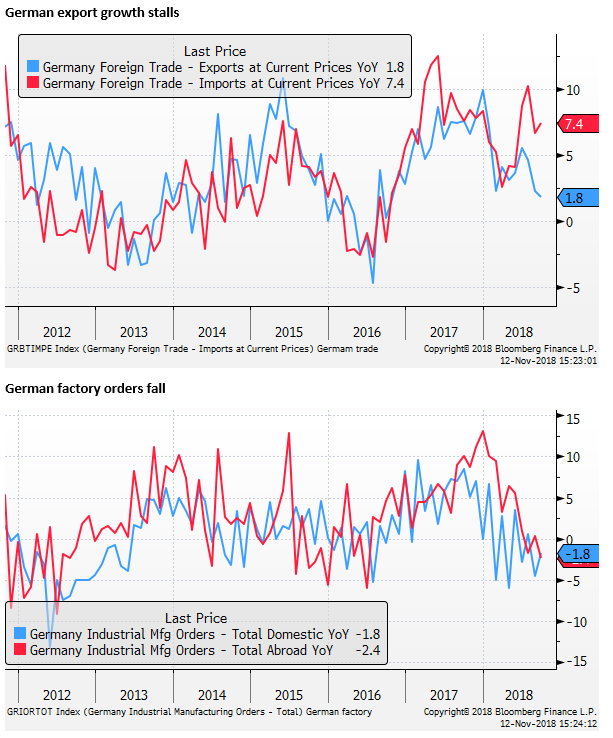

Weaker confidence in Eurozone export markets

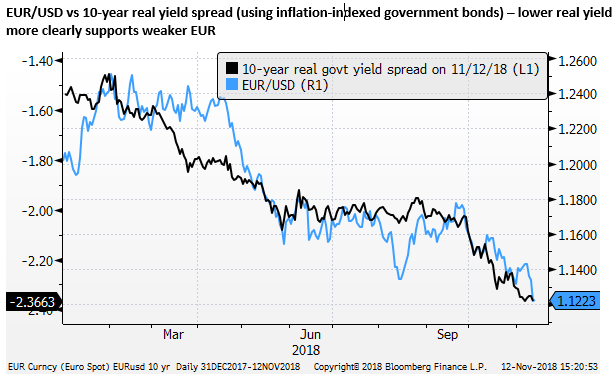

The EUR/USD appears to be developing a clearer downtrend that is consistent with the Eurozone’s persistently weaker economic growth data since Q1. At times it had seemed to ignore weaker growth data supported by expectations that it might be short-lived, and upbeat assessments by the ECB reaffirming their intention to end QE this year. However, the market may be losing confidence that the Eurozone will rebound, contributing to a clearer down-trend in the EUR

The Eurozone is a significantly more export-driven economy than the USA, and it appears that its weaker industrial performance through the last six-months may reflect weaker demand growth from China and much of the rest of the world outside of the USA. As such, weaker confidence in the Chinese economy, in part driven by US trade policy, may now be spilling over to weakness in the EUR, and in turn, broadening strength in the USD.

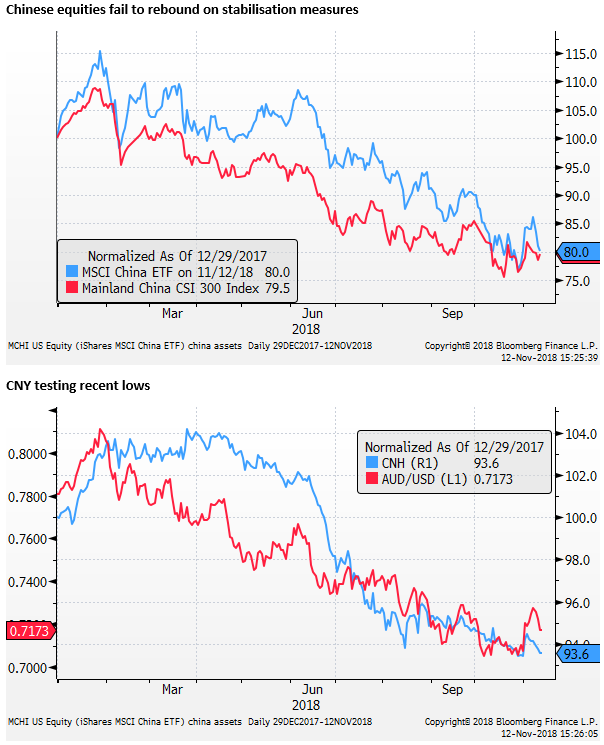

Chinese asset markets remain subdued

The Chinese authorities have made many announcements over recent weeks, including new policies and commitments to support its stock markets, provide lending support for the private sector, and increase fiscal spending. This has helped stabilise the equity market, but it has not generated a sustained rebound in Chinese stocks, and the CNY has resumed a steady weakening trend.

A good deal of the confidence slump in the Asia region relates to US trade policy, including 10% tariffs across around half of Chinese exports to the USA, and threats to increase and broaden tariffs at the beginning of next year.

However, there may be deeper problems with the Chinese economy related to efforts over recent years to clean up excesses in its credit markets.

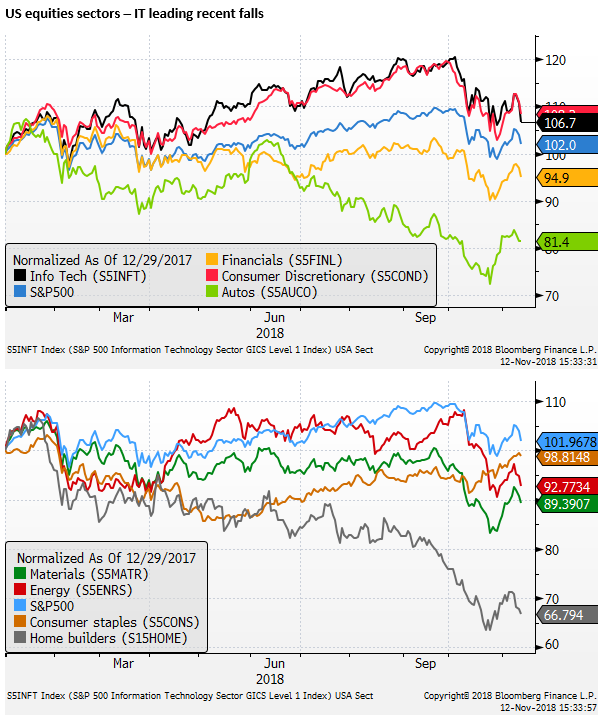

Tech sector demand peaking

There also appears to be slowing growth developing in a maturing tech sector. Apple Inc. equities have fallen significantly since its recent earnings report. Recent reports from Apple’s suppliers suggest that demand for iPhones is weaker than expected, triggering broader weakness in tech equities. Weaker demand in the tech sector would be expected to increase the drag on many Asian countries; including in particular Taiwan, Korea and China.

Confidence in the outlook for growth in China and the rest of Asia appears to have been significantly dampened. This is spilling over to weaker growth expectations in the Eurozone, making EUR more vulnerable to Brexit uncertainty, and some homegrown issues related to Italy.

Equity investors in the USA are not enthused by the prospect of weaker global growth, a weaker tech sector, and the uncertainty generated by US trade policy. As such, US equities have resumed a fall on Monday.

At some point, the fall in global growth confidence, damaging US equities, may increase fear of a weaker US economy. However, the Fed will not be easily dissuaded from hiking rates by a moderate downturn in US equities.

Fed policy outlook firm for the time being

The Fed is displaying considerable confidence in its outlook for several more rate hikes into the middle of next year. In light of the elevated uncertainty around global growth, Brexit, Italy, the Chinese financial system and US trade policy, the relative certainty that the Fed will hike rates in December and next year may be driving bullish USD sentiment.

There may be an opportunity for Fed Chair Powell to express some concern over the increased risk to US growth arising from weaker global growth on Wednesday when he takes part in discussion with Dallas Fed President Kaplan. But we doubt at this stage Powell is ready to change his tune.

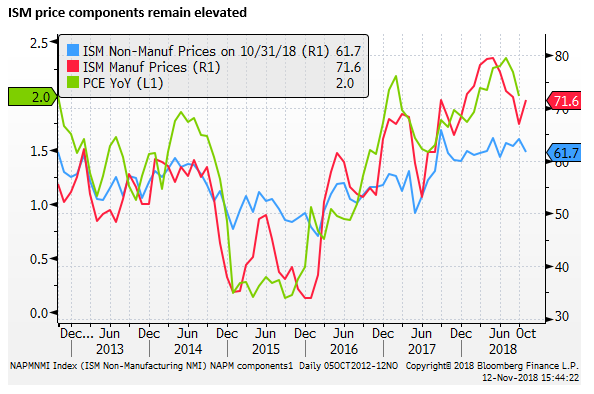

The evidence from the US economy points to ongoing stable and solid growth with increasing inflation pressure. Wages growth has picked up, and surveys suggest businesses are facing higher costs, including from tariffs, and are more inclined to pass these through to selling prices.

Inflation expectations remain stable, and few anticipate a rapid pick-up in US inflation. But evidence from the domestic economy suggests that the Fed should gradually lift rates towards and perhaps a little beyond levels that might be regarded as neutral.

US CPI inflation data on Wednesday will be watched closely for evidence for or against the notion that inflation pressure is building in the USA, and may be important for direction in the USD.

Risks for the USD

Before we go all in on the USD into year-end, there are a number of important events that could tip the scales against the USD.

We need to be wary that Chinese stepped up efforts to support growth may generate improved confidence in the Asia region. Brexit uncertainty is dragging down the GBP and EUR, but a breakthrough in EU and UK negotiations may be near. The Trump-Xi meeting on 1 December may ease trade tensions. If the US equity market downturn becomes severe enough it could dampen expectations that the Fed will hike rates. Political risk may return as an issue in the US as the market contemplates Democrats exercising their power in the House of Representatives. The fall in oil prices could help stabilise global growth expectations and close the performance gap between the USA and the rest of the world.

A Wild Brexit Ride

There may well be a number of twists and turns for GBP yet as Brexit plays out.

The GBP is down on Monday as the passage for a compromise deal through UK parliament looks narrower after a pro-EU member Jo Johnson (not his more famous brother and Brexiteer member Boris) resigned his cabinet post and stated his support for a new referendum.

Now both brothers have resigned from the cabinet but from either side of the debate, highlighting the fine-line PM May is trying to walk to appease both sides of the Brexit debate. That they come from the same family is a metaphor for how Britain is tearing itself apart.

But is selling the GBP on a deal failure the right strategy? Consider what happens next – possible fresh elections and calls for a new referendum, and quickly the market may start to factor in the increased probability of the UK staying in the EU, driving GBP back up. If you are trading GBP, and increasingly the EUR, you have to remain nimble.

The uncertainty is keeping investment managers and big business on the sidelines of the FX market, exacerbating the risk of larger swings in GBP.