Add Deutsche Bank to the list of risks for the EUR and Global Markets

Bank analysis is not my field of expertise, but as a macro analyst of FX markets, it is hard to ignore the rapid slide in Deutsche Bank’s (DB) share price. DB is one of the top five Globally Systemically Important Banks (G-SIB) as designated by the G20’s Financial Stability Board (FSB). It is around the 12th largest bank globally by total asset size ($1.5tn), and yet its market cap is now only $20bn. If it is called on the raise more capital this would be a problem. Its share price performance suggests it is highly influenced by the political risk in Italy. We should add DB’s rapid slide in share price this year (down over 40% to revisit record lows in 2016) as a risk factor for global financial stability and in particular the Eurozone. Considering Populists are taking over in Italy, the Spanish government is set to fall, and Trump is pursuing trade restrictions on the EU, the outlook for EUR is getting murky.

Add Deutsche Bank to the list of risks for the EUR

Bank analysis is not my field of expertise, but as a macro analyst of FX markets, I look at a lot of elements to build a picture of potential risks for a currency. This includes equity market developments and financial stability issues. In this respect the equity performance of Deutsche Bank is interesting.

Overall, banks in the Eurozone are significantly underperforming their global peers this year, and this has much to do with Deutsche Bank.

Italian bank shares fell sharply from mid-May, helping contribute to weaker Eurozone bank shares, but the falls were almost matched by German banks, particularly Deutsche Bank, which is down over 40% this year leading falls in the Eurozone.

Even as Italian bank shares have stabilised in recent days, Deutsche Bank and the overall Eurozone bank share index has fallen further.

DB listed on the Frankfurt exchange fell 7.2% on Thursday following news reports that the bank’s USA business had been added to the US bank regulator’s (Federal Deposit Insurance Corporation – FDIC) “problem list” that have “financial, operational or managerial weaknesses that threaten their continued financial viability.”

Deutsche Bank Hits Record Low as It Defends Troubled U.S. Unit – Bloomberg.com

The FDIC does not name banks on its Problem List. The news arises from the sudden jump in the assets of banks on the list (from $13.9bn to $56.4bn), even though the number of banks on the list fell from 95 to 92. The assumption of commentators is that the jump reflects a large institution being added to the list, and DB fits the bill as a troubled bank.

Quarterly Banking Profile – FDIC.gov

The WSJ also reported that the US Federal Reserve had designated Deutsche Bank’s US Business unit as in a “troubled condition”. This had been done about a year ago, but not previously made public.

Deutsche Bank’s U.S. Operations Deemed Troubled by Fed – WSJ.com

In 2016, a time of broader global financial markets troubles, there were fears that DB might run into funding problems and add to financial stress. There was much media coverage of an IMF report from 30-June 2016 that said, “Among Globally Systemically Important Banks (G-SIBs), Deutsche Bank appears to be the most important net contributor to systemic risks.”

IMF says Deutsche Bank’s global links make it biggest potential risk; 30-June-2016 – Reuters.com

Around the same time in mid-2016, DB failed the US Fed’s stress test

Santander, Deutsche Bank: U.S. stress test repeat offenders; 29 June-2016 – Reuters.com

In September 2016, Deutsche Bank shares hit a record low as low global bond yields undermined bank shares and DB faced a big payout to the US DoJ to settle fines related to its Mortgage-Backed Securities Business. Initially, the request was for $14bn, it later settled for $7bn in December 2016.

The chart below shows that even though global bank shares have recovered from their lows in 2016, DB is back at these lows again.

The share price performance suggests that we should again be worried about the solvency of DB and whether further deterioration in its share price might begin to have implications for global financial conditions and policymakers.

It would be fair to say, given its weak share price performance, which could make it more difficult to recapitalize if required, that just as the IMF argued in 2016, DB still represents the biggest global systemic threat of all banks.

The EUR has bounced back in recent days as the political risk in Italy has moved from critical to just heightened. Higher than expected Eurozone CPI also helped. However, a populist government is now forming in Italy. And the Spanish government is expected to unravel with a no-confidence vote against PM Rajoy on Friday.

Italy’s president approves populist Rome government – FT.com

Spain’s opposition secures votes to oust Mariano Rajoy – FT.com

Furthermore, the US has moved forward with applying steel and aluminium tariffs against the EU, and other trading partners. And it has threatened auto tariffs against the EU. These may not be applied for another year, but it does point to a clear intent by the USA to give its industry an advantage against import competition. And the EU, in particular, Germany, is a major exporter to the USA.

This points to increased political and economic risks faced by the Eurozone. The troubles at DB add to these risks and will indeed feed off them, as it has done recently during the Italian political crisis.

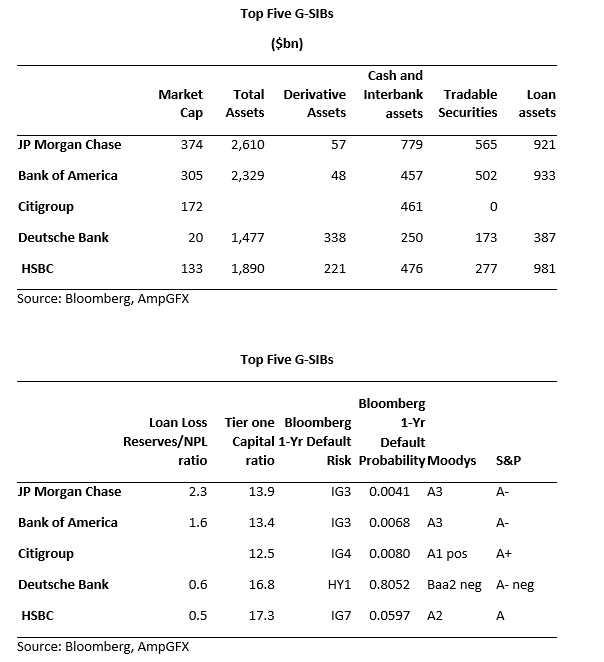

If DB is unable to arrest its share price decline, indeed we should be wary of global financial implications. The Financial Stability Board (FSB) set up by the G20 to monitor global financial stability, has DB in its top five G-SIBs. This is based on , “size, interconnectedness, substitutability, cross-jurisdictional activity, and complexity”. Without a doubt, within that five, DB is the most troubled.

DB has total assets on $1.48 tn; its not the biggest in the group, but it is indeed large. It is around the 12 largest global bank. Considering its size, its market capital appears rather thin at $19.6bn, highlighting a key problem if it is forced to raise capital.

It has a relatively high Tier 1 capital ratio of 16.8%, above its FSB recommended minimum of 12%. But it is hard to tell how safe that would make the bank. Much depends on the quality of its assets.

Of concern for investors should be DB’s large derivatives book ($337.5bn according to Bloomberg), the largest of all the other top 5 G-SIBs.

DBs is under ratings outlook negative at Moodys and S&P, already with the lowest rating of other G-SIBs. Bloomberg risk metrics see it below Investment grade and deteriorating

In the event that DB did face funding difficulty, it could pose a threat to stability for other banks. But almost certainly, the German government would come to the rescue. This might avert a big financial crisis, but it could be seen as an adding to downside risk for the EUR, damaging confidence to some extent in the global economy, especially where DB operates.