Alternative Brexit vote on Monday may lift GBP

- The defeat of May’s deal on Friday was narrower but still emphatic, rendering it almost dead.

- We see a higher probability, perhaps even a high probability, of a majority of MPs now supporting a customs union Brexit in the indicative votes on Monday.

- The bigger the vote, especially a majority, for a customs union will make it harder for Brexiteers in the Tory Party to take control and run the clock down to a no deal Brexit.

An emphatic third loss

On Friday, May lost a third vote in a split version of her deal that included only the withdrawal (divorce) agreement and excluded the political (trade relations) agreement. (286 for, 344 against, net -58, 20 abstainers out of 650 MPs).

34 Conservative MPs out of 330 voted against the deal, including 10 Democratic Union Party (DUP) MPs; 41 Tory MPs (presumably mostly hard-line Brexiteers) voted for the deal for the first time.

(Source: Theresa May suffers fresh defeat on Brexit plan vote – FT.com)

PM May has made comments suggesting that she may be considering calling for a fresh election. She said, “I fear we are reaching the limits of this process in this House.”

However, it is far from clear what path PM May will take now. She may resign, call for a fresh election, change tack and move to support an alternative plan, or forge on attempting to find support for her deal.

It would seem that after the third rejection, by a still significant net 58 votes, it is time to give up on her deal, but it’s not clear she will. The FT report linked below, discussing the politics around her next move, argues that she is likely to give it yet another push.

May running out of options after third Brexit defeat – FT.com

Monday is the next big test

Apart from the possibility that May resigns the leadership of the Tory Party or calls for new elections over the weekend, the next big event is a re-run of the indicative votes on alternative plans on Monday.

The failure on Wednesday of any other alternative plan to achieve a majority of MP votes was seen as a set back for the GBP; highlighting the wide divisions in parliament and making it harder to see how the Brexit riddle might be solved.

However, the failed third vote on May’s deal on Friday should open the door for some MPs that were only prepared to support that deal to switch horses to one of the alternatives on Monday.

286 MPs voted for May’s deal on the third time on Friday. At least 41 of those were hard Brexiteers that voted for the deal for the first time. Of the remaining 245, an unknown number may have abstained from alternative plan votes, and could now choose one on Monday to help avoid a no deal.

We presume that those MPs that prefer a harder Brexit, including a no deal Bexit, would have voted no to the alternative softer Brexit plans on Wednesday. As such there may not be many new MPs to join the no vote ranks on Monday.

There will be some, because all Tory Cabinet Ministers (23 MPs) were ordered to abstain from the Wednesday vote. But they are a mixed bunch, and these votes should have little impact on the net outcome on Monday.

Furthermore, having seen the results of Wednesday’s vote, MPs may now be prepared to move towards the more popular alternatives in an attempt to help parliament find a majority needed to move the process forward.

As such, there is a higher probability of one or more of the alternative plans finding a majority. I dare to say a high probability.

The two plans that were closest to a majority were:

- A Brexit with a customs union (264 for, 272 against, net -8, 114 abstain out of 650 MPs);

- And a second referendum (268 for, 295 against, net -27, 87 abstain out of 650 MPs).

There were three versions of a softer Brexit than PM May’s deal in the Wednesday vote:

- The most popular was the Customs one (discussed above), another was a ‘Norway-plus’ membership of the EU single market and customs union (188 for, 283 against, net -95, 179 abstain);

- The other was the Labour Party Plan also for a permanent customs union and a strong relationship with the single market (237 for, 307 against, net -70, -106 abstain).

There were also a lot of abstainers from the softer Brexit plans because they want a second referendum. The FT.com reports that Liberal Democrats (12 MPs) and the Scottish National Party (35 MPs) did not vote for any softer Brexit options, holding out instead for a second referendum.

The FT.com also reports that 311 MPs in total voted for one or more of the three softer Bexit options. This is 24 short of a majority of 650 MPs in total, but as noted many abstainers might consider a softer Brexit, even if not their first choice and the alternative was a no deal Brexit.

MPs tailor indicative votes to maximise support – FT.com

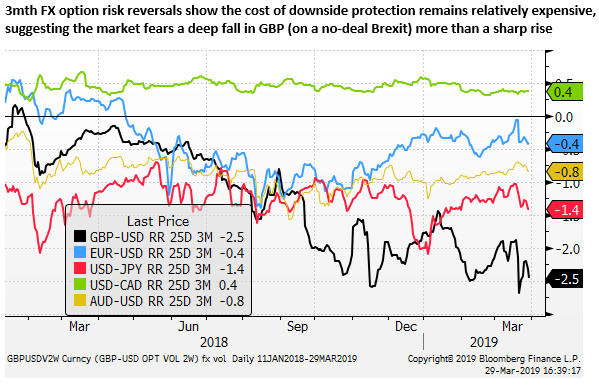

The prospect of a majority of MPs supporting one of the soft Brexit plans on Monday, the most probable being the customs union version, may push the needle towards this outcome becoming more likely, and a no deal less likely, boosting the GBP. Note that a majority of UK businesses favours a customs union or in general closer trading relations with the EU.

The clock is still ticking

Whatever the outcome on Monday, these are still indicative votes, and the clock is still ticking, so the uncertainty will remain high.

At this stage the Tory Conservatives with the support of the DUP still control parliament, and most of the hard Brexiteers are in the Tory Party. So they may still attempt to prevent a meaningful vote for a softer Brexit and attempt to let the clock tick down to a no deal outcome. The deadline is currently 12 April.

If May resigns as PM, who takes control of the Tory Party and becomes the new PM will influence what happens next. A moderate might help move towards a softer Brexit; a hard Brexiteer may attempt to force a no deal Brexit.

The larger the vote in favour of a soft Brexit, the harder it will be for a Tory government to force a no deal outcome. At some point over the next two weeks, ahead of the current cliff edge, the strong overall support for avoiding a no deal, suggests a high probability that a no-confidence vote will succeed and force a fresh election before a no deal cliff edge is reached.

In response to the third rejection of the PM May deal on Friday, Donald Tusk, President of the European Council, called an emergency EU summit on 10 April. We doubt that the EU will let the UK reach the 12 April deadline without a deal if parliament votes to dissolve and call a new election, or wants to begin discussions on an alternative plan. We expect the EU to grant a long delay to allow time for new elections, a new government and a new approach to Brexit. The 10 April summit provides the forum to move the deadline.

As such, we are still optimistic that GBP will strength next week. The result of the Monday vote may be key. A significant majority of MPs in favour of a customs union Brexit should be seen as positive for the GBP. It would suggest this outcome ultimately is more likely even if it comes after a new election. And a new election also raises the probability of a new referendum that may allow Britons to vote to call off Brexit altogether. A strong indicative vote for a new referendum and a clear rejection for a no deal Bexit on Monday might also be seen as a step towards a better outcome for the GBP.

Ultimately GBP should benefit from the removal of a no deal, signs that parliament can agree to a plan; including a fresh election that forces parties to offer voters a clearer choice. And the prospect of a new referendum that might provide the public clearer choices on the type of Brexit possible and include an option to remain. The UK economy should benefit from signs that the UK is more clearly moving down a path of retaining close trading ties with the EU, sufficient to avoid a customs border in Ireland.

What we wrote on Thursday, 28 March – Chasing Brexit down a rabbit hole

The dollar IS the story; Gold confounds, Brexit rabbit hole; EUR punished – AmpGFXcapital.com

Brexit developments are churning rapidly as deadlines force the UK parliament to fix its deep divisions. It remains difficult to chase this rabbit down its burrow and figure out which tunnel it comes out. The failure of parliament, with almost a free vote, to find a majority for any of a range of alternatives to PM May’s deal on Wednesday made it harder to see a path to solving the riddle.

May is still pushing for her deal, offering to resign soon after if it is passed. This may help bring some Eurosceptics in her party to fall behind it. The GBP appears to like any deal at this stage, even if May’s deal gets up, and Eurosceptics take control of the Tory party and the trade negotiations that would then be required in the deal’s transition period.

However, upside for the GBP would be limited by the prospect of lengthy contentious trade negotiations that would potentially further damage economic confidence and ultimately result in a deeper fall in GBP.

But if the Eurosceptics take control of the Tory party, Europhiles inside the Tory party might consider joining a no-confidence motion with the Labour Party and bring down their own government to force fresh elections.

PM May is thought to be considering to split her deal into two parts, and put only the divorce deal to a vote on Friday. The hope appears to be that MPs might vote for it just to allow the EU to agree to further extending the deadline on Brexit from 12 April to 22 May, allowing it more time to agree on a plan on trade relations. This might help GBP at the margin, but it does little to resolve uncertainty, so gains would be muted.

Further debate and another vote on a narrower set of alternatives to May’s deal appears to be set for Monday. This perhaps raises more hope for the GBP. A deal involving a customs union, endorsed by the UK business sector, was close to a majority in the votes on Wednesday. If parliament can achieve a majority on Monday, it may seem to boost the chances of this kind of deal winning a meaningful vote and becoming policy, boosting then GBP.

However, the government is still run by the Conservatives and support for such a deal comes mainly from the Labour Party, so the rabbit would remain deep in the labyrinth of tunnels.

There was also significant, perhaps more than expected, support for putting any deal back to the people in a referendum, and this is now Labour Party policy.

Ultimately, it appears that an election with a possible referendum to follow would seem the best way forward to solving the riddle. But the Tories have the most to lose from an election, and thus are trying to avoid one.

The Tory Party is the most divided over Brexit, and its hardliners are arguably moving against the tide of public opinion. The nation remains divided, but many voters might opt to now Remain in light of the difficulties with Brexit that have been revealed in recent years.

As such, the path towards an election is not clear and rocky. It may require more divisive pressure up against the cliff edge to force one to happen. A very acrimonious split in the Tory Party might be required. Some splitting on both sides of politics has occurred already with 11 MPs resigning from both the Labour and Tory Parties to form the Independent Group.

The GBP remains beholden to the Brexit issue, and no one appears to have a good handle on the what path it is taking and how long it takes for a viable solution to emerge.

What we wrote on Tuesday – Brexit indicative votes may boost GBP

Brexit indicative votes may boost GBP – AmpGFXcapital.com

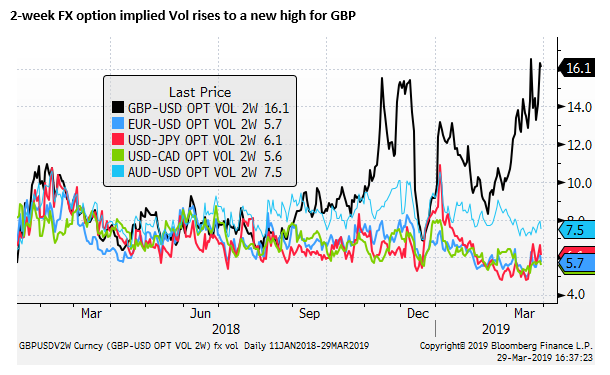

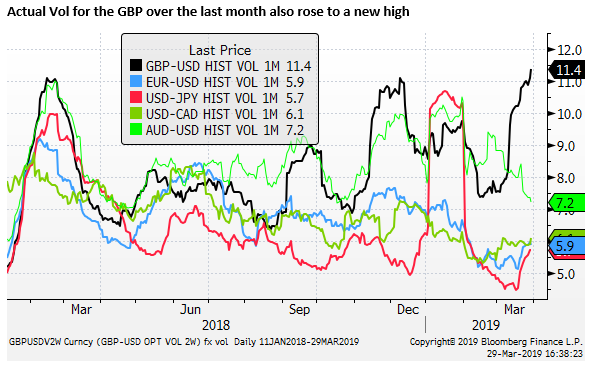

GBP is chopping in a relatively narrow range around 1.32 as the market struggles to interpret the increasingly frantic developments in UK politics.

The GBP strengthened from its recent lows last week after the EU agreed to provide another two weeks for the UK to decide on a path, until 12 April. This appears to have made space for parliament to come up with an alternative to PM May’s deal, and/or reduce the risk of an accidental no-deal Brexit.

However, the gains have been muted as it remains unclear what path the UK parliament will take.

The GBP seemed to strengthen on reports that ERG Chair Jacob Rees-Mogg might support May’s deal. However, it is not clear why the market would like this outcome.

It is far from clear that even with Rees-Mogg’s support, bringing with it some other euro-sceptics such as those in the ERG, would be sufficient to achieve a majority for PM May’s deal. The press seems to think it might, but it appears to me he does not have enough followers to make the difference.

Even if May’s deal scrapes in, it still requires the trade relationship to be negotiated over a transition period, and if Euro-sceptics are rallying behind it, it may tend to turn off Europhiles that want closer trade relations post-Brexit.

The GBP had been rallying on signs that May’s deal might get through in the past because it tended to reduce uncertainty over the path forward. But passage of May’s deal by the slimmest of margins, combined with the likely removal of May as Tory leader sooner rather than later, a split Tory party over the Brexit issue, and a larger number of MPs that want to retain close trade ties with the EU is likely to bring forth an equally uncertain transition period that may seem never-ending.

As such, we are not sure the GBP should have gained on Rees-Mogg’s support for May’s deal.

The indicative votes on Wednesday for an alternative to May’s deal appear to have much more promise for the GBP, in my view. A path towards an alternative plan appears to offer more chance of getting parliamentary support and provide more certainty to UK business.

The fact that a majority in parliament voted on Monday to allow the indicative votes appears to suggest that there is capacity for parliament to find a workable majority on an alternative. That alternative is likely to involve the UK remaining in a customs union with the EU, a decision that would please UK business and offer a way to solve the border issue in Ireland. It would require a longer delay but would provide more certainty for the UK economy, setting the UK on a more workable path.

The bigger the majority that can be formed around one or more alternatives, the more pressure on PM May to ditch her deal and get out of the way of a cross-party process.

It is not exactly clear how the indicative votes may work, but one possibility is that MPs can vote for more than one alternative, suggesting they may prefer several in place of PM May’s deal. This appears to raise the likelihood that one or more will get a clear majority of indicative support.

Wednesday’s votes are not binding, and it is not clear what May will do after they are conducted. If they show significant majorities for one or more alternative options, she should feel increased pressure to support a cross-party process to solve the Brexit riddle. This might split the Tory party to the point that Labour sees an opportunity to call another vote of no-confidence and force fresh elections.

Alternatively, if PM May rejects cross-party support for alternatives, it could also split the Tory Party and allow scope for a vote of no confidence and a fresh election. May herself could admit her deal is dead and decide it is time to call an election.

May may just admit her deal is dead and resign leadership. This raises the risk that Eurosceptics take control of the Tory party. This might seem to raise the odds of a no deal Brexit, but it is also likely to raise the odds that it splits the party and results in a no-confidence vote and fresh elections.

The odds of a fresh election appear to be increasing. In many respects, given the degree of the split in UK parliament, this would seem progress on solving the Brexit riddle. It would force major parties to develop more cohesion around a Brexit policy, and give the people a chance to vote on those policies.

A fresh referendum could be part of party policy (Labour has said it now supports a new referendum), and could then be put to the people with a clearer understanding of the choices involved.

Undoubtedly there remains considerable uncertainty and scope for hyper-volatility in the GBP over the coming weeks. But in the near term, if the votes on Wednesday reveal a significant majority in favour of one or more alternatives to May’s plan, this should be viewed as moving the risks towards a more certain and better outcome or the UK economy, even if it suggests a longer delay.

The EU is likely to grant a long delay if parliament is moving towards an alternative plan with or without fresh elections or another referendum.