America First

The USD and US yields have surged as Trump raises to the top of his agenda infrastructure spending with an “America First” policy. Trump made no mention of immigration in his victory speech, praised Clinton and called for national unity, lessening fear he might indict Clinton, build a wall on the Mexican border, and incite violence and division across racial lines. Clinton and Obama called for a peaceful exchange of power and acceptance of a Trump presidency, further helping create a sense of stability and investor confidence. Trump will have considerable power to achieve his agenda quickly and more fully with Republicans holding both houses of Congress. He will have a hold over his Republican colleagues in Congress given the strong anti-establishment movement he has inspired, further adding to his power. An America First policy poses some risk for the US traded goods sector and global economy, and may reduce the spillover of fiscal expansion to other countries. But this tends to enhance the potential uplift fiscal spending provides to US growth, boosting both yields and the USD, and reduces the benefit for emerging market assets and currencies.

The Risks from a Trump America

The sell-off in global equities and the USD vs safe haven currencies (JPY, CHF, EUR) was very short-lived (albeit deep) on the night of election counting. The initial sell-off reflected the anti-trade, anti-international cooperation and divisive social policies in the Trump campaign.

Trump’s election campaign was strongly critical of trade agreements including the Trans-Pacific Partnership (TPP) deal and even NAFTA and claimed that China and Japan and other countries had benefited from “terrible” trade agreements that had hurt the American economy. As such, the market fears that Trump will make it harder to trade, potentially hurting growth abroad and USA companies exporting to global markets.

Trump also proposed a vastly different attitude to global relations. He suggested NATO was broken and Saudi Arabia and other countries may have to pay for US forces to provide support. On the other hand, he suggested that he would be able to defeat Islamic extremism with implied more aggressive US involvement. In a broad sense, he suggested that the US might tend to withdraw from engagement in global affairs. This might be seen as opening the door for China to boost its influence in the Asia region and Russia to exert more influence in Europe and the Middle East. These policy notions, while not particularly well-formed, pointed to a riskier geopolitical environment that might lead to increased conflict and greater uncertainty weakening investor risk appetite.

Related to these notions on trade and international relations, Trump proposed a tougher immigration policy specifically for Mexican and Muslims. He also proposed tougher monitoring of Muslim communities in the USA to address risks of terrorist acts. These policies might increase the USA as a target for extremist acts, both from abroad and radicalized USA citizens. It is debatable whether Trump’s policies might generate more or less risk of global terrorism. But they generate greater uncertainty over global terror risks and those risks in the USA.

In a broad sense, the USA Election has left the USA perhaps the most divided in decades. With Muslims and Latinos feeling like outsiders this time more than African Americans. Trump is seen as the champion of white lower and middle-income Americans. Having stoked these divisions, Trump will struggle to generate a unified nation. Social unrest will be a threat to confidence and growth.

There are a number of risks to growth in the USA and globally from a Trump presidency. However, they are only risks and the time-line to any potential fallout is extended and uncertain. On the other hand, there are a number of reasons to expect Trump’s more immediate policy actions to boost growth in the USA specifically.

The Great Builder

First and foremost, the Republicans control all the parts that determine legislation – the Administration, the Senate, and House of Representatives. This provides Trump with significant scope to push through his championed policies quickly and more fully. Obama had this power for the first two years of his presidency and used it to pass the contentious Obamacare policy.

In Trump’s victory speech his first policy message was to boost infrastructure spending. He said, “I’ve spent my entire life and business looking at the untapped potential in projects and in people all over the world. That is now what I want to do for our country.”…. “We are going to fix our inner cities and rebuild our highways, bridges, tunnels, airports, schools, hospitals. We’re going to rebuild our infrastructure, which will become, by the way, second to none. And we will put millions of our people to work as we rebuild it.”

This seems to raise to the top of his to-do list, infrastructure spending. And as a property developer, he appears to see this as his strength and perhaps, hopefully, his most important objective.

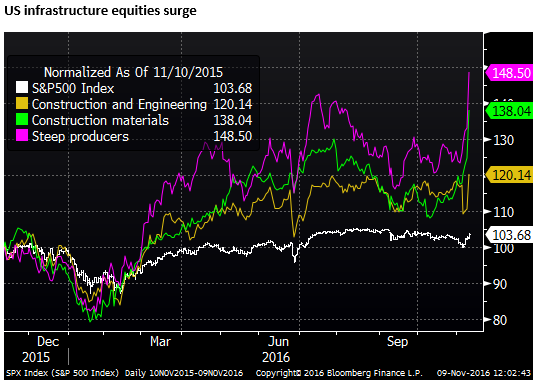

This message has resonated with the market, evidenced by a surge in construction-related stocks. The S&P500 construction an engineering Index was up 9% on Wednesday.

Construction materials (+10%) and steel sector (+11%) equities are up even more. The surge in these US company shares may reflect the strong message in Trump’s campaign to “Put America First” embodied in his anti-free trade message. The market is thus expecting less of the US infrastructure spending to spill over to imports of foreign-produced construction goods and services.

Clinton was also planning to boost infrastructure spending, but she would have had to go through an obstructionist Congress.

Trump the Unifier

The very first message in the Trump victory speech was to express gratitude toward Clinton for her long years of public service, and a call for national unity (“bind the wounds of division”) and to reach out to those in his own party that had criticized Trump during the campaign. He said, to those that had “chosen not to support me in the past” …. “I’m reaching out to you for your guidance and your help so that we can work together to unify our great nation.”

There was no mention in his speech about controlling immigration. As such, one might hope that the more divisive policies discussed during his campaign, including building a wall on the Mexican border and clamping down on immigrating Muslims, might fall well down the Trump agenda.

By praising Clinton, one might also hope that Trump does not pursue legal action against Clinton as he threatened during the election.

Trump may now work on mending the fences inside the Republican movement and attempt to repair the racial division he incited during the election.

America First

Trump’s final message was to help repair relations with foreign countries, but with the emphasis on America first. He said, “I want to tell the world community that while we will always put America’s interests first, we will deal fairly with everyone, with everyone — all people and all other nations. We will seek common ground, not hostility; partnership, not conflict.”

The speech, therefore, helped to alleviate, to some extent, the risks of social division and geopolitical uncertainty. This might be seen as supporting global investor risk appetite

Peaceful Transition

In her concession speech, Clinton emphasized the transition of power peacefully and said that, “Donald Trump is going to be our president. We owe him an open mind and a chance to lead.” The speech was sufficient to acknowledge Trump’s legitimacy, but beyond that, there was a message to Americans that they must remain active in their advocacy of equality and advance policies, such as actions to mitigate climate change, regardless of who was in government. One might argue then that there was a soft message not to accept some of the ideas raised by the Trump campaign that energized his support base.

President Obama gave a speech that emphasized the message of unity and acceptance of the election result. As such, overall the Democratic movement has been urged to accept the result and advocate peacefully for their agenda. Fear of civil disobedience may also be calmed by the loser’s response.

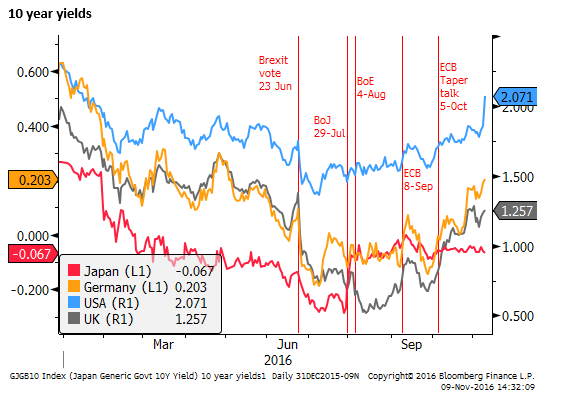

Surge in US yields

One of the most dramatic developments is a surge in US yields and curve steepening. In contrast, there has been relatively little rise in yields in Europe or Japan.

The surge in yields is a reflection of the strong emphasis by Trump on infrastructure spending and the sweep of Congress and administration by Republicans. Trump is seen as having the clout within his own party and the numbers across Congress to get things done.

He did not mention tax cuts in his victory speech, but this was a key part of his election campaign, so this too might add to a risk of fiscal expansion, boosting yields.

The surge in yields may also reflect the Trump “American first” mission, keeping more of the fiscal spending from leaking offshore.

Furthermore, it may generate a sense that other nations will see the US Treasury market as a less viable reserve currency. The USD is not going to lose its primary role in global finance overnight, but at some level, the direction of a Trump America, to put America first, is to withdraw from international cooperation on economic and political matters. This may lessen the role of US financial markets in global finance, and encourage other nations to, over time, shift toward holding less US Treasuries in their reserves.

There might also be a thought that Fed Chair Yellen will be replaced sometime next year in favor of a less dovish Chair. Trump was very critical of Yellen for holding rates low, painting her as part of a conspiracy to support the Democrats and Clinton.

Currency implications

The surge in yields is likely to support the USD particularly against very low yielding JPY and EUR. Already the rebound in the USD against these currencies has fully reversed the fall overnight on the initial reaction to the Trump victory.

The rise in the USD vs these currencies might be slowed if the rise in yields dampens the US and global equity market. Sectors of the US market that rely on international trade and global equities may be undermined by the Trump America first message.

EUR may also be undermined by thoughts that the trend towards anti-establishment populism in the UK Brexit vote and the USA Trump election will spill over to a defeat of constitutional reform in Italy championed by the PM Renzi on 4 December, and other elections in the years ahead.

Emerging market and commodity currencies have weakened. They fell on the election result, with the MXN the biggest loser. They attempted to rebound with the recovery in US equities. However, they have weakened again in US trading. This reflects the sharp rise in US yields and the spillover from a stronger USD against JPY and EUR.

However, another reason for the strength in the USD against emerging and commodity currencies is that Trump’s message is America first, this lessens the benefits of a stronger US economy spilling over to the global economy, and thus it is less bullish for emerging or commodity currencies that, at times, benefit from expectations of stronger US economy. A move against free trade, more generally, threatens many emerging markets.

In a broad sense, an America First policy combined with fiscal expansion should tend to boost US yields and the USD.

The larger risk for the USA and World

Trump’s campaign message was racially charged and dishonest. He held up many straw figures including Clintons, Mexicans, Muslims, China and many more, and encouraged supporters to throw insults and threats at them to vent their frustration. He derided shamelessly and ruthlessly many individuals, incited violence, claimed media bias and threatened to mobilize his supporters against a so-called rigged system if he lost.

His claims were vastly exaggerated and outrageous. His conduct was deplorable. He may have done this because he thought it the best way for him to win support for the presidency.

It does appear that Trump is prepared to say whatever it takes to get his way, changing his tune to suit his audience. He is the worst kind in charlatan and it is a great shame that Americans accepted this as their leader.

I presume now he has power that he will act the part. But it is so very disappointing that dishonesty and racial vilification is rewarded. He embodied the same persona as Hitler and Mussolini, fascists that appealed to the weakness in humanity to blame minorities and foreigners for their economic problems.

Both these fascists were successful in their early years, using their power and popularity to restore growth and employment. They also sort to control the press and remove opponents to consolidate their power. From there megalomania took over.

We have seen similar actions in Russia more recently, with Putin suppressing democracy, removing opponents, controlling the press. Democracy is fragile and people are weak, prepared to follow flawed leaders if they provide jobs.

Trump may well be a successful economic leader, although it remains to be seen if his fiscal expansion will not reap problems down the road if it creates a big budget hole, while business suffers from America first anti-trade policies.

If the economy improves and vindicates Trump’s policy and popularity, what will he do with it on social issues and climate change? Will his older white working class followers demand tougher immigration rules? If the economy starts to falter will Trump ramp up his anti-China rhetoric? How far would Trump go to distract his supporters from a weakening economy – indict Clinton? Start a war?

Who is Trump? What are his ambitions? We have to be suspicious about someone so clearly self-serving and prepared to act so hatefully and dishonestly.

I have heard many Republicans say that Clinton was a flawed candidate with questionable dealings. But her motivations and conduct during the election and over more than 30 years of public service reflect a genuine effort to make the lives of other better. Whether you agree with her policies or not, there was no comparison between the two candidates on character. Who brags about grabbing pussy whether in a locker room or not.

I still have more confidence that America will survive as a strong democracy and a global leader. But its beacon of hope for the world has been dimmed.