Anatomy of a bond market correction

After reaching record lows in July and a period of stable trading in August, global government bond yields have broken above their recent range and may be on the cusp of a larger correction. There has not been a significant change in the outlook for global growth or inflation. In fact, recent inflation indicators have weakened in Japan and Europe and have changed little in the US. However, bond yields may have become irrationally low this year, and driven to extremes in the wake of Brexit. Subtle policy shifts by the BoJ and ECB point to reluctance to deliver more QE and dissatisfaction with low and negative longer-term bond yields. The US Fed is also creeping closer to another rate hike. In the background, the market is beginning to think about modest fiscal expansion and a shift in policymaker attitudes towards less reliance on non-conventional monetary policy easing, seen near its limits, and more openness to fiscal expansion.

Global equities, corporate bonds and emerging market assets have been driven higher this year by a reach for yield and falls in government bond yields. As such, a correction in yields that may have further to go may trigger a bigger correction in asset markets more generally. This may tend to support the USD against EM and commodity currencies that have gained along with higher risk asset markets.

The BoJ appears to be aiming for higher longer term yields, balanced by lower short-term yields. The rise in Japanese long-term yields since 29 July and more recently after speeches by BoJ Governor Kuroda and his Deputy Nakaso may have been the most important catalyst of higher global bond yields. The strength in JPY this year appears to have been a significant contributor to lower global bond yields up to July. Since July, JPY has become more erratic. The shift in policy tone at the BoJ may also be a catalyst for a turn in the JPY trend this year. If so it may point to a reinforcing decline in the JPY and rise in global bond yields.

Anatomy of a bond market correction

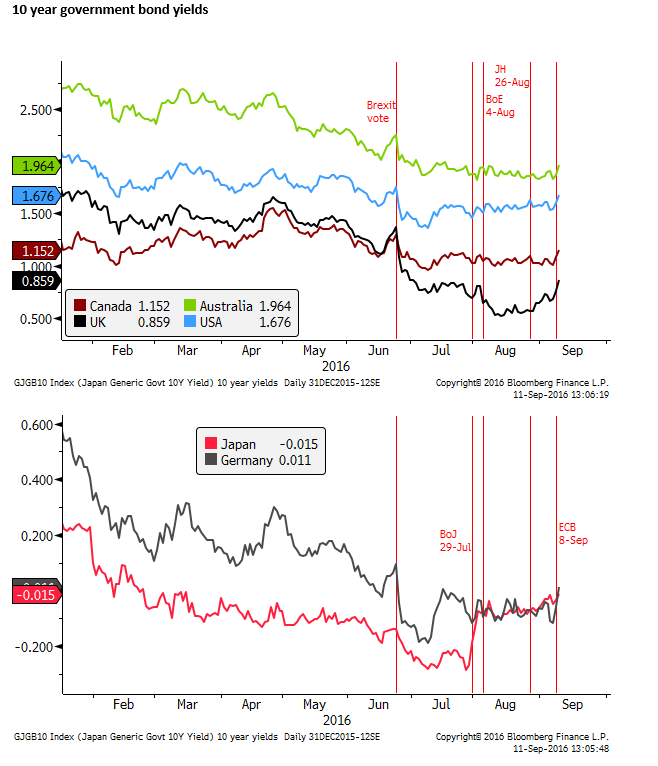

The Brexit vote (23 June) extended the global yield down-trend, yields reached a low point on 8 July (despite US payrolls surprising on the same day with a much stronger than expected rebound in June). The following week yields started to rise as a global equity rally took hold, and the UK quickly resolved its political leadership gap with the ascension to PM by Theresa May.

Yields edged lower into the 29 July BoJ policy meeting where more QE was expected. But Japanese yields rose sharply (by around 20bp) after the BoJ failed to deliver additional bond purchases. US Treasuries rose by around 10bp and bunds by around 8bp in the 2 days after the BoJ meeting, reversing falls earlier in the week.

On 4 August, the UK BoE announced a cut in rates and new QE program, sending UK yields to their record lows between 10 and 15 August. This was only a modest drag on other markets’ yields. Apart from the UK, other bond markets were relatively stable and range-bound over August.

Since around end-August Japanese yields drifted higher on BoJ commentary that they may prefer higher long-term yields to address profitability concerns at banks, insurance companies and pension managers.

UK yields also started to retrace some of their earlier sharp falls on better than expected economic reports.

Bund yields slipped to the low end of their range ahead of the ECB policy meeting on 8 Sep, but rose after the ECB made no policy changes.

Since the ECB meeting, most global bond markets have broken above the stable range highs in August and early-September and thus may be sending signals of a bottoming in yields, at least for the time-being.

The turn higher yields came as global asset markets rebounded strongly after the Brexit vote. Japanese bond yields led the rise as the BoJ baulked at more QE on 29 July and in recent weeks have discussed the costs of low long-term yields on its financial institutions. US economic data has been mixed, but labor data generally firmer than expected, and Fed officials have been raising expectations for a near-term rate hike, especially in the lead up to and during the 26 August Jackson Hole Symposium. The BoE dragged yields lower with additional policy easing on 4 August, but recent economic reports have been better than expected, seeing UK yields reverse some earlier falls in recent weeks. The ECB failed to deliver any additional easing at its recent policy meeting. It is studying how it might make room for more asset purchases if needed, but sounded reluctant to adopt more easing.

The bond market may have become over-bought in the wake of Brexit. Economic conditions overall have hardly changed much, inflation indicators remain subdued. But central banks appear to be more reluctant to extend easing measures further and more worried about the dampening effects of negative long-term bond yields on financial institution profits and economic confidence.

Negative long-term yields are arguably irrational and any business that continues to buy bonds in this state seems unsustainable. As such, they may be vulnerable to a significant snap-back even if fundamental conditions change little.

Spillovers to Equities and currencies

The rise in yields spilled over the first significant correction in global equities and asset markets more generally since Brexit.

Asset prices globally had been pushed higher by the extreme lows in government bond yields, forcing investors to seek yield in higher-risk markets. As such, higher bond yields have been a catalyst for a broader asset market correction.

Volatility in global asset markets has been very subdued, perhaps fueling a sense of complacency over risk in higher yielding markets.

The fall in asset markets has spilled over to a significant correction in emerging market currencies. The USD has strengthened more generally, but modestly against the EUR.

The retreat in emerging currencies in several cases came after they had risen to highs for the year earlier in the week, last week. Many have not broken-out of recent uptrends. On balance emerging, currencies may be regarded as in the middle of the range over the last month.

What may drive further correction?

Perhaps we are on the cusp of a longer period of rising yields. But we have to consider what may drive this. There is limited evidence of inflation in Japan or the Eurozone. In fact, recent inflation readings have been weaker than expected. UK inflation expectations have risen with the sharp fall in the GBP this year. Inflation appears relatively stable in the USA.

The rise in yields may be supported by more focus on fiscal policy. The new leadership of the UK government is expected to consider easing fiscal policy to support the economy through Brexit. Japan has announced new fiscal measures since mid-year. Around the same time, Korea announced a fiscal stimulus package. Canada expanded fiscal policy earlier this year. China has been using easier fiscal policy to underpin growth this year. The next US government is expected to be less fiscally conservative. There is increasing pressure at G20 meetings to use fiscal policy to support growth and a greater awareness that monetary policy is reaching its limits to support growth. While fiscal expansion may overall be relatively modest, it does appear to have at least turned from being a drag to support growth. This shift combined with a sense of reluctance to expand QE measures significantly further may be sufficient to contribute to a further correction in bond markets.

With yields above the range over the last month, they appear more vulnerable to extending higher in the near term, and the market may be more responsive to developments that are bearish for bonds.

On the other hand, in most respects, the rise in bond yields appears corrective of an earlier excessive fall rather than a fundamental shift in central banks’ policy outlooks and progress towards achieving their higher inflation targets. As such, it remains to be seen if bond yields are set for a long-lived recovery.

Japan yields a key catalyst

Probably the most significant bond negative development appears to have come from the rhetoric of the BoJ suggesting they would prefer higher longer-term bond yields. As such their policy announcement on 21 September is a crucial event.

However, comments from Kuroda and Deputy Governor Nakaso indicate that they want to at least maintain the overall “level” of policy accommodation. This suggests that, if they want higher long-term yields, they prefer to balance this with lower short-term yields. This suggests that they may opt for a deeper negative interest rate policy.

There is a high degree of uncertainty over how the BoJ will adjust policy to achieve this goal of a twist in its curve and the effects that it may have on global bond markets. If the BoJ ops for a deeper negative cash rate target this may limit the overall upward pressure on bond yields. Nevertheless, there may be scope for higher long-term yields even if the cash rate target is moved deeper into negative territory, especially if it is accompanied by a weaker JPY.

Fed policy remains in focus

In the midst of the upswing in bond yields last week, US 2yr swap rates returned to near their recent highs reached after the Jackson Hole Symposium. There is 30% probability priced-in of an FOMC 25bp rate hike on 21 September and a 60% chance of a hike by the 12 December policy meeting.

The most recent USA economic data, particularly the ISM reports and to some extent a softer than expected set of labour data in August do not support the case for a hike. However, recent Fed speakers have continued to highlight the broader trends in the labor market conditions over the last year and believe the case has strengthened for a hike in recent months.

This may be contributing to some strength in the USD and higher USA yields. However, Fed speakers have also emphasized that policy will be raised gradually and cautiously, and the overall level of interest rate rises in the current cycle is likely to be relatively shallow, sending a mixed message for the USD and USA yields.

There is considerable focus on a speech by Fed Governor Brainard scheduled for Monday. She is seen as relatively dovish and close to Chair Yellen. Her speech is the last on the schedule before the Fed’s self-imposed blackout period ahead of the 21 Sep FOMC. Brainard’s inclusion on the speaker schedule was quite recent, and some are wondering if she will be used to send a signal of a readiness to deliver a hike next week.

USD/JPY crucial to broader market outlook

The steep fall in USD/JPY this year appears to have contributed to lower bond yields in Japan by undermining inflation and increasing expectations for additional policy easing. And the larger than anticipated fall in Japanese bond yields up to July appeared to spill over to deeper falls in global bond yields. As such the appreciation of the JPY has been closely aligned with global bond yields this year.

A strong JPY has coincided with broad gains this year in riskier assets including equities, corporate bonds and emerging markets, despite the JPY historically been seen as a safe-haven asset. This is because equities and riskier asset prices have risen in response to falling global government bonds yields rather than any enhanced confidence in economic growth.

Since 29-July, we have seen some divergence between JPY and bond yields. Japanese yields have led a recovery in global yields, USD/JPY has been more erratic, but is overall still in a declining trend. We wonder now if the rise in bond yields will soon be joined and enhanced by a weaker JPY.

It is not particularly logical that higher yields in Japan should now weaken the JPY. However, if higher Japanese yields spill over the higher yields abroad, the market may not see higher yields in Japan as supportive for JPY. Furthermore, we think the BoJ wants a twist in the curve, including lower short-term rates. As such, we see a high probability of a deeper negative interest rate. A deeper NIRP may weaken the JPY. This would be very desirable from a Japanese policy perspective and it would support upward pressure on longer-term Japanese yields.

The BoJ would accept an overall bigger rise in bond yields (i.e. more genuine steepening without the twist) if it coincided with a weaker JPY, because the weaker JPY would help lift inflation expectations.

To the extent that global bonds may have become over-extended this year, the same may be true for the JPY. As such, if the bond market corrects, the JPY may also correct and the two may seem correlated and their corrections reinforcing each other.

USD/JPY is yet to show much evidence of breaking its downtrend. But it has been the longest period this year (since 23 June) that the USD/JPY has not made a new low, and it may be showing early signs of diverging from this trend.