Does anything in FX make sense anymore?

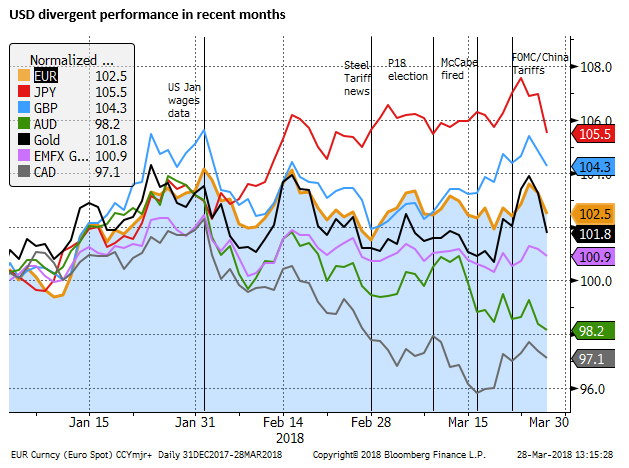

Just when you think you have a bead on the likely direction in FX markets, you would be advised to sit, wait and consider taking the opposite view. There have been a number of swings in the last month that have reversed and put the market back into the preceding range. Issues the market is grappling with are US trade protectionist policy, a drop in confidence in the US high tech sector, US political chaos, thawing North Korean tensions, and tightening in USD short-term funding, spreading to higher Australian bank funding costs. Just as trade fears may be easing, high tech sector woes may be increasing. US political risk is likely to build into the mid-terms. As March draws to a close, it seems best to watch and wait for cleaner air to derive trading strategy.

Turbulence without direction

March has been a particularly turbulent month in FX and other markets without clear direction leaving investors hardly any wiser as to what the key drivers are likely to be for the rest of the year.

USD/JPY up, but for how long this time?

The most recent iteration of this turbulence might be the rebound in USD/JPY even as global equity markets appeared to be suffering a bout of significant risk aversion and US and global bond yields have fallen.

Is the rebound in USD/JPY a fiscal year end squeeze? Does it reflect good vibes on North Korea after a meeting between its leader Kim Jong Un and Chinese President Xi?

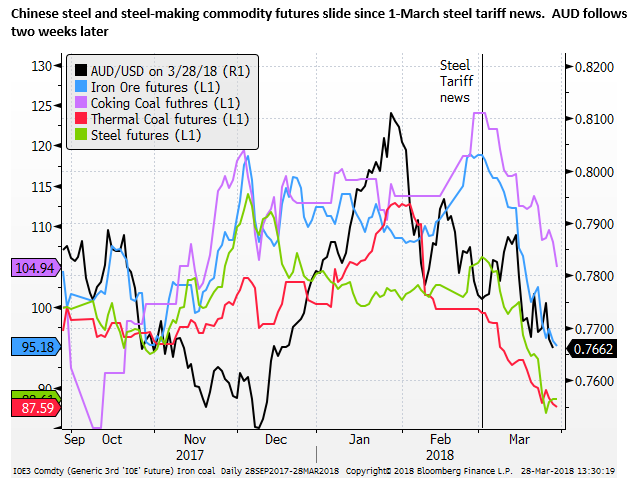

AUD down as China tariff proxy and weaker commodity prices

The AUD rose quite significantly in the weeks after steel and aluminum tariffs news hit on 1 Mar, appreciating from near 0.77 to above 0.79 on 14-Mar, before slumping in two days back to 0.77. In recent weeks it has struggled around its lows for the year; somewhat below 0.77.

The initial rise in AUD in the first half of March was confounding but might be explained by political uncertainty in the USA and mixed debate over the impact of the steel tariffs.

The fall in recent weeks might reflect an eventual acceptance that steel tariffs could not be good for the commodity exporter, the continued fall in steel-making commodity prices in China, and rumours that the US would introduce more targeted tariffs aimed specifically at China.

On 21 March, in the hours after the FOMC policy decision to hike rates, news broke that Trump was set to announce broad-ranging tariffs against China the following day. On 21/22 March, global equities fell on the reports and announcement by Trump that the US planned tariffs on $50bn of Chinese imports, and retaliation by China that it would initially raise tariffs on $3bn of USA imports. The AUD appeared to slide further, especially on crosses, in response to the tariffs.

The increased fear of trade war appeared to weaken the USD against a range of currencies; in particular, the JPY and EUR. However, these moves are reversing in trading so far this week.

Trade war fears may now be easing

We cannot be sure that the AUD will continue to slide on trade war fears. In fact, it has regained some lost ground against the EUR, JPY, and NZD in trading on Wednesday, in the context of a bounce in the USD.

The bounce in the USD is a perhaps a sign that fears over trade wars may start to calm as we head into April. The China/North Korea leaders’ meeting might be seen as a sign that China is seeking to help the denuclearization process as part of diplomatic efforts to contain US trade protectionism.

The USA has also reached a new trade pact with South Korea and this may point to less risk of a trade war breaking out between the US and China; showing that it is using a stick and carrot approach, and is willing to discuss and come to an agreement on trade.

If so, to the extent that the AUD’s recent fall has reflected a proxy role for a US/China trade war risks, it is possible to see a rebound in global risk appetite and recovery in the AUD in coming weeks, perhaps more so against crosses.

On the other hand, Chinese commodity prices remain at recent lows, and this may reflect broader issues over demand for steel in China. Recent property market data in China suggests that the sector is in a slowdown that might dampen construction activity. Chinese authorities also appear to be paying more attention to tightening less regulated and shadow credit markets.

As such, we might keep a close eye on Chinese commodity prices and their influence, or otherwise, on the AUD.

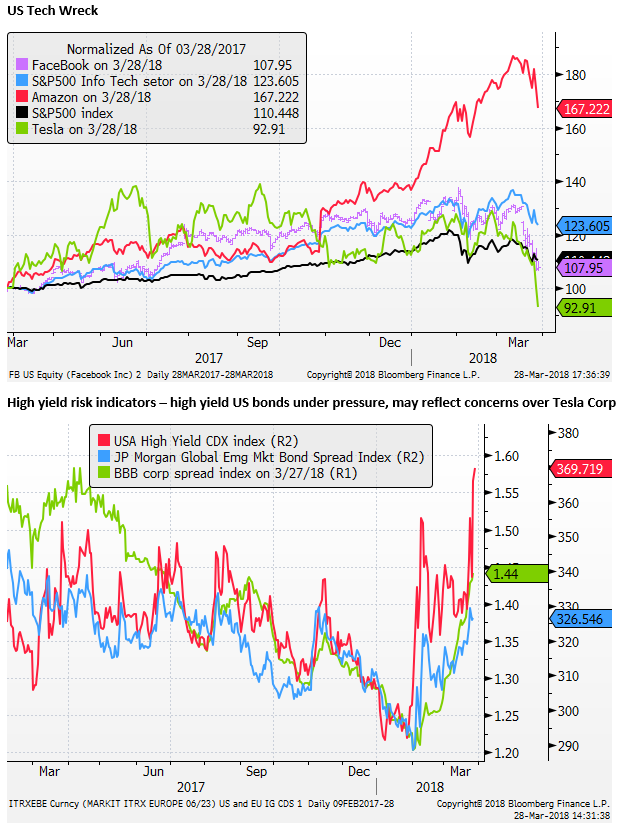

US Tech stocks hit by controversy

A consideration for markets is the more recent deterioration in US high tech stocks. Does this represent a point of risk for the USD? Could it spill over to Asian tech exporters?

The high tech sector has been a key driver of the US equity market in recent years, and the demise in high profile stocks may threaten broader confidence in US equities, the US economy, and global risk appetite.

Some of the issues that have hit confidence in this sector are likely to linger. These include regulatory pressure brewing on Facebook and setbacks for self-driving vehicles. Fears over regulatory pressure in the sector spilt over to Amazon on Wednesday.

Trump hates Amazon, not Facebook; 28-Mar – Axios.com

The rebound in the USD on Wednesday seems a bit odd in the context of weakness in its equity market and lower US yields. As such we cannot be sure it will last.

The tech-centric sell-off in recent weeks has increased risk for the highly leveraged Tesla. Its rapid slide in recent days is generating negative feedback for high yield bond markets and points to risk of broader contagion to other asset classes.

The prospect of more permanently elevated high yield spreads suggests downside risk for USD/JPY (notwithstanding its bounce in recent days). It might threaten currencies of deficit EM countries. It could spill over to weaker global growth expectations and undermine EM and commodity currencies more generally.

As the risk is coming more from the US tech sector, it might support the EUR against the USD as an alternative safe haven.

US Treasury bond yields have retreated in recent days along with weaker US equities; this may yet undermine USD/JPY and support EUR/USD in coming sessions. However, it must be noted that the USD yield advantage has increased significantly over the last year, and just now as the yield spread has narrowed a bit, the USD is performing more strongly. As such it is hard to say how the USD will react, if at all, to the recent fall in US yields.

US Political uncertainty goes into over-drive

The News swirling around Trump and his administration in March has kept heads spinning trying to keep up. This includes, among other issues: firings and resignations from his administration; a rise in influence of trade and foreign policy hawks; trade tariff announcements; firing of ex-FBI Director McCabe; pressure on the Muller investigation to be closed; Trump’s head lawyer resigning; a deepening and widening Mueller investigation; mixed messages on Russia; sex scandals; a big swing against a Trump-endorsed candidate in the Pennsylvania Special election.

There is little reason to expect a respite in the White House drama. Ex-FBI Director Comey is set to release his tell-all book and give a TV interview in April. Trump is trying to hire more lawyers. There is talk of a Summit with the Russian leader, despite the suspicions of collusion, Facebook is likely to face more scrutiny over its role in Russian election meddling, Mueller is not going away and in fact, will loom larger. The approaching mid-term elections are likely to heighten fears of erratic behaviour. If Democrats take control of one or both houses, the focus on the Mueller investigation is likely to increase, raising the odds of impeachment proceedings.

Political uncertainty at times appears to have weakened the USD, although it has appeared to shake-off such developments in recent weeks. We continue to see the approach of mid-term elections heightening risk potentially undermining the USD.

Trump Chaos time-line

The resignation of chief economic advisor Gary Cohen (6 March) after disagreeing with steel and aluminum tariffs. This led to a rise in influence of trade hawks in the White House.

The firing of Secretary of State Tliierson (13-Mar), Resignation of National Security Advisor McMasters (23 Mar). both replaced with foreign policy hawks (State: Pompeo; NSA: Bolton)

The 20pt swing against the Republican Party and upset Democrat victory in the Pennsylvania special election (14-Mar).

A rise in calls for gun control since Marjory Stoneman Douglas High School Shooting in Parkland Florida on 14-Feb.

Former Russian spy poisoned by a nerve agent in London (4 Mar). UK expels 23 Russian diplomats (14 Mar). 20 other countries expel Russian diplomats, including the USA (26 Mar). Trump calls to congratulate Putin on Russian Presidential election win (21 Mar).

Former FBI Director McCabe fired two days before his retirement (16 Mar); Trump sends out many tweets attacking Mueller investigation, claiming a deep state conspiracy. Trump’s lawyer leading the contact with the Mueller investigation, Dowd, calls for Mueller investigation to be closed. Dowd resigns, (22-Mar). Trump is reported to be finding it difficult to find a replacement.

Trump steel and aluminum tariff news (1 Mar), the response is widespread criticism from Republicans in Congress, US business and other countries. Cohen resigns (6 Mar). Trump orders tariffs, but winds these back to exclude Canada and Mexico (8 Mar). Further exemptions are provided to Argentian, Australia, Brazil, Canada, Mexico, EU and South Korea (21 Mar).

Rumours increase during March that the US plan wide-ranging tariffs against China. Trump orders tariffs to apply to $50bn of Chinese imports, and restrictions on Chinese investment in US companies (22 Mar). China announces retaliatory tariffs on $3bn of US imports. Fears of a trade war cause a sharp fall in US and global equities after the 21/22 China Tariff news.

US strikes a new trade deal with South Korea (27 Mar) where US gains some concessions on auto trade.

White House Names Allies to Receive Tariff Reprieve; 23-Mar – WSJ.com

Trump hits China with tariffs, heightening concerns of global trade war, 23-Mar – CNN.com

Trump gets South Korean concessions in first trade deal; 27 Mar – Politico.com

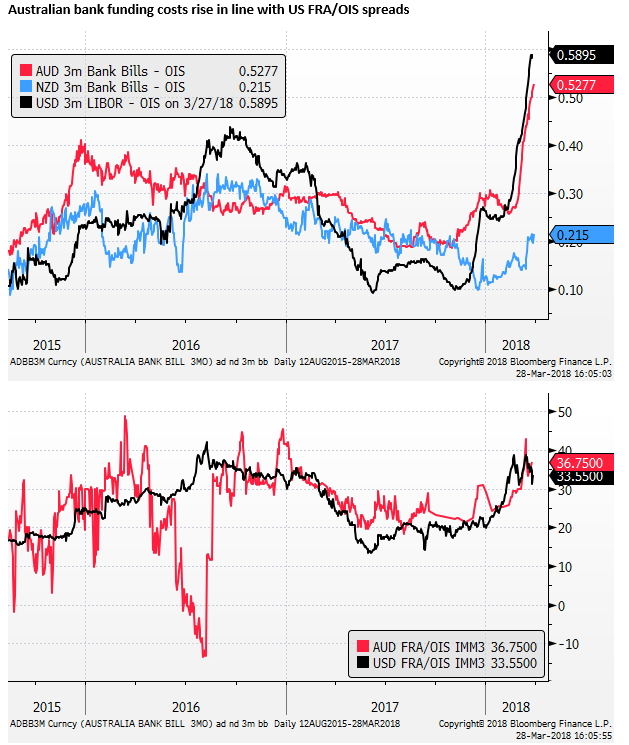

A rise in LIBOR Spreads

Perhaps the rise in US LIBOR over US cash rate expectations (LIBOR/OIS spreads, and FRA/OIS spreads) is a factor behind the rebound in USD in recent days. There have been many articles written on this phenomenon recently.

A variety of analysts suggest that it may be related to the US tax reform; including incentives for companies to reduce their cash hoards (short-term USD paper) held in offshore markets. And an increased supply of US Treasury bills, raising the competing yields in US commercial paper markets. Such factors may suggest that there is a structural shift up in the LIBOR/OIS spread that while adding to corporate and bank funding costs modestly, is unlikely to blowout to severe proportions and trigger broader asset market correction.

In past times, a rise in USD term funding costs might represent some stress in credit markets and lead to a squeeze higher in USD exchange rates. However, it seems unlikely that there would be generalized credit stress at this time of a relatively upbeat global economy, ongoing QE policies in Japan and Europe, and excess liquidity in the US banking system.

The recent volatility in equity markets and wider credit spreads might be feeding back into higher funding costs, and vice-versa. However, in recent sessions, as equities have fallen and credit spreads have widened, FRA/OIS spreads have narrowed from recent highs. As such, there appears to be a limited connection between the two.

Analysts have also noted that if there were a genuine squeeze on dollar funding, it would tend to widen cross-currency basis swaps. In fact, these have narrowed suggesting that there has been little evidence of a scramble for USD funding from most other major countries.

There has been no apparent correlation between the USD exchange rate and FRA/OIS spread widening. It is possible that the spread widening helped stabilize the USD In recent months, but the evidence is far from convincing.

Higher Australian bank funding costs

The rise in USD FRA/OIS spreads has not been replicated to any significant extent in most other currencies, although an exception is for the AUD.

AUD interbank funding costs have increased significantly, in line with USD funding costs. On the one hand, this might support the AUD, raising the carry return from the AUD investment.

On the other, it might weaken the AUD, representing a higher funding cost for Australian banks, reducing their net interest margins. At some point it might lead Australian banks to raise mortgage rates, more broadly tightening credit conditions in Australia

It is hard to see a clear link from rising USD and AUD interbank borrowing costs to either the USD or AUD exchange rate. However, it is interesting to note that Australian banks are one of the few foreign banking sectors to see a fallout from higher US bank borrowing costs.

This suggests that Australian banks are more reliant on foreign sources of capital as a marginal source of balance sheet funding than other countries’ banks. This is despite a significant reduction in Australian banks’ use of short-term money markets since the 2008 Global Financial Crisis (down from around 35% to 20% of bank funding).

If we are searching for reasons why the AUD is weaker, it may be that the market is showing concern over the rise in Australian bank funding costs, whereas other currencies, (including the NZD) have not. However, again, we are not reading too much into this development at this stage.