AUD clouds clearing, GBP storm clouds brewing

An easing in Chinese financial stress indicators, a recovery in Chinese metals and coal futures prices, and generally upbeat Australian economic reports in recent weeks suggests that the AUD may perform relatively well in the near term at least. Upside against the USD may be limited, but it may have room to rebound from near range lows against the NZD. While New Zealand economic activity remains robust, dairy prices have been stable in recent weeks, the New Zealand housing market appears to be more clearly slowing down in response to macroprudential measures introduced late last year. The RBNZ is progressing on adding DTI limits to its macroprudential toolkit. The NZ national election is coming into view and a return to the stable and respected National-led Parliament is not assured. Futures market positioning suggests that there is an unusual net long NZD position held on the CME. GBP looks vulnerable after a series of poor economic reports that suggest that Brexit uncertainty may only just be starting to undermine business confidence. Furthermore, political uncertainty is still rising as the authority of PM May is questioned in parliament and by the media. The BoE may have been premature in warning of possible rate hikes later this year. Near term, direction may depend on the UK labour report this week.

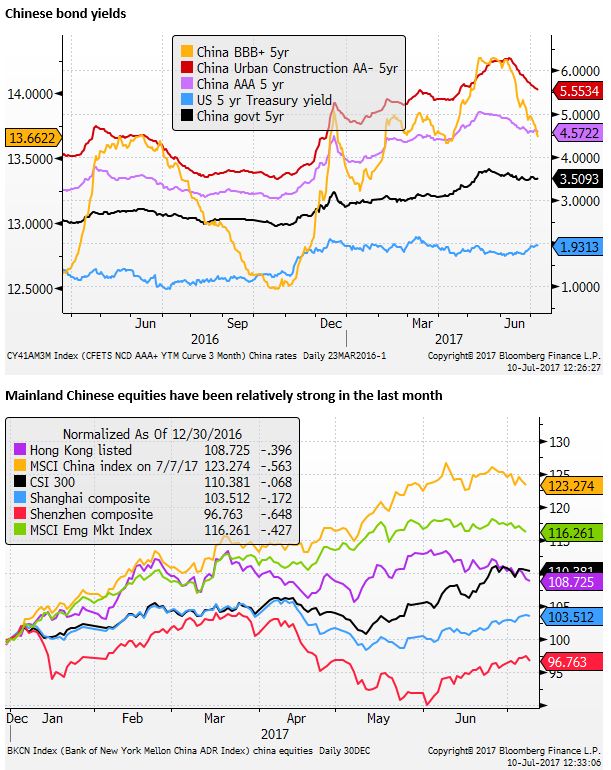

Chinese financial stress indicators have eased

Chinese money market rates have eased in recent weeks to around the lows since April. Yields on Negotiable Certificates of Deposits, often used by smaller banks for funding, have eased significantly from a peak in mid-June. Interbank lending rates have also eased from June highs. Some of the decline reflects the end of a seasonally tight funding near the end of half-year.

High yield corporate bond yields are at a low since April. Higher grade and Chinese government bond yields have been relatively stable in June, unaffected much by a rise in global yields. As such, the spreads to lower grade/higher yielding bond has narrowed in recent weeks.

The mainland Chinese equity market has been relatively strong in the last month.

Implied volatility for CNH is trading around the lows since the surprise mid-2015 CNY devaluation, consistent with relatively low volatility in global markets more generally.

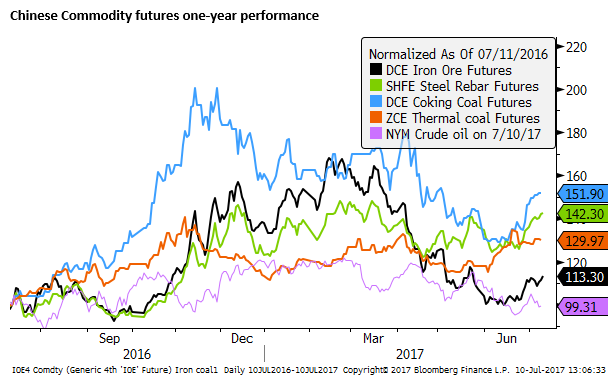

While Chinese activity indicators have shown mixed results in recent months, Chinese iron ore, steel, and coal futures have been recovering in recent weeks.

Australian economic indicators improve

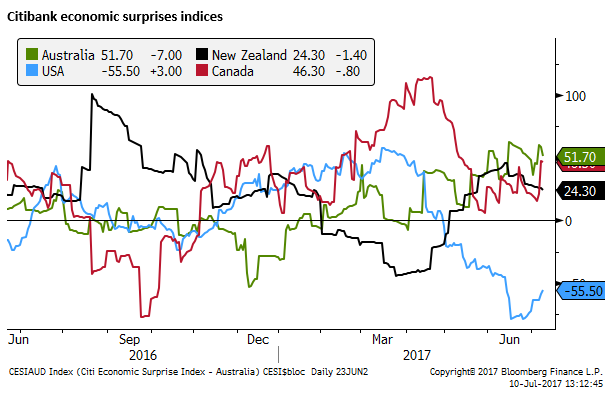

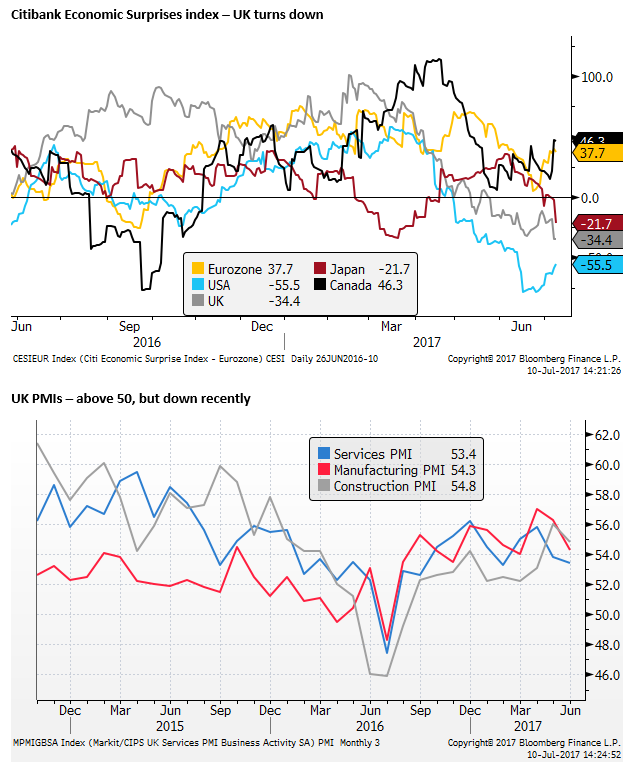

Recent economic reports in Australia have tended to beat expectations, more so than most other countries. The Citibank Economic surprise index for Australia is at 52%, above Canada (expected to hike rates this week) at +46%, above New Zealand at +24%, well above the USA at -56% and the UK at -34%.

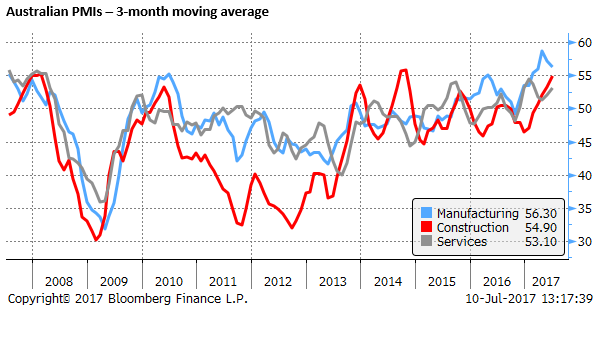

The NAB Business survey due on Tuesday should show a solid outcome after the PMI data for June showed rising trends across all sectors (services, construction, and manufacturing) all significantly above 50.

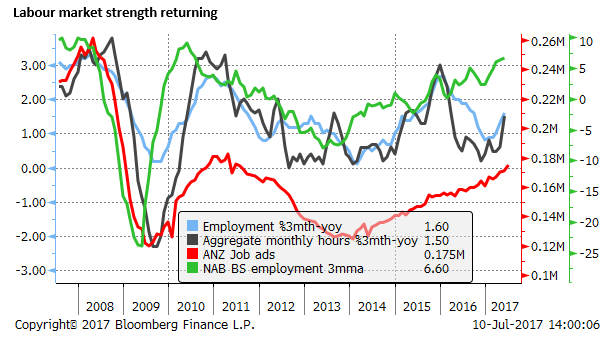

Labour market data has strengthened in recent months, and indications of tightening capacity utilization, strong business surveys, including employment components, and solid growth in job ads suggest that the trend should continue in next week’s labour report.

It doesn’t feel like the time to make bold FX calls against the USD, but it may be worth looking for opportunistic strength in the AUD against selected currencies. AUD/NZD is still near range lows after the AUD fell on the most recent largely unchanged RBA policy statement. The minutes of that meeting may reveal a little more about the RBA mindset, but it is unlikely to bring fresh reason to sell the AUD.

The New Zealand economy is also performing relatively well, but its housing market is showing clearer signs of having slowed in response to macroprudential measures. There is a national election on 23 September, and there is a significant risk that the National government, seen as a safe pair of hands, loses its ruling majority, and either needs to work with NZ First, or loses power to a Labour Party led coalition. Dairy prices have been stable recently, whereas, Australian commodity prices have recovered some losses earlier in the year.

GBP facing renewed uncertainty

The GBP appears vulnerable to ongoing heightened political uncertainty as disparate forces in parliament fail to present a unified Brexit position. Recent UK economic reports suggest that BoE talk about possible rate hikes later this year were premature.

Theresa May braced for a fall as Brexit tests loom – FT.com

The UK economic surprises index fell sharply last week to -34%.

UK manufacturing production rose 0.4%y/y in May, weaker than 1.0% expected.

UK construction spending fell 0.3%y/y in May, weaker than +1.1% expected.

UK trade balance was weaker than expected.

UK NIESR GDP estimate for the three months through June was 0.3% 3mth/3mth, pointing to an another weak quarter in Q2 after the low Q1 GDP result of 0.2%q/q, below the long-run trend of 0.6%.

UK Halifax house price index slowed to 2.6% 3mth-y/y in June, below 3.1% expected, a low since 2013.

All three UK PMI indicators fell, and were weaker than expected, although they remain above 50.

BoE Governor Carney said on 28 June that spare capacity in the UK economy had eroded, and the more it does, the BoE’s “tolerance for above average inflation falls.”

He said, “The extent to which the trade-off moves in that direction will depend on the extent to which weaker consumption growth is offset by other components of demand including business investment, whether wages and unit labour costs begin to firm, and more generally, how the economy reacts to both tighter financial conditions and the reality of Brexit negotiations. These are some of the issues that the MPC will debate in the coming months”.

The recent data suggests that Brexit risks may be just starting to spill over to weaker business confidence. Labour data is due this Wednesday, and they may fail to impress, considering the recent trend in activity indicators.

GBP has been relatively stable in the last week, despite the soft data. Non-commercial speculative futures positions in GBP on the CME are still short, but by the least amount since March.

The market may be flirting with the idea that soft-Brexit supporters are gaining the upper hand in parliament, and may lead the UK to an outcome which is more business friendly. However, uncertainty remains high, deep divisions over Brexit remain prominent, and it is far from clear that any other Prime Minister would command the power to lead a unified UK position in Brexit negotiations.

The economy appears at risk of lagging the rest of the world, and this will only intensify political uncertainty, leaving the GBP vulnerable to slipping back towards previous lows.