AUD falls, but current news is stronger

There are domestic risks for the AUD coming from a slowing housing market, fallout from the Royal Commision into the financial sector, and a national election coming into focus. China is seen as a risk for AUD, with its trade friction with the USA and plans to rein in its shadow-banking sector. However, current economic trends are quite supportive for the AUD. Stronger commodity prices and strong employment growth boosted the Government budget. Business surveys of current conditions are running at record highs. The RBA is forecasting above-trend growth over several years. Recent Chinese data remains solid, including a strong trade report, and Chinese commodity prices have firmed in the last month. Australia’s trade balance is in surplus. We see further downside for the AUD, largely on upside risk for the USD and weaker EM assets, but we note that a weaker AUD may only further boost current conditions and inflation pressure in Australia. At some point, it could bring forward rate hike expectations.

Strong Australian fiscal position

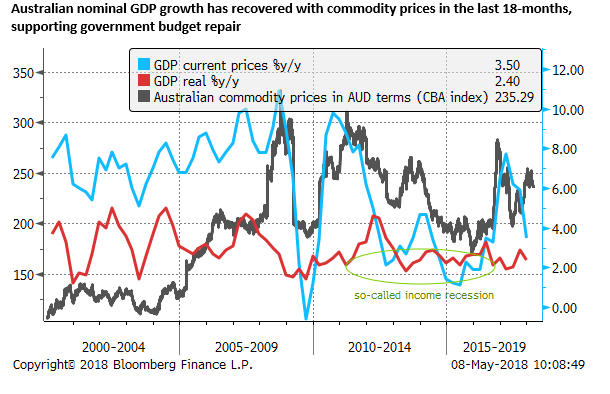

The Australian annual government budget is out, and the media reports are glowing. It revealed a strong increase in revenue from the mid-year update in December, reflecting stronger company profits and employment growth. Commodity prices have lifted significantly, helping the bottom line.

The government has both brought forward the date that it returns to surplus while cutting income taxes.

The budget is thought to be a good set up for the government to take to the next election. By cutting income taxes, it also hopes to get support from two cross-bench Senators to pass company taxes that have been held up for some time.

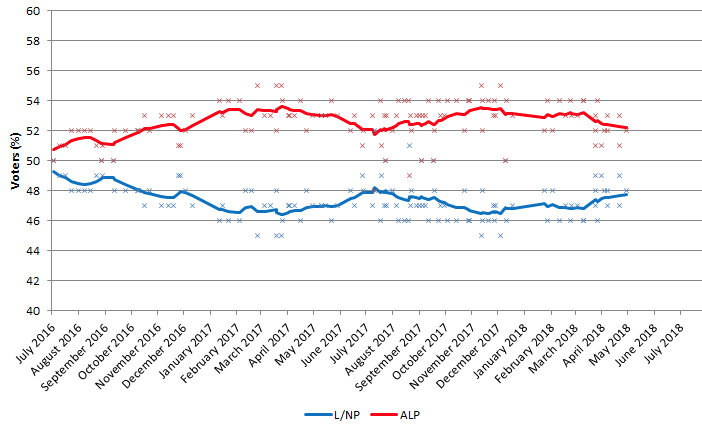

An election is due early next year, although there is every chance the government calls the election this year if it senses that it is developing positive momentum in the polls. The government has been trailing the Labor Party opposition since soon after the last election in 2016, but its position has improved in recent months.

It may seem surprising then that the AUD is weaker following the budget release. Without developments in global markets, the AUD may have responded quite positively to this budget.

Perhaps the sizeable fall in the AUD after the budget reflects pent-up selling pressure that was waiting for the budget to be released (hoping for a post-budget bounce) before executing sell orders.

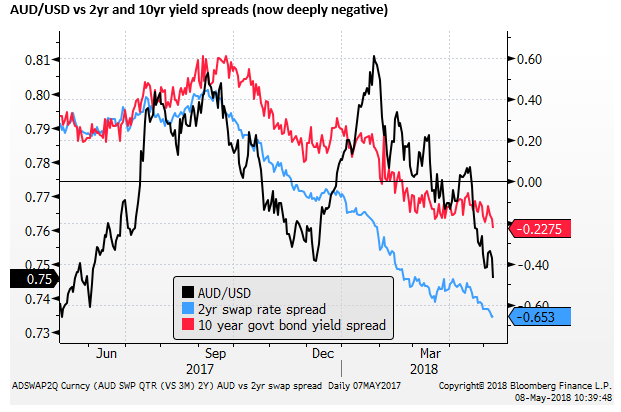

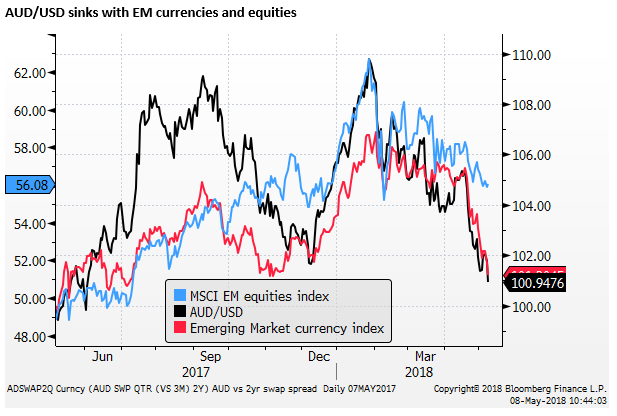

The AUD has weakened in recent weeks in line with a broadly stronger USD and weaker emerging-market assets. Higher US interest rates and yields have pushed the AUD into a negative yield spread across its yield curve.

Nevertheless, the budget position in Australia is good news for the AUD. Rating agencies immediately reaffirmed their AAA ratings.

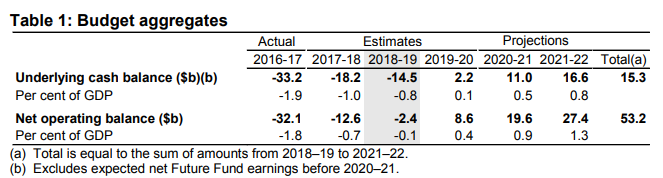

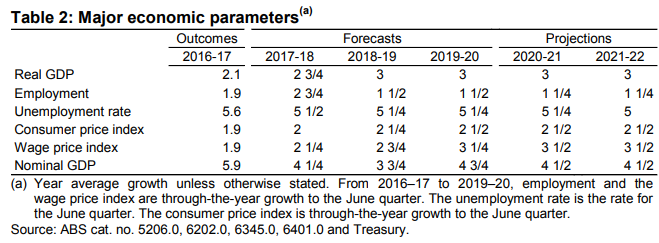

The deficit is forecast at a modest 1.0% of GDP in the current fiscal year (2017/18), returning to a surplus in two years (2019/20), a year earlier than the mid-year economic update released in December.

This compares favourably internationally; fiscal balances reported in the 2018 IMF Fiscal Monitor are as follows: USA (-3.7% of GDP), Euro Area (-1.0%), UK (-2.7), Japan (-3.3%), emerging Asia (-3.9% GDP), emerging Europe (-2.2%), Latin America (-6.4%).

Australian government debt as a share of GDP is now forecast to peak in the current fiscal year (2018/19) at 18.6% of GDP, falling steadily to 3.8% in 2028/29. In December, net debt was forecast to rise over the next three years to 22.1%.

This compares favourably internationally, debt levels reported in the 2018 IMF Fiscal Monitor are as follows: Net government debt: USA (81.1%), Euro Area (70.3%), UK (80.6%), Japan (120.7%), G20 Emerging (45.2%). Gross government debt: emerging Asia (51.5%), emerging Europe (32.6%); Latin America (62.8%).

Source: Budget Strategy and Outlook; Budget Paper No. 1 2018/19 – Budget.gov.au

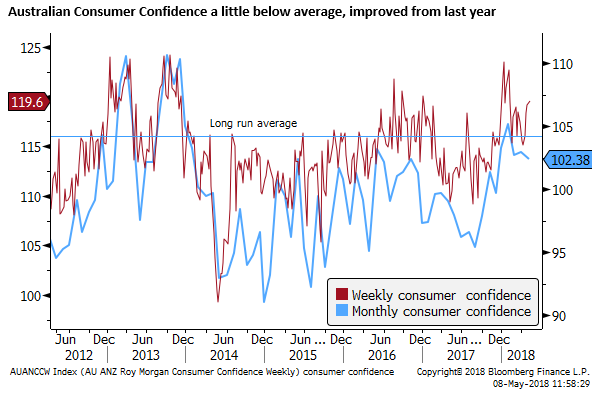

Furthermore, modest income tax cuts should tend to bolster consumer confidence.

Election uncertainty a factor dampening the AUD

The approaching election in Australia is a negative for the AUD. Perhaps the budget is a reminder that the election may come sooner than expected. The election is negative because it generates policy uncertainty and reminds the market how unstable government in Australia has been for the last decade.

The Australian economy has performed reasonably well, despite weak governments, although it has struggled to provide strong policy direction that might have helped drive the economy out of its long period, post-mining boom, of sub-trend growth since 2013.

Excessive reliance on easy monetary policy and aggressive bank lending over this period has resulted in an alarming rise in household debt and house prices. Mis-managed energy policy is widely considered to have led to under-investment and electricity shortages in the last year.

At this stage, the next election looks hard to call, with the risk of another change of government. Labor opposes company tax cuts, and supports personal income tax cuts. But perhaps more important for the market is its plans to significantly reduce tax breaks for housing investment, a potential negative for the housing market that is more vulnerable after peaking in the last year.

The earliest possible date for an election is 4 August this year. With a half senate election required by 18 May 2019, a full national election is expected to be held by this date.

Betting odds favour the opposition Labor Party winning the next election (69.4% probability) vs 37.7% for the ruling Liberal-National Coalition (Australian Politics odds – CrownBet.com.au).

Recent polls show the race tightening, but the Labor retains a lead on a two-party preferred voting basis of around 52% to 48%.

Source: Next Australian federal election – Wikipedia.org

Market more attuned to weaker than expected data

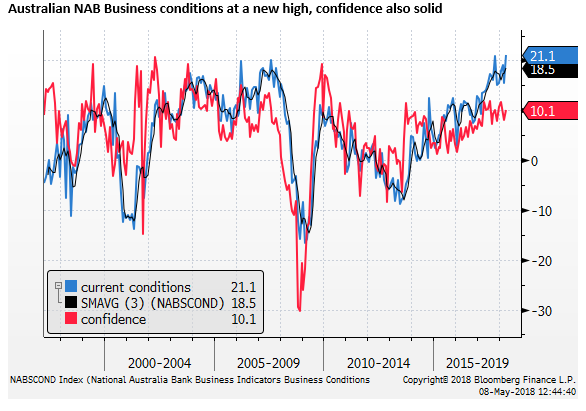

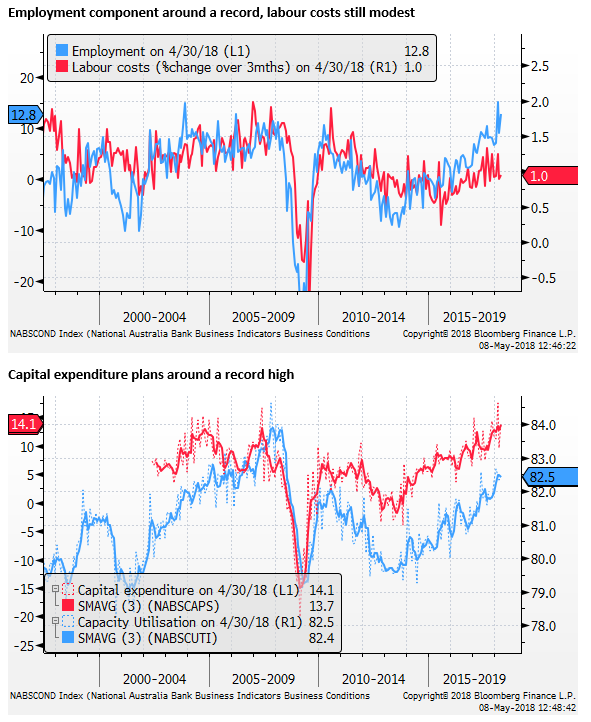

Including the budget, the AUD has had little reaction to a range of quite positive economic reports over the last week; including a very strong NAB business survey reported on Monday, strong PMI data over the previous week, an upbeat RBA monetary policy statement, stronger than expected building approvals and trade balance.

The Citibank economic surprise index for Australia has been improving over the last month from a low of -40 to -6, in contrast to weaker trends in most other economies.

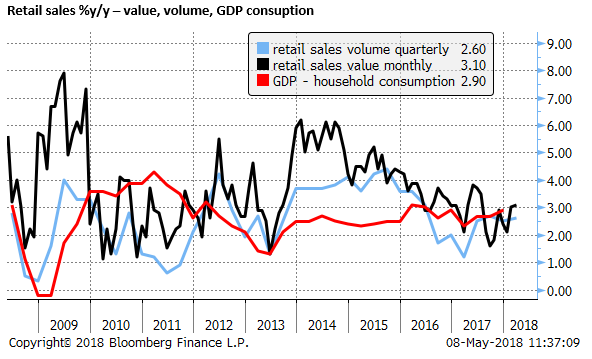

Retail sales ebb in Q1

On the other hand, the AUD fell on weaker than expected retail sales reported on Tuesday ahead of the budget.

Retail sales value were flat in March, below 0.2% expected. Retail sales volume was reported to be up 0.2%q/q in Q1, below 0.6% expected, and revised down from 0.9% to 0.8%q/q in Q4; pointing to a softer personal consumption increase in Q1 GDP, after a strong Q4 last year.

Retail sales have been more closely watched in recent years given the concern that low wage growth and rising household mortgage debt may weaken consumer demand. While retail sales and consumption weakened in 2016 and in Q1- 2017, it has improved and is running at or a little above trend over the last year.

Housing market risks

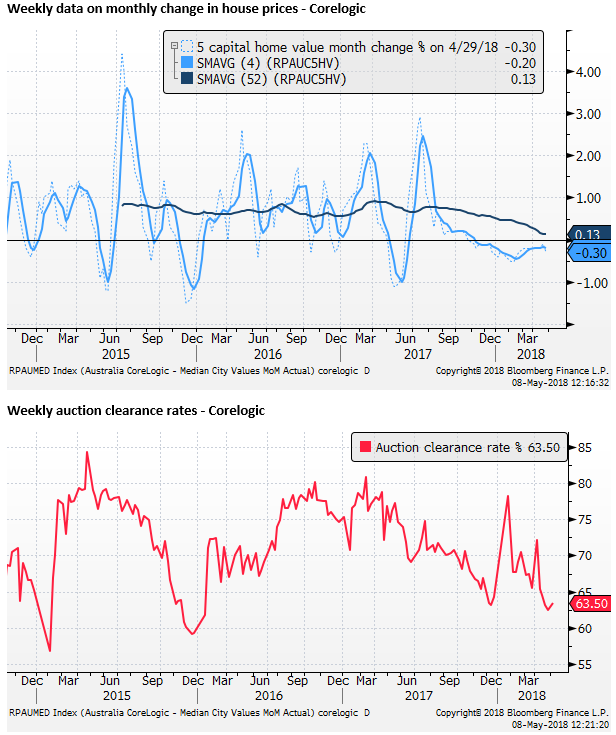

Adding to risks to household consumption is the recent slowing in the housing market. The CoreLogic 5 capital city index shows prices falling since November last year at a modest rate of around 0.3% per month. And auction clearance rates are running below average levels.

At this stage, it is not clear that the modest slowing in the housing market is dampening consumer confidence and spending.

Strong current business conditions

Apart from the housing market, recent economic indicators for business have been very strong, and the RBA has forecast GDP growth running moderately above trend over the next two and a half years in its quarterly statement on released last Friday, unchanged from its February projections.

On a three-month average, current conditions (18.5) are at a record for the survey, rising just above the peak in 2007. Confidence also remains around the highs since 2010.

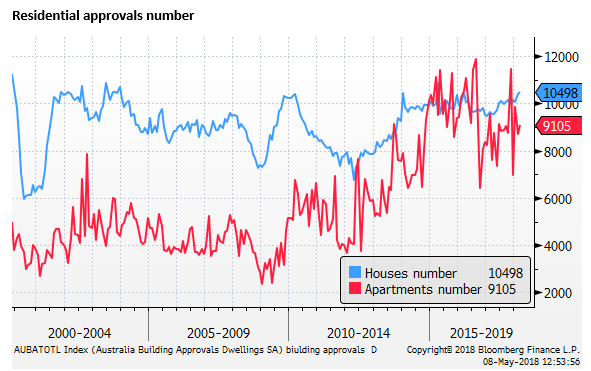

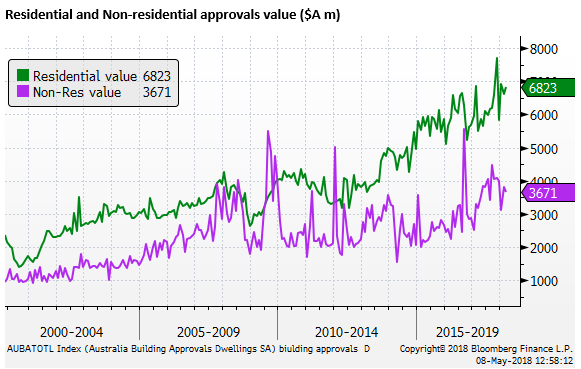

Building approvals firming

Residential building approvals released last week also showed resilience with apartment approvals stable and house approvals rising in the last year.

Non-residential approvals (value) are also contributing to solid growth in construction and private sector business investment.

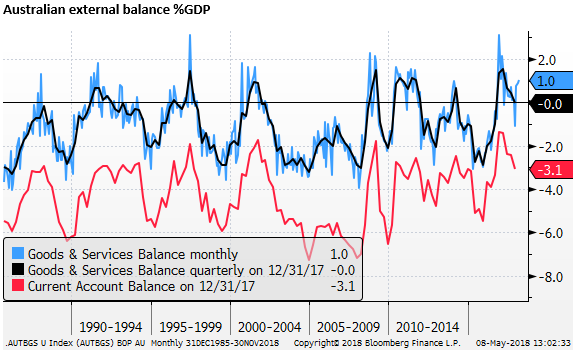

Stronger external balance

The Australian trade balance was also strong at a $A1.53 bn in March, ahead of 0.87bn expected, a surplus of around 1.0% of GDP

One of the factors recently weighing on the AUD is the trade threats between the USA and China. However, the Chinese trade data released on Tuesday were much stronger than expected. Exports rose 12.9%y/y, above 8.0% expected and imports rose 21.5%y/y, above 16.0% expected.

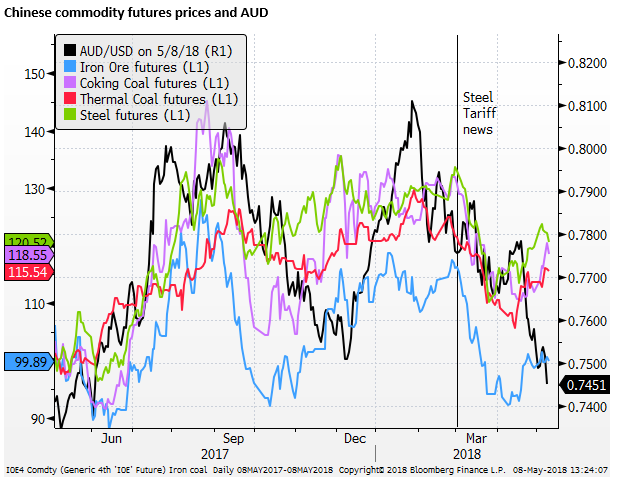

Chinese commodity prices firmer in the last month

Steel, iron ore and coal futures prices in China fell in March after steel tariffs were announced, but they have been firming over the last month, in contrast to the recent slide in the AUD.

We expect the AUD to weaken further as the USD responds to higher yields in the US and pressure on EM assets continues in the near term. Its chart pattern suggests it can fall further after breaking an uptrend over the last few years.

However, we are cognizant that the current trend in Australia in different circumstances might lift the AUD and rate expectations. If the AUD continues to fall it might further support business profits and generate direct inflation pressure. Eventually, this could bring forward rate hike expectations.