AUD/JPY may gain on diverging Fed/BoJ and improved risk sentiment

We see scope for the AUD to recover modestly after its recent steep fall. Global risk appetite has picked up and Chinese asset markets and currency have stabilized. The AUD is comfortably in the middle of its range since the middle of last year, a period where the Australian economy appeared to be transitioning well from mining to non-mining sectors. The RBA is likely to be patient and wait for a probable Fed rate hike in coming months, Australian election on 2-July and Q2 inflation data in late July. The USD may strengthen on a rate hike, but its gains against commodity and EM currencies may be modest. AUD/JPY and other JPY crosses may show gains if the mood continues to shift towards Fed policy hike and BoJ policy easing.

AUD in comfort zone

After its sharp retreat from .78 to sub-0.72, the AUD has stabilized in the last week. Sitting close to the middle of a roughly 0.70/.75 range that has corralled a lot of its trading since the middle of last year, a period when the economy appeared to be transitioning well from mining to non-mining.

The big risk factors that might drive the currency lower remain – (China-centric risks, an oversupply of apartments) – But from current levels the AUD has scope to recover if neither risk develops further in the near term.

Transitioning economy

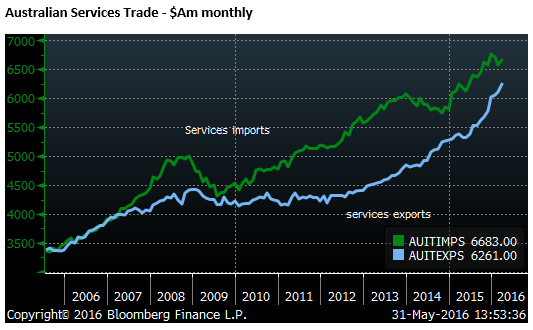

Commodity prices matter to Australia, but less so now that the focus is on a transitioning economy. As important is the strength or otherwise in non-resource sectors.

Net exports rose significantly more than expected and will contribute a strong 1.1%q/q to GDP growth in the national accounts released later today. Net services exports reflecting increasing demand for tourism and education appear to be providing solid support for the economy.

Services exports in Q1 rose 6%q/q in Q1, with volumes also up 6%. Services imports rose only 1% in value (up 3% in volume).

In monthly trade data, services exports rose 16.2%y/y in March, faster than services imports that rose 6.9%.

The capital expenditure survey released last week suggests growth in investment in non-mining sectors remains on a fairly flat trend. However, business lending data rose a strong 0.8%m/m in April, annualizing at a rate of 7.9% in the last three months, up 7.7% annualized in three-months over the previous three-months, and up 6.8% in the last three months over the same period a year earlier. As such, business credit growth has gained momentum and growing at a moderate to strong rate.

The capex survey may not be picking up investment activities in some of the more dynamic service sectors, with business credit growth suggesting activity is reasonably buoyant outside of the resources sector.

RBA can wait

Low inflation and wages growth were the key reason for the RBA’s recent rate cut. Slavish pursuit of its inflation target might argue for another rate cut, but activity indicators suggests that it can be patient, wait to see the impact of a probable rate hike in the USA in June/July, see if business confidence in Australia gets a lift or otherwise from the election on 2-July. And establish whether inflation stabilizes in Q2 after recent weak outcomes. With oil prices rising and the AUD weaker in the last month, inflation may lift in coming quarters.

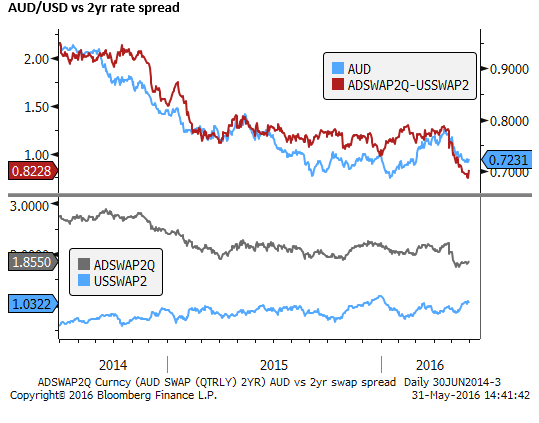

USD reacting less to US rates

The USD has rebounded in the last month and it may improve further in response to a near term rate hike. The market is still only pricing-in the chance of a Fed rate hike in either June or July at 53%, whereas we see it at around 80%. There is a surprising amount of skepticism in the market that the Fed will follow through on its rhetoric from various FOMC members, including Yellen herself.

Our bias remains to buy USD against other currencies in the lead up to the 15 June policy meeting. However, the USD has in general under-performed relative to the improvement in its yield advantage this year. As such, we cannot expect with great certainty that a further rise in US yields in response to a summer Fed rate hike will drive USD significantly higher.

It may be the case that the strong rally in the USD from mid-2014 through 2015 built-in a good deal of the current gradual policy tightening by the Fed. The delivery of those rate hikes may now have less impact on currencies.

The US and global stock market has rallied in recent weeks even as Fed rate hike expectations have increased. The global market appears to be well prepared for this second Fed rate hike that if delivered in coming months will be six or seven months after the first hike in December last year. The slow and cautious pace of Fed tightening may be helping underpin confidence in global markets and dampening the positive impact on the USD.

Buoyant risk appetite and search for yield may send capital in search of diminishing but still higher yielding currencies.

Chinese markets settle down

We have highlighted unsettled Chinese assets and currency recently as a factor that led us to see a weaker AUD – including soft equities, corporate bonds and currency. However Chinese yields have stabilized in recent weeks, mainland equities rose 3% on Tuesday on speculation that they may be included in the MSCI global indices. The Chinese currency has traded somewhat firmer against its basket over recent weeks, CNY implied volatility has eased, the spread between offshore CNH and onshore CNY has eased, as have spreads along the forward delivery curve.

We see a broader weaker trend in Chinese assets and currency persisting and acting as a negative influence on the AUD and other Asian currencies. However, this pressure has eased recently and, combined with buoyant global equity markets, might support commodity and Asian currencies in the near term.

In the last month, the AUD and other Asian currencies have not responded to the recovery in broader measures of risk appetite including narrower credit spreads, stronger global equities and lower volatility measures. This may be because the improvement has been more in developed markets than emerging markets, particularly China. Nevertheless, the risk is now that we see the AUD improve, at least for a time, if more severe risk aversion in China does not over-power the improved risk appetite in developed markets.

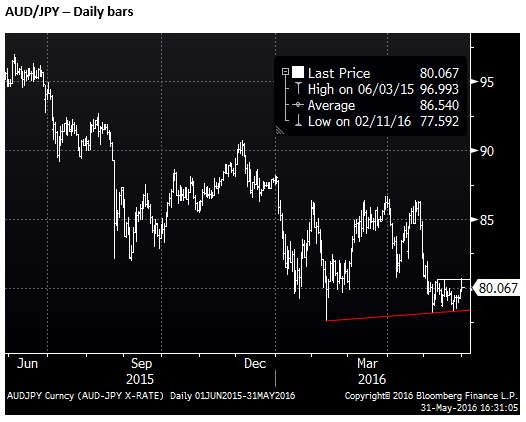

Diverging Fed and BoJ paths may pave way for higher AUD/JPY

USD/JPY has been grinding higher over the last month, testing resistance and leaving the market in a mixed frame of mind. A key resistance is the high prior to the no-policy easing on 28 April (111.9).

Expectations are building for the BoJ to step-up with additional easing at any one of the next few meetings. This is helping support the USD/JPY. The market has not formed a clear view of when the BoJ may pull the trigger. It may be as soon as the 16 June meeting, but it might wait for the upper house election and government fiscal policy measures expected in July.

JPY has out-performed most other currencies this year, but the downtrends in JPY crosses appear to be stalling over the last month. In a risk positive environment, JPY crosses might break to the topside, especially if the BoJ steps up its policy easing.

If the USD were to gain on Fed policy tightening or a more hawkish policy statement and press conference on 15 June, USD/JPY may break the 111.9 resistance and drag up JPY crosses.