Bank of England Sets Glacial Hike Projections

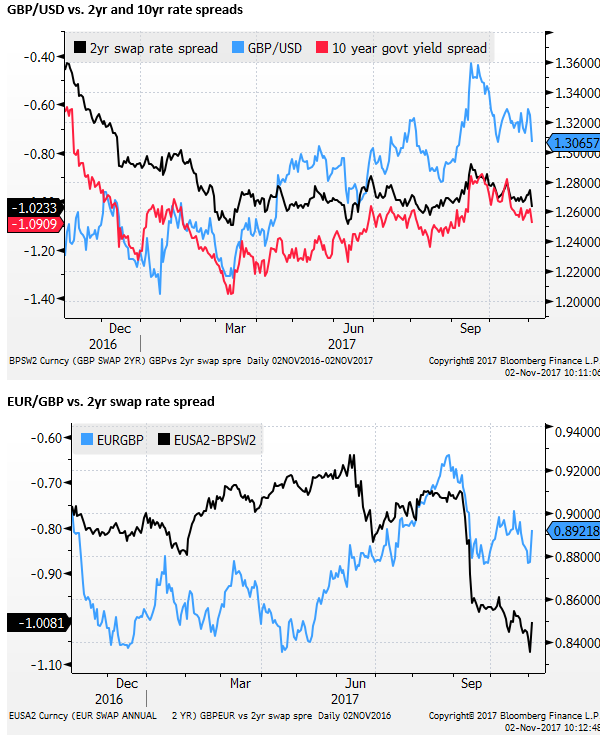

The market had a glacial pace of hikes priced-in for the UK over the next three years, and the Bank of England Inflation Report largely reinforced these expectations. Two of nine MPC members dissented from the hike and appear to reflect market expectations that inflation pressures (beyond that driven by GBP depreciation) will remain subdued, notwithstanding a 42-year low in the UK unemployment rate. Like the USA, the market appears to feel more comfortable with rates below the central bank’s rate projections, and the immediate market response was to drop 2yr UK rates by around 7bp. The BoE is hiking not because the UK economy is all that strong; in fact, it is significantly under-performing G7 and its trading partners’ growth. The Bank is hiking because it appears that potential output growth is equally subdued. There appears to be limited slack in the economy, and its modest growth outlook is still expected to gradually use up what little slack may be left, increasing domestic inflation pressure. There is elevated uncertainty over the direction of UK rates reflecting the range of potential Brexit negotiation outcomes, UK political uncertainty, and a lack of historic guideposts to assess the current state of the UK economy and how it has already reacted to Brexit uncertainty. The GBP is already historically cheap, and its fall since the Brexit referendum is consistent with its relatively sluggish economic performance. It remains difficult to assess its future direction, but the market’s rate outlook is subdued, and it appears to have priced-in tough times ahead for the UK economy.

A Glacial Pace of hikes

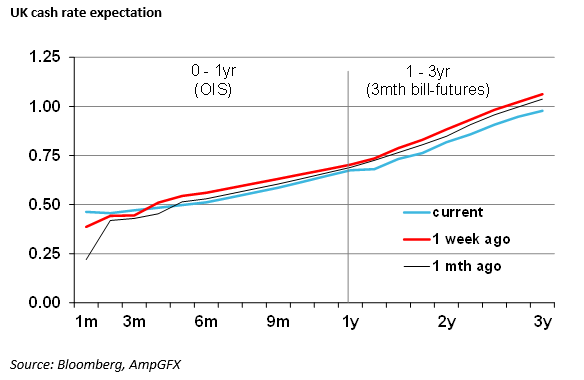

The BoE delivered the expected rate hike, the first in 10-years, but the market has pushed the UK rates curve and the GBP lower quite significantly. It is fair to say that the hike was largely priced-in ahead of the decision and the market was most concerned with the Bank’s outlook for rates ahead.

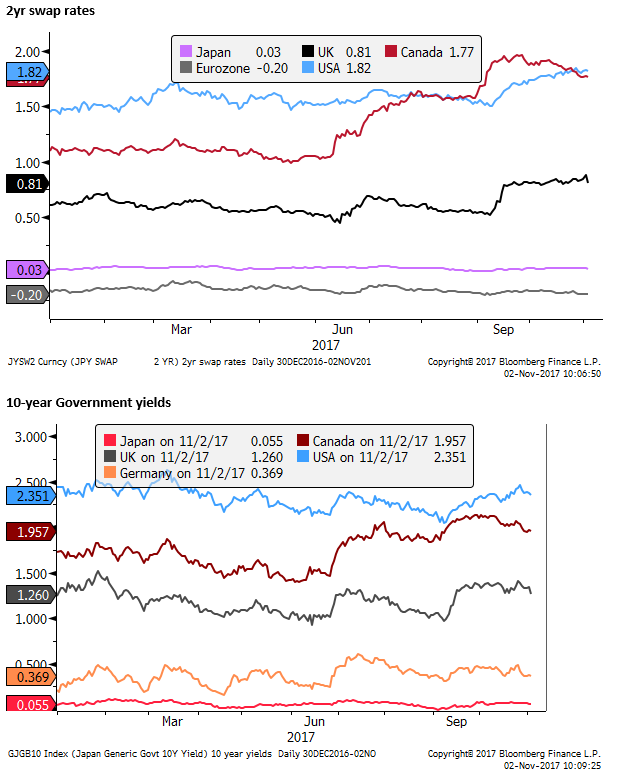

2yr swap rates are down by 7bp and 10-year government yields are down 8bp. Some of the down-draught may reflect lower US rates. US 2y swap rates are 0.5bp lower and 10-year US government yields are 2.5bp lower.

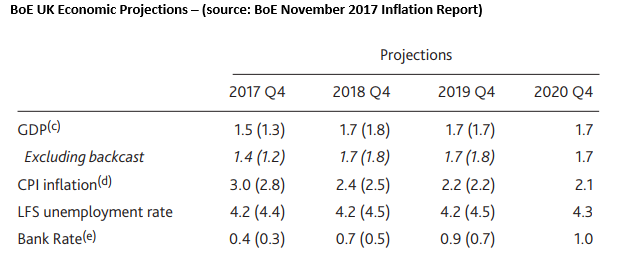

The BoE inflation report sets its forecasts over the next three years based on the market’s pricing for rate hikes. The market had projected around one more hike by around end-2018, and another over the next two years. So only two more hikes over three years.

With this glacial pace of hikes, the BoE projected the inflation rate to rise to a peak of 3.2%y/y in October (from the latest data of 3.0% y/y in Sep) and then slide steadily over the three-year horizon to 2.1%.

If we assume that the Bank likes to get its forecast for inflation at the end of its horizon, if not sooner, on target, then, this forecast suggests that the Bank does not currently think rates will need to rise much faster than glacial market pricing.

Source (Bank of England Inflation Report November 2017)

Global markets appear to feel more comfortable pricing in less hikes than central bank projections in most major economies. It appears that the market thinks the risks are skewed towards lower inflation outcomes than central banks. I guess markets have seen little upward pressure on wages from tightening labour markets and is seeing past trends where inflation in many countries has undershot central bank expectations.

As such, with the BoE forecasts basically agreeing with current market forecasts, the market’s reaction was to push rates lower.

The vote for the hike at this meeting was 7 for and 2 against. The split in the vote may reflect a degree of ambivalence, reinforcing the notion that this was a ‘dovish hike.’

Uncertainty, Modest Growth, Limited Slack

The forecast and outlook reflect a high degree of uncertainty for the growth, capacity, inflation and interest rates. Most of the uncertainty, over and above normal forecast uncertainty, relates to Brexit negotiations, and assessing the implications of the impact Brexit has already had, without historical guide-posts.

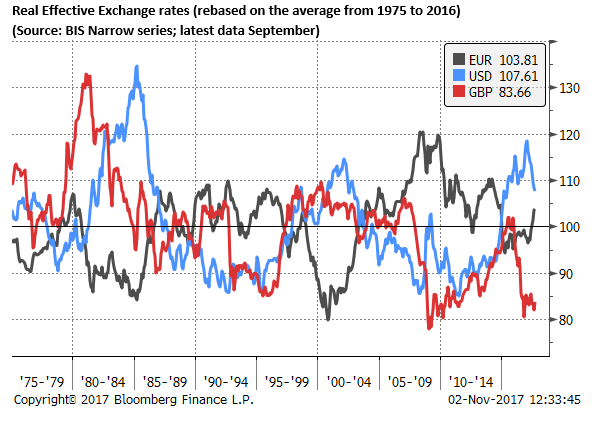

Most of the reason why inflation has exceeded target in the last year relates to the depreciation of the exchange rate. Naturally, the forecast for a fall in inflation over the next three years arises because this exchange rate effect is expected to wash out. Inflation is expected to lift slightly above target because the BoE is forecasting a rise in domestic inflation pressures.

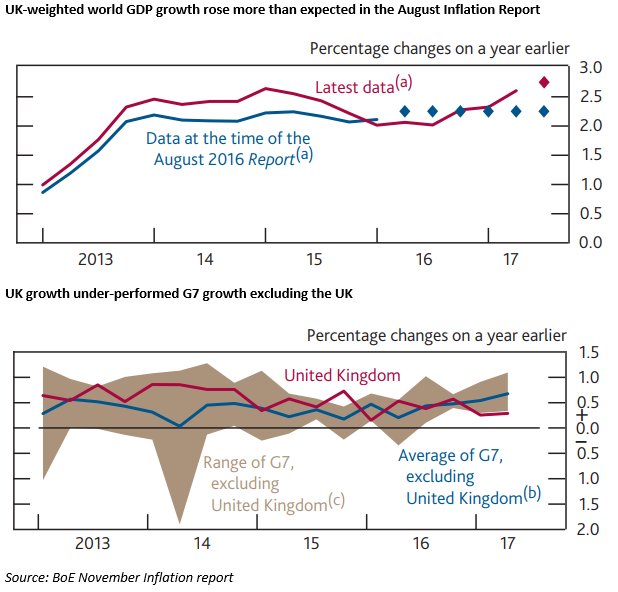

The Bank has a modest, steady outlook for UK growth over the coming three years, in-line with its outcome in the last year, noticeably under-performing its global growth forecasts. The Bank notes that the UK economy has underperformed the global recovery in the last year. The MPC statement said, “Uncertainties associated with Brexit are weighing on domestic activity, which has slowed even as global growth has risen significantly.”

The relative underperformance in the UK economy may help account for the weaker GBP exchange rate since the Brexit referendum; reflecting largely Brexit uncertainty. It implies to investors a lower potential rate of return from investing in UK assets.

However, it does not deter the BoE from tightening because it also sees that potential output in the economy as diminished, likely to grow equally modestly to demand growth, and capacity constraints already apparent. The MPC said, “Brexit-related constraints on investment and labour supply appear to be reinforcing the marked slowdown that has been increasingly evident in recent years in the rate at which the economy can grow without generating inflationary pressures.”

MPC quotes

The BoE MPC said that since the August Inflation Report that, “data outturns had been broadly in line with expectations, or a little stronger. Global momentum had been strong, domestic financial conditions had been highly supportive, and consumer confidence had remained resilient. Spare capacity appeared to have eroded, if anything, a little more rapidly than the Committee had anticipated in its August projections, and the margin of slack in the economy now seemed fairly limited, while underlying domestic inflationary pressures had shown some signs of picking up, in line with expectations. This, in turn, had reduced the degree to which it was appropriate for the MPC to tolerate an extended period of above-target inflation.”

For the two members that voted not to hike (Jon Cunliffe and Dave Ramsden), the MPC minutes said that they “felt that there was insufficient evidence so far that domestic costs, in particular wage growth, would pick up in line with the Inflation Report’s central projection. It was possible that there was a greater degree of slack in the economy than was assumed in the central case, for example, if a larger part of the recent weakness in productivity had been cyclical. In addition, for those members, recent experience suggested that wage growth could continue to be less responsive to falling unemployment than past experience would suggest.”

It seems that the market tends to agree with these dissenting members.

All members agreed that “any future increases in Bank Rate would be expected to be at a gradual pace and to a limited extent.” This has similarly been the refrain of the Fed. Gradual and limited would still give the BoE scope to raise rates significantly faster than current market pricing which is glacial.