Bank of Canada could surprise again

The BoC rate decision tomorrow is a line ball call. The output gap model suggests getting a hurry on because the economy is moving into excess demand and rates are far below neutral. Recent consumer, housing, and labor market data also support getting on with hikes. Some more recent, albeit modest, ebbing in business activity indicators suggest the Bank can take a more standard path of hiking on a quarterly schedule and waiting until the 25 October MPR date. Inflation is also not an immediate concern. The recent pace of CAD exchange rate gains might give the Bank some pause before hiking again. The level of the CAD exchange rate is not particularly high, but the external balance in Canada remains historically weak. The USD continues to struggle due to heightened economic and political uncertainty. Gold has rallied, and US yields are lower reflecting increased haven demand. Stronger global manufacturing is underpinning commodities and commodity currencies. EUR has stalled ahead of ECB meeting; it may correct a bit more if the ECB forecasts that the higher EUR this year dampens its inflation outlook.

Bank of Canada could hike again this week

The Bank of Canada moves into the spot light tomorrow with a rate decision that the market sees as a line-ball call.

The market is rating the odds of a hike at a 42%, down from 56% last week, dampened it seems by risk aversion related to Korea and US political and macroeconomic uncertainty, dragging down US yields and spilling over to global rates.

According to Bloomberg, 21 out of 26 analysts surveyed think rates will remain on hold, 5 predict a hike.

The BoC hiked rates for the first time this cycle at its previous meeting on 12 July, by 25bp to 0.75%. This began the process of removing essentially two emergency rate cuts in 2015 to deal with an oil price shock.

The BoC is almost fully priced by the market to deliver a second hike to 1.0% by its next meeting on 25-October. This would seem sensible timing as it would coincide with the quarterly monetary policy review.

A third hike this cycle is priced to be delivered by the 7 March policy meeting next year.

Output gap model calls for faster hikes

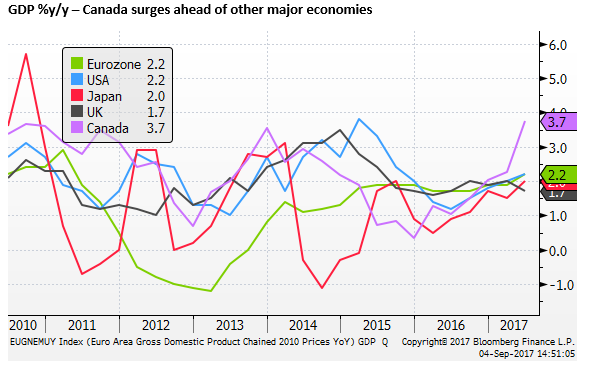

The odds of a back-to-back rate hike on Wednesday got a lift after the stronger than expected Q2 Canadian GDP report last week. GDP rose 4.5%q/q saar in Q2; above 3.7% expected, up 3.7%y/y using the quarterly data, or 4.1% 3mth/yoy using monthly data. The fastest annual pace since 2000.

More than most central banks, the BoC leans on an output gap model of inflation. In its July Monetary Policy Review, the BoC forecast 2.8% annual growth in 2017, above the long run potential growth rate estimate of around 1.3%, closing its negative output gap around the end of this year.

The surge in GDP in the first half of the year suggests that the output gap may already be near closed.

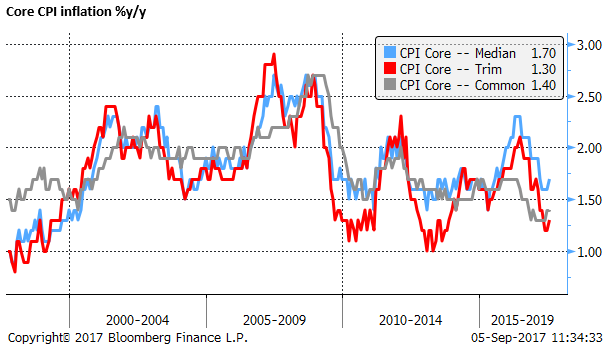

While inflation remains well below target, core measures have lifted from the lows and are consistent with the BoC MPR forecast for it to return to the 2% target by mid-2018. As such, you could argue that the BoC should be approaching a neutral policy setting by mid-next year.

However, at 0.75%, rates are a long way below the BoC’s perception of neutrality at around 3%, suggesting that it may want to step up the pace of policy tightening.

The market is not even close to anticipating that the BoC will push rates to 3% next year. Few could see rates rising so far ahead of US rates, potentially pushing the CAD much higher. The market may also doubt the 3% neutrality estimate given the historically high level of Canadian household debt (170% of disposable income). Nevertheless, the model driven BoC might see policy too far below neutral.

Inflation is not an immediate problem

Recent inflation data In Canada showed at least a modest pick-up in the underlying measures in in the most recent data for July. And this may be consistent with the BoC forecast for a return to 2% by mid-2018. Nevertheless, inflation remains relatively low and significantly below target. Most other central banks might sense there is little urgency to tighten policy, especially given the global trend towards persistent low inflation despite tightening labor markets.

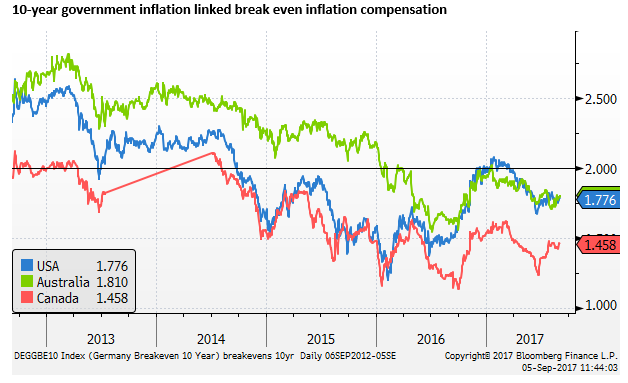

Long term government inflation-linked bond breakevens suggest that the market is not seeing much inflation risk in Canada. 10-year breakeven inflation compensation in Canada is 1.46%, below the US at 1.78%. The gap below the USA opened up in 2016, although Canadian inflation expectations have increased significantly from the low in June, despite the recent strength in the CAD.

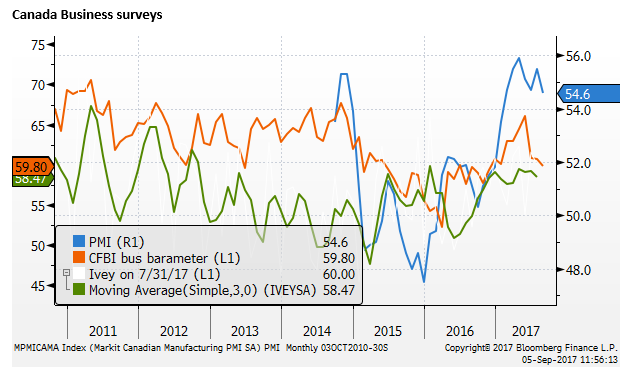

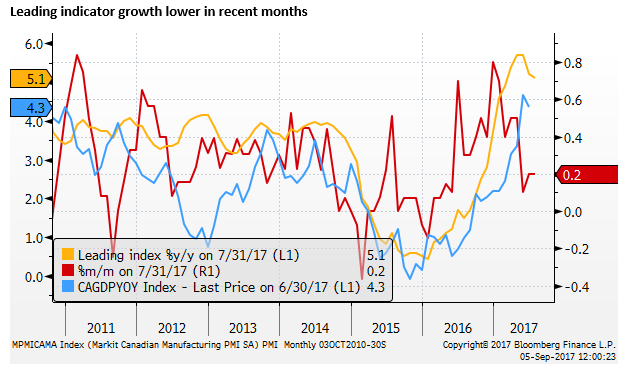

Some peaking in recent activity indicators

Looking at more recent activity indicators in Canada, they remain robust, but they have ebbed from the highs earlier in the year. As such, the BoC may view the surge in GDP growth in Q2 as the likely high point for the year; allowing them a bit more time before hiking again.

The Canadian Markit manufacturing PMI peaked in April at 55.9 and was 54.6 in August. The CFBI business barometer peaked at 66.1 In May and was 59.8 in August

The leading index has slowed to 0.1 to 0.2%m/m increase for the last three months to July; the annual increase has slowed from 5.7%y/y in May to 5.1%y/y in July

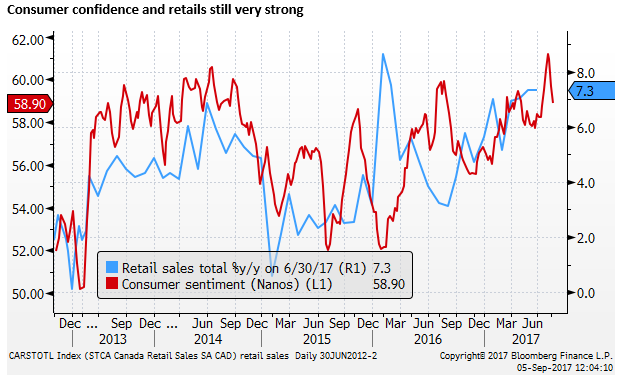

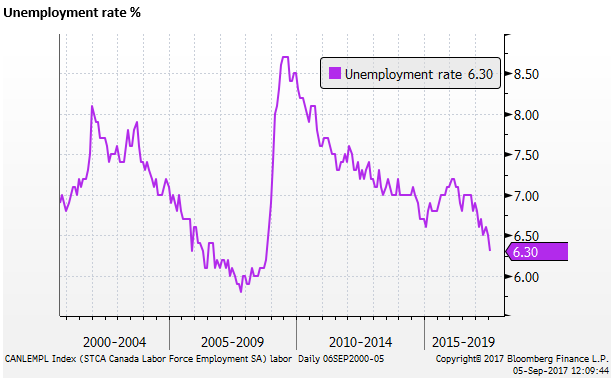

Consumer, housing, and labor market support hike

More supportive of hiking this week, consumer confidence remains high, and the most recent data on the labor market, retail sales, and house price growth are at cyclical peaks.

Consumer confidence has ebbed from a peak since 2010, but remains around historic highs. Retail sales rose a strong 7.3%y/y in June.

The labor market has strengthened significantly this year. Unemployment has fallen sharply from 6.9% at the end of last year to 6.3% in July. It has only been lower in the 2006/08 period. Employment growth reached 2.1%y/y in July, the fastest pace since 2012.

House price growth remained at 14.2%y/y in July. The pace of house price growth may be a significant concern for the central bank and a sign that rates are too low.

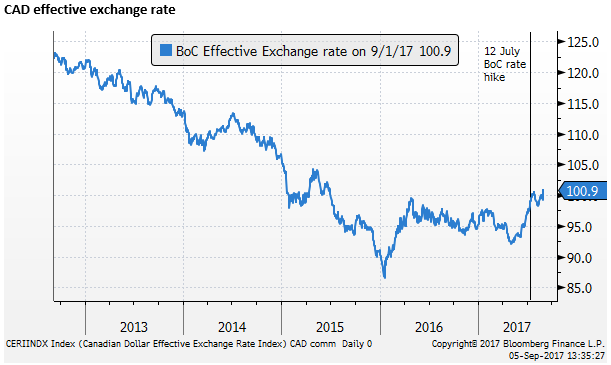

Pace of CAD gains may be reason to delay hike

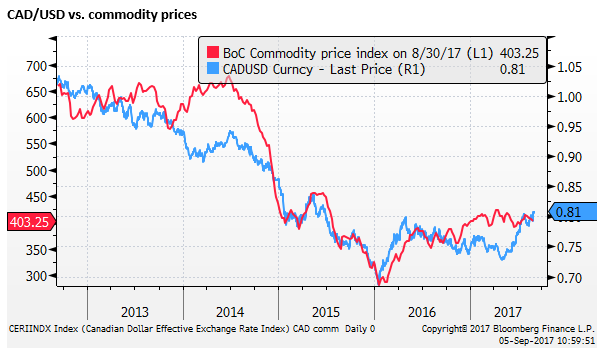

The recent strength in the CAD may be a factor that causes the BoC some pause on back-to-back rate hikes, potentially causing too much of tightening shock. Since the 12 July first rate hike, the BoC CAD effective exchange rate index is up 3.6%.

The CAD rose sharply in anticipation of the 12 July policy tightening; it is up by 9.5% from its low for the year in May. As such, combined with higher interest rates, the stronger CAD has added further to the tightening in policy from earlier in the year.

The pace of the CAD rally since May may be a factor that discourages a back-to-back hike.

The level of the CAD exchange rate relative to its long run history is not as worrisome. It is significantly below its 10 or 20-year average.

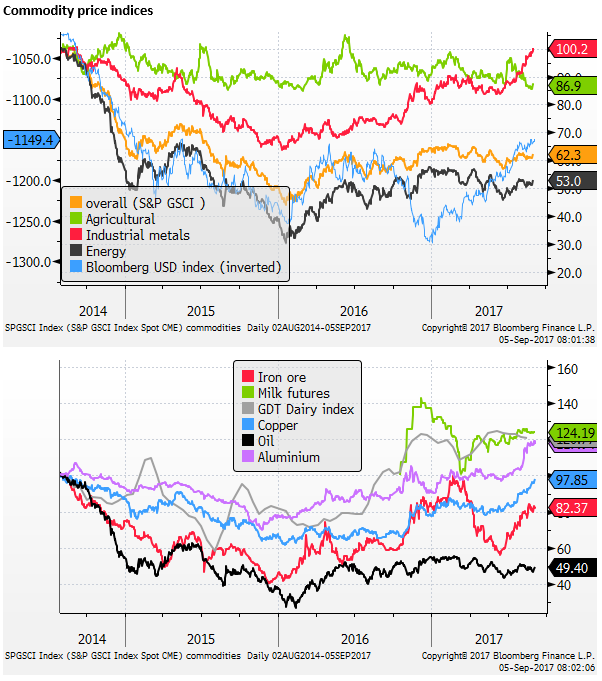

However, as a major energy producer, Canadian commodity prices are much lower than before the 2014 oil shock. Energy prices and the BoC Commodity price index have been relatively stable this year, not improving as much as industrial metals prices. The CAD was under-performing commodity prices through to April, but has reconnected with them since.

Weak Canadian external position

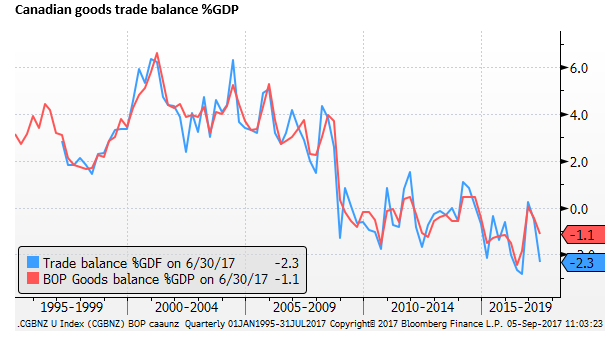

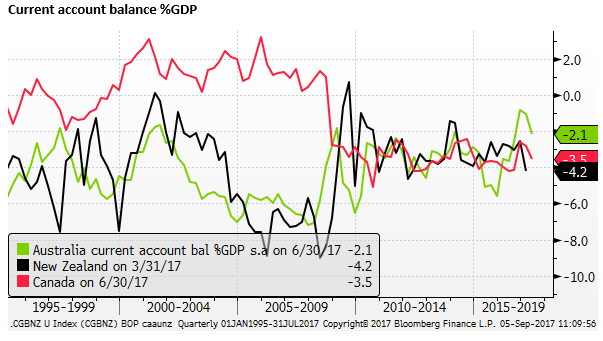

The CAD is not necessarily out of line with commodity prices, and it does not appear particularly expensive relative to long term averages. But its strength in recent months appears to have dampened export revenue and contributed to a widening in the current account deficit.

However, the deficit is probably also a reflection of the relative strength of the Canadian economy, boosting imports. In June, export revenue was up 12.4%y/y, and imports were up 10.4%y/y.

The Trade deficit in June was around 2.3% of GDP, and 1.1% for Q2. With a services deficit atd 1.2% of GDP, and an income deficit of 1%, the Canadian current account deficit of 3.5% in Q2 is relatively large and remains historically wide. As such, the external balance conditions does suggest that the CAD exchange rate could be too high.

USD struggles as economic and political uncertainty increases

The USD remains a difficult beast to tame. The data is showing improvement in recent months, displaying resilience to political uncertainty and continuing to support the case for gradual policy tightening. But wage growth remains subdued, and there is little pressure for faster rate hikes.

Now the market has to consider the impact of Harvey’s devastation, which will generate weaker economic outcomes in the near term, and greater uncertainty in the underlying trend, arguing for a more cautious Fed policy tightening through at least the rest of this year. Another hurricane is threatening Florida

Congress has a lot on its plate; a spending bill, debt ceiling, Harvey relief spending, and a tax reform bill

Geopolitical risk is heightened around North Korea.

The administration is pushing harder against trade pacts; renegotiating NAFTA, threating to pull out of a trade agreement with South Korea. The US is also using trade as a carrot/stick to increase economic pressure on North Korea.

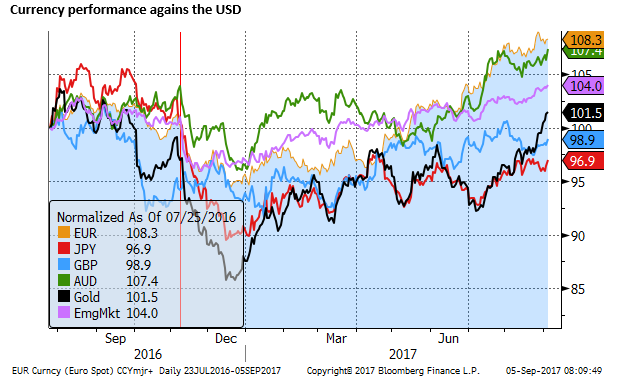

The USD remains near the lows on broad indices, undermined by lower US yields. US 10-year yields are down 9bp from the close last week, shrugging off a rebound on Friday to be at a new low for the year. 2-year swap rates are also near their lows since mid-year, as yet showing little positive response to firmer economic trends in recent months.

While uncertainty over the macroeconomic outlook is higher in the US, global economic growth appears to have strengthened, tending to support other currencies abroad.

Gold surges on haven demand

Gold has risen more sharply than other major currencies against the USD in the last two weeks, suggesting that the market’s demand for a haven asset has increased. Higher geopolitical tensions and US political risks appear to be boosting the gold price. This is spilling over to a stronger JPY.

Global manufacturing supports commodity currencies

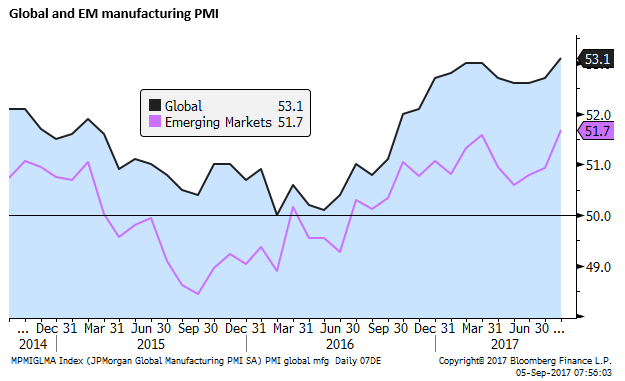

The global manufacturing PMI rose to a 15-year high in August, supported by a solid pick-up in the emerging market component.

The stronger global manufacturing cycle and weaker USD appears to be contributing to stronger industrial commodity prices, supporting commodity currencies.

EUR stalls ahead of ECB meeting

The EUR has been the leading currency gainer this year against the weaker USD. However, its gains have stalled in the last week or so, with gains in the JPY, commodity and EM currencies taking up the running. Even the GBP has firmed a bit more recently.

EUR may appear more fully priced against the ECB that is likely to re-emphasis that it intends to retain considerable monetary policy accommodation for the foreseeable future, even if it does taper its QE beginning next year, as is already widely anticipated. ECB sources have been reported as saying the ECB may delay announcing its QE policy adjustment expected for next year until later in the year.

Recent Eurozone economic surveys remain strong, but have ebbed from peaks. The composite PMI was 55.7 in August, down from a peak of 56.8 in May.

Eurozone equities have been in a gradual declining trend since May, under-performing other major and EM markets, showing the dampening impact of a rising EUR exchange rate (although Euro stocks have outperformed major markets incorporating currency return).

Net speculative long EUR positions on the IMM reported by CFTC has been around the high since 2007 for over a month, whereas traders remain moderately short JPY and GBP.

The ECB meeting on Thursday will be watched closely for hints on ECB policy. ECB staff forecasts will be updated and often form the basis for key policy changes by the ECB. Few anticipate any announcements on Thursday, but the market will be seeking hints from the Draghi press conference. Of key importance will be any change in the inflation outlook.

While medium term market-based measures of inflation expectations remain stable, the ECB may see the recent rise in the EUR exchange rate as dampening the inflation outlook next year. If so, it might generate a little more profit-taking in EUR.