Bank of Canada may pick up the pace

The market is on board for a hike this week but appears to have been lulled into thinking that’s it until next year. However, the Bank of Canada has policy set still well below neutral, despite an economy and inflation largely on target and growth above trend. More likely is that they come off their mini pause and step up the pace to what will still be described as gradual policy tightening by hiking several times over the year ahead.

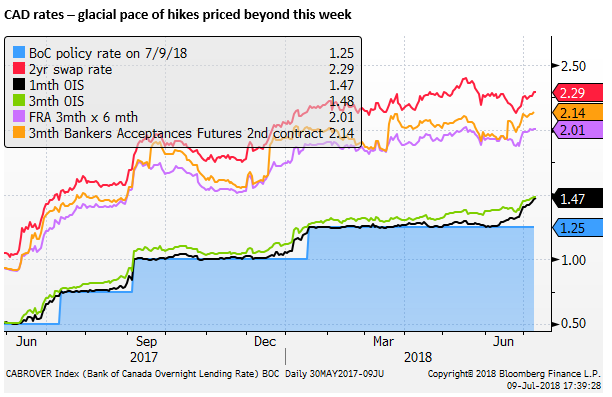

Few hikes are seen after this week

The market appears well-prepared for a hike by the Bank of Canada on Wednesday; a 25bp hike to 1.5% is 90% priced-in.

This would be the fourth hike in the current cycle that began exactly a year ago in July last year.

But over that period the pace of hikes has slowed from two in successive policy meetings in Jul/Sep last year, then a wait of three policy meetings (four months) for a third hike in January. A hike this week would be a wait of four policy meetings (six months).

While the market has largely concluded that the Bank will hike this week, it is also assuming that the bank is now on a very slow pace of tightening; not pricing in the next hike until early next year (at least another six months).

As such, there is still scope for the market to react to the policy statement this week; including the quarterly Monetary Policy Report and press conference.

Parsing the Bank of Canada Statement – skip one hike one? Gradual or cautions?

The Bank of Canada Governor Poloz gave a speech on 27 June ( Let Me Be Clear: From Transparency to Trust and Understanding – BankofCanada.ca).

In that speech, he gave a strong hint that a hike was coming at the meeting this week. He said, “Some observers noted” that we removed “we would be cautious about future policy adjustments” and replaced it with “we would take a gradual approach to raising interest rates”.

Poloz said, “this shift in language represented increased confidence that the economy was performing as we expected, and that higher interest rates will indeed be warranted. Financial markets understood our message.”

It’s a subtle shift, but the implication taken by the market and endorsed by Poloz in this speech was that, since the Bank had waited six months, by saying they are taking a gradual approach, it was time to hike again – probably this week.

Gradual in central bank speak means just about anything they want it to mean, but typically you can assume they may be thinking of skipping one meeting between hikes.

Poloz’s speech on transparency, ironically, had some contradictions. On the one hand, in the above comments, he encouraged the market to parse the statement carefully.

But on the other hand, he said, “Since 2014, we have begun drafting each interest rate announcement on a blank page. This is to avoid getting locked into repeating specific language that, when changed, can create big market disruptions.” Which suggests we should not parse the statement too carefully?

So good luck interpreting the statement this week. However, if the Bank takes out “gradual” and reinserts “cautious” in the statement this week, you might conclude that the Bank is going back into a mini-hold and is not thinking it will raise rates again in the next six months or more.

However, if they retain “gradual”, you might conclude that they think another hike may be warranted in around three months (skip one – hike one). In which case, the statement should be viewed as somewhat more hawkish than what is currently priced-in to the market.

Our view is that the Bank is going to stay with “gradual”. In other words, we think it is coming off a mini-hold that resulted in a six-month wait for the fourth hike this cycle, and it will suggest that it is heading into a period of a somewhat faster pace of hikes. A more standard “gradual” pace of hikes on a schedule closer to three months between hikes.

The Bank can be vague and confusing in its language. It has a history of dropping surprises on the market, which suggests that messaging its moves to the market is not necessarily its forte or priority.

It would be clumsy, in our view, if it thought that switching between “cautious” and “gradual” might be a kind of traffic light warning to the market that hikes were on or off for the next meeting. So I don’t expect them to shift back to “cautious”. But if it did, the market might play the game and use it as a sign that a hike is off the table, until it is replaced again with “gradual”.

Heading back to neutral

Our view is that the evidence from the economy in recent months suggests that a gradual return to policy neutrality over the coming year is a reasonable base case forecast.

The Bank has estimated neutral policy rates to be between 2.5 and 3.5%. With rates at 1.25%, it has at least five 25bp hikes to get back to its neutrality estimate.

As such, it will still see that, after a hike this week, that policy is significantly accommodative, and project above-trend economic growth.

In the April MPR, the Bank assumed that there was some slack in the economy; but not much. It estimated that the output gap was between -0.75% and +0.25%.

While the unemployment rate is around a record low, the Bank thought there was still a bit of slack, and noted that wage growth was still somewhat below what it would normally be if there were no-slack.

Wage growth not quite back to normal; dips from Q1 peak

In April, the Bank estimated that wages growth was running at an underlying rate of 2.7% in Q1, although this rate appeared “to have been boosted somewhat by the impact of the minimum wage increase”. (neutral wage growth is seen to be around 3%).

More recent data suggests that wage growth has eased a bit from its cyclical high in Q1. As such the Bank may continue to feel it is not ‘behind the curve’ and can move rates gradually back to neutral.

Nevertheless, wage growth has picked up to levels that suggest that the labour market is getting pretty close to normal.

Tighter capacity indicators

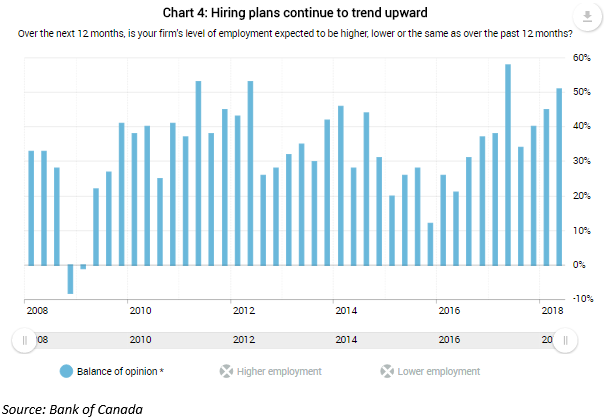

The Bank of Canada’s Q2 Business Outlook survey also indicated capacity pressures are generally tightening, and in the labour market specifically.

The survey also pointed to strong hiring plans

Inflation close to target

Underlying inflation measures have been stable in recent months, just below the 2% target. With inflation close to target, and capacity constraints tightening, the Bank is likely to see the need to keep hiking after this week.

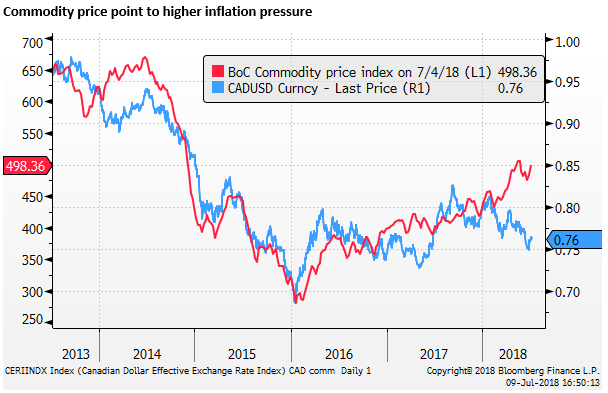

Commodity price points to increased inflation pressure

The rise in oil prices over recent months has boosted commodity prices for Canada, while the exchange rate has eased. The combination should bolster the outlook for growth and inflation, and support the case for raising rates.

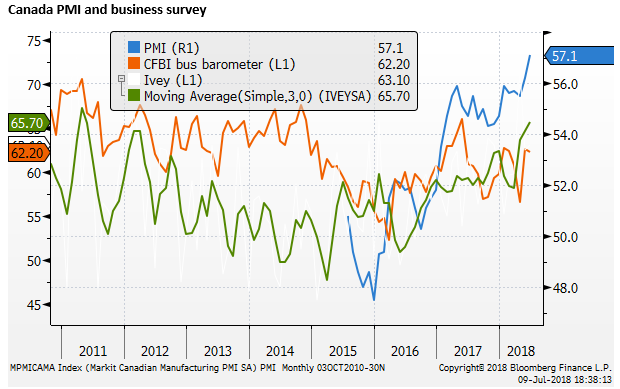

Activity indicators are robust

Recent manufacturing PMI data were at a cyclical high in Canada. The Markit PMI rose to 57.1 in June. The Ivey whole economy PMI averaged 65.7 in the three-months in June, a high since 2011.

The noise around NAFTA negotiations has gone quiet recently. It may be the case that Canadian businesses are delaying investment until greater clarity on trade relations. However, the tightening capacity constraints suggest that business investment should remain supported. The Bank will show the appropriate degree of cautions over the NAFTA renegotiation risks. However, there is unlikely to be fresh concern.