Bank of Canada set to hike, but what about the RBA?

The Bank of Canada has essentially made the case to remove the 50bp of policy accommodation it handed out in 2015 to deal with the oil price shock. Rates in Canada have jumped in the last month to price in about three-quarters of this normalization, but there may be some room for the CAD to firm further. The question we should be pondering is what about the RBA next week? Will it join the central bankers in recent weeks that have fluffed up their hawkish feathers? Even subtle changes in tone have had big impacts recently. Witness the stronger EUR and NZD. The RBA was actually making noises about subjugating their inflation target to financial stability concerns over household debt and house prices since around October last year. And macroprudential steps appear to have cooled the housing market this year. As such, it is less likely to see a need for rate rises soon. Nevertheless, it will probably upgrade its assessment of the labour market. The market still has little chance of hikes priced in for the RBA in the year ahead, seeming to dismiss what in fact has been a relatively optimistic tone in RBA statements towards global growth and investment. Given the current sensitivity in the market to shifts in central bank tones, we see upside risk for the AUD next week. The AUD is already trading near an important resistance level; a break above will trigger technical support. We are not convinced that the AUD is set for a renaissance, as its highly indebted households appear quite sensitive to even small rate rises. But the same might have been said for Canada.

Bank of Canada set-up to raise rates

On Wednesday, in a CNBC interview, in Sintra, Portugal, while attending the ECB forum on central banking, Bank of Canada Governor Poloz made comments that significantly raised expectations for a hike at the next BoC meeting on 12 July. The ECB gathering of central bankers has generated several more hawkish comments from central bankers, including the BoE and ECB.

The market was blind-sided by a speech by Bank of Canada Deputy Governor Wilkins on 12 June that shifted the BoC to a clear tightening bias. Since then 2yr Canada rates and the CAD have been rising. Poloz gave this move more juice.

On Wednesday, Poloz responded to a question on “room for rate hikes to come?”, saying, “Well rates are of course extraordinarily low and we cut them by 50 basis points in 2015 to counteract the effects of the oil price shock speed up the adjustment. It does look as though those cuts have done their job. But we’re just approaching a new interest rate decision so I don’t want to prejudge. But certainly, we need to be at least considering that whole situation now that the capacity excess capacity is being used up steadily.”

CNBC Transcript: Stephen Poloz, Bank of Canada Governor – CNBC.com

This suggests that 12 July is a live meeting, and the PMC needs to “at least be considering” a hike.

The BoC has characterized the last 50bp of cuts in 2015 as designed to deal with an oil price shock. The evidence suggests that the shock has past and the economy is back on track. As such, there may be a relatively low hurdle for the BoC to remove those two 25bp cuts.

Canada led a global upswing in rates

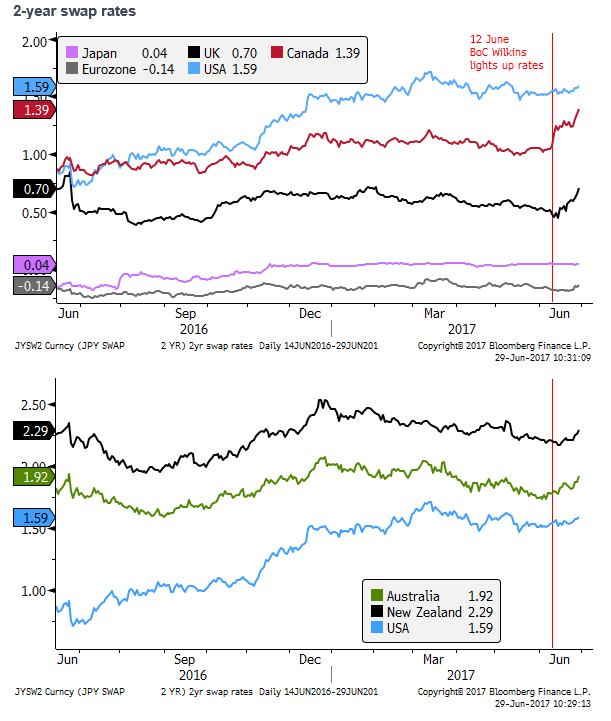

Since the day before the Wilkins speech on 12 June, 2-year Canadian swap rates are up from 1.07% to 1.40% (+33bp). Canada led a recent upswing in rates and yields across global markets, and its yields have risen more than its peers over the last month.

The BoC sees the output gap on track to be closed soon

The rates market is pricing the odds of a 25bp BoC hike on 12 July at 76%. The market is assigning the July meeting a high probability since it also coincides with the quarterly Monetary Policy Report.

The quarterly MPR provides an opportunity to reset forecasts and is the obvious time to recalibrate policy. Having danced the market so close to pricing in a hike, the BoC might decide that it should get on with it, or else be accused of sending mixed signals. As such, a hike indeed appears very likely.

This would be part of a two-step process of unwinding the 2015 cuts, so the market is also pricing in a high probability of a follow-up hike later in the year.

A key point made by Senior Deputy Governor Wilkins in her 12 June speech was that the recovery in Canada was broadening across sectors and regions in the economy. A sign, she considered, that the economy had adjusted to the reality of lower oil prices. She said, “The data show that more than 70 per cent of industries have been expanding—a rate we have not seen since the oil price shock. That is the kind of diversity that helps support strong and sustained overall growth.”

Governor Poloz said in his CNBC interview on Wednesday said that the adjustment to the 2014/2015 oil price shock is “largely complete” and suggested that the energy sector has stabilized and adjusted to an oil price in the $40 to $50 zone.

Poloz also said that the BoC expects growth to moderate from the strong 3.7% q/q SAAR in Q1 to a more normal pace, but still above potential.

The April MPR projected growth would slow to 2.5% in Q2. The long run potential growth rate is “projected to increase gradually from a trough of 1.3 per cent in 2016–17 to 1.6 per cent by 2020” (Apr-MPR).

The BoC said that, “in the first quarter of 2017 [excess capacity in the economy] remains material, between 1 1/4 and 1/4 per cent.”

It projected that the output gap would close in annual projections next year, and become positive in 2019.

The recent strength in the recovery suggests that the gap may be near closed toward the end of this year.

Policy is considered extremely accommodative, and so the BoC may think it appropriate to remove some of that accommodation before the output gap is completely closed. On the other hand, the very low inflation outcomes this year would suggest there is less urgency.

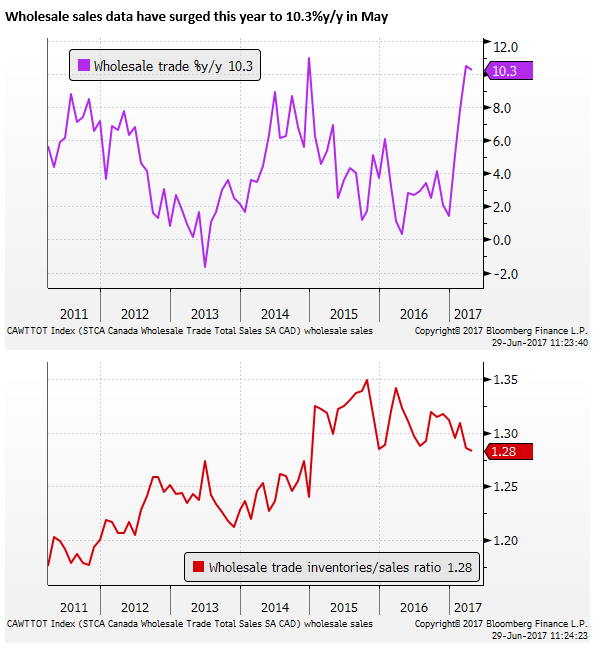

Strong growth indicators

The First quarter was very strong for Canada, and they are already forecasting some moderation in the rest of the year. Nevertheless, economic indicators started Q2 on a firm footing.

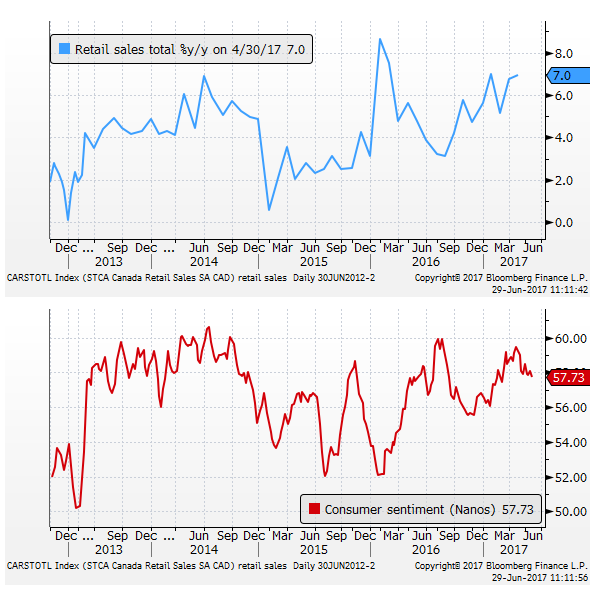

Retail sales have been rising strongly, up 7.0%y/y in April. However, consumer confidence peaked in April and has eased in recent months, albeit at above the 50 neutral level, it is still solid.

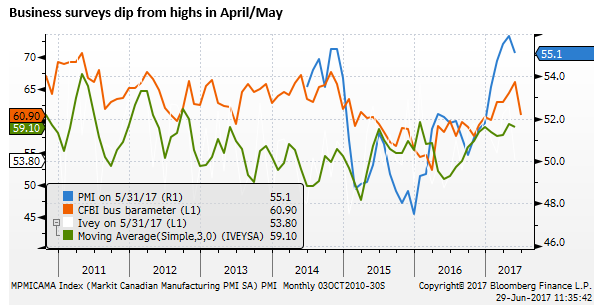

Business surveys are solid, but reached recent peaks around April/May, and have ebbed recently. The CFIB business barometer index fell significantly from 66.05 in May to 60.9 in June, a low since January.

The Markit Canada manufacturing PMI peaked at 55.9 in April and fell to 55.1 in May, the June data is due on 4 July.

The IVEY total economy PMI is shown in the chart below as a 3-mth moving average, given its high volatility; it dropped sharply in May (53.8) from two strong months in March/April above 60, leaving its three-month average down a touch in May to 59.1.

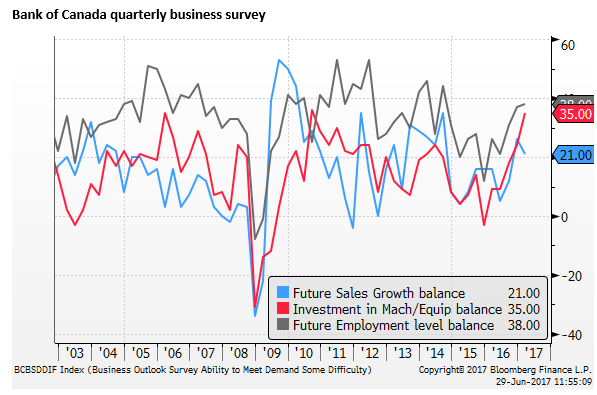

The Bank of Canada holds stock in its own quarterly survey of business conditions. The Q2 results are released on 30 June. In Q1, investment intentions were at a high since 2010. Employment intentions were at a high since Q3-2014. Future sales expectations dipped to a moderate level. The data are consistent with the economy having completed the adjustment to the oil price shock in 2014/2015.

Resurgent Canadian house prices

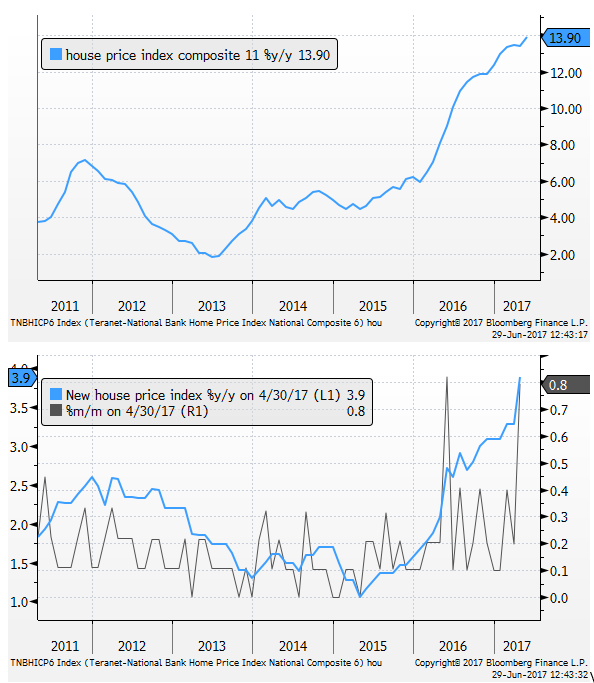

A factor that may be encouraging the Bank of Canada to remove policy accommodation is a resurgence in house price growth. The nationwide existing home price index rose to a new peak rate of annual inflation (13.9%y/y in May) with broadening priced appreciation across the country. The new home price index also rose to a new peak inflation rate of 3.9%y/y in April

However, while prices are up, building permits were down significantly in March and April to the lowest level since July last year, and home sales were down for two months in March (-1.7%m/m) and April (-6.2%m/m).

Canada Employment growth strong

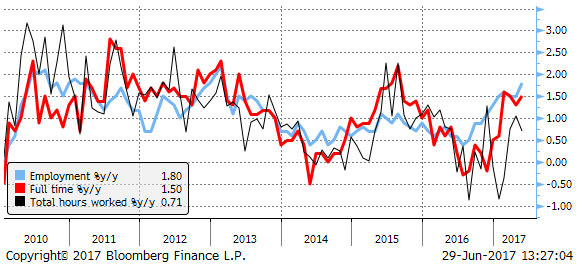

Employment growth has picked up sharply since mid-last year, rising at a strong rate of 1.8%y/y in May. However, total hours worked (discussed in the April MPR) has grown more modestly; little changed since March at +0.7%y/y.

The unemployment rate was 6.6% in May, around its post-financial crisis low. Apart from the pre-crisis years, this is historically low for Canada.

Will the RBA and RBNZ follow the global central bank trend?

A number of central banks have exhibited more optimistic outlooks for their economies and moved to a less dovish stance (Fed, BoC, ECB, and BoE). A common theme across all these central banks is significant more confidence in the strength and breadth of a global economic recovery.

A question many will be pondering is – will the RBA and RBNZ make similar adjustments to their policy bias? The market was blindsided by the shift to a tightening bias by the Bank of Canada, which has similarities in its housing and commodity exposure to Australia. The market should be wary of a shift in tone from the RBA at its policy meeting next week.

The market has raised its probabilities for rate increases in Australia in recent weeks, reflecting a global trend higher in rates. Since the 12 June BoC Wilkins speech, where Canadian rates have risen 33bp, Australian 2yr rates have risen by 17bp, still significant, and more than either the US or New Zealand.

The RBNZ eschewed its opportunity to shift its bias, maintaining its guidance in its 22 June policy statement; “Monetary policy will remain accommodative for a considerable period. Numerous uncertainties remain and policy may need to adjust accordingly.” This was an interim meeting between its quarterly MPS, making it less likely that the RBNZ would shift tone.

Until recently, the market was still entertaining the possibility that the RBA might cut rates again from its record low 1.5%, this probability has now dwindled to negligible levels and the market sees the risk of hikes coming into view late this year. However, there is only modest a probability implied that the RBA will hike for the next year, and less than a full 25bp of hikes is priced in until end 2018.

RBA was early in shifting focus from inflation to financial stability

However, the RBA can actually be argued to have led the movement towards subjugating its inflation target in the interest of financial stability. Since around October last year, the RBA has played down the prospect of further cuts in rates, reflecting its concern over high household debt and rising house prices, accepting a longer period of below target inflation.

The RBA, with its work on the Council of Financial Regulators (CFR), has encouraged the bank regulator APRA and ASIC, to enacted a range of quantitative and qualitative rules on mortgage lending that have tended to tighten credit conditions this year.

As such, perhaps there’s less reason to anticipate a significant shift in the RBA statement next week. In any case, the RBA is not the type to provide much guidance, preferring to keep its options open. Its recent statements have concluded, “The Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.”

Even subtle changes can have a big impact

Nevertheless, one thing we have learned recently is that even subtle changed in outlook can have a sizeable impact on market pricing. The EUR has jumped sharply in recent sessions on what was essentially a statement of greater confidence from Draghi that the ECB will achieve its inflation mandate over the medium term. The NZD jumped sharply after its unchanged policy guidance, it seems, because it said higher commodity prices partly explained the rebound in its exchange rate since the previous meeting.

As such we see a risk that the AUD too jumps if the RBA sounds even modestly more optimistic.

The RBA will upgrade its labour market assessment

The RBA will be inclined to upgrade its assessment of the labour market since last month. In its 6 June policy statement, it said, “Indicators of the labour market remain mixed. Employment growth has been stronger over recent months, although growth in total hours worked remains weak.”

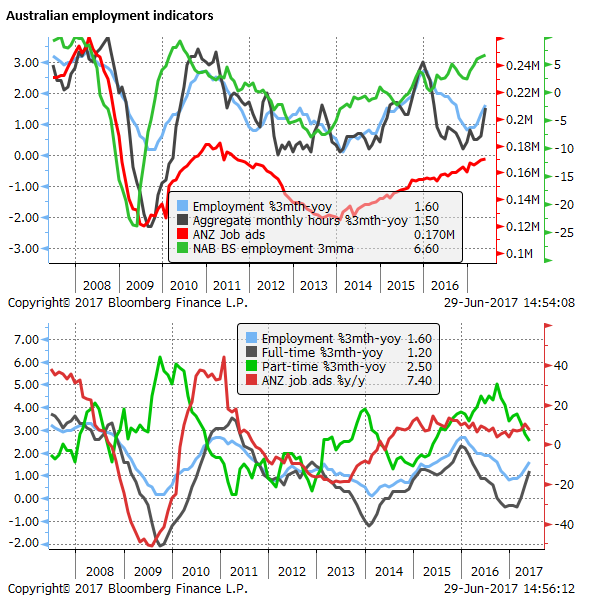

Recent data shows that employment growth (1.6% 3mth-yoy) and aggregate hours (1.5% 3mth-yoy) have picked up significantly, with growth in full-time jobs (1.2% 3mth-yoy) taking over from part-time jobs (+2.5% 3mth-yoy).

Meanwhile, indicators of further employment remain solid. The NAB business survey employment component has risen to its highest 3mma level since 2010 and ANZ job ads are rising at a solid 7.4%y/y rate.

The unemployment rate has fallen to 5.5%, a low since 2013. And the participation rate has recovered from its fall late last year. There is still slack in the labour market, but momentum has picked up.

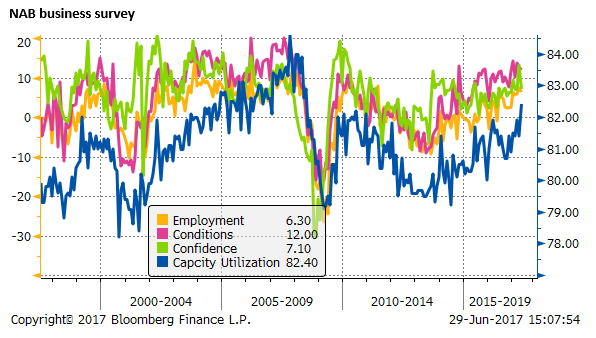

Capacity Utilization has increased

The RBA has noted that business surveys have been solid, above average levels; certainty, the most recent data reinforce this message. The NAB business survey indices for conditions and confidence ebbed in May from their peak in April. But its index of capacity utilization rose to a new peak since 2008.

Housing market softer

However, what will make the RBA more inclined to hold rates low for the time being is that the macroprudential steps on the mortgage market, appear to be paying off. Housing activity and prices are slowing.

Furthermore, the RBA may still be concerned that the high levels of household debt and cooling housing market may be contributing to weaker consumption activity. In April, retail sales rebounded but they have been trending down in recent years, and consumer confidence is low compared to most other countries.

Inflation firming

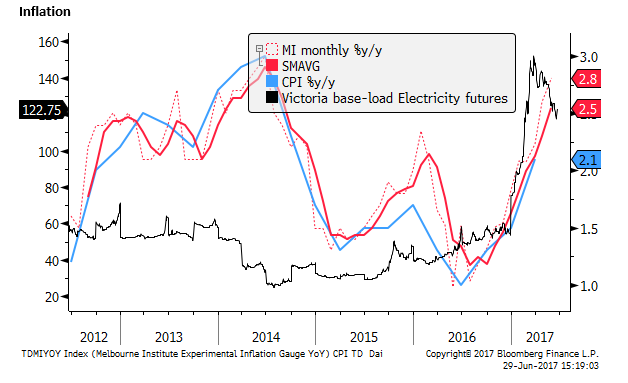

Inflation also appears to be moving in the right direction. The monthly Melbourne Institute data suggests that headline inflation will pick-up in Q2, and the underlying measures should retain the increase in Q1. Of consideration is the surge in electrical energy prices in Australia this year. This may tend to flow through to headline inflation data over the year.

RBA may play it cool, but risk is towards less dovish

On balance, the RBA statement that is already quite balanced, and acknowledging strength in the global economy, may offer few surprises. The RBA should continue to view risks in consumption and housing market. However, it is likely to upgrade its assessment of the labour market.

We doubt it will change its final (lack of) guidance on rates, but it is possible that even a somewhat more optimistic tone on the labour market could trigger strength in the AUD as the market views these through the lens of the global trends towards less dovish policy.

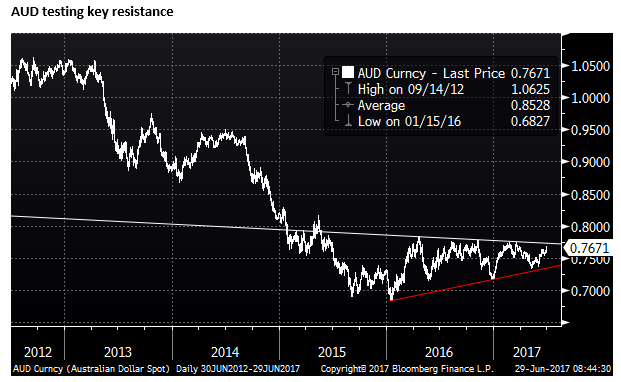

AUD/USD testing major resistance

The AUD/USD chart pattern is also set up to generate a significant shift in tone should the market sense a hint of less dovishness from the RBA. It is not far below a major trend line that defines a long period of consolidation at lower levels in recent years.

We are not convinced that the AUD will begin a renaissance. We note that the high levels of household debt in Australia and the halting housing market could make Australian consumers very sensitive to even a modest rise in mortgage rates. Nevertheless, we see a risk that the AUD does break up on a more optimistic RBA assessment next week.