Banks weak, but commodities firming

News related to Deutsche Bank turned around what was a developing risk positive trend in global markets and currencies this week. A stronger oil price helped weaken the JPY and strengthen energy producers, more broadly boosting risk appetite. We are not convinced problems at Deutsche bank will have a sustained negative impact on global markets, and would prefer to fade the risk-off mood on Thursday. However, as we approach month-end and key US inflation data on Friday, patience is advised. Sentiment is likely to remain fragile in the lead-up to the US election and a probable rate hike by the Fed in December. Low global bond yields have tended to undermine bank equities and expose problems at the weakest banks. This issue has been felt most in Europe where the ECB is pursuing a negative interest rate policy and its QE program has flattened the yield curve. Japan faces similar problems and the BoJ implemented Yield Curve Control to help support its financial sector, but yields remain low and Japanese bank shares have failed to recover much. However, low yields have more broadly helped lift global asset markets; particularly those in emerging markets. As discussed earlier in the week, commodity prices are firming and may reflect a strengthening global economy albeit from a modest growth rate. We may see more evidence of this in PMI data that are coming out today in many countries.

Conflicting forces from low rates policy

Until negative news on Deutsche Bank hit the market, there was building strength in EM and commodity currencies and a weakening trend in the JPY. This developing trend experienced a significant setback on Thursday.

Some Deutsche Bank Clients Reduce Collateral on Trades – Bloomberg.com

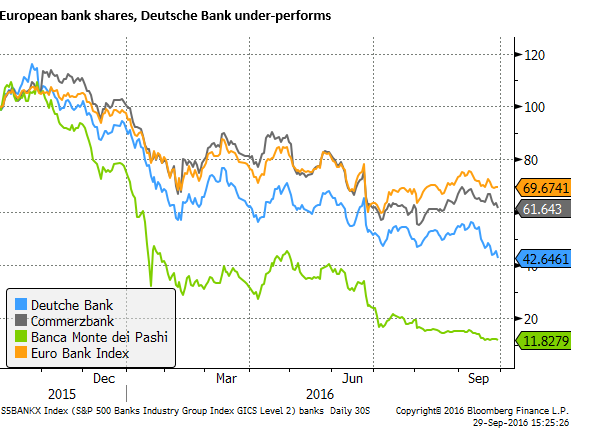

Deutsche Bank’s problems have intensified since the USA Department of Justice, on 16 September, made a claim of $14bn against the bank to settle its case related to alleged misselling MBS before 2008. Deutsche Bank plans to argue for a much lower fine, but the risk is that it faces a bigger fine than it had provisioned for forcing the bank to raise additional capital.

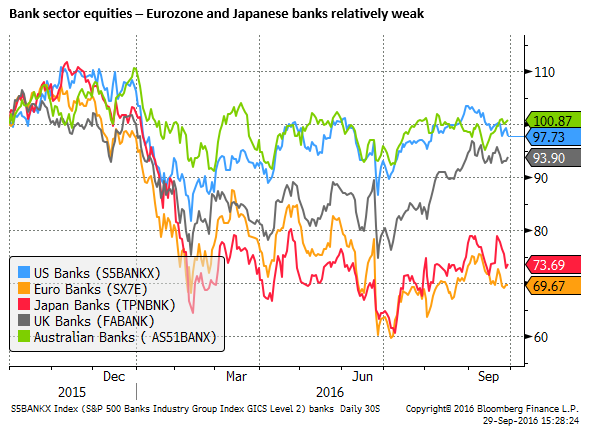

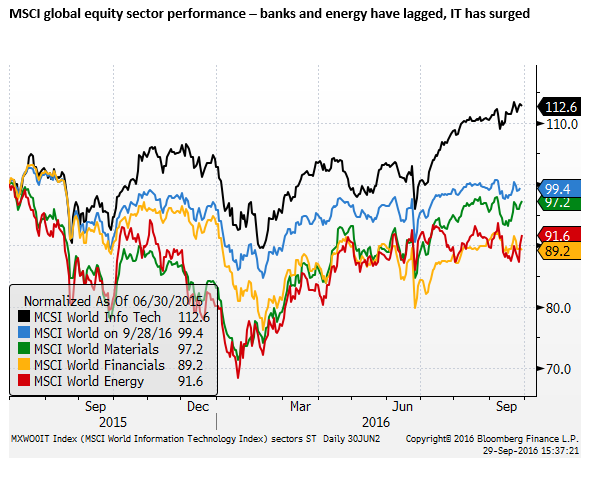

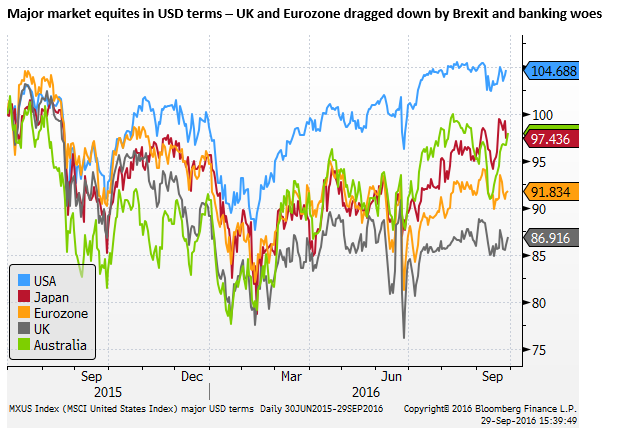

European bank shares have underperformed this year in part due to the low flat European yield curve with negative rates, cutting into bank profit margins. Essentially the same problem that has undermined bank share prices in Japan, and weakened overall financial sector company performance, including pension managers and insurance companies that traditionally invest in long-term bonds.

Since the BoJ introduced its negative interest rate policy on 29 January, it has used a tiered approach, so that banks are not paying negative rates on all of their excess reserves, to help limit the cost to banks from this policy. Since 21 September, it has further moved to add so-called Yield Curve Control (YCC) to its policy to limit the degree to which its JGB purchases flatten the yield curve, to help improve the profitability of banks and other financial institutions.

These mitigation efforts by the BoJ have been at best mildly effective so far. The bounce in Japanese bank share prices has been quite limited. The yield curve overall remains quite flat with much of the curve, out to at least 10 year JGBs, still negative. Nevertheless, the BoJ’s YCC may have provided some support to Japanese equities, and it might provide a framework for its monetary policy to be more sustainable and therefore more credible and effective.

The fall in Deutsche bank shares, spilling over to other bank shares and overall equity market, may place pressure on the ECB to also consider a policy of yield curve control.

Conversely, the same underlying factor that is contributing to bank woes, low bond yields, occasionally spilling over to broader risk aversion, at other times is contributing to stronger equities as investors hunt for higher-yielding assets. As such, the equity market and other high beta assets have been buffeted by the conflicting forces emanating from extraordinary monetary policies in Japan and the Eurozone.

Exposing deeper problems

The problems experienced by Deutsche Bank and other European banks are not entirely related to a low flat yield curve. Many European banks are still considered by the market to have bloated balance sheets with insufficient capital. Some face on-going litigation costs and costs associated with meeting new regulatory frameworks that are ironically designed to make them safer. New regulations are forcing banks to meet new capital and liquidity requirements and undergo regular stress tests that are pressuring them to unload businesses, raise capital and restructure. This process tends to highlight existing weaknesses in their balance sheets and undermine profitability.

Banks are considered political liabilities. The German government, headed into an election cycle next year, is very reluctant to provide support to any bank. If it was forced too, it might be inclined to impose a significant cost on existing shareholders (rather than imposing costs on taxpayers).

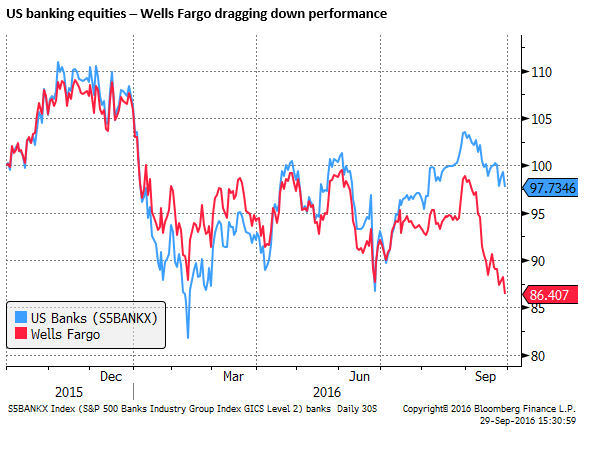

In the USA, yet another scandal is unfolding at the third largest bank by assets, Wells Fargo, for the alleged creation of over 2 million fake bank accounts. The reputation of the banking industry remains at a low ebb and calls for more regulation are increasing, worsening the outlook for profitability.

Fragile confidence

The global equity market was roiled on Thursday by a Bloomberg news story that some of Deutsche Bank’s customers had withdrawn collateral held at the bank to facilitate their trading business with the bank. This action suggests that some customers of Deutsche Bank are reducing direct exposure in case the bank were to experience bankruptcy.

Bankruptcy is extremely unlikely, as almost certainly, Deutsche bank, as a Globally Systemically Important Bank (G-SIB), would receive all the liquidity it needs to ensure it can settle all trades, and indeed receive government backing, if required, to stay in operation.

Nevertheless, customers would not want any hint of disruption in their capacity to make and settle trades. As such, they might feel it prudent to shift collateral to alternative banks to broaden their capacity to keep trading in case Deutsche bank faces even a short-term disruption.

At issue is customer and counterparty confidence in Deutsche Bank. If confidence ebbs it can snowball and threaten to generate a widespread call on Deutsche Bank’s sources of funding. The Bank would then be forced to curtail its trading activities and ask for ECB and/or government support, creating considerable damage to its reputation.

Notwithstanding the political distaste for bailouts, Deutsche Bank would almost certainly receive one and avoid major systemic risk. But such an event would probably generate significant downward pressure on bank shares, it would exacerbate concerns that the ECB’s easy monetary policy is not working, further increase regulatory pressure on the banking system globally, and there would be a broader fallout to asset prices and global economic confidence.

This fear accounts for the contagion from a Bloomberg news story to global risk appetite. However, confidence in Deutsche Bank’s capacity to remain in business and service its customers could be quickly restored. As mentioned, at the end of the day, it is almost certainly likely to receive all the ECB and/or government support it requires. Investors might then treat it as a troubling case that may or may not need government support to restore its financial stability over the medium term, and revert to seeking out other higher yielding assets.

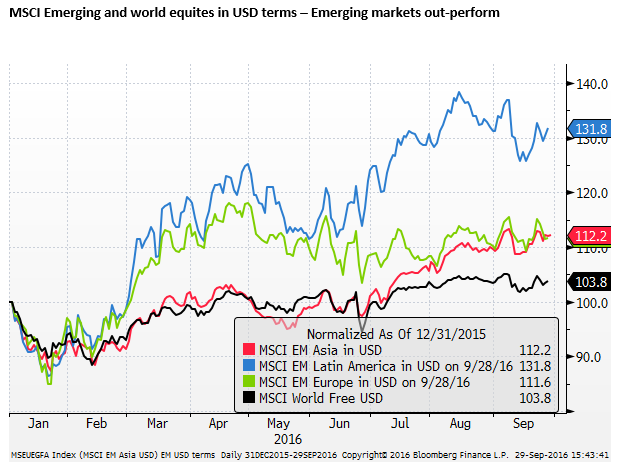

As such, we could again revert to overall strength in other equities and high beta assets, including higher yielding emerging markets and commodity producer assets and currencies. As discussed, low global bond yields, while undermining banks shares, tend to support the broader asset market. It is far from clear that the Deutsche Bank’s problems will have a sustained negative impact on global markets.

The problems at Deutsche bank have been around, albeit increasing, for over a year, intermittently dampening broader investor confidence, but on the whole, it has not had a sustained negative impact.

Commodity price gains

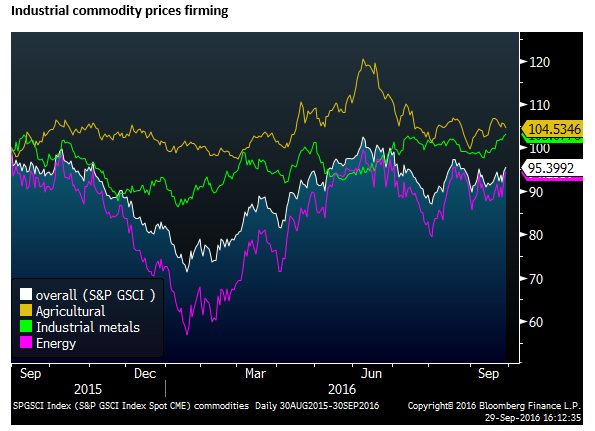

As mentioned earlier this week, commodity markets outside of oil have been firming, consistent with generally stronger than expected demand in China this year and a modest recovery in a number of large emerging markets. In general, this may be pointing to improving demand in the global economy. Low global bond yields and stronger asset markets (outside of banks) are helping support a global recovery, even though it may still be a modest recovery.

Oil prices have jumped since Wednesday on prospects of more control in OPEC supply, so now oil prices are also firmer along with other industrial commodity prices, helping lift energy shares. Firmer oil prices may also help lift global confidence by raising inflation expectations, contributing to a weaker JPY, and underpin the US energy sector that has been a significant drag on US investment and manufacturing activity over the last two years. US Core capital goods orders firmed for the third month in a row in August