Bear claws dig into the US dollar

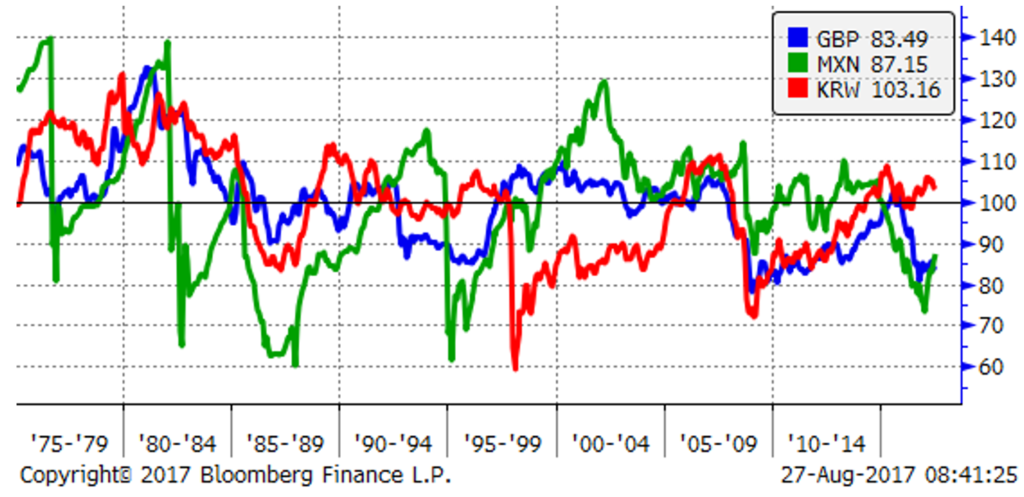

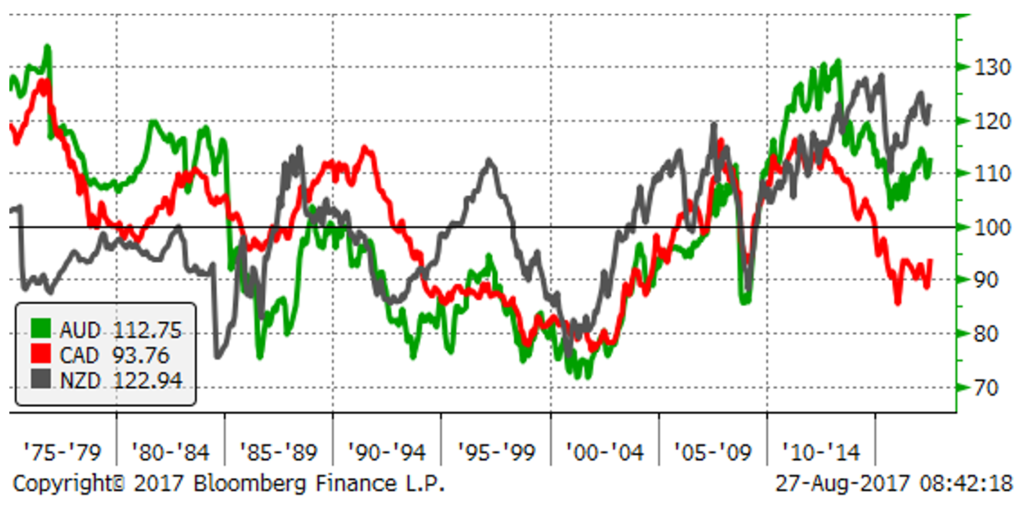

The persistent bear-trend in the USD this year showed its claws last week with fresh lows in the Bloomberg dollar index since January-2015. It’s not just about the rebound in the EUR, EM currencies and equities are significantly out-performing. Monetary policy is no longer diverging, the Fed is shifting from rate rises to quantitative tightening, synchronised global growth is supporting EM, EUR is rising on hedge unwinds and its current account surplus, Stephen Jen’s dollar smile theory is coming back into vogue, and political risk in the US has risen to new heights with government shut-down fears spiking. The dollar could bite back if wage pressures show up or US tax reform gains traction. Trump is supposed to shift his attention to promoting tax reform, according to his chief economic advisor Cohn. Looking out to next year, beyond the Chinese Government Congress, China stability fears present a significant risk for EM and commodity currencies.

Bear claws dig into the US dollar

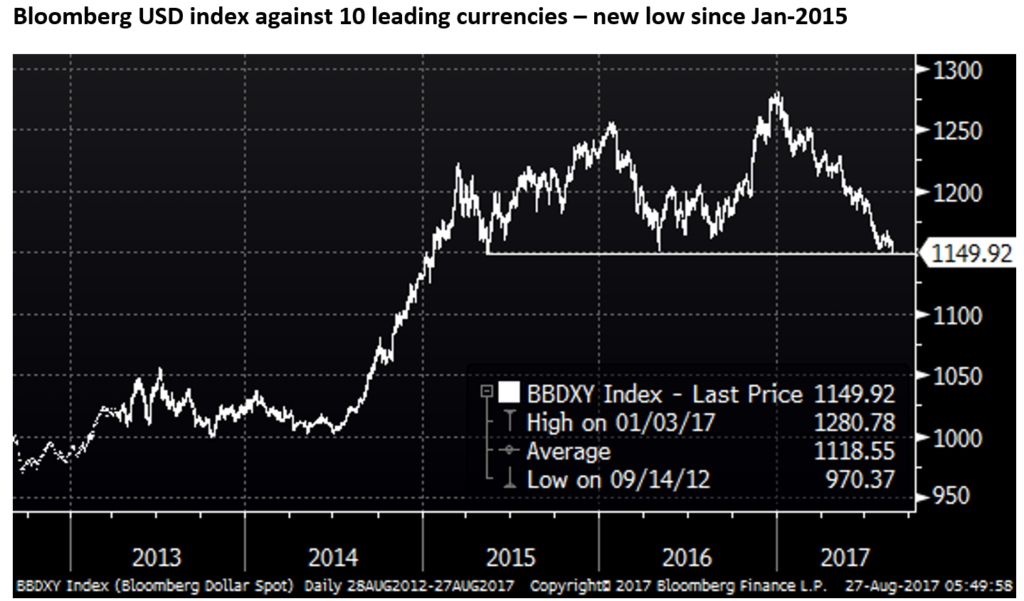

The persistent bear-trend in the USD this year showed its claws last week with fresh lows in the Bloomberg dollar index against 10 leading currencies after a month long consolidation. It posted a new low since January-2015 on Friday and closed basically on the baseline if its range over this period.

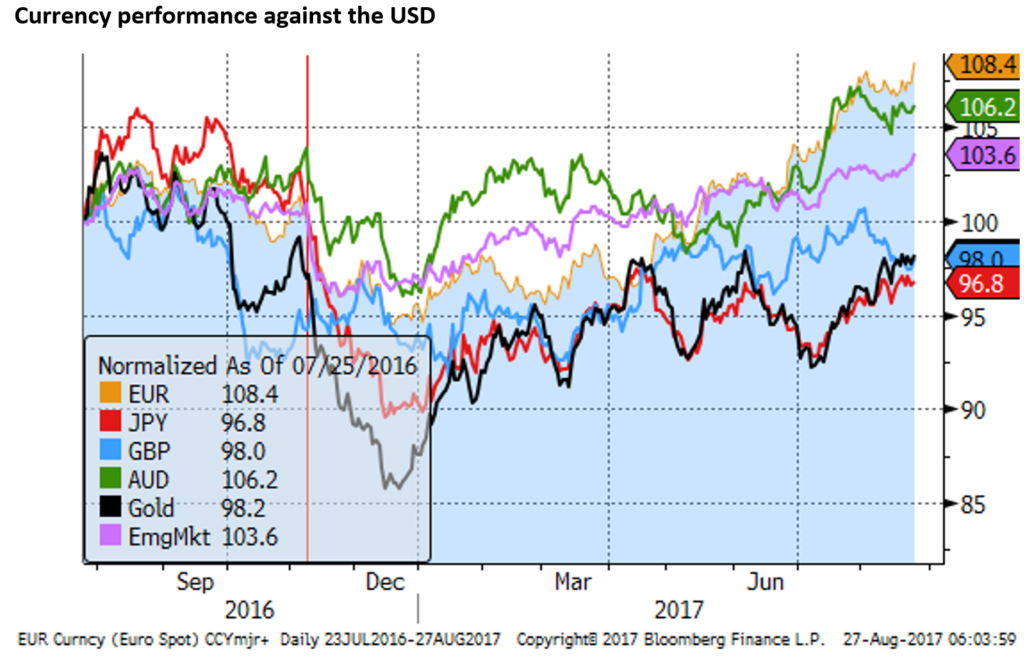

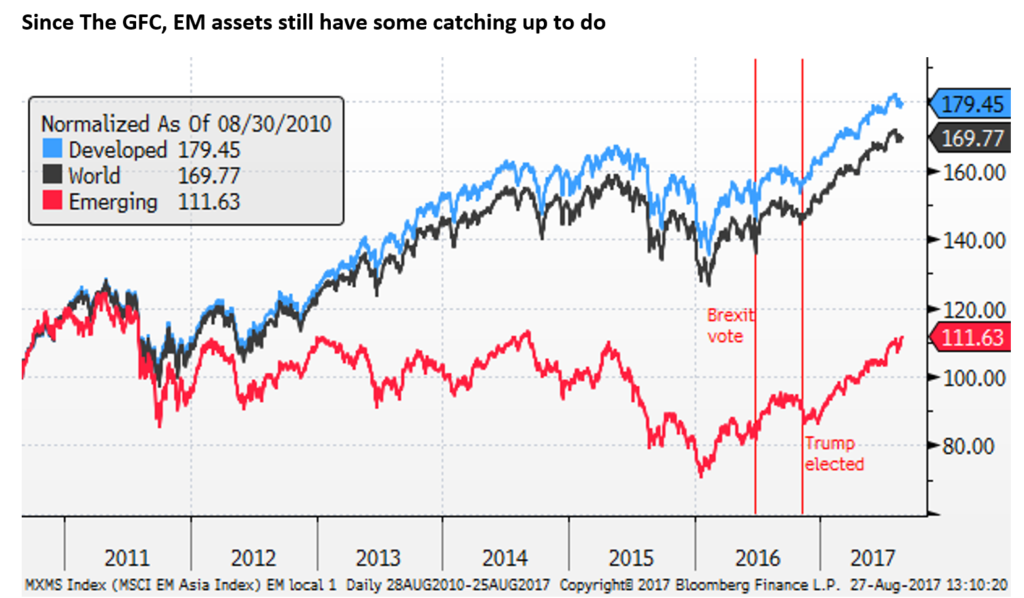

It’s not just about the rebound in the EUR, the MSCI Emerging market currency index rose to a new peak last week, not fazed by recent increased volatility in the equity market. It is at a high since 2014, reversing more than three-quarters of its fall since the oil price collapse in 2014 to its low in Jan-2016.

Emerging market equities have surged since the relatively minor hiccup on the latest North Korea tensions, significantly widening their outperformance of developed market equities this year.

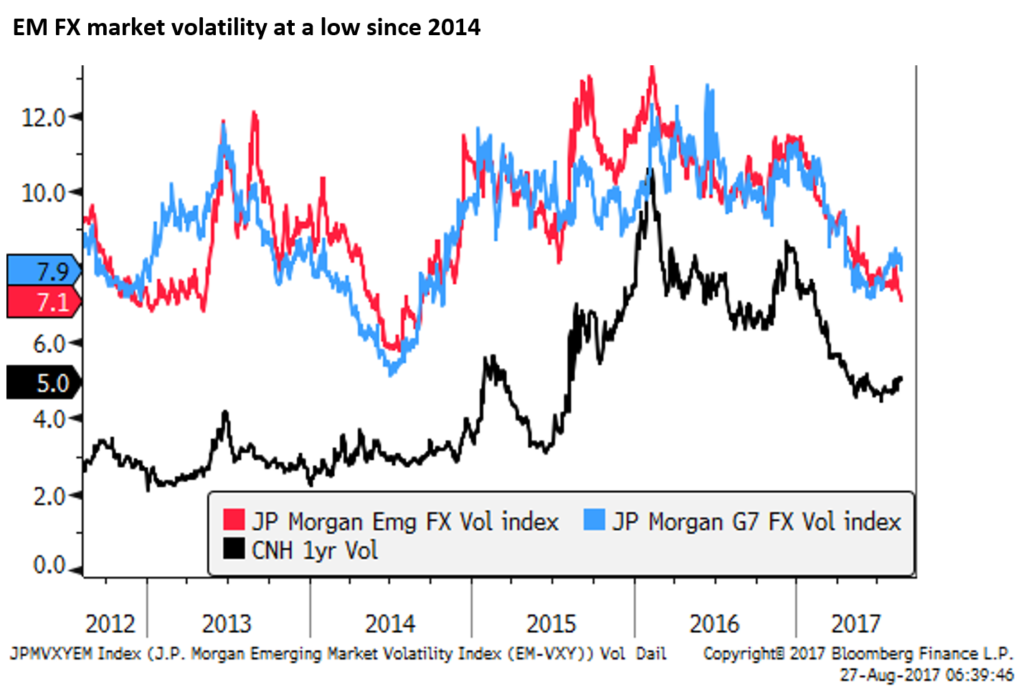

Relative confidence in emerging market currencies has pushed an index of EM FX implied volatility to a low since 2014, below an index of G7 FX vol.

EUR leading the rise in other currencies

The EUR surged twice on Friday, after each of the Yellen and Draghi Jackson Hole speeches. Both did not speak on the issues the market was most interested in. Yellen did not draw the link from financial stability to monetary policy as many, including myself, thought she might. And Draghi did not discuss a widely anticipated QE taper, or the recent strength in the EUR. As such, the speeches removed risks that were holding back EUR demand.

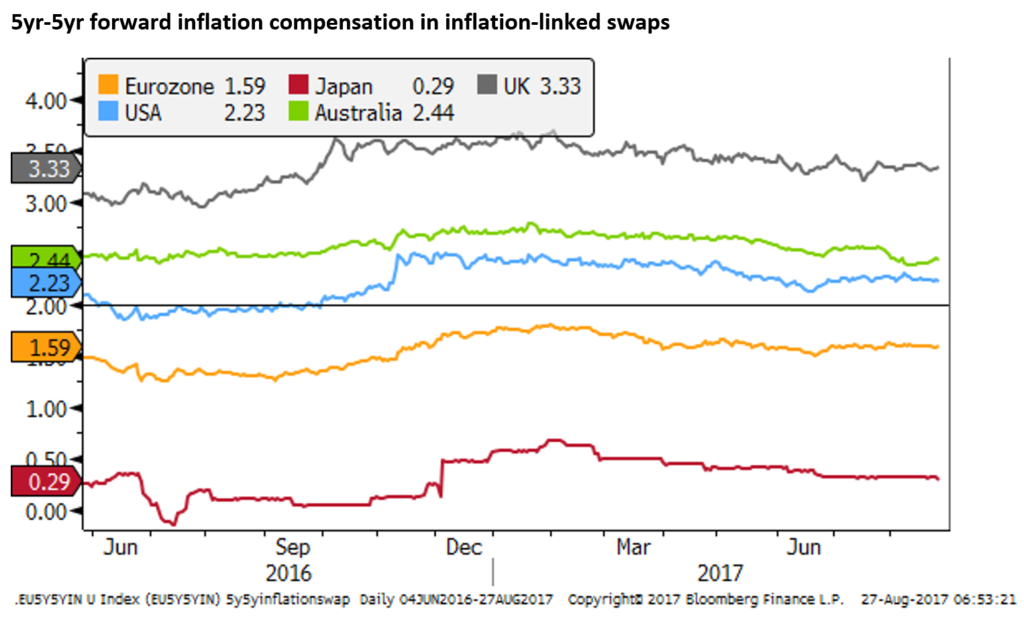

One factor that may ultimately temper the EUR rally is if the market senses that the strength in the EUR starts to significantly weaken the medium term inflation outlook in the Eurozone. However, market indicators of inflation expectations remain stable in the region; albeit still below the 2% ECB target.

The bear market case for the US Dollar

We appear to have moved into a proper bear market for the USD. There may be several factors explaining this.

MP no longer diverging

In 2014 and 2015, the USD appeared to be boosted by the notion of diverging monetary policy, where the Fed was the only central bank considering to be raising rates. This is no longer a driving influence; even though there are still few other central banks considering hikes, the broad impression is that other major country central banks are tilting towards less policy accommodation.

QT means lower rates profile

The Fed is moving towards unwinding its balance sheet; let’s call in quantitative tightening (QT). This means it is less likely to raise rates over the period ahead. The Fed has been trying to say QT can happen in the background and may not affect its rates policy. But it is a form of tightening, and naturally, will make the Fed more cautious about future rate hikes.

Some may argue that QT might support the USD, but the links from QT to currency are loose and probably flow through its impact on rates and yields, and in turn other asset classes. It may cause the US yield curve to steepen, but not raise overall yields. And yields may take some time to rise anyway, as QE abroad and low inflation expectations globally hold yields down.

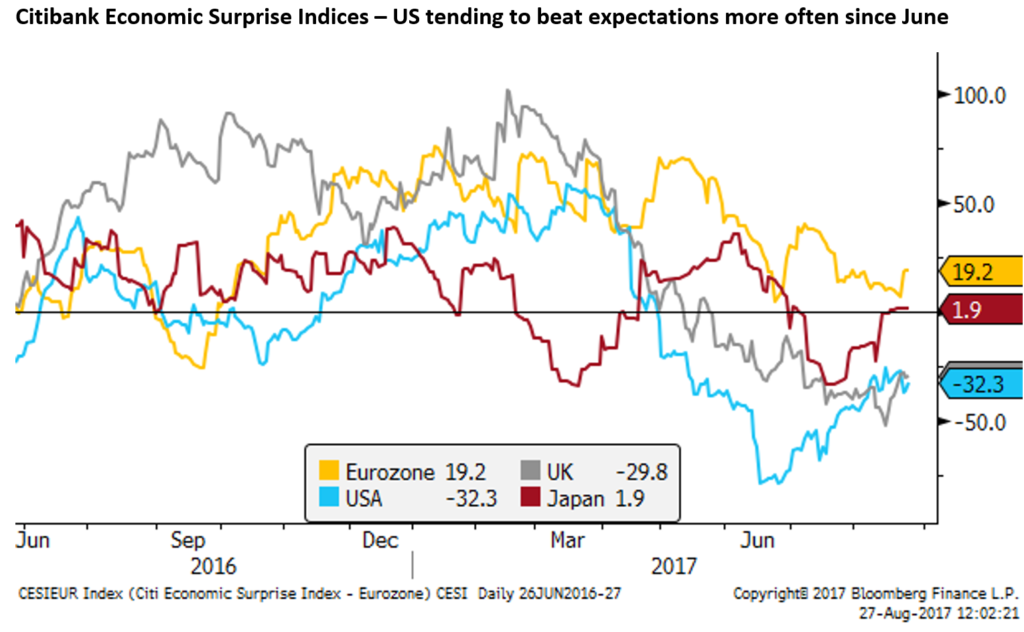

Synchronised growth and dollar smile

The US economic recovery is no longer so special with more synchronised global growth. The OECD reported last week that it has forecast growth in all of its 45 countries for the first time in a decade, and 33 are accelerating, the most since 2010. (Related WSJ article). A popular idea introduced by Stephen Jen about a decade ago, a highly rated currency strategist turned hedge fund manager, is that the USD’s performance tends to have a smile when plotted against US economic growth. It does well when the US economy is significantly out-performing the rest of the world, or the US and the world are in distress, but tends to fall when the global economy is in synchronised growth. (Smiling dollar; Sep-2008 – FT.com)

Capital flow and balance of payments

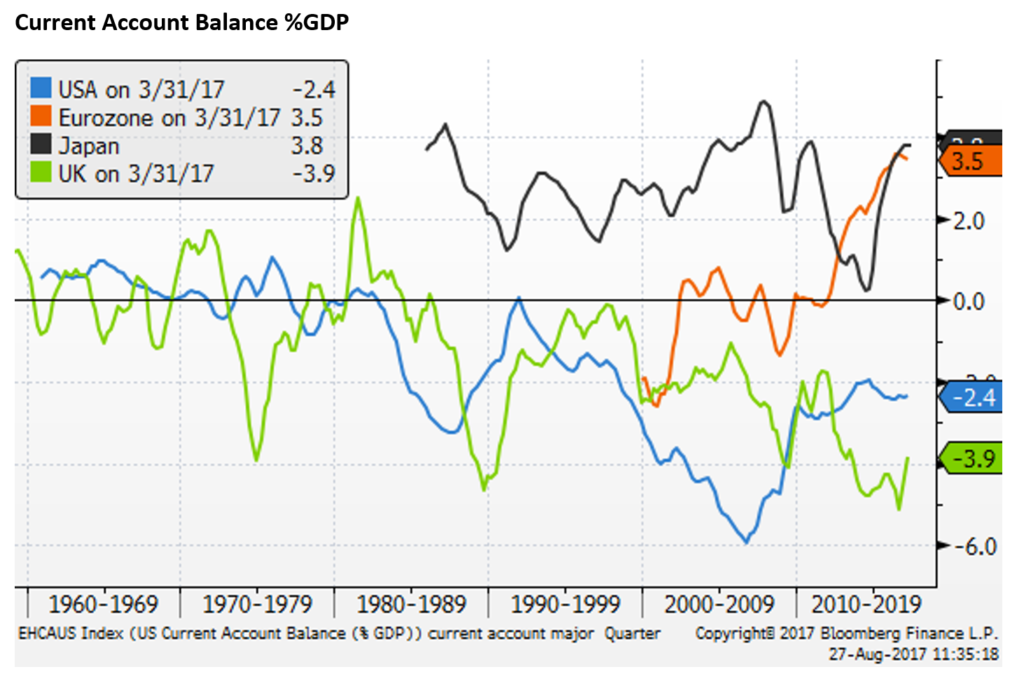

Part of the smile theory relates to capital flows and balance of payments. Capital is flowing more readily to EM markets. Their external positions are improved, whereas the USA still has a significant current account deficit (-2.4% of GDP in Q1). The US equity market is more fully priced and investors are seeking to diversify returns shifting capital towards other capital markets. Emerging markets are now at their strongest position since 2014, and exposure to this broad asset class has no doubt increased significantly. However, emerging markets have more broadly underperformed since the Global Financial Crisis with regular major setbacks; including the Eurozone crisis, the 2013 taper tantrum, oil price shock and China deval in 2014/2016. If investors are seeing EM as in their best relative position since the GFC, the current rally could extend for another year or more.

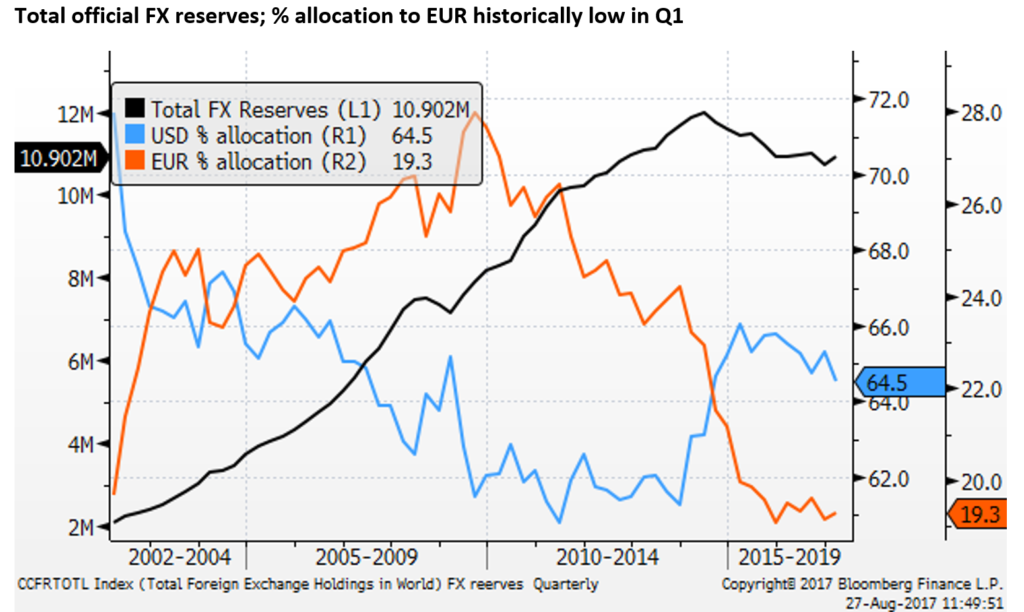

FX reserves growth

During prolonged past phases of EM market out-performance, the USD has been thought to underperform as EM countries FX reserves grow, and they look to diversify these reserves into other currencies. As FX reserves start to move into a growth phase, analysts may again argue that this tends to make the USD fall more broadly. We are not in a clear growth phase for FX reserves yet, but we are seeing some evidence of this starting. As it stands, FX reserve managers may feel they are under-weight EUR, with around a record low allocation in Q1.

Political uncertainty

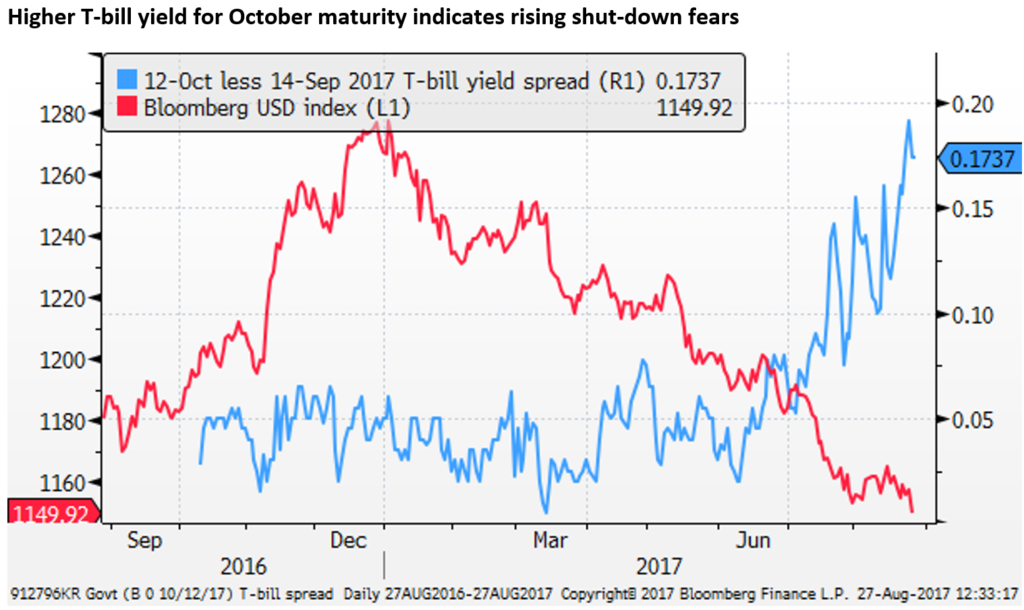

The decline in the USD appears to also reflect the heightened political uncertainty in the US. In recent weeks, President Trump has openly criticised Republican leaders in Congress over their failure to date to achieve a rise in the debt ceiling, and he has threatened to demand border wall funding even if this causes a government shutdown. The market is seeing a significant risk of this occurring, raising political risk for the USA to new highs, from an already elevated level related to the administration’s pursuit of an Alt-Right tinged agenda and erratic confrontational leadership style.

EUR hedges unwinding

The EUR is the highest weight in USD indices, and it is leading the gains this year. Investors are widely thought to be unwinding FX hedges on their Eurozone asset holdings this year. Economic growth and political stability have boosted the case for holding Eurozone assets. The valuation assessment of Eurozone assets includes the EUR exchange rate. If Investors are currency hedged, they risk missing out on valuation gains if they come through EUR currency appreciation rather than asset price appreciation. As such unwinding EUR hedges makes sense from a diversification and risk management perspective. During the ECB QE expansion phase, the EUR was considered a weak currency, and it made sense to hedge. There may still be large amounts of these 2014/2015 era hedges to be unwound. The Eurozone has a significant current account surplus (3.5% of GDP in Q1), so without capital outflow, it will tend to appreciate.

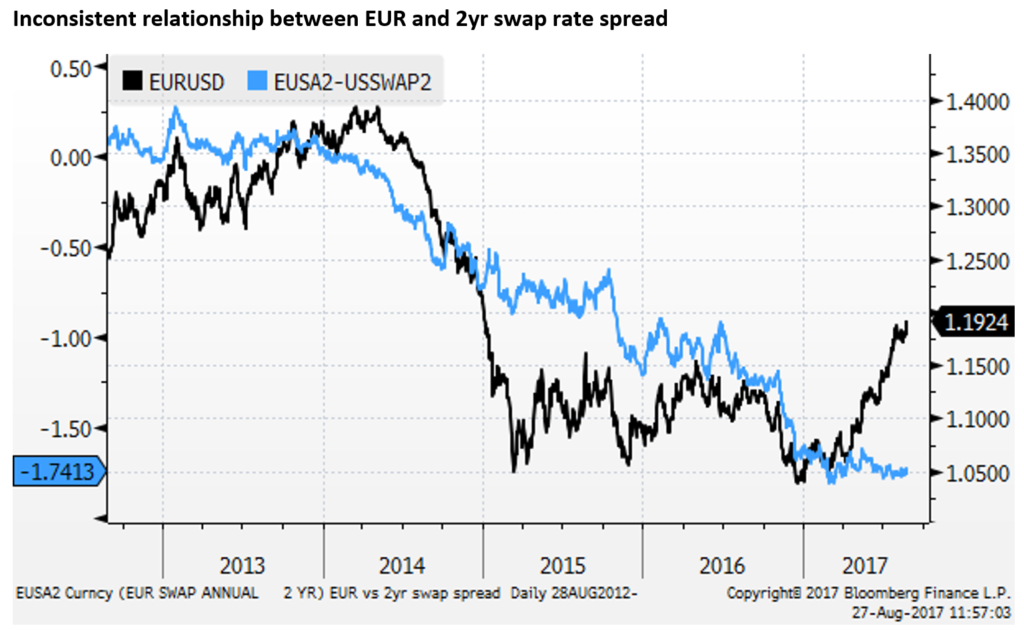

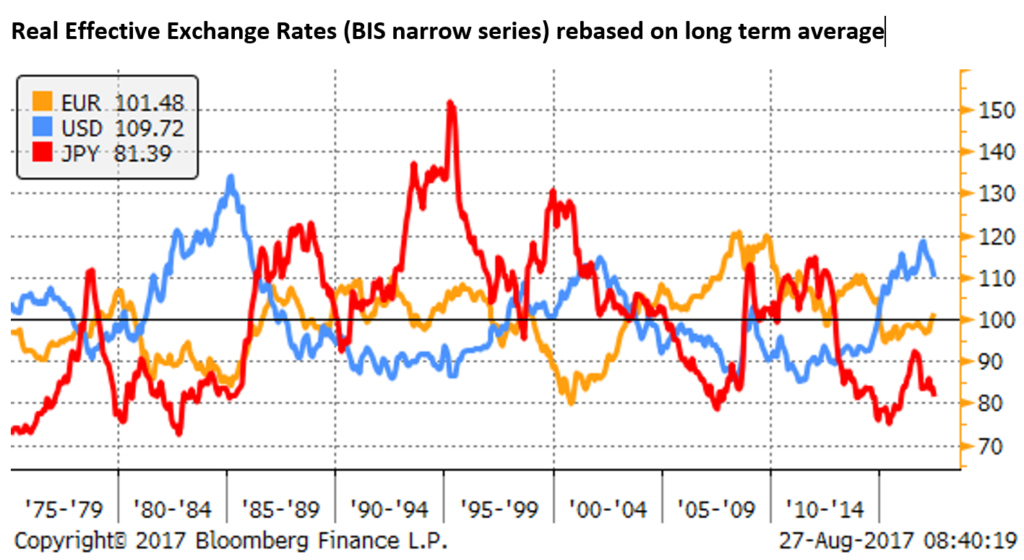

It is interesting to note that there has been only a subtle shift in ECB policy and it still has negative interest rates. This might ultimately temper the EUR recovery. But over the longer term, EUR has had a very inconsistent relationship with short term interest rates, and that relationship has been essentially non-existent in the last year. Over a long term perspective, the EUR is near its long run real average. The ECB may not want a rapid recovery, but there is little evidence yet that its rise is curtailing the Eurozone economic recovery of dampening inflation expectations.

Dollar may bite back, especially if tax reform comes through

While the USD may appear in a broad bear market, there is potential for it to bite back. The US growth outlook has picked up in recent months and is showing resilience to political uncertainty. The labour market data this week may help support the USD; especially if wage growth starts to show up, which is possible now that the labour market appears to be relatively tight. This could help revive rate hike expectations and US yields.

The heightened political uncertainty around the tight timeline for a new spending bill (end-Sept) and debt ceiling resolution (probably in October), and erratic Trump style appears to have prevented investors from positioning for tax reform.

Chief Economic Advisor Gary Cohn said Trump would begin a sustained public relations push for tax reform, starting on Wednesday this week, and Cohn predicting major legislation would be passed this year.

Apart from growth boosting tax cuts the reform is expected to include moving from a global to a territorial tax system and include a one-time tax break to repatriate offshore retained earnings. This would potentially generate a substantial rebound in the USD.

If Congress can make progress the spending bill/debt ceiling issues, and Trump can stay on a tax reform message, there is scope for a significant tactical recovery in the USD before year-end.

Transcript: Gary Cohn on tax reform and Charlottesville – FT.com

China remains a cloud, but storm may come next year

While confidence in emerging markets is relatively high, it remains tenuous in China. Especially after it completes its 19th Chinese Government Congress that happens every 5 years. The broad consensus is that China is delaying dealing with excesses in its financial system and maintaining steady and solid economic growth in the lead-up to this event in November. But afterwards, the market will be more nervous about the prospect of more financial sector stress and weaker Chinese economic growth.

Weaker Chinese markets could unwind confidence in EM and commodity markets, and generate a recovery in the USD against related currencies. It could generate speculative positions squaring more broadly, and spill over to a weaker EUR (since the speculative community is now significantly long EUR, according to CFTC data).

If China does choose to step up efforts to unwind financial excesses, it might not do it immediately after the November Congress, but wait through the turn of the year, including beyond Chinese New Year. Perhaps from March into Q2 would be the more sensible timing.

However, there is already evidence that China is squeezing a little harder on the shadow-banking system. It has announced a number of regulatory measures this year designed to force banks to report more of their off-balance sheet asset management products.

One indicator of stress is up since last year. Chinese short term Negotiable Certificates of Deposit (NCD) rates have increased significantly. These are typically used by smaller banks to help fund their investments in asset management products. Higher NCD rates point to higher funding costs and some tightening in conditions. Similarly, interbank rates for one-year terms have risen more significantly than for shorter maturities, further pointing to some cautiousness in lending between banks for longer terms.