Bears are still growling and the Fed blows hot and cold

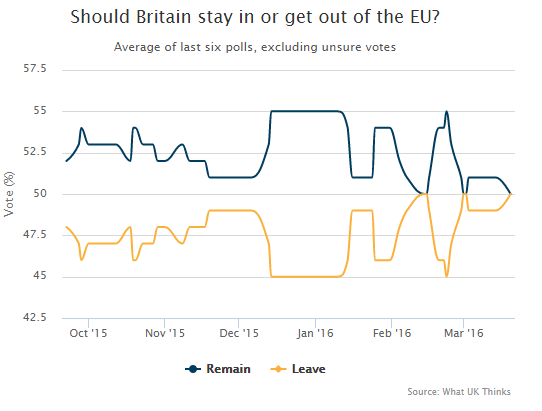

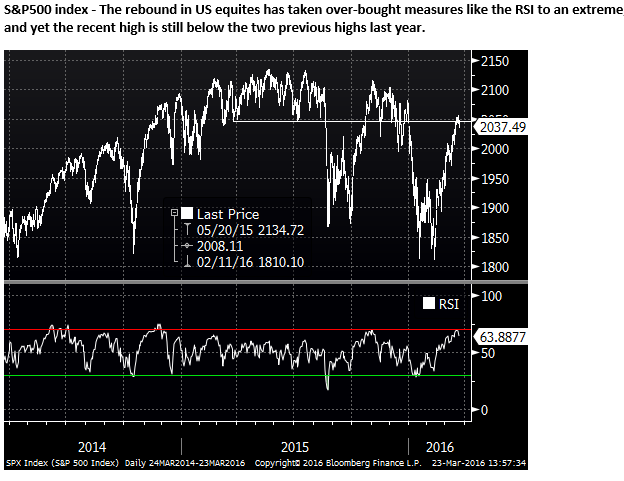

We wrote on Monday that currencies might start to range trade and global markets may start to calm-down, encouraging more carry trades, potentially supporting higher yielding commodity and EM currencies against the lowest yielding EUR and JPY. However, markets have failed to calm so far this week. We need to recognize firstly that there has already been a sizeable rebound from the recent lows in equites and commodity markets and these markets appeared over-bought and still in down-trends over the last nine months or more. As such, they were vulnerable to a pull-back. Similarly, high yielding currencies were over-bought and due a pull-back. The recent global market recovery also appears to have emboldened several FOMC members to come out with hawkish comments that appear at odds with the message taken from the FOMC meeting last week. These Fed speakers, while only a few voices, create more uncertainty over the outlook for Fed policy, tending to support the USD and contribute to renewed selling in equities. Initially we thought the terror attacks in Brussels would have little sustained impact on markets, but one angle that may play to more sustained uncertainty is raising the odds of Brexit. The latest polls, even before this event predict a dead-heat for the 23 June referendum, and Brexit fears are a drag on GBP and to some extent EUR. It is probably a minor matter for markets at the moment, but I find the US election primaries particularly disturbing. The popularity of isolationist views and success of divisive and inflammatory campaigning in the primary races suggests any eventual administration and Congress will struggle to make much positive contribution to the US or global economy.

FOMC members run hot and cold and send a confusing message

Maybe it’s just a case of the more hawkish members of the Fed speaking in public forums this week, or perhaps they felt it necessary to emphasize the risks of hikes after the market interpreted the FOMC meeting last week as dovish. But the Fed comments are out-of-step with the more benign set of forecasts for inflation, growth and interest rates in the FOMC projections last week and the risks posed by the global environment expressed in the press statement. So the market could be excused for a degree of confusion over where the Fed is at and where it is going.

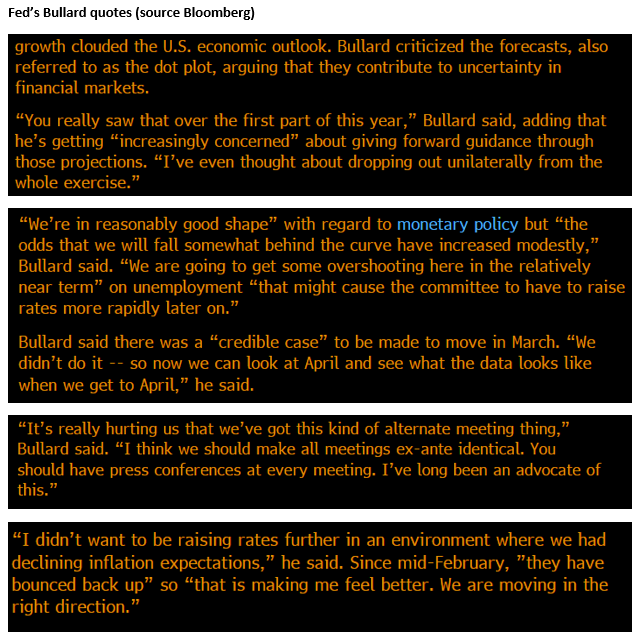

Comments today by St Louis Fed’s Bullard were particularly more hawkish than the FOMC message last week. It should be remembered that Bullard is the most up-and-down commentator on policy, and thus it is dangerous taking much notice of him.

But several Fed Presidents (Bullard, Williams and Harker) argued that inflation and labour market strength were more firmly trending towards the Fed’s targets, and they appeared more confident that hikes may be required in one of the next couple of meetings, not less confident as appeared to be the case in the FOMC projections and statements last week.

In the lead-up to the FOMC statement last week global financial market risks appeared to be diminishing, inflation expectations were firming again, and actual inflation readings were above expected for the last few months, while the labor market recovery appeared on track. And yet the FOMC maintained its inflation forecast for this year at a core 1.6%, below the most recent reading of 1.7%, and it lowered its median projection from 1.9% to 1.8% for 2017.

That revision was clearly dovish, and could only be explained by fears that the economy may stall, perhaps reflecting the concerns that the Fed expressed in its statement by global uncertainties, or a sense that wage growth will remain low even as unemployment might fall further, or that the recent high readings were anomalies.

However, listening to Bullard, Williams and Harker this week, you might have thought they had raised their forecasts for inflation and were ready to hike in April if global market conditions remain more stable. Only one of these speakers (Bullard) is in the group of 10 FOMC voters this year (out of 17 FOMC members).

These views should place these three members in the group that forecast at least three further hikes this year. (More than the two hikes that was the median and mode of the FOMC projections).

How much weight we apply to these more hawkish comments is debatable. Fed members may feel more like talking up the prospect of rate hikes at this juncture because global markets are more solid, commodity prices have rebounded, and the USD is weaker recently. But actually delivering on a hike is much harder and they will go quiet if conditions change again and the risks to the outlook become more apparent. The progress towards Fed hikes in likely to remain quite cautious.

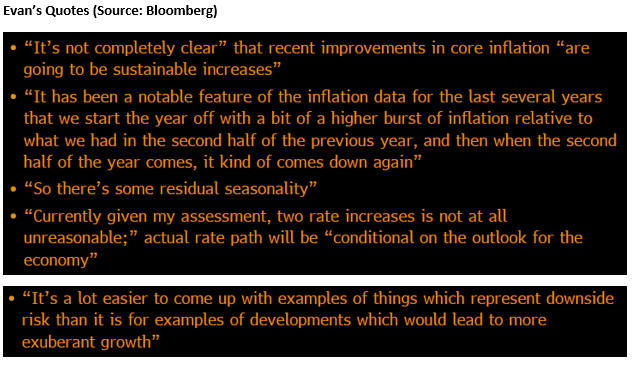

Fed member Evans, speaking yesterday, known as a dovish member, placed himself in the two hikes this year camp, in-line with the median forecast. He noted research where actual inflation outcomes appear to have some residual seasonality, and tend to be higher in the first half of the year, and fade later in the year.

His views appeared more consistent with the tone of the FOMC statements and projections last week, although he is not a voter this year.

The bears are still growling

The more hawkish Fed comments this week from reasonably respected voices in the Fed, albeit it seems on the hawkish side of the current balance of opinion, has contributed to some recovery in the USD from its recent lows.

However, like commodity and global equities markets, the currency market was probably due for some correction of powerful rebounds over the last month or so. As such we must be cautious over-interpreting what have been sizeable pull-backs in oil, metals, equites and rebound in the USD so far this week.

Nevertheless, it does suggest that the skittishness that characterized the global markets in the first month or two of the year remains a significant influence.

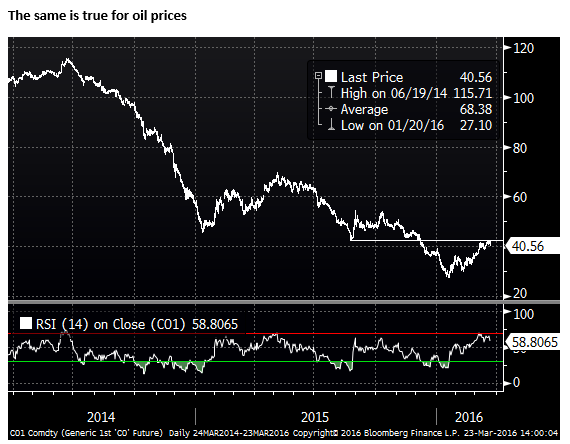

Notwithstanding the sharp recovery in global equites and most commodity markets over the last month, most are still in a downtrends over the last nine months or so.

An interesting observation from Bloomberg journalist Joseph Ciolli is that there has been record inflows to Exchange Trade Funds that pay the investor the performance of the VIX equity volatility index. As equites have rebounded VIX has dropped to relatively low levels, implying less market fear of large market corrections. However investors have bought into these ETFs, essentially predicting a rebound in equity market volatility.

It is somewhat contradictory, but while the low level of VIX implies greater market calm, some savvy investors are predicting that calm will not last, and it seems they are right, so far, with sizeable correction in equites this week and a firming in VIX. We might conclude that the higher than normal inflow of funds to these ETFs is a sign that there is higher than normal skepticism that the rebound will be sustained.

Brexit fear

A factor that appears to have contributed to weakness in the GBP and to some extent also the EUR appears to be the viewpoint that the case for Brexit is strengthened by the terror attack in Brussels, playing to the concerns of many Britons over unfettered immigration from Europe.

Even before this event, the polling remains very tight for the 23 June referendum. Based on an average of the last six polls are at a dead-heat.